- Australia

- /

- Metals and Mining

- /

- ASX:OBM

3 ASX Penny Stocks With Market Caps Under A$3B To Consider

Reviewed by Simply Wall St

As the Australian market rebounds, with the ASX showing positive momentum and gold reaching new highs, investors are keenly observing opportunities across various sectors. Penny stocks, though an old term, continue to capture attention as they often represent smaller or newer companies that can offer growth potential at lower price points. By focusing on those with strong financials and a clear growth trajectory, these stocks can present valuable opportunities for investors seeking to explore underappreciated segments of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.485 | A$139M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.53 | A$119.35M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.83 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.72 | A$418.78M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.30 | A$243.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.044 | A$51.47M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.071 | A$37.4M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.75 | A$358.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.28 | A$1.4B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 423 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Australian Clinical Labs (ASX:ACL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Australian Clinical Labs Limited offers pathology diagnostic services in Australia and has a market cap of A$482.28 million.

Operations: The company's revenue primarily comes from its Pathology/Clinical Laboratory Services segment, which generated A$741.27 million.

Market Cap: A$482.28M

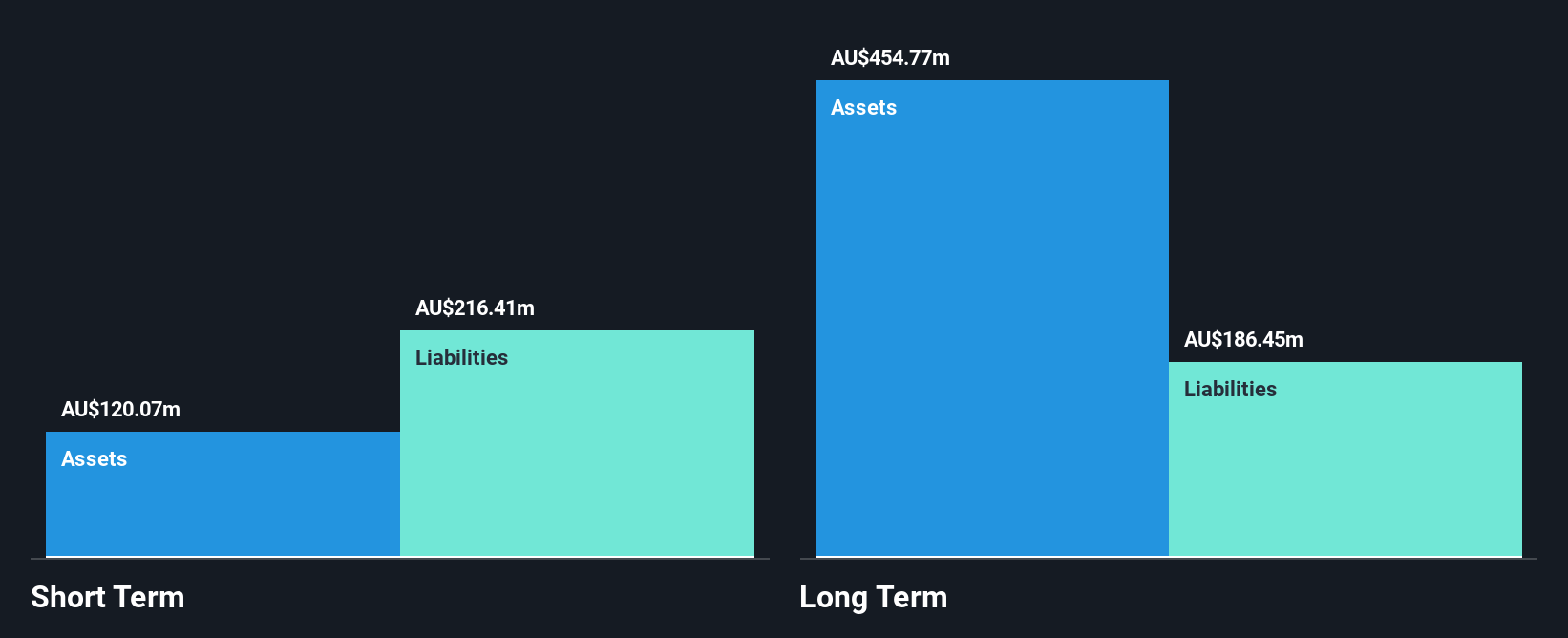

Australian Clinical Labs Limited, with a market cap of A$482.28 million, reported significant earnings growth of 35.5% over the past year, surpassing its five-year average decline. Its net profit margins improved to 4.4%, and interest payments are well-covered by EBIT at 4.8 times coverage. The company completed a share buyback program and is exploring accretive acquisitions for growth. Despite trading below estimated fair value and having satisfactory debt levels, short-term assets do not cover liabilities, posing a risk factor. The management team is experienced with an average tenure of 6.3 years, supporting operational stability amidst strategic expansion efforts.

- Navigate through the intricacies of Australian Clinical Labs with our comprehensive balance sheet health report here.

- Evaluate Australian Clinical Labs' prospects by accessing our earnings growth report.

Delta Lithium (ASX:DLI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Delta Lithium Limited focuses on the exploration and development of lithium properties in Western Australia, with a market cap of A$136.27 million.

Operations: Delta Lithium Limited has not reported any revenue segments.

Market Cap: A$136.27M

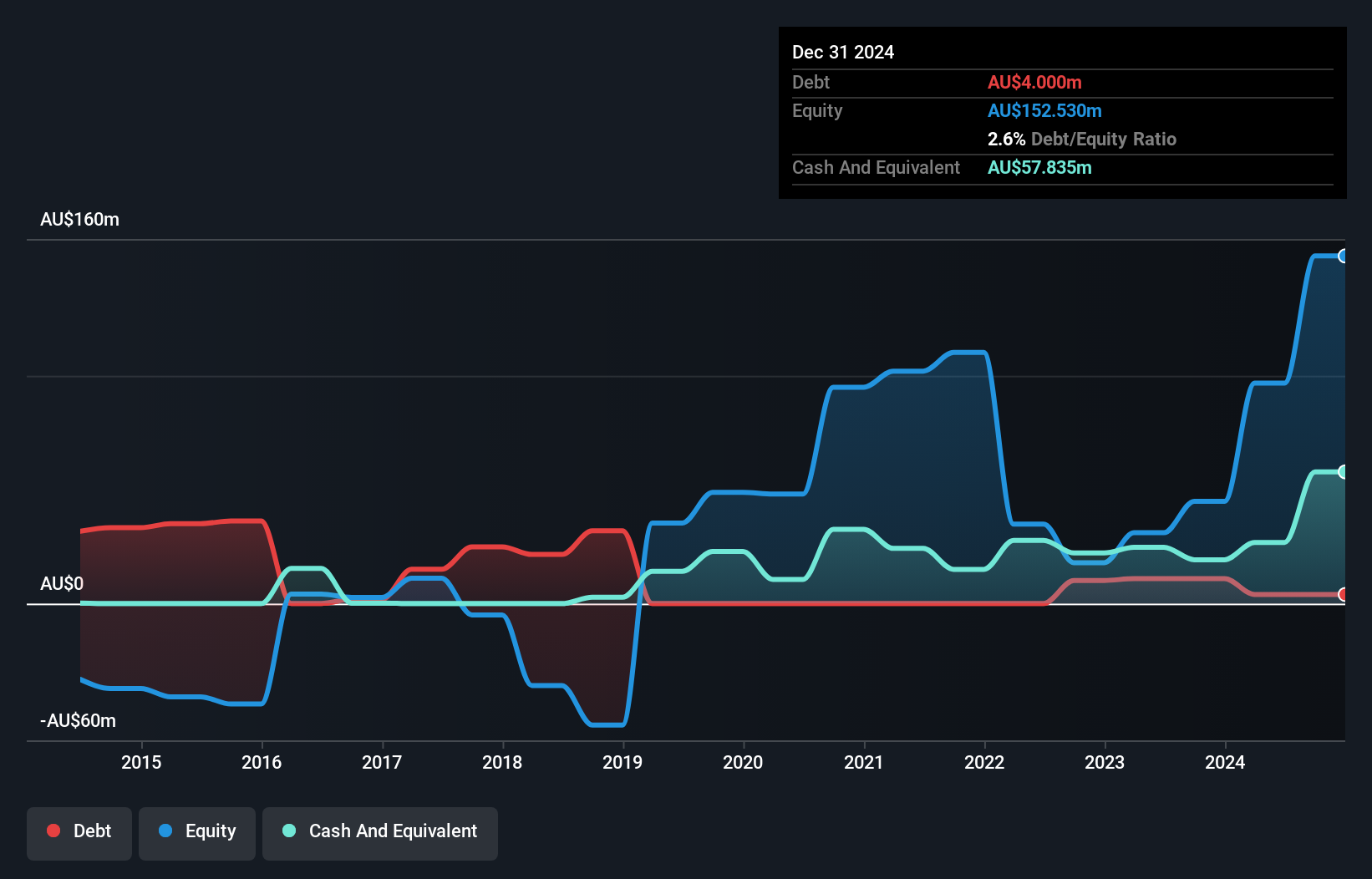

Delta Lithium Limited, with a market cap of A$136.27 million, is pre-revenue and currently unprofitable, reporting a net loss of A$3.68 million for the year ended June 30, 2025. Despite this, the company is debt-free and has short-term assets of A$119.2 million exceeding both its long-term liabilities (A$1.3 million) and short-term liabilities (A$5 million), indicating strong financial positioning relative to obligations. However, earnings are forecast to decline by an average of 38.9% annually over the next three years, presenting potential challenges ahead in achieving profitability or revenue growth without significant strategic shifts or external funding sources.

- Dive into the specifics of Delta Lithium here with our thorough balance sheet health report.

- Learn about Delta Lithium's future growth trajectory here.

Ora Banda Mining (ASX:OBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market cap of A$2.39 billion.

Operations: The company generates revenue of A$404.29 million from its gold mining operations.

Market Cap: A$2.39B

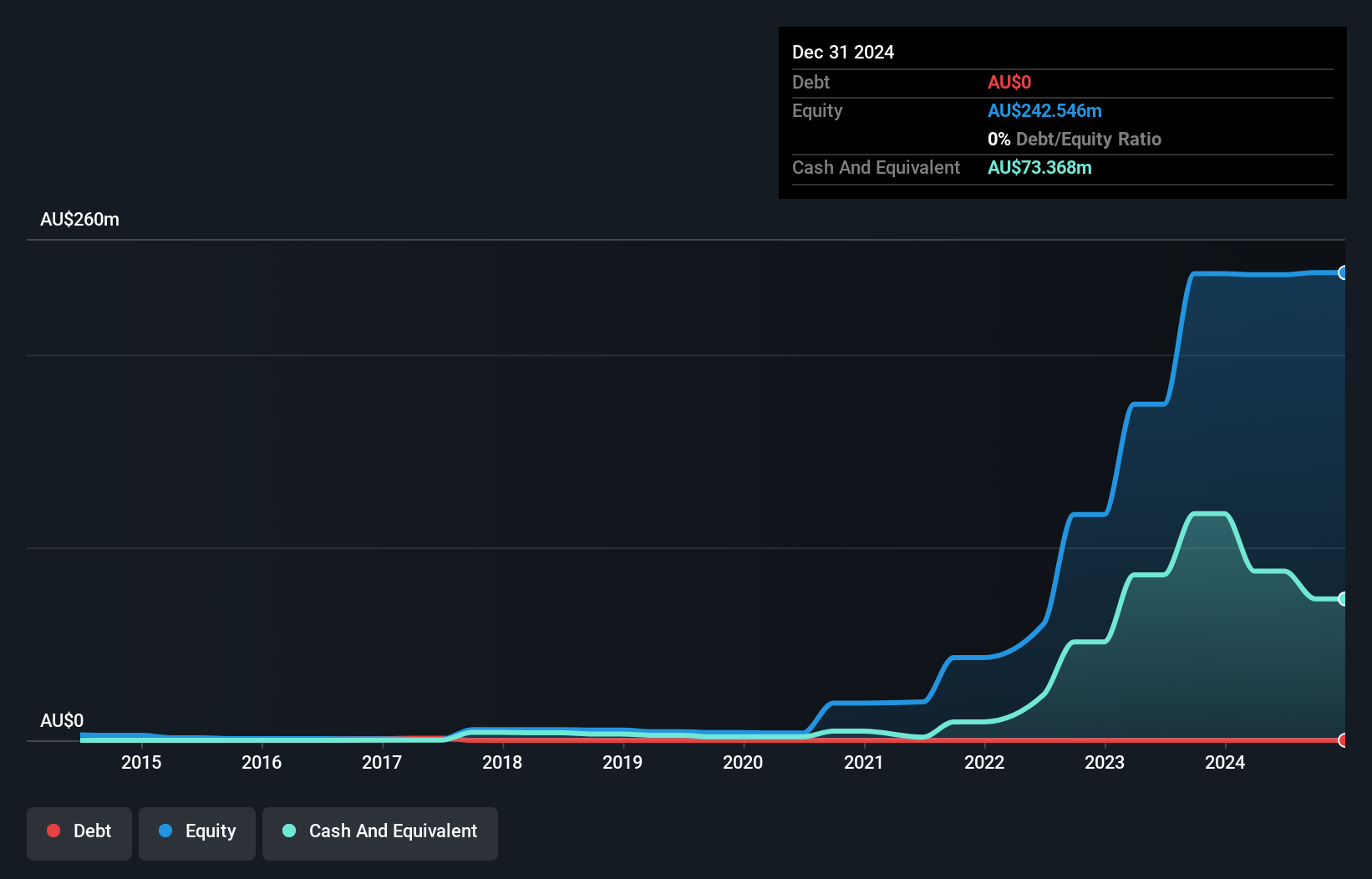

Ora Banda Mining Limited has demonstrated significant financial growth, with earnings surging by 575% over the past year and net income reaching A$186.08 million, up from A$27.57 million a year ago. The company benefits from strong profitability metrics, including an outstanding return on equity of 65% and high-quality earnings characterized by substantial non-cash components. Operating cash flow comfortably covers debt obligations, reinforcing its solid financial health alongside short-term assets exceeding both short-term and long-term liabilities. Trading at a good value relative to industry peers, Ora Banda's robust performance is further supported by experienced management and board members guiding strategic decisions effectively.

- Get an in-depth perspective on Ora Banda Mining's performance by reading our balance sheet health report here.

- Gain insights into Ora Banda Mining's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Access the full spectrum of 423 ASX Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OBM

Ora Banda Mining

Engages in the exploration, operation, and development of mineral properties and mining in Australia.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.