Here's Why We Think Nufarm (ASX:NUF) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Nufarm (ASX:NUF). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Nufarm with the means to add long-term value to shareholders.

See our latest analysis for Nufarm

Nufarm's Improving Profits

Over the last three years, Nufarm has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Nufarm's EPS shot from AU$0.15 to AU$0.26, over the last year. It's not often a company can achieve year-on-year growth of 73%.

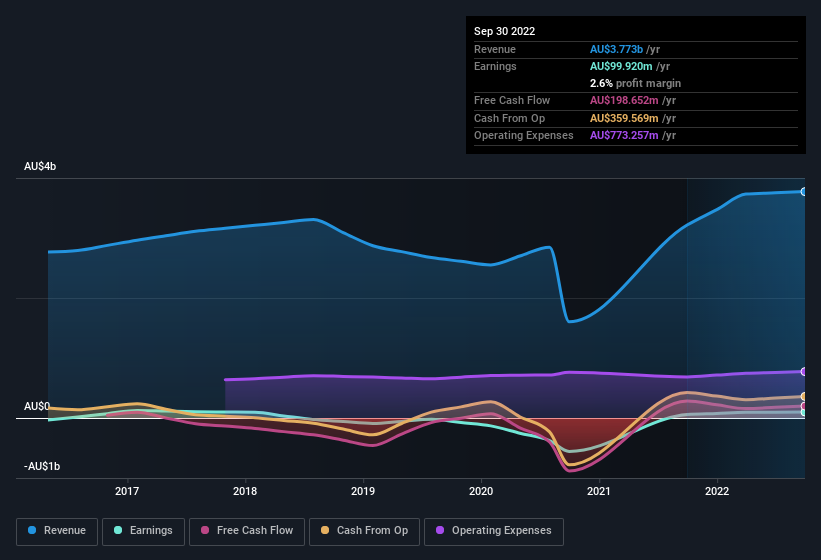

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Nufarm maintained stable EBIT margins over the last year, all while growing revenue 17% to AU$3.8b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Nufarm's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Nufarm Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Nufarm shareholders can gain quiet confidence from the fact that insiders shelled out AU$322k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was MD, CEO & Executive Director Gregory Hunt who made the biggest single purchase, worth AU$138k, paying AU$5.51 per share.

Is Nufarm Worth Keeping An Eye On?

Nufarm's earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this these factors intrigue you, then an addition of Nufarm to your watchlist won't go amiss. Now, you could try to make up your mind on Nufarm by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Nufarm is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nufarm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NUF

Nufarm

Develops, manufactures, and sells crop protection solutions and seed technologies in Europe, the Middle East, Africa, North America, and the Asia Pacific.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives