- Australia

- /

- Metals and Mining

- /

- ASX:NST

The Bull Case For Northern Star Resources (ASX:NST) Could Change Following 25-Year Renewable Power Deal

Reviewed by Sasha Jovanovic

- Northern Star Resources has entered a 25-year renewable power purchase agreement with Zenith Energy to supply wind, solar and battery-backed electricity to its Kalgoorlie Consolidated Gold Mines operation, aiming to improve power security and cut carbon intensity from the late 2020s.

- This long-term deal ties one of Northern Star’s largest gold hubs to cleaner, potentially more stable-cost energy, which could influence its operating risk profile and how investors view its future cost base.

- We’ll now explore how locking in renewable power at Kalgoorlie may reshape Northern Star’s broader investment narrative and long-term risk profile.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Northern Star Resources Investment Narrative Recap

To own Northern Star, you need to believe it can turn its enlarged Australian gold footprint into resilient, cash generative production while keeping big project and cost risks in check. The new 25‑year renewable power deal at Kalgoorlie supports that story around energy cost visibility and decarbonisation, but the more immediate catalysts and risks still sit with delivering the KCGM mill expansion, managing all in sustaining costs, and progressing Hemi on time and on budget.

The recent completion of the A$5,000,000,000 all share acquisition of De Grey Mining, and with it the Hemi project, is the announcement that most shapes how this power agreement might matter over time. Together, they reinforce that Northern Star’s investment case now hinges on whether it can integrate a much larger asset base, execute multi year capital programs and maintain cost discipline while industry wide inflation and permitting risk remain live issues for shareholders.

Yet investors should also be aware that …

Read the full narrative on Northern Star Resources (it's free!)

Northern Star Resources’ narrative projects A$9.1 billion revenue and A$2.0 billion earnings by 2028.

Uncover how Northern Star Resources' forecasts yield a A$27.39 fair value, a 5% upside to its current price.

Exploring Other Perspectives

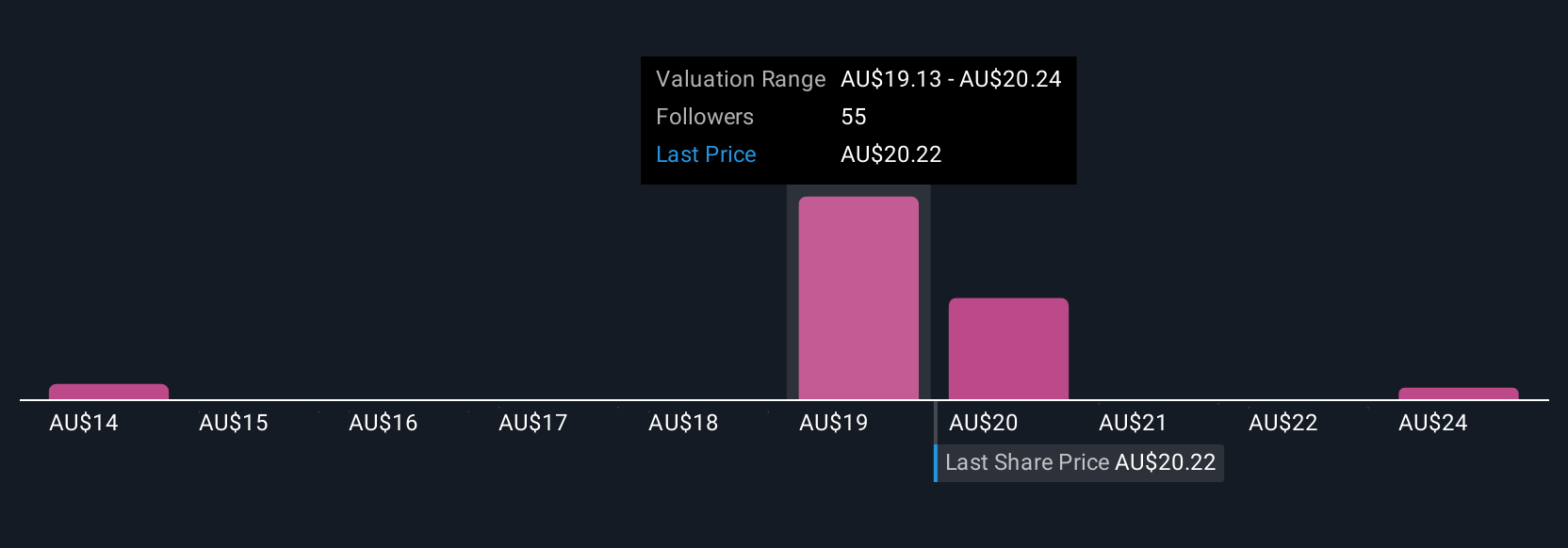

Thirteen members of the Simply Wall St Community now place Northern Star’s fair value anywhere between A$13.56 and A$58.16, with many clustering in the A$22 to A$36 range. Against that spread of views, the execution risk around KCGM’s expansion and the Hemi development could be what ultimately decides which of these valuations comes closer to how the market prices the company over time, so it is worth comparing several of these perspectives side by side.

Explore 13 other fair value estimates on Northern Star Resources - why the stock might be worth 48% less than the current price!

Build Your Own Northern Star Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Star Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northern Star Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Star Resources' overall financial health at a glance.

No Opportunity In Northern Star Resources?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Star Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NST

Northern Star Resources

Engages in the exploration, development, mining, and processing of gold deposits.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026