- Australia

- /

- Metals and Mining

- /

- ASX:NAG

Shareholders May Not Be So Generous With Nagambie Resources Limited's (ASX:NAG) CEO Compensation And Here's Why

Key Insights

- Nagambie Resources to hold its Annual General Meeting on 29th of November

- Salary of AU$233.3k is part of CEO James Earle's total remuneration

- Total compensation is similar to the industry average

- Nagambie Resources' three-year loss to shareholders was 44% while its EPS was down 31% over the past three years

Shareholders of Nagambie Resources Limited (ASX:NAG) will have been dismayed by the negative share price return over the last three years. Per share earnings growth is also lacking, despite revenue growth. The AGM coming up on 29th of November will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

See our latest analysis for Nagambie Resources

How Does Total Compensation For James Earle Compare With Other Companies In The Industry?

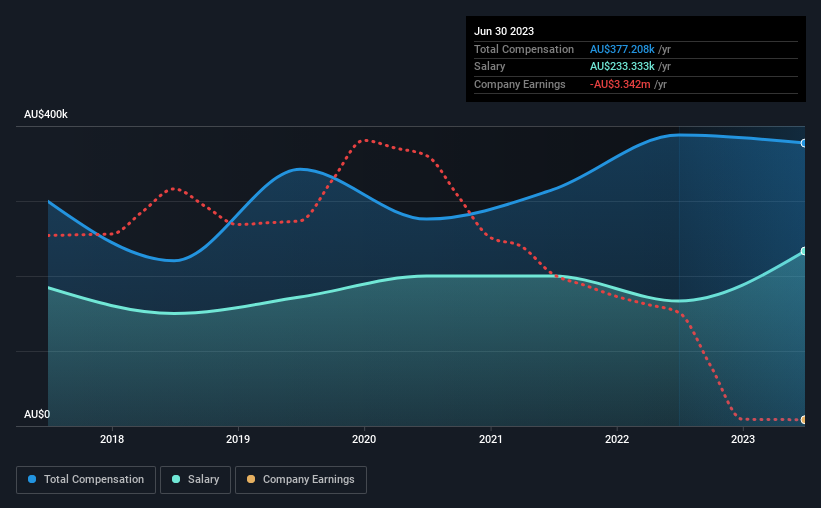

According to our data, Nagambie Resources Limited has a market capitalization of AU$16m, and paid its CEO total annual compensation worth AU$377k over the year to June 2023. That's mostly flat as compared to the prior year's compensation. In particular, the salary of AU$233.3k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Australian Metals and Mining industry with market capitalizations below AU$306m, reported a median total CEO compensation of AU$386k. From this we gather that James Earle is paid around the median for CEOs in the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$233k | AU$167k | 62% |

| Other | AU$144k | AU$221k | 38% |

| Total Compensation | AU$377k | AU$388k | 100% |

On an industry level, around 61% of total compensation represents salary and 39% is other remuneration. Our data reveals that Nagambie Resources allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Nagambie Resources Limited's Growth

Over the last three years, Nagambie Resources Limited has shrunk its earnings per share by 31% per year. Its revenue is up 20% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Nagambie Resources Limited Been A Good Investment?

The return of -44% over three years would not have pleased Nagambie Resources Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 5 warning signs for Nagambie Resources (of which 3 are potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nagambie Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NAG

Nagambie Resources

Explores for and develops gold and related minerals, and construction materials in Australia.

Moderate risk with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)