- Australia

- /

- Metals and Mining

- /

- ASX:MIN

Mineral Resources (ASX:MIN) Valuation in Focus as Critical Minerals Rally Boosts Investor Interest

Reviewed by Kshitija Bhandaru

The latest jump in interest around Mineral Resources (ASX:MIN) comes as lithium and critical minerals stocks stage a fresh rally on the ASX. This momentum is fueled by renewed enthusiasm for clean energy and supply chain resilience.

See our latest analysis for Mineral Resources.

MIN’s share price has surged 23% over the past month and 61% across the past 90 days, thanks to sector-wide excitement around lithium and upbeat news from its iron ore operations. While momentum is clearly building in the short term, the past year’s 13% decline in total shareholder return highlights the volatility facing critical minerals stocks. Longer-term gains remain significant.

If this rebound in mining leaders has you looking for the next big opportunity, it could be the perfect moment to discover fast growing stocks with high insider ownership

With shares vaulting higher in recent months, investors now face a critical question: is Mineral Resources still trading at a valuation discount, or has the recent rally already captured the company’s future growth potential?

Most Popular Narrative: 20.6% Overvalued

With Mineral Resources shares closing at A$44.14, the most widely followed narrative contends that the fair value is only A$36.60. This casts the recent rally in a different light and sets up a sharp debate about whether the stock has sprinted too far, too fast, beyond what its earnings trajectory can support.

Ongoing investments in infrastructure, logistics (haul roads, transshippers), and automation are already driving operational efficiencies and enabling margin expansion in Mining Services. Future benefits are expected to accrue as volumes increase and cost per tonne decreases, supporting earnings and net margin growth.

Curious what numerical leaps and strategic bets underpin this sky-high share price? The narrative’s projected margins and growth assumptions fuel a valuation model with some eyebrow-raising underlying estimates. Wondering just how bold those forecasts are and what’s required to achieve that fair value? Don’t miss the full breakdown.

Result: Fair Value of $36.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent financial constraints and sustained low lithium prices could challenge the company’s growth outlook and may require a more cautious approach to expansion.

Find out about the key risks to this Mineral Resources narrative.

Another View: Value Signals from Revenue Multiples

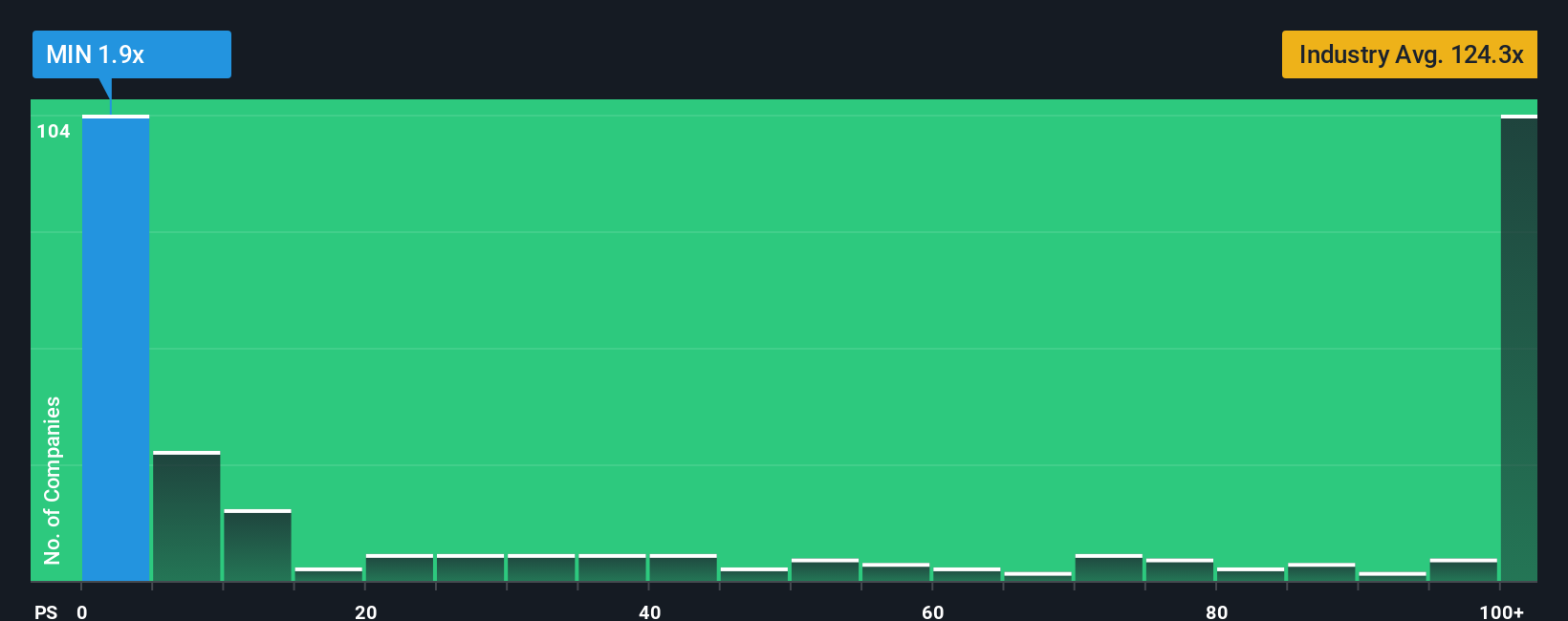

Stepping back from earnings models, the market’s lens through revenue tells a different story. Mineral Resources trades at a Price-to-Sales of 1.9x, which is cheaper than both its peers (3.7x) and the industry average (123.5x), and is well below the market’s fair ratio of 23.3x. That could point to a valuation opportunity, or it may indicate that investors remain wary due to its recent losses. Can the company close this gap as conditions change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mineral Resources Narrative

If these perspectives stir fresh questions or you see things differently, you can easily run your own numbers and shape a personal view in just a few minutes, then Do it your way.

A great starting point for your Mineral Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your next great opportunity could be just one click away. Don’t let others leave you behind as these investment themes gain traction and reveal future leaders.

- Find potential bargains and attractively priced opportunities with the help of these 899 undervalued stocks based on cash flows backed by robust cash flow metrics.

- Enhance your passive income strategy by targeting these 19 dividend stocks with yields > 3% offering yields above 3% from resilient, steady payers.

- Stay at the forefront of digital disruption by exploring these 79 cryptocurrency and blockchain stocks pioneering advancements in blockchain and cryptocurrency solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, provides mining services in Australia, Asia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)