- Australia

- /

- Metals and Mining

- /

- ASX:MIN

Does Investor Optimism in Critical Minerals Shift the Long-Term Growth Outlook for Mineral Resources (ASX:MIN)?

Reviewed by Sasha Jovanovic

- Mineral Resources shares advanced as part of a strong rally in lithium and critical minerals stocks, even though there was no direct news from key Chinese markets.

- Investor sentiment in the sector has been lifted by ongoing broker updates and a positive industry outlook, reflecting increased interest despite muted consumer performance on the broader S&P/ASX 200.

- We'll explore how renewed enthusiasm for the critical minerals sector may influence Mineral Resources' investment narrative and growth drivers.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Mineral Resources Investment Narrative Recap

To own shares in Mineral Resources, investors will need to have confidence in a global energy transition that drives ongoing demand for lithium and iron ore, together with the company's ability to manage capital intensity and commodity pricing volatility. This week’s rally in lithium-related stocks is a sign of sector-wide optimism, but given the absence of major news or a material change in the company’s operations or end markets, it has limited impact on Mineral Resources’ immediate catalysts or the major risk of elevated debt and funding needs following significant capital expenditure.

Among recent developments, the September announcement of a US$700 million debt refinancing stands out, as it directly addresses concerns around high interest expenses and liquidity, currently the most pressing risk for Mineral Resources. This move has the potential to improve near-term financial stability, but the company’s future growth and margin recovery still depend on how quickly it can ramp up profitable operations and whether higher lithium prices materialise before further expansion plans are activated.

Yet, despite the optimism, there’s a contrasting caution for investors around the risk that if lithium prices remain weak or capital intensity stays high, then...

Read the full narrative on Mineral Resources (it's free!)

Mineral Resources' narrative projects A$5.8 billion revenue and A$284.7 million earnings by 2028. This requires 9.3% yearly revenue growth and an earnings increase of A$1,188.7 million from A$-904.0 million today.

Uncover how Mineral Resources' forecasts yield a A$36.60 fair value, a 16% downside to its current price.

Exploring Other Perspectives

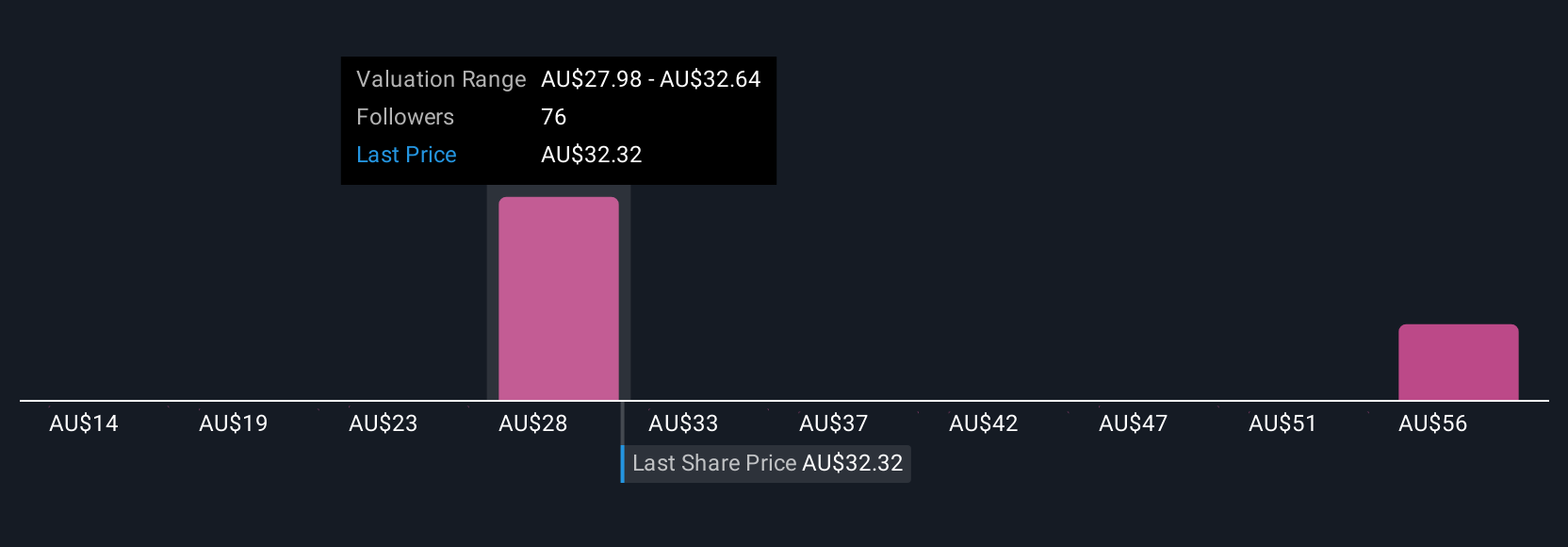

Ten members of the Simply Wall St Community put fair value for Mineral Resources between A$20.46 and A$54.04, illustrating widespread disagreement. Against this backdrop, many are watching how recent debt refinancing might influence the company’s ability to weather ongoing price volatility and high funding needs.

Explore 10 other fair value estimates on Mineral Resources - why the stock might be worth as much as 24% more than the current price!

Build Your Own Mineral Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mineral Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mineral Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mineral Resources' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, provides mining services in Australia, Asia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion