ASX Growth Companies With High Insider Ownership In October 2024

Reviewed by Simply Wall St

The Australian market has experienced a mixed performance recently, with the ASX200 closing 0.74% lower at 8,209 points due to a fall in commodity prices, despite strong retail sales data for August. In this environment of fluctuating sector performances and economic indicators, identifying growth companies with high insider ownership can provide valuable insights into potential investment opportunities.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 49.3% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's uncover some gems from our specialized screener.

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Liontown Resources Limited focuses on the exploration, evaluation, and development of mineral properties in Australia and has a market cap of A$1.90 billion.

Operations: Liontown Resources Limited generates revenue through the exploration, evaluation, and development of mineral properties within Australia.

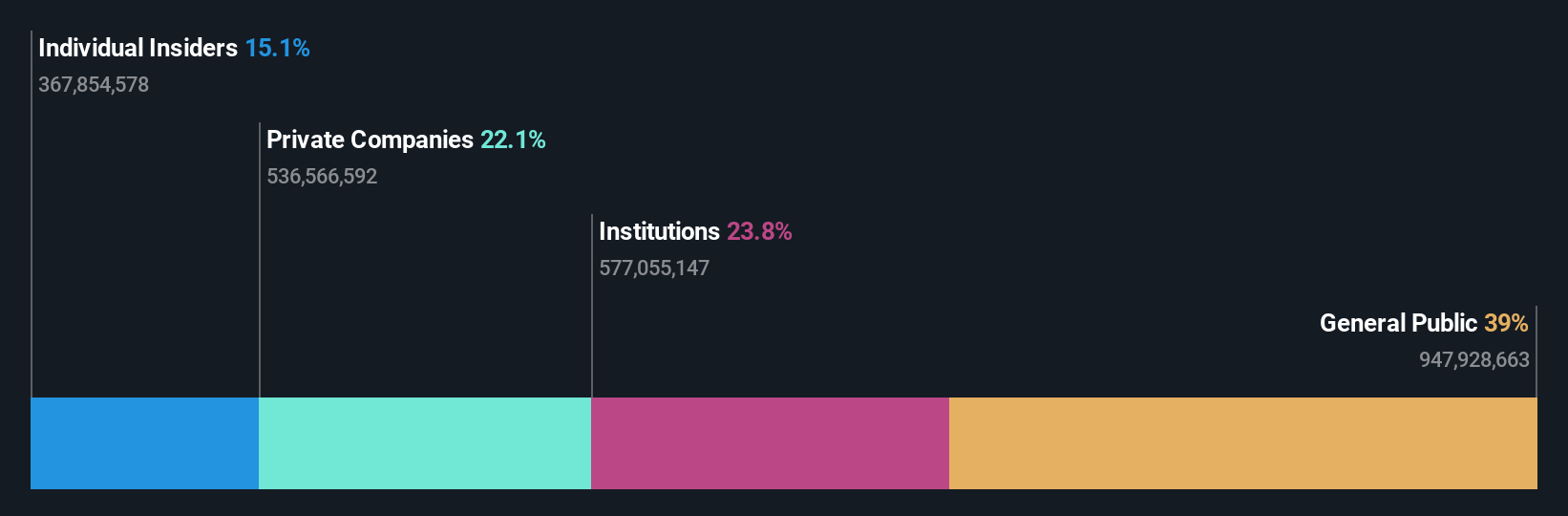

Insider Ownership: 16.4%

Earnings Growth Forecast: 49.3% p.a.

Liontown Resources, a growth company with significant insider ownership, has seen more insider buying than selling in recent months. Despite reporting a net loss of A$64.92 million for FY 2024, its revenue is projected to grow at 38.8% annually—significantly above the market average. The company's strategic partnership with LG Energy Solution includes a US$250 million investment and an extended offtake agreement, bolstering its Kathleen Valley lithium project and positioning it for future profitability within three years.

- Take a closer look at Liontown Resources' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Liontown Resources shares in the market.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$10.06 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: The company generates revenue from several segments, including Energy (A$16 million), Lithium (A$1.41 billion), Iron Ore (A$2.58 billion), Mining Services (A$3.38 billion), and Other Commodities (A$19 million).

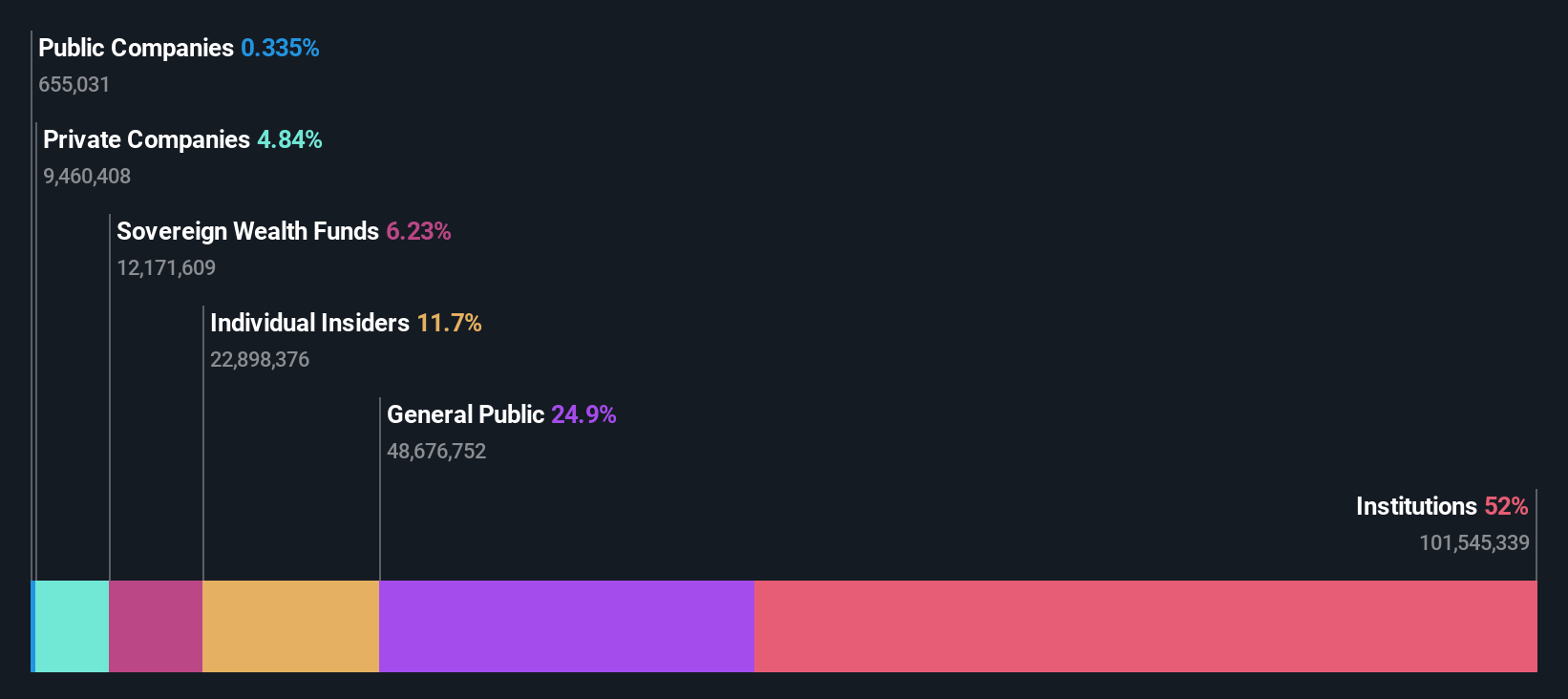

Insider Ownership: 11.7%

Earnings Growth Forecast: 38.3% p.a.

Mineral Resources has seen more insider buying than selling recently, indicating confidence from its leadership. Despite a drop in net profit margins from 5.1% to 2.4% and net income falling to A$125 million, the company remains undervalued by approximately 46.5%. With earnings forecasted to grow at 38.3% per year—outpacing the Australian market—Mineral Resources is positioned for substantial growth, although interest payments are not well covered by current earnings.

- Navigate through the intricacies of Mineral Resources with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Mineral Resources shares in the market.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.76 billion.

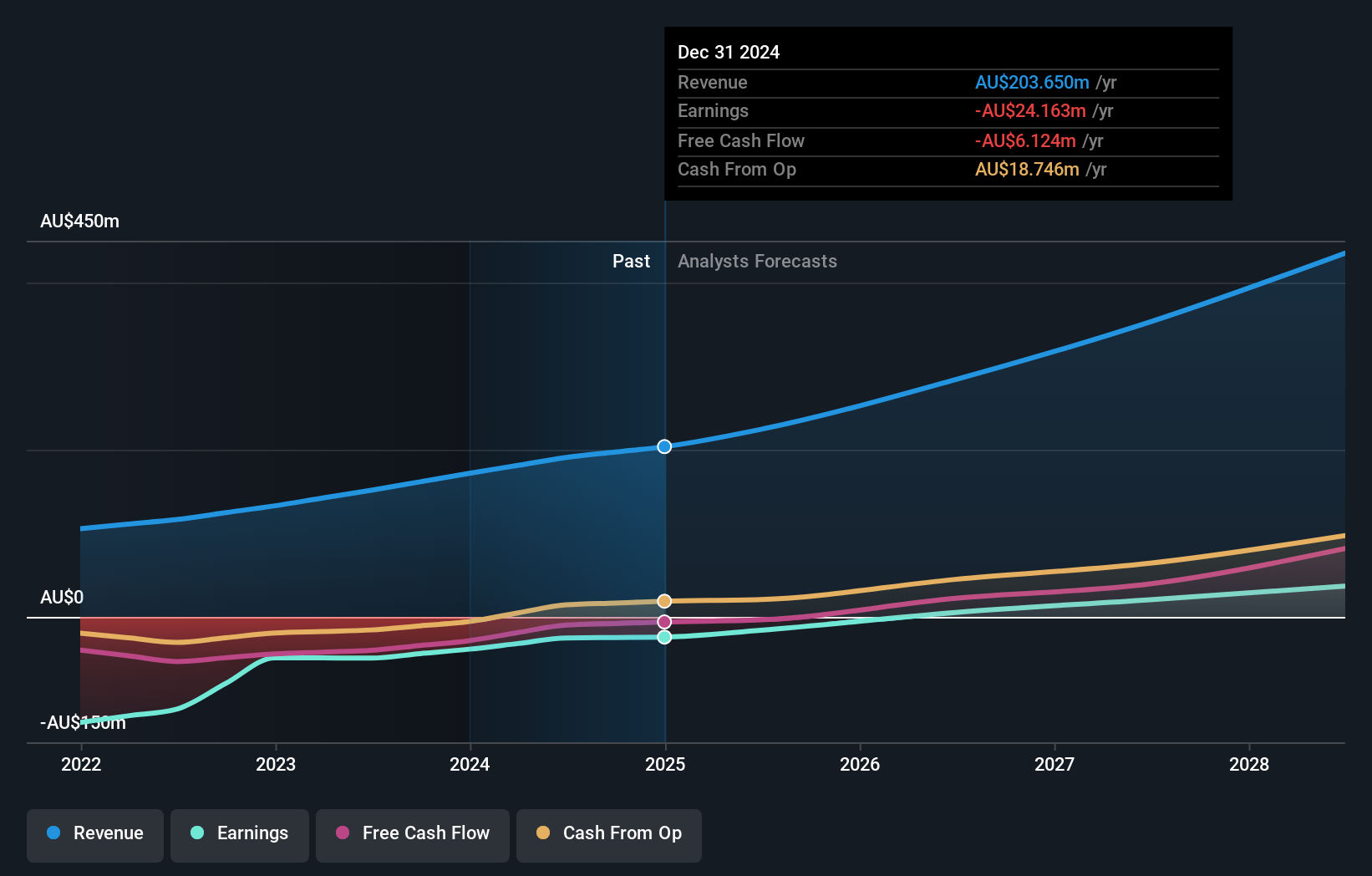

Operations: The company's revenue primarily comes from its software and programming segment, totaling A$190.84 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 60.5% p.a.

SiteMinder is trading at 13.5% below its estimated fair value and has a high forecasted return on equity of 25.5% in three years. Earnings are projected to grow annually by 60.52%, with revenue expected to increase by 19.4% per year, outpacing the Australian market's growth rate of 5.5%. Recent earnings reported sales of A$190.67 million, up from A$151.38 million last year, while net loss narrowed significantly to A$25.13 million from A$49.3 million previously.

- Get an in-depth perspective on SiteMinder's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that SiteMinder is trading beyond its estimated value.

Next Steps

- Discover the full array of 102 Fast Growing ASX Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDR

SiteMinder

Provides software and online licensing solutions in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives