- Australia

- /

- Specialty Stores

- /

- ASX:TPW

ASX Growth Companies With High Insider Ownership In November 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, yet it has seen a robust 15% increase over the past year with earnings forecasted to grow by 13% annually. In this context of steady growth, stocks with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Catalyst Metals (ASX:CYL) | 14.8% | 33.1% |

| Medallion Metals (ASX:MM8) | 12.9% | 72.7% |

| Genmin (ASX:GEN) | 12.3% | 117.7% |

| Acrux (ASX:ACR) | 18.4% | 91.6% |

| AVA Risk Group (ASX:AVA) | 15.7% | 77.3% |

| Pointerra (ASX:3DP) | 20.8% | 126.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 67.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's uncover some gems from our specialized screener.

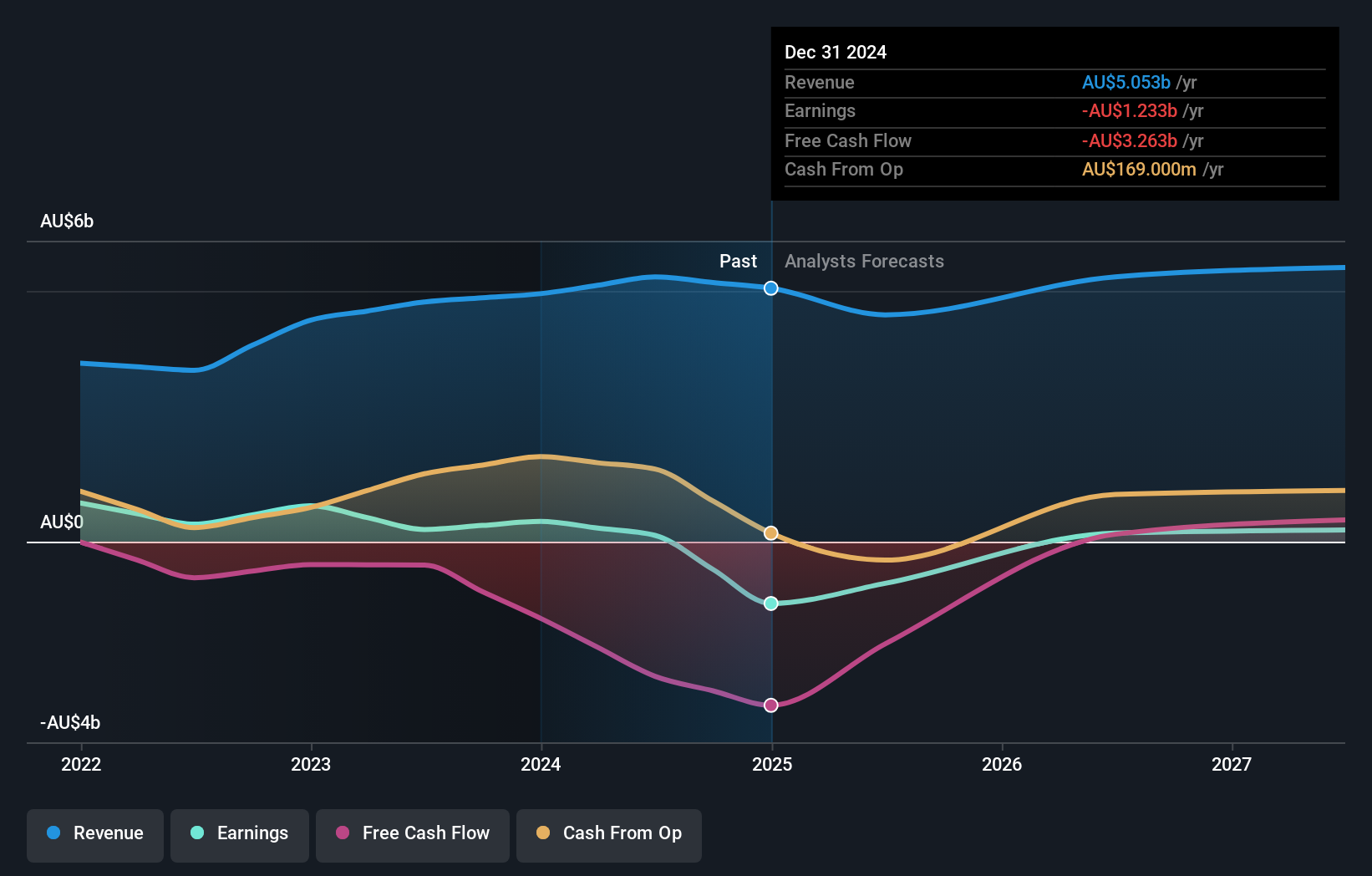

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, along with its subsidiaries, operates as a mining services company in Australia, Asia, and internationally with a market cap of A$6.82 billion.

Operations: The company generates revenue from several key segments, including A$3.38 billion from Mining Services, A$2.58 billion from Iron Ore, and A$1.41 billion from Lithium, with additional contributions of A$16 million from Energy and A$19 million from Other Commodities.

Insider Ownership: 11.7%

Earnings Growth Forecast: 38.8% p.a.

Mineral Resources demonstrates strong growth potential with earnings forecasted to grow significantly at 38.8% annually, outpacing the Australian market. Despite a high net debt of A$4.4 billion, strategic asset sales and partnerships are being pursued to bolster financial stability. Insider ownership remains robust with no substantial recent sales, indicating confidence in its prospects. However, profit margins have declined and interest coverage is weak, highlighting financial challenges amid ongoing leadership transitions and asset sale considerations.

- Unlock comprehensive insights into our analysis of Mineral Resources stock in this growth report.

- The valuation report we've compiled suggests that Mineral Resources' current price could be inflated.

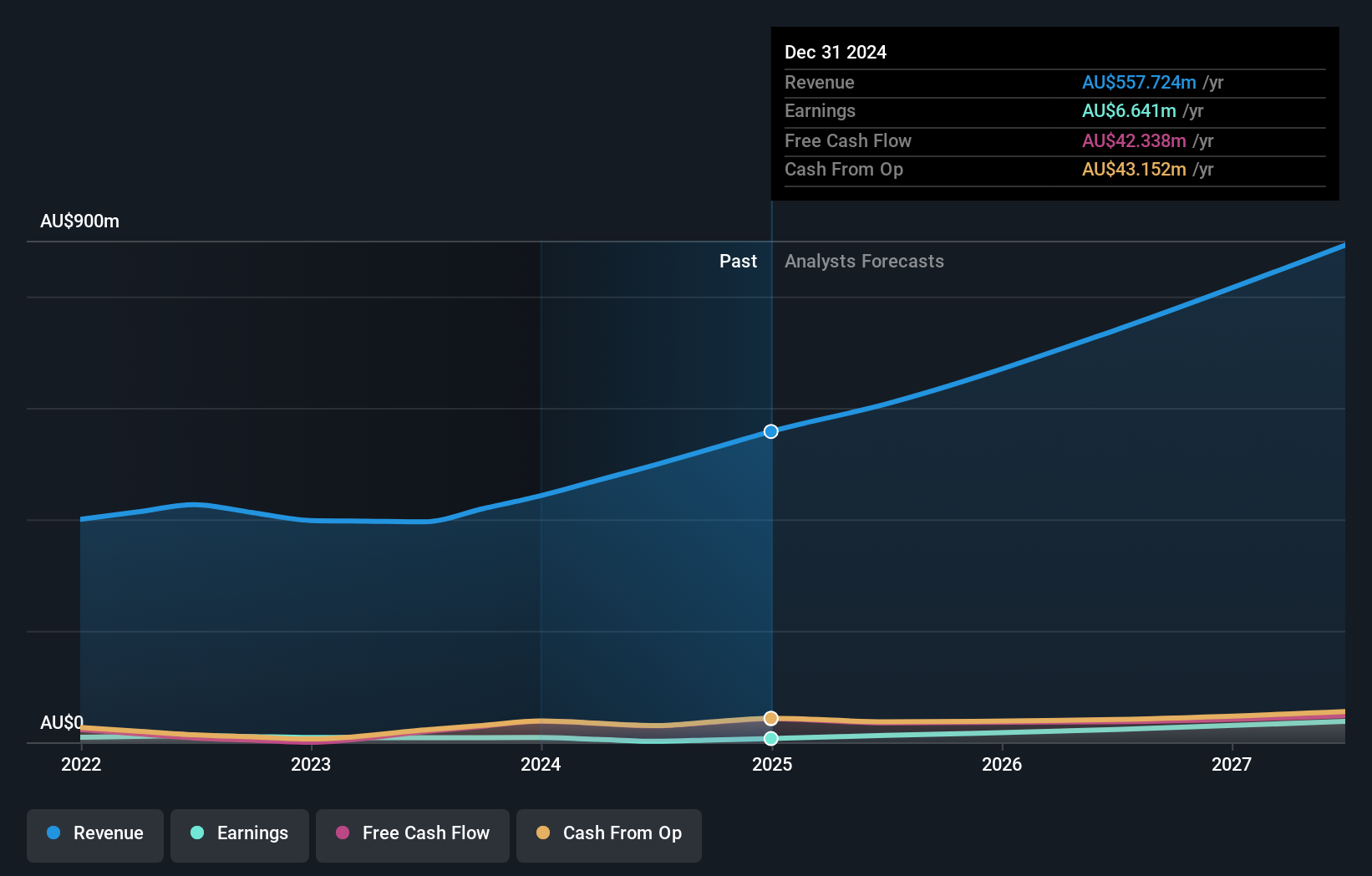

PWR Holdings (ASX:PWH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PWR Holdings Limited specializes in the design, prototyping, production, testing, validation, and sale of cooling products and solutions across Australia and various international markets with a market capitalization of A$933.23 million.

Operations: The company's revenue segments consist of A$41.98 million from PWR C&R and A$111.26 million from PWR Performance Products.

Insider Ownership: 13.2%

Earnings Growth Forecast: 15% p.a.

PWR Holdings showcases growth potential with earnings expected to grow at 15% annually, surpassing the Australian market average. The company reported A$97.53 million in sales and A$20.99 million in net income for the year ending June 2024, reflecting consistent profitability improvements. Insider ownership is strong, with no significant recent insider trading activity suggesting confidence in its trajectory. Recent executive changes include appointing Sharyn Williams as CFO, indicating a strategic focus on financial governance and operational outcomes.

- Click here to discover the nuances of PWR Holdings with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that PWR Holdings is priced higher than what may be justified by its financials.

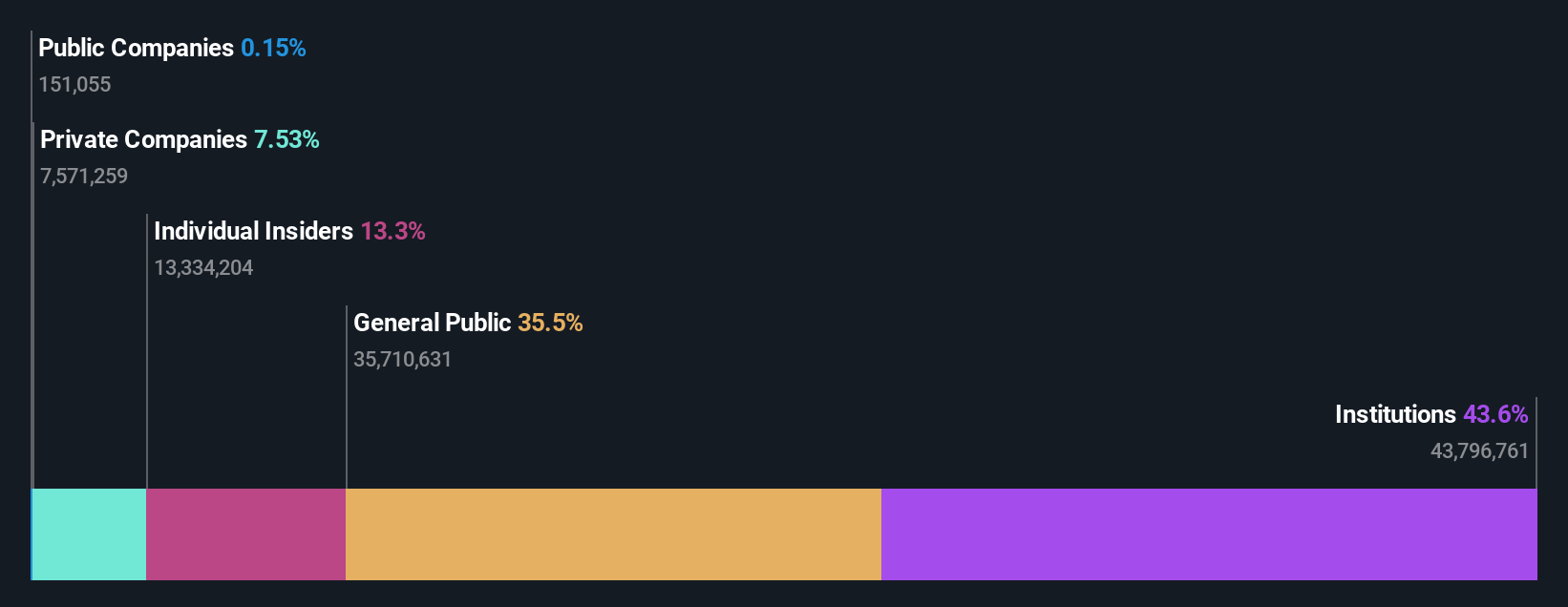

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products in Australia with a market cap of A$1.39 billion.

Operations: The company's revenue comes from the sale of furniture, homewares, and home improvement products, amounting to A$497.84 million.

Insider Ownership: 13.8%

Earnings Growth Forecast: 40.2% p.a.

Temple & Webster Group is trading below its estimated fair value, with revenue expected to grow at 15.8% annually, outpacing the broader Australian market. Earnings are forecast to rise significantly at 40.2% per year, indicating robust growth potential despite recent margin declines from 2.1% to 0.4%. Insider activity shows more buying than selling in recent months, reflecting confidence in future performance ahead of the Q1 2025 results announcement on November 7, 2024.

- Get an in-depth perspective on Temple & Webster Group's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Temple & Webster Group is trading beyond its estimated value.

Make It Happen

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 90 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Temple & Webster Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TPW

Temple & Webster Group

Engages in the online retail of furniture, homewares, and home improvement products in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives