- Australia

- /

- Metals and Mining

- /

- ASX:LTR

ASX Growth Companies With High Insider Ownership In December 2025

Reviewed by Simply Wall St

As the Australian market navigates a period of uncertainty, with recent RBA decisions and sector fluctuations impacting investor sentiment, attention is increasingly turning towards growth companies with high insider ownership. In such an environment, stocks where insiders hold significant stakes can often signal confidence in the company's long-term prospects, making them intriguing considerations for investors seeking stability and potential growth.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.4% | 96.4% |

| Titomic (ASX:TTT) | 13.5% | 74.9% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 11% | 31.4% |

| IRIS Metals (ASX:IR1) | 23% | 144.4% |

| Emerald Resources (ASX:EMR) | 18.4% | 57.2% |

| Elsight (ASX:ELS) | 17.3% | 77% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Here's a peek at a few of the choices from the screener.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited operates quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$2.19 billion.

Operations: The company generates revenue of A$465.04 million from its quick service restaurant operations across multiple countries.

Insider Ownership: 15.9%

Earnings Growth Forecast: 32.3% p.a.

Guzman y Gomez is trading at 45.2% below its estimated fair value, with insiders substantially buying shares recently. The company has just turned profitable and forecasts significant earnings growth of 32.3% per year, outpacing the Australian market's 12%. Revenue is expected to grow at 15.5% annually, faster than the market average of 5.9%. A recent A$100 million share buyback plan aims to enhance shareholder returns while supporting expansion plans for new restaurant openings in FY26.

- Unlock comprehensive insights into our analysis of Guzman y Gomez stock in this growth report.

- The valuation report we've compiled suggests that Guzman y Gomez's current price could be inflated.

Liontown (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liontown Limited focuses on the exploration, evaluation, and development of mineral properties in Australia and has a market cap of A$4.35 billion.

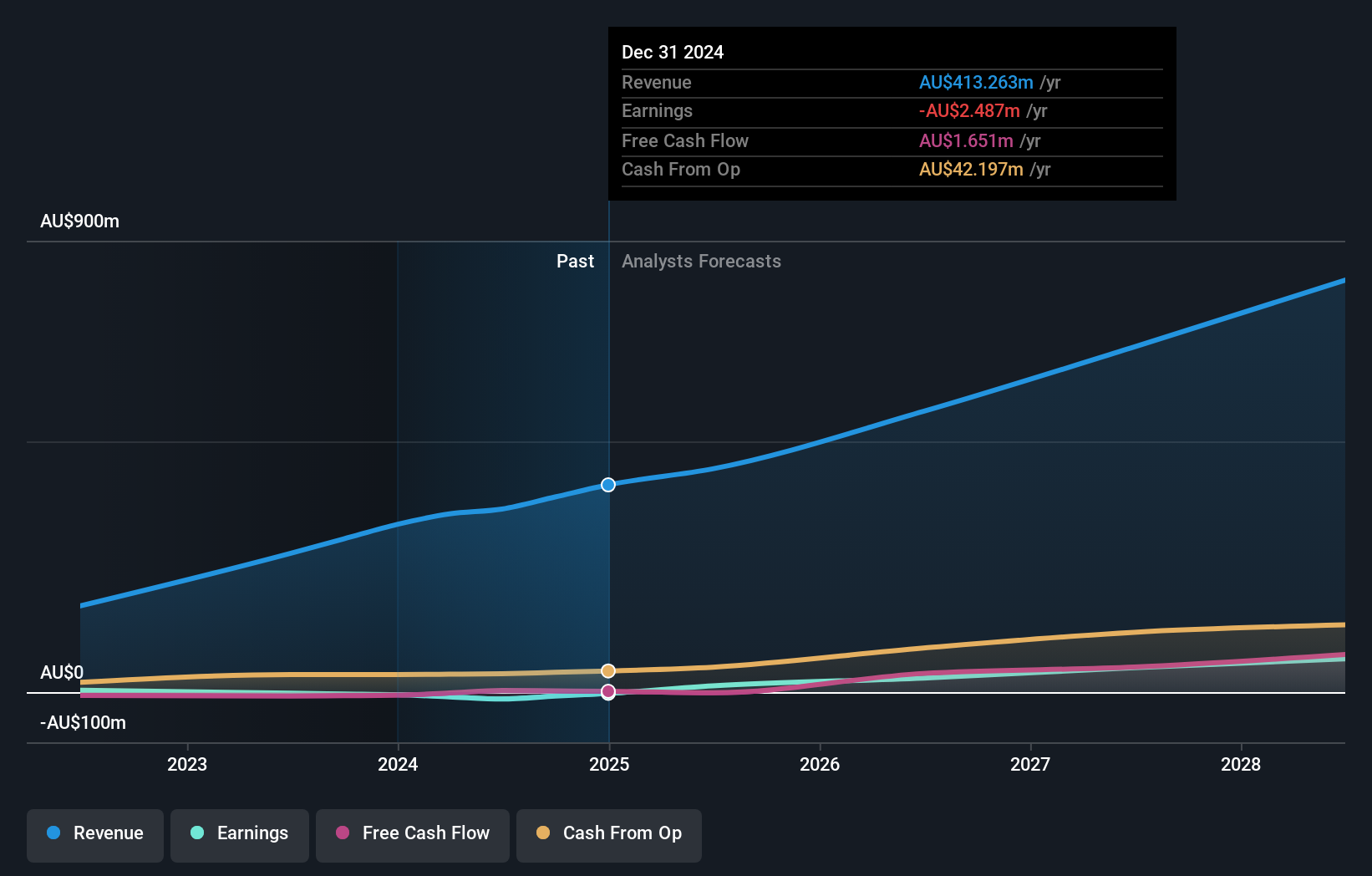

Operations: The company's revenue segment primarily consists of A$297.57 million from the exploration and development of minerals in Australia.

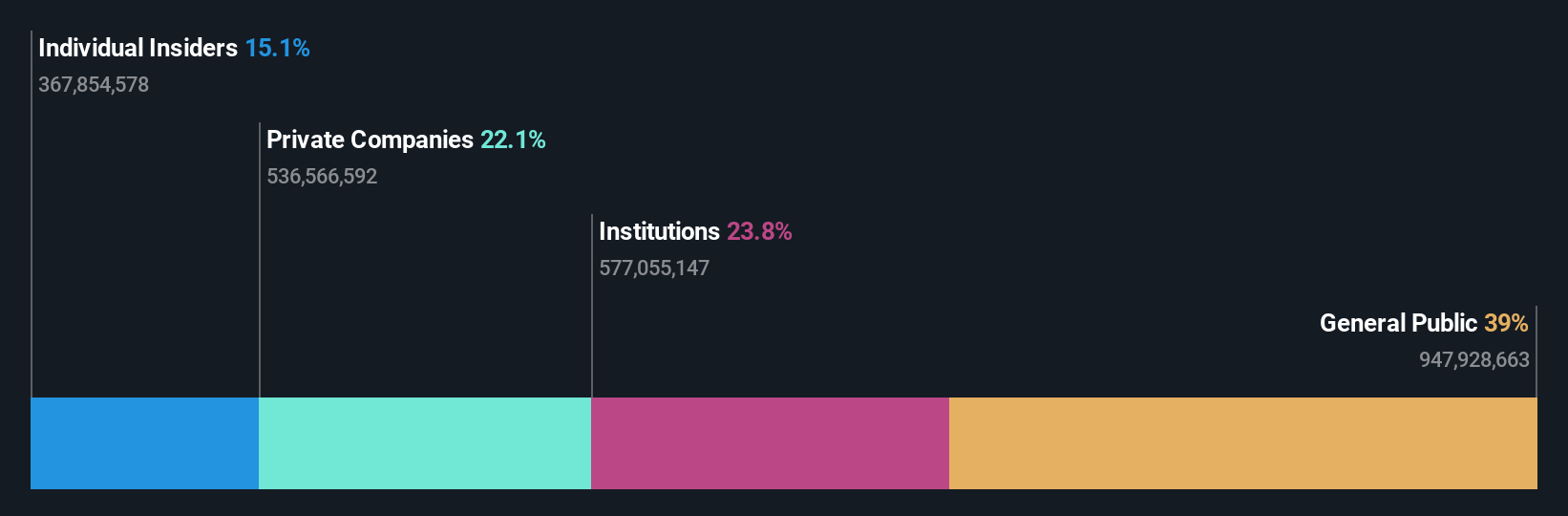

Insider Ownership: 12.1%

Earnings Growth Forecast: 72% p.a.

Liontown Resources is trading at 72.8% below its estimated fair value, with revenue projected to grow at 22.4% annually, surpassing the Australian market's growth rate. Despite recent insider selling, no substantial insider buying has occurred in the past three months. The company is expected to become profitable within three years, indicating above-average market growth potential. However, it recently reported a net loss of A$193.28 million for FY2025 amidst executive leadership changes.

- Get an in-depth perspective on Liontown's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Liontown's share price might be on the cheaper side.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, along with its subsidiaries, offers mining services across Australia, Asia, and internationally with a market cap of A$9.84 billion.

Operations: The company's revenue segments include A$601 million from Lithium, A$2.33 billion from Iron Ore, and A$3.30 billion from Mining Services.

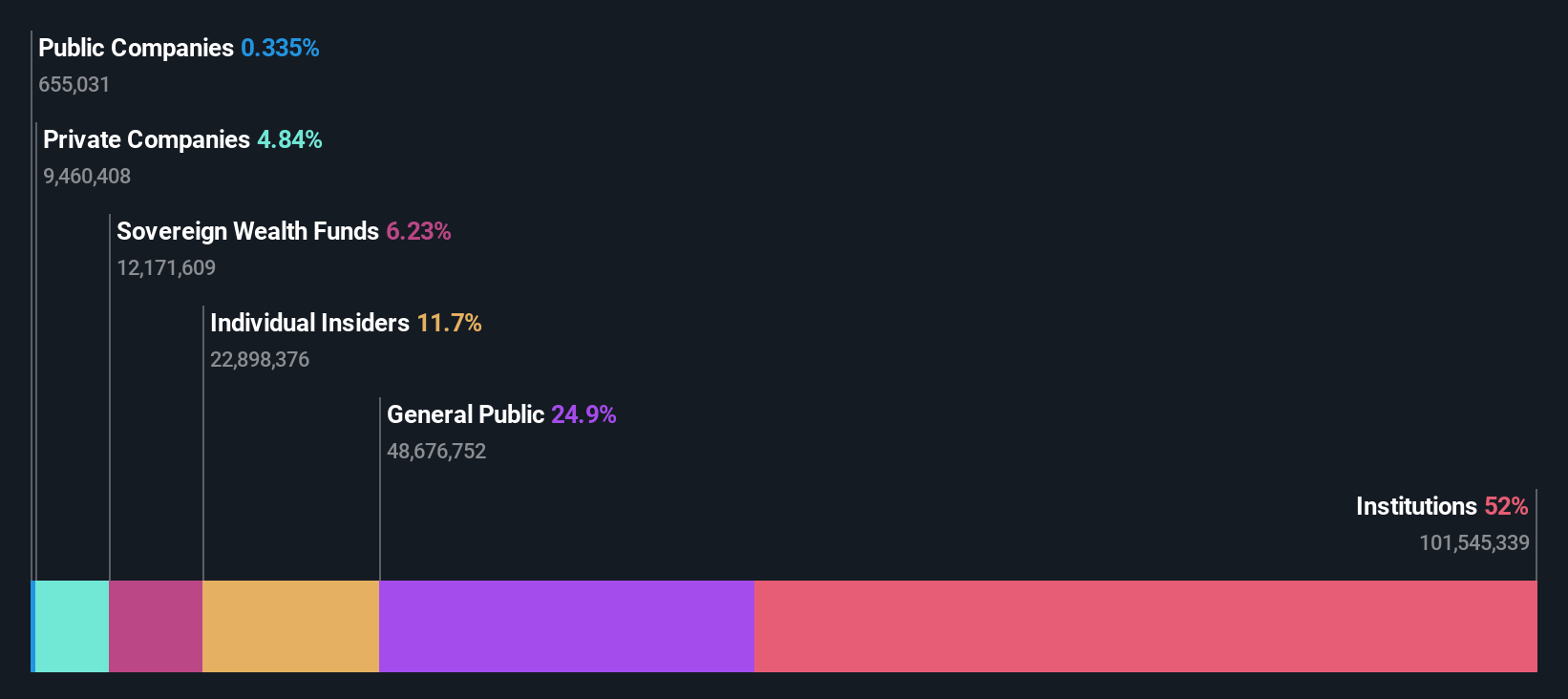

Insider Ownership: 11.4%

Earnings Growth Forecast: 59.5% p.a.

Mineral Resources, backed by billionaire Chris Ellison, is navigating a strategic phase with high insider ownership. The company is pursuing asset sales such as the Bald Hill lithium mine to manage its A$5.4 billion net debt after posting a significant loss. Despite this, its revenue growth forecast of 5.9% annually aligns with market expectations, while profitability is anticipated in three years. Recent board appointments enhance governance amid M&A discussions and rebounding lithium prices.

- Delve into the full analysis future growth report here for a deeper understanding of Mineral Resources.

- Our valuation report unveils the possibility Mineral Resources' shares may be trading at a discount.

Turning Ideas Into Actions

- Get an in-depth perspective on all 111 Fast Growing ASX Companies With High Insider Ownership by using our screener here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026