- Australia

- /

- Hospitality

- /

- ASX:FLT

ASX Growth Companies With High Insider Ownership Featuring Flight Centre Travel Group And Two More

Reviewed by Simply Wall St

Amidst a mixed performance in the Australian market, with sectors like financials showing strength while materials face declines, investors continue to navigate through varying economic signals. In such a landscape, growth companies with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.7% |

| Catalyst Metals (ASX:CYL) | 17.1% | 77.1% |

| Biome Australia (ASX:BIO) | 34.5% | 114.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 59.4% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 96.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 109.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

Let's review some notable picks from our screened stocks.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market capitalization of approximately A$4.96 billion.

Operations: The company generates revenue primarily through its leisure and corporate travel services, totaling A$1.28 billion and A$1.06 billion respectively.

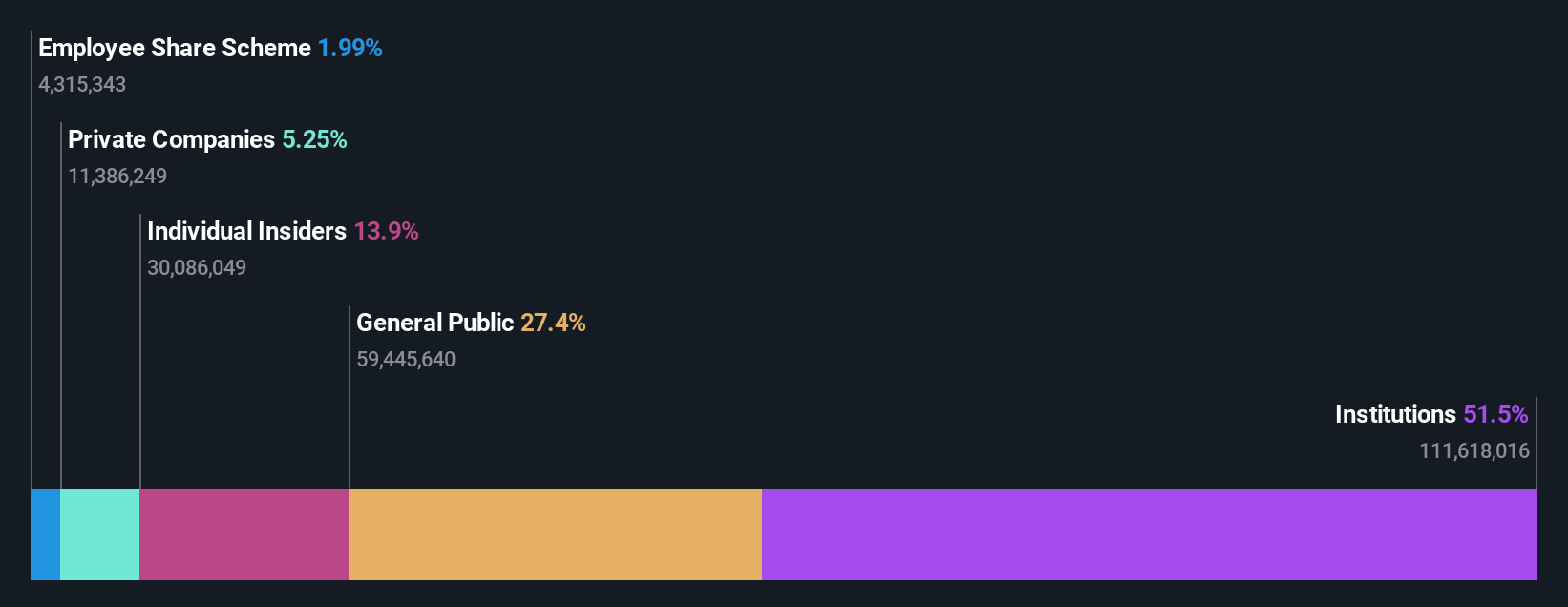

Insider Ownership: 13.3%

Flight Centre Travel Group, a notable entity in the travel sector, showcases promising financial prospects with insider ownership that aligns interests with shareholders. While its earnings are set to increase by 18.84% annually, this growth is robust but not exceptional. Revenue is expected to rise at 9.7% per year, outpacing the Australian market's 5.3%. Additionally, Flight Centre's Return on Equity is anticipated to be high at 21.9% in three years, reflecting efficient equity use and potential for sustained profitability.

- Click here to discover the nuances of Flight Centre Travel Group with our detailed analytical future growth report.

- According our valuation report, there's an indication that Flight Centre Travel Group's share price might be on the cheaper side.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★★☆

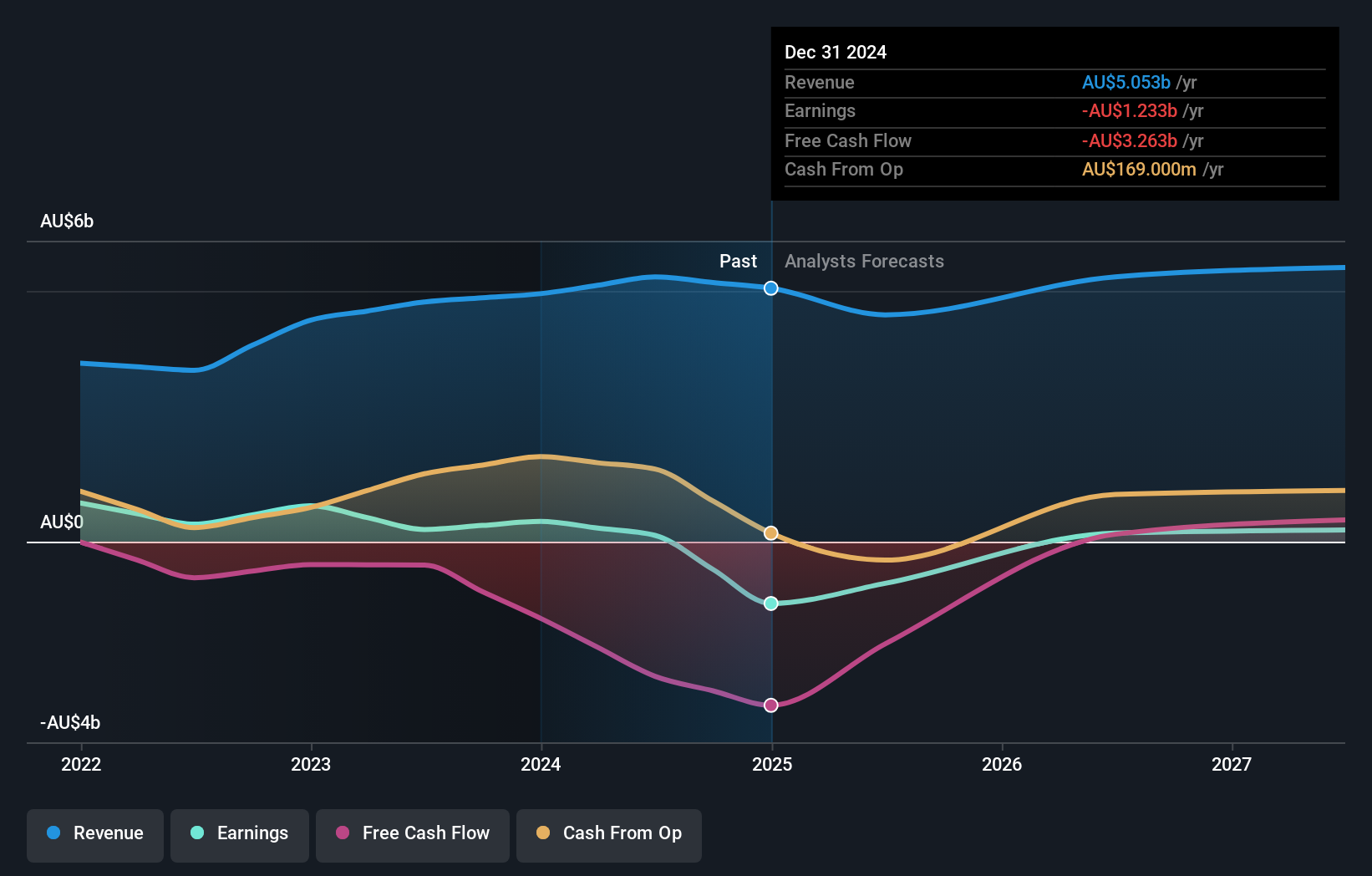

Overview: Mineral Resources Limited is a mining services company operating in Australia, Asia, and internationally, with a market capitalization of A$11.28 billion.

Operations: The company generates revenue through three primary streams: lithium (A$1.60 billion), iron ore (A$2.50 billion), and mining services (A$2.82 billion).

Insider Ownership: 11.6%

Mineral Resources, while trading at 40.5% below its estimated fair value, shows robust prospects with earnings expected to grow by 30.9% annually, outpacing the Australian market's average of 12.9%. However, it faces challenges as interest payments are not well covered by earnings and profit margins have declined from last year. Insider ownership aligns interests with shareholders, supporting potential growth despite financial pressure points.

- Navigate through the intricacies of Mineral Resources with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Mineral Resources' share price might be on the expensive side.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

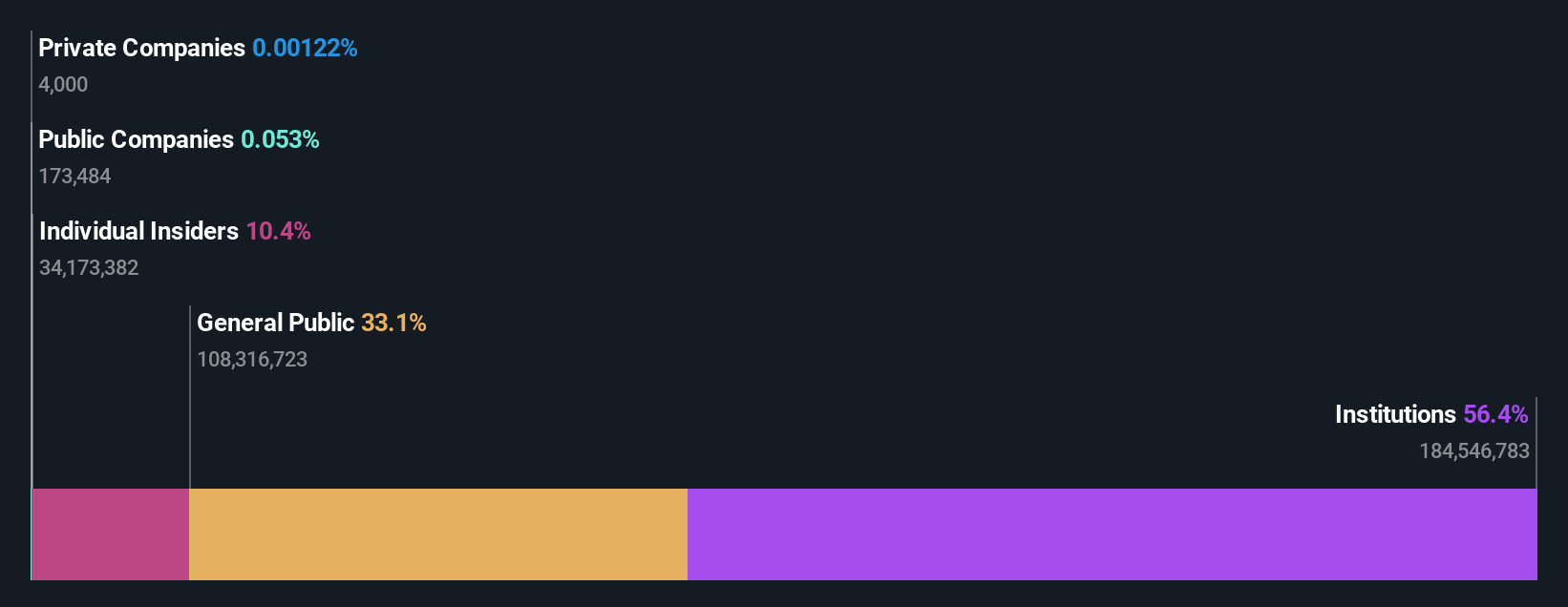

Overview: Technology One Limited is an Australian company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both domestically and internationally, with a market capitalization of approximately A$6.19 billion.

Operations: The company generates revenue through three primary segments: software sales contributing A$317.24 million, corporate services adding A$83.83 million, and consulting services at A$68.13 million.

Insider Ownership: 12.3%

Technology One, with high insider ownership, is positioned for continued growth, though its pace may not be as rapid as some peers. The company's recent financials show a solid increase in revenue to A$240.83 million and net income to A$48 million. The appointment of Paul Robson to the board could further enhance strategic initiatives, given his background in SaaS and operational efficiency. While the P/E ratio stands below industry average at 56.4x, earnings are expected to grow by 14.35% annually, slightly above the Australian market forecast of 12.9%.

- Get an in-depth perspective on Technology One's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Technology One implies its share price may be too high.

Turning Ideas Into Actions

- Embark on your investment journey to our 91 Fast Growing ASX Companies With High Insider Ownership selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Solid track record with excellent balance sheet.