The Australian market is set to open on a positive note, with the ASX 200 futures indicating an upward trend, despite recent disruptions due to a power outage. In light of these developments, investors might be considering various strategies as they navigate the final trading days before the holiday break. Penny stocks, while sometimes seen as an outdated term, continue to offer intriguing opportunities; they often represent smaller or newer companies that can provide significant returns when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$177.63M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.885 | A$306.91M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.80 | A$99.57M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.49 | A$303.87M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.59 | A$779.23M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.80 | A$100.97M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,054 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Midway (ASX:MWY)

Simply Wall St Financial Health Rating: ★★★★★★

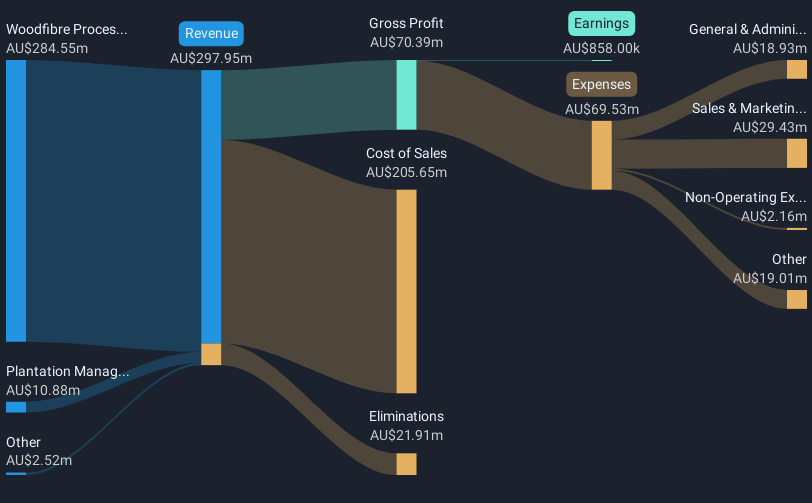

Overview: Midway Limited is involved in the production, processing, marketing, and export of woodfibre across Australia, China, Japan, and Southeast Asia with a market cap of A$105.68 million.

Operations: The company generates revenue primarily from its Woodfibre Processing segment, which accounts for A$284.55 million, and its Plantation Management segment, contributing A$10.88 million.

Market Cap: A$105.68M

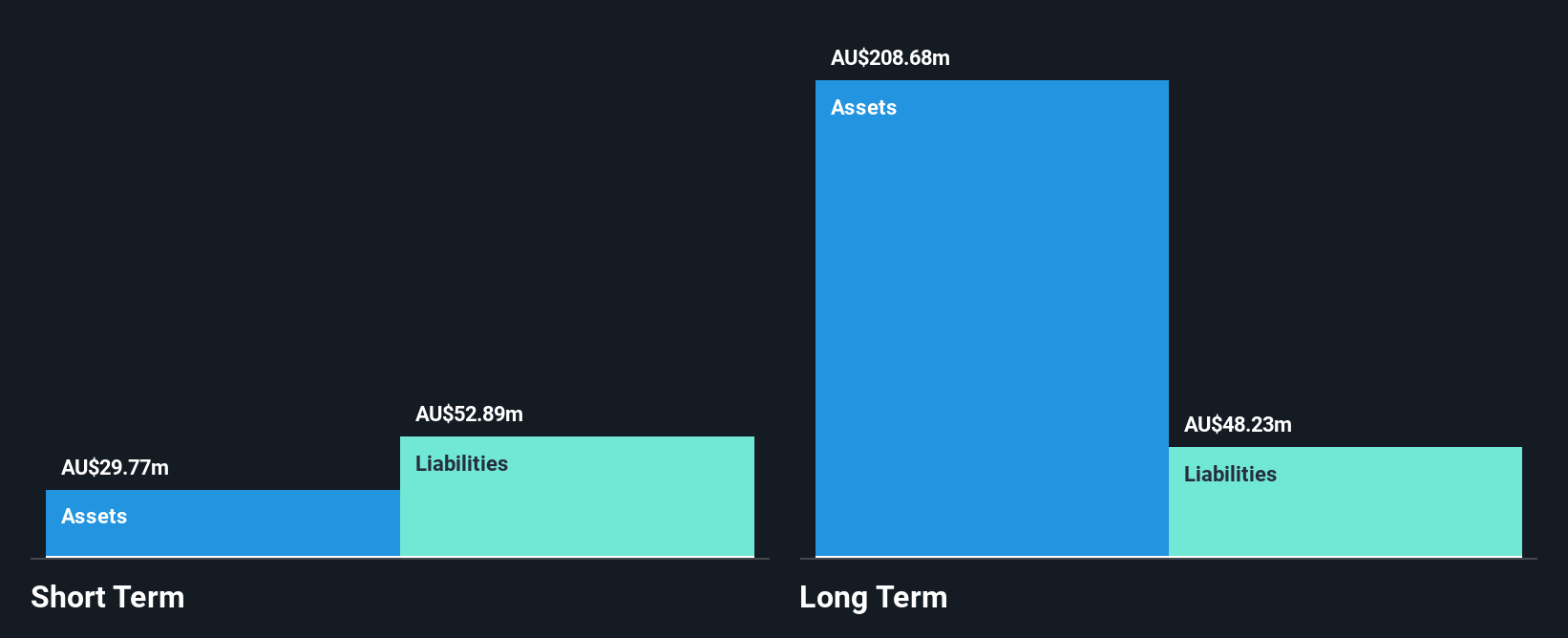

Midway Limited, with a market cap of A$105.68 million, has recently become profitable, marking a significant turnaround despite its earnings having declined by 31.5% annually over the past five years. The company benefits from strong short-term asset coverage of both short and long-term liabilities and has reduced its debt to equity ratio significantly over five years. However, Midway's return on equity remains low at 0.7%, and its share price is highly volatile. Recently, River Capital Pty Ltd announced plans to acquire Midway for approximately A$103 million, pending shareholder approval and other conditions.

- Click to explore a detailed breakdown of our findings in Midway's financial health report.

- Examine Midway's past performance report to understand how it has performed in prior years.

ReadyTech Holdings (ASX:RDY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ReadyTech Holdings Limited offers technology-based solutions in Australia and has a market cap of A$373.84 million.

Operations: The company's revenue is derived from three main segments: Workforce Solutions (A$30.74 million), Government and Justice (A$42.51 million), and Education and Work Pathways (A$40.55 million).

Market Cap: A$373.84M

ReadyTech Holdings Limited, with a market cap of A$373.84 million, has shown profitability growth over the past five years, though recent earnings growth of 9.8% is below its historical average. The company trades at a significant discount to its estimated fair value and has reduced its debt to equity ratio from 73.6% to 27.7%, indicating improved financial health. However, short-term assets do not cover liabilities, and shareholders have experienced dilution with a 2.9% increase in outstanding shares over the past year. ReadyTech's management and board are considered experienced, contributing positively to governance stability.

- Jump into the full analysis health report here for a deeper understanding of ReadyTech Holdings.

- Examine ReadyTech Holdings' earnings growth report to understand how analysts expect it to perform.

Strategic Elements (ASX:SOR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Strategic Elements Ltd invests in companies focused on rare earths and rare metals exploration and materials development, with a market cap of A$22.50 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$22.5M

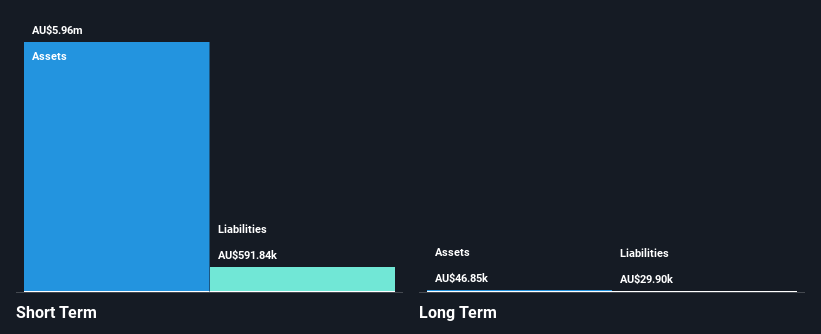

Strategic Elements Ltd, with a market cap of A$22.50 million, is pre-revenue and unprofitable, focusing on rare earths and metals exploration. The company has no debt and sufficient cash runway for over two years if its free cash flow continues to decline at historical rates. Despite shareholder dilution of 4.9% in the past year, short-term assets cover both short-term (A$591.8K) and long-term liabilities (A$29.9K). However, the stock remains highly volatile compared to most Australian stocks, complicating investment considerations for those cautious about price fluctuations in penny stocks.

- Get an in-depth perspective on Strategic Elements' performance by reading our balance sheet health report here.

- Explore historical data to track Strategic Elements' performance over time in our past results report.

Taking Advantage

- Access the full spectrum of 1,054 ASX Penny Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RDY

Good value with reasonable growth potential.