- Australia

- /

- Consumer Durables

- /

- ASX:FWD

ASX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Australian market is experiencing a downturn, with the ASX200 set to open 0.94% lower today, mirroring declines in US indices as investors shift their focus to upcoming inflation data. Despite these broader market challenges, penny stocks continue to capture interest due to their potential for growth at lower price points. While the term "penny stocks" might seem outdated, they still represent an intriguing investment area for those seeking opportunities in smaller or newer companies with strong financials and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.92 | A$312.61M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.62 | A$72.68M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.77 | A$229.66M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.665 | A$815.98M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.185 | A$1.09B | ★★★★★★ |

| West African Resources (ASX:WAF) | A$1.535 | A$1.75B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.05 | A$135.49M | ★★★★★★ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Calix (ASX:CXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Calix Limited is an environmental technology company offering industrial solutions for global decarbonisation and sustainability challenges across Australia, Europe, the United States, and Southeast Asia, with a market cap of A$151.19 million.

Operations: Calix generates revenue from several segments including the United States (A$16.83 million), LEILAC (A$3.29 million), and Australia & Southeast Asia (A$4.96 million).

Market Cap: A$151.19M

Calix Limited, with a market cap of A$151.19 million, operates in the environmental technology sector and has been navigating challenges typical for penny stocks. Despite being unprofitable, it shows potential with forecasted revenue growth of 28.41% annually and reduced debt levels from 16% to 0.9% over five years. The company maintains a sufficient cash runway for over a year and has not significantly diluted shareholders recently. However, its recent removal from major indices like the S&P/ASX 300 indicates volatility concerns, although analysts are optimistic about future stock price increases by a substantial margin.

- Click here and access our complete financial health analysis report to understand the dynamics of Calix.

- Gain insights into Calix's outlook and expected performance with our report on the company's earnings estimates.

Fleetwood (ASX:FWD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fleetwood Limited, with a market cap of A$190.07 million, operates in Australia and New Zealand, focusing on the design, manufacture, sale, and installation of modular accommodation and buildings.

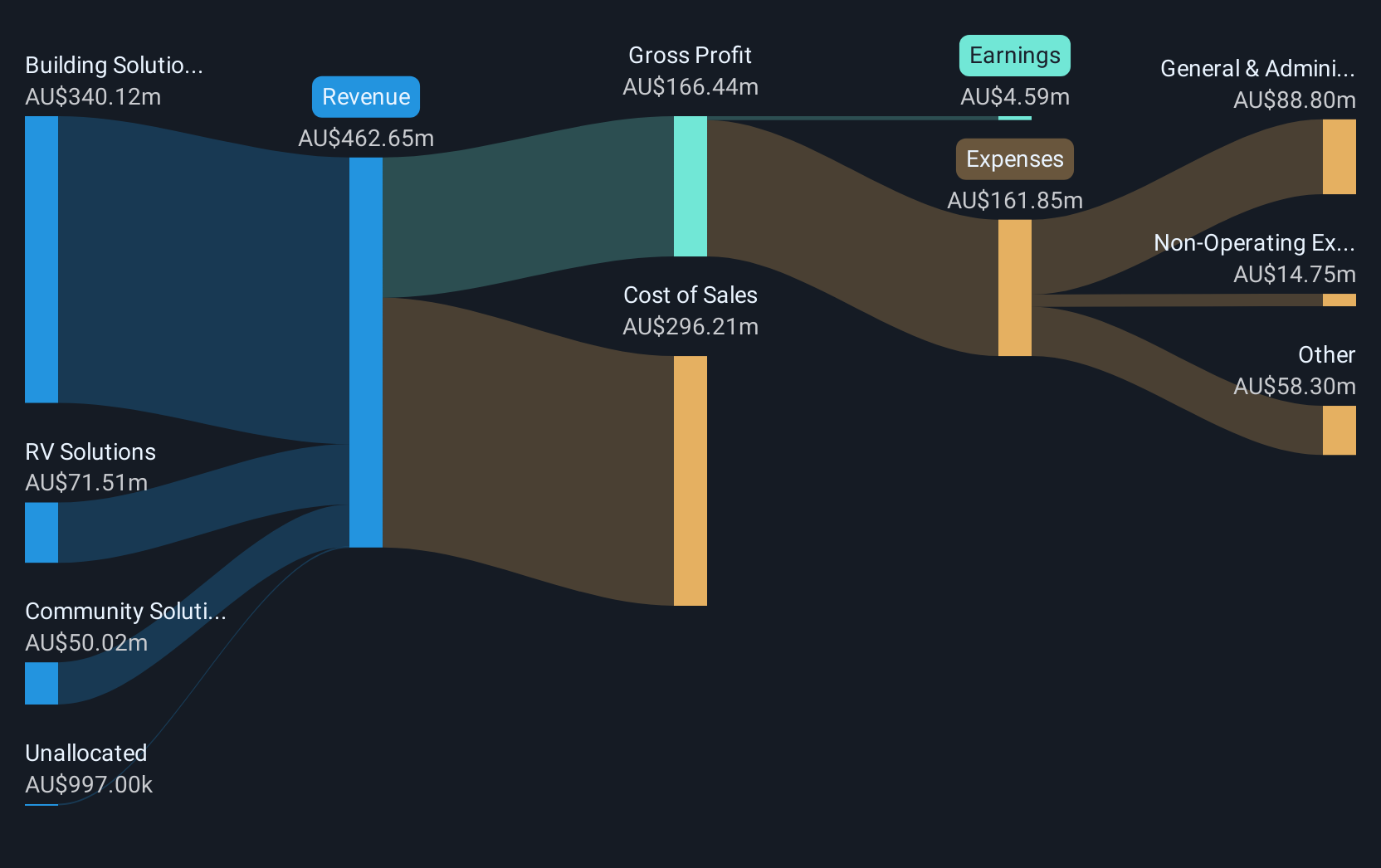

Operations: The company's revenue is derived from three main segments: RV Solutions generating A$75.50 million, Building Solutions contributing A$309.61 million, and Community Solutions with A$33.70 million.

Market Cap: A$190.07M

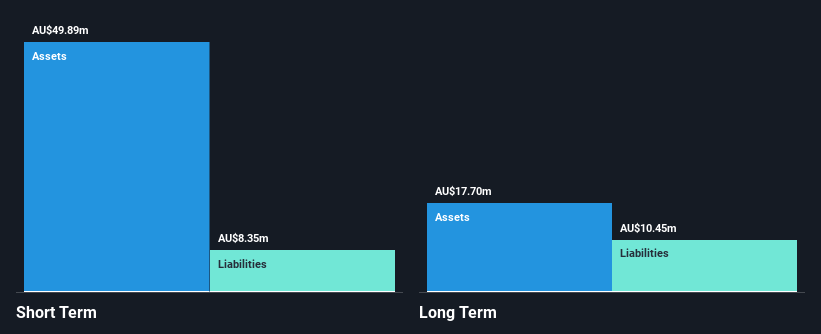

Fleetwood Limited, with a market cap of A$190.07 million, presents a mixed picture typical for penny stocks. The company is debt-free and its short-term assets exceed both short and long-term liabilities, indicating financial stability. Recent earnings growth of 85.2% outpaces the industry average, although long-term profit trends show decline. Fleetwood's net profit margin has improved to 0.9%, but return on equity remains low at 2.3%. The company completed a share buyback and increased dividends recently, reflecting shareholder-focused actions despite modest profitability improvements over the past year amidst stable volatility levels in stock performance.

- Jump into the full analysis health report here for a deeper understanding of Fleetwood.

- Understand Fleetwood's earnings outlook by examining our growth report.

Magontec (ASX:MGL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Magontec Limited, with a market cap of A$16.33 million, researches, develops, manufactures, and sells generic and specialist magnesium alloys across Europe, China, North America, and other international markets.

Operations: Magontec Limited has not reported any specific revenue segments.

Market Cap: A$16.33M

Magontec Limited, with a market cap of A$16.33 million, is currently unprofitable but has shown financial prudence by maintaining more cash than total debt and reducing its debt-to-equity ratio significantly over the past five years. Despite stable weekly volatility, the stock remains highly volatile over shorter periods. The company recently announced a substantial share buyback program to repurchase approximately 28.48% of its issued shares from Qinghai Salt Lake Magnesium Co Limited, pending shareholder approval. However, Magontec reported a net loss of A$7.47 million for the nine months ending September 2024, reflecting ongoing financial challenges amidst strategic restructuring efforts.

- Click to explore a detailed breakdown of our findings in Magontec's financial health report.

- Explore Magontec's analyst forecasts in our growth report.

Next Steps

- Take a closer look at our ASX Penny Stocks list of 1,035 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FWD

Fleetwood

Engages in the design, manufacture, sale, and installation of modular accommodation and buildings in Australia and New Zealand.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives