- Australia

- /

- Metals and Mining

- /

- ASX:MAU

We're Keeping An Eye On Magnetic Resources' (ASX:MAU) Cash Burn Rate

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Magnetic Resources (ASX:MAU) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Magnetic Resources

When Might Magnetic Resources Run Out Of Money?

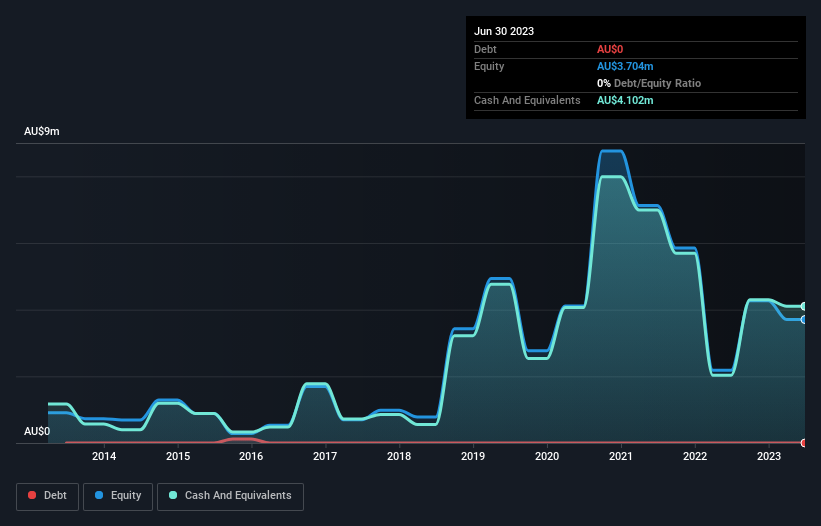

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Magnetic Resources last reported its June 2023 balance sheet in September 2023, it had zero debt and cash worth AU$4.1m. Importantly, its cash burn was AU$5.9m over the trailing twelve months. Therefore, from June 2023 it had roughly 8 months of cash runway. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. However, if we extrapolate the company's recent cash burn trend, then it would have a longer cash run way. The image below shows how its cash balance has been changing over the last few years.

How Is Magnetic Resources' Cash Burn Changing Over Time?

While Magnetic Resources did record statutory revenue of AU$480 over the last year, it didn't have any revenue from operations. That means we consider it a pre-revenue business, and we will focus our growth analysis on cash burn, for now. Given the length of the cash runway, we'd interpret the 23% reduction in cash burn, in twelve months, as prudent if not necessary for capital preservation. Magnetic Resources makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

Can Magnetic Resources Raise More Cash Easily?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Magnetic Resources to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Magnetic Resources' cash burn of AU$5.9m is about 2.2% of its AU$270m market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Magnetic Resources' Cash Burn Situation?

On this analysis of Magnetic Resources' cash burn, we think its cash burn relative to its market cap was reassuring, while its cash runway has us a bit worried. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Separately, we looked at different risks affecting the company and spotted 4 warning signs for Magnetic Resources (of which 2 are a bit concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MAU

Magnetic Resources

Engages in the exploration of mineral tenements in Western Australia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)