- Australia

- /

- Metals and Mining

- /

- ASX:MAH

Hansen Technologies And 2 Other ASX Penny Stocks To Consider

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.5%, but it has risen by 19% over the past year, with earnings expected to grow by 12% per annum in the coming years. For investors interested in smaller or newer companies, penny stocks — despite their somewhat outdated name — can still offer surprising value and potential for growth. In this article, we will explore several penny stocks that stand out for their financial strength and long-term potential amidst current market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.61 | A$66.82M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$126.84M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$100.95M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$833.14M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$115.04M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Hansen Technologies (ASX:HSN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hansen Technologies Limited develops, integrates, and supports billing systems software for the energy, utilities, communications, and media sectors with a market cap of A$1.00 billion.

Operations: The company's revenue is primarily generated from its billing segment, which accounts for A$347.61 million.

Market Cap: A$1B

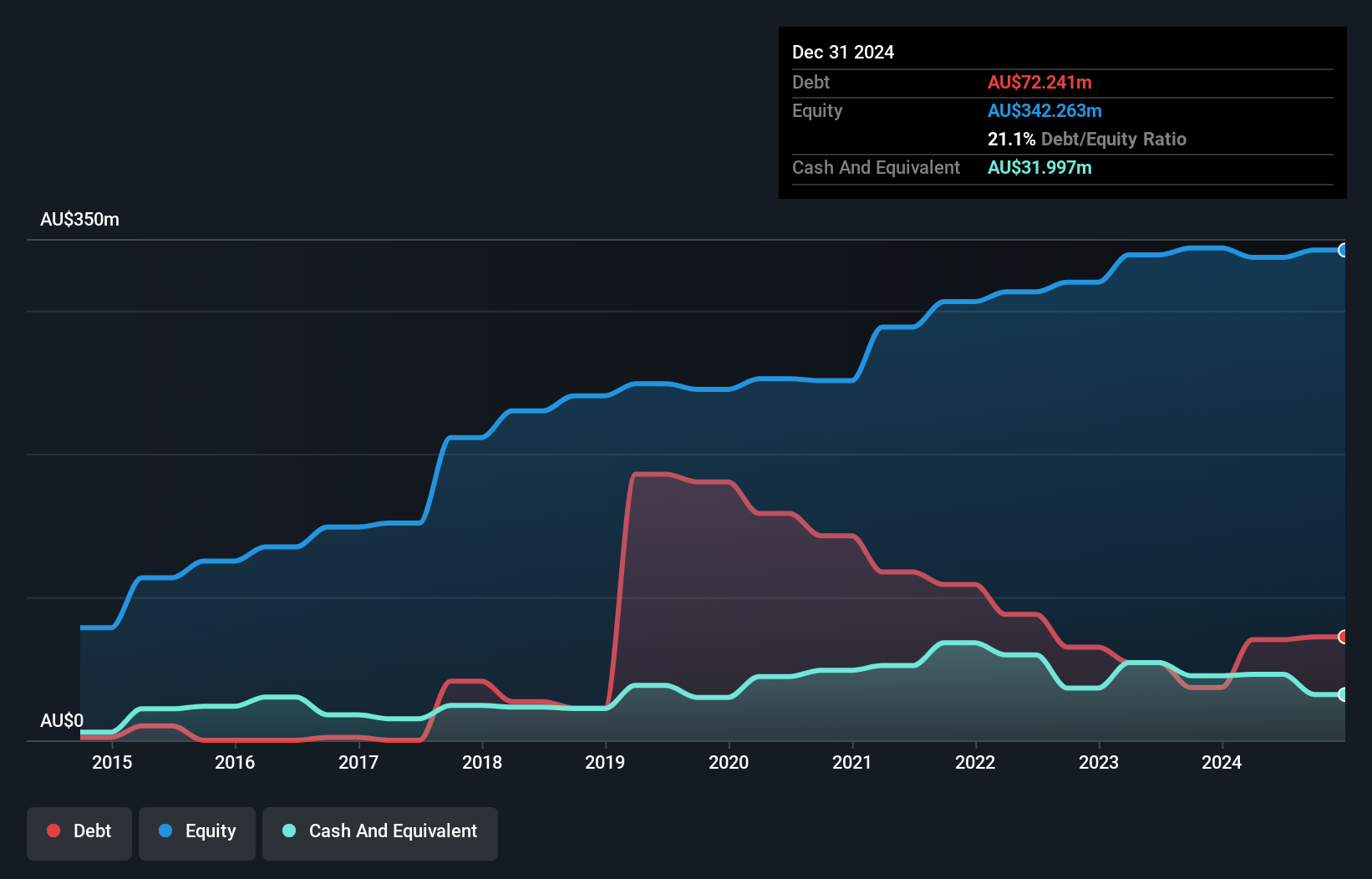

Hansen Technologies, with a market cap of A$1 billion, has shown stable weekly volatility over the past year and is trading below its estimated fair value. Despite having high-quality earnings, Hansen reported a decrease in net profit margin from 13.7% to 6% and negative earnings growth last year, primarily due to the acquisition of the loss-making PowerCloud business in Germany. This decline is temporary, as the company expects to restore profitability by the end of FY25. The management team is relatively new with an average tenure of 0.8 years, while the board remains experienced. That said, Mr. Andrew Alexander Hansen has held the positions of Managing Director and Chief Executive Officer since 1993. Recent developments include securing a contract with Area Nett AS in Norway for its Customer Information System and announcing dividends amidst declining profits compared to the previous year’s figures.

- Click here and access our complete financial health analysis report to understand the dynamics of Hansen Technologies.

- Gain insights into Hansen Technologies' outlook and expected performance with our report on the company's earnings estimates.

Macmahon Holdings (ASX:MAH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining, mining support, and civil infrastructure services to companies in Australia and Southeast Asia, with a market cap of A$696.79 million.

Operations: The company generates revenue of A$2.03 billion from its mining and civil services segment.

Market Cap: A$696.79M

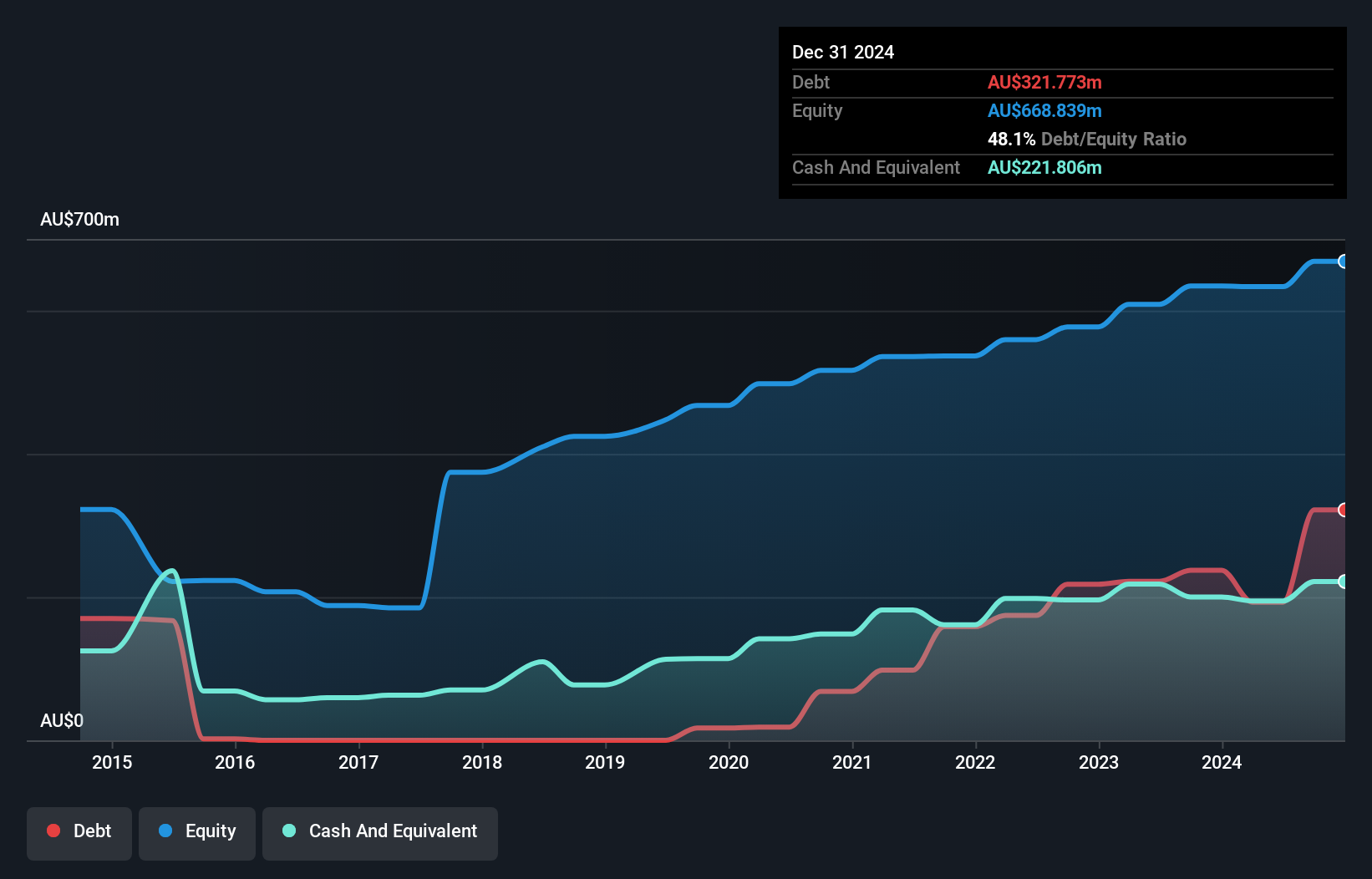

Macmahon Holdings, with a market cap of A$696.79 million, reported revenue growth to A$2.03 billion but experienced a decline in net income to A$53.23 million for the year ended June 30, 2024. Despite stable weekly volatility and high-quality earnings, its profit margins have decreased slightly from the previous year. The company's debt is well covered by operating cash flow, and it has more cash than total debt. Recent board changes include the appointment of two new independent directors with extensive industry experience and the retirement of a long-serving director following their upcoming AGM on October 29, 2024.

- Click here to discover the nuances of Macmahon Holdings with our detailed analytical financial health report.

- Examine Macmahon Holdings' earnings growth report to understand how analysts expect it to perform.

Smart Parking (ASX:SPZ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Smart Parking Limited designs, develops, and manages parking management solutions across New Zealand, Australia, Germany, and the United Kingdom with a market cap of A$204.29 million.

Operations: The company's revenue segments include A$6.28 million from the Technology Division and A$51.53 million from Parking Management across Denmark, Germany, Australia, New Zealand, and the United Kingdom.

Market Cap: A$204.29M

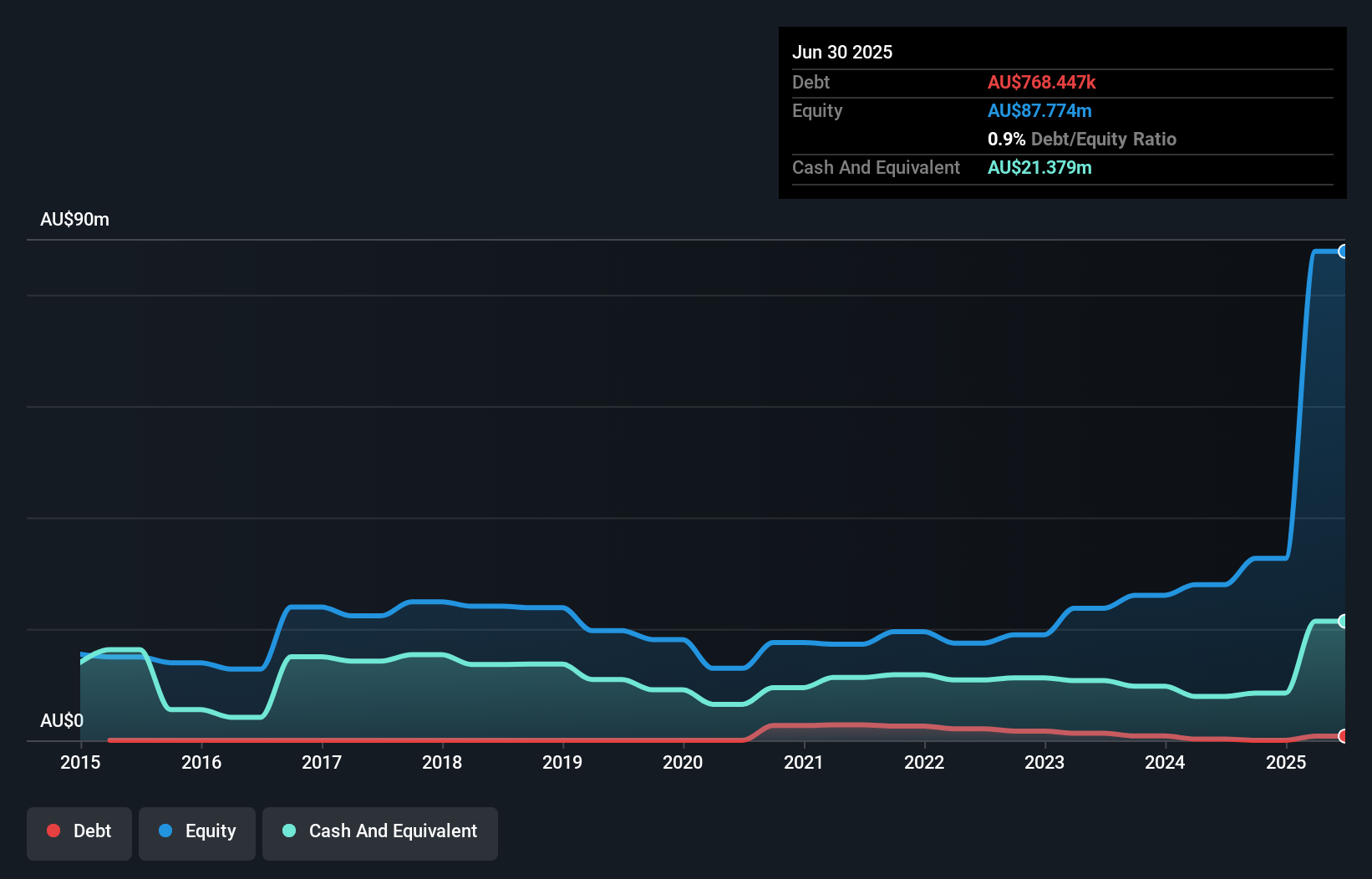

Smart Parking Limited, with a market cap of A$204.29 million, reported revenue of A$54.3 million for the year ending June 30, 2024. Despite a decline in net income to A$3.7 million from the previous year, the company maintains high-quality earnings and stable weekly volatility at 8%. The board is seasoned with an average tenure of 12 years, and management is experienced with a tenure averaging 2.8 years. Smart Parking's short-term assets cover both its long-term and short-term liabilities comfortably while its debt is well covered by operating cash flow at a very large percentage relative to debt levels.

- Dive into the specifics of Smart Parking here with our thorough balance sheet health report.

- Evaluate Smart Parking's prospects by accessing our earnings growth report.

Taking Advantage

- Embark on your investment journey to our 1,031 ASX Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAH

Macmahon Holdings

Provides surface mining, underground mining and mining support, and civil infrastructure services to mining companies in Australia and Southeast Asia.

Excellent balance sheet and good value.