- Australia

- /

- Metals and Mining

- /

- ASX:LYC

Why Lynas Rare Earths (ASX:LYC) Is Up 15.2% After Achieving Exclusive Heavy Rare Earth Production and Securing A$750 Million Expansion Funding

Reviewed by Sasha Jovanovic

- In September 2025, Lynas Rare Earths marked a significant achievement by becoming the only commercial-scale producer of separated heavy rare earths outside China, while securing A$750 million in new funding for expansion in both Malaysia and the United States.

- An insider share purchase by director John Beevers further emphasized leadership confidence in the company's direction at a time when rare earth supply chains and regulatory considerations remain in sharp focus.

- We'll explore how Lynas's leadership in heavy rare earth production and insider confidence could shape its future investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Lynas Rare Earths Investment Narrative Recap

To be a Lynas Rare Earths shareholder, you have to believe Western governments will keep backing critical minerals independence, and that Lynas can execute its global expansion despite Malaysia’s ongoing regulatory unpredictability. The new A$750 million funding and milestone in heavy rare earth production outside China are significant for the supply shift, but neither eliminates the immediate overhang from policy and permitting risks in Malaysia, which remain the most pressing challenge for investors in the short term.

Of recent announcements, the A$750 million equity raise stands out as most relevant, directly supporting ambitious capacity growth in Malaysia and the U.S. Even with substantial funding secured, success depends on Lynas’s ability to manage expansion without regulatory interruption, particularly as moves to scale up processing heighten execution demands tied to both local policy support and project timelines.

But despite these breakthroughs, investors should be mindful that Malaysia’s unpredictable regulatory hurdles remain a live issue...

Read the full narrative on Lynas Rare Earths (it's free!)

Lynas Rare Earths' outlook anticipates revenue of A$1.9 billion and earnings of A$732.6 million by 2028. This is based on an expected annual revenue growth rate of 50.1% and a dramatic increase in earnings of A$724.6 million from the current A$8.0 million.

Uncover how Lynas Rare Earths' forecasts yield a A$13.12 fair value, a 32% downside to its current price.

Exploring Other Perspectives

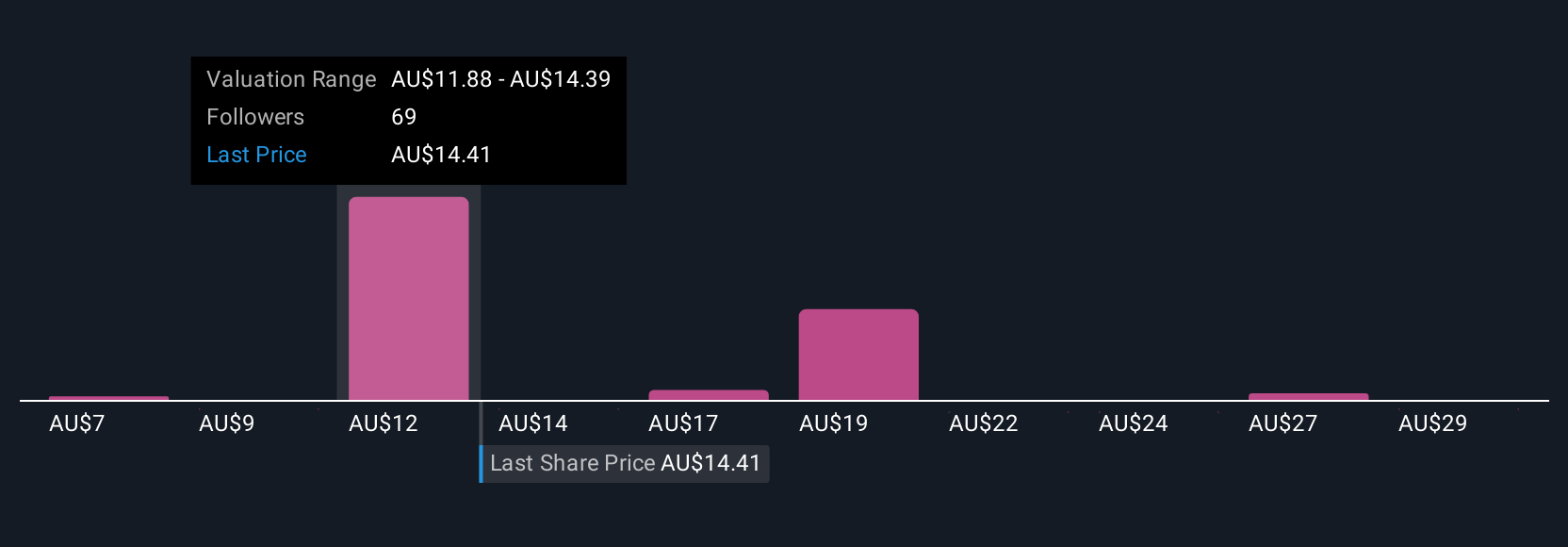

Seventeen fair value estimates from the Simply Wall St Community range from A$8.90 to A$31.93 per share, reflecting broad differences in growth forecasts and risk appetites. With regulatory uncertainty in Malaysia a live risk, you are encouraged to compare diverse assessment methods and weigh multiple viewpoints before forming your own takeaway.

Explore 17 other fair value estimates on Lynas Rare Earths - why the stock might be worth less than half the current price!

Build Your Own Lynas Rare Earths Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lynas Rare Earths research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lynas Rare Earths research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lynas Rare Earths' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives