- Australia

- /

- Metals and Mining

- /

- ASX:LYC

Is Now the Right Moment for Lynas Rare Earths After China’s Latest Export Curbs?

Reviewed by Bailey Pemberton

Thinking about Lynas Rare Earths stock right now? You are not alone. The stock has been on an absolute tear, with a 17.6% jump in just the last week and a massive 39% surge over the past month. If you have been watching from the sidelines, it is nearly impossible not to notice the incredible 215.3% year-to-date return, and a whopping 668.3% gain over the last five years. These numbers have investors asking whether there is still room to run, or if it is already priced for perfection.

Recent headlines give some context to the excitement. China's latest move to tighten controls on rare earth exports has sent shockwaves through the global supply chain, directly boosting companies like Lynas that are outside China's reach. At the same time, talk of price floors for rare earths among G7 countries and possible new support for non-Chinese producers keep drawing attention to Lynas's critical role and potential for further upside. The market seems to be re-evaluating the company's risk profile and growth prospects, given these global shifts.

Of course, no matter how strong the story, valuation matters. Lynas Rare Earths scores only 1 out of 6 on a standard undervaluation check, suggesting that most traditional methods see it as fully or even richly valued right now. Still, numbers rarely capture the full story, and different valuation approaches can lead to very different conclusions. Up next, we will break down how Lynas stacks up on the major valuation metrics. There is an even more insightful way to look at the company's value coming at the end of the article.

Lynas Rare Earths scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lynas Rare Earths Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future free cash flows and then discounting those back to the present value. This approach relies on analyst forecasts and mathematical extrapolation where analyst coverage ends.

For Lynas Rare Earths, the most recent free cash flow is negative, at A$-403.8 million. However, analysts expect operations to rebound, forecasting A$148.4 million in free cash flow by 2026. Projections then climb rapidly, with figures such as A$506.9 million in 2027 and A$645.7 million in 2028. Beyond the five-year mark, the estimates continue higher. By 2035, free cash flow is projected to reach about A$1.2 billion, though these longer-term figures are extrapolated and should be treated cautiously.

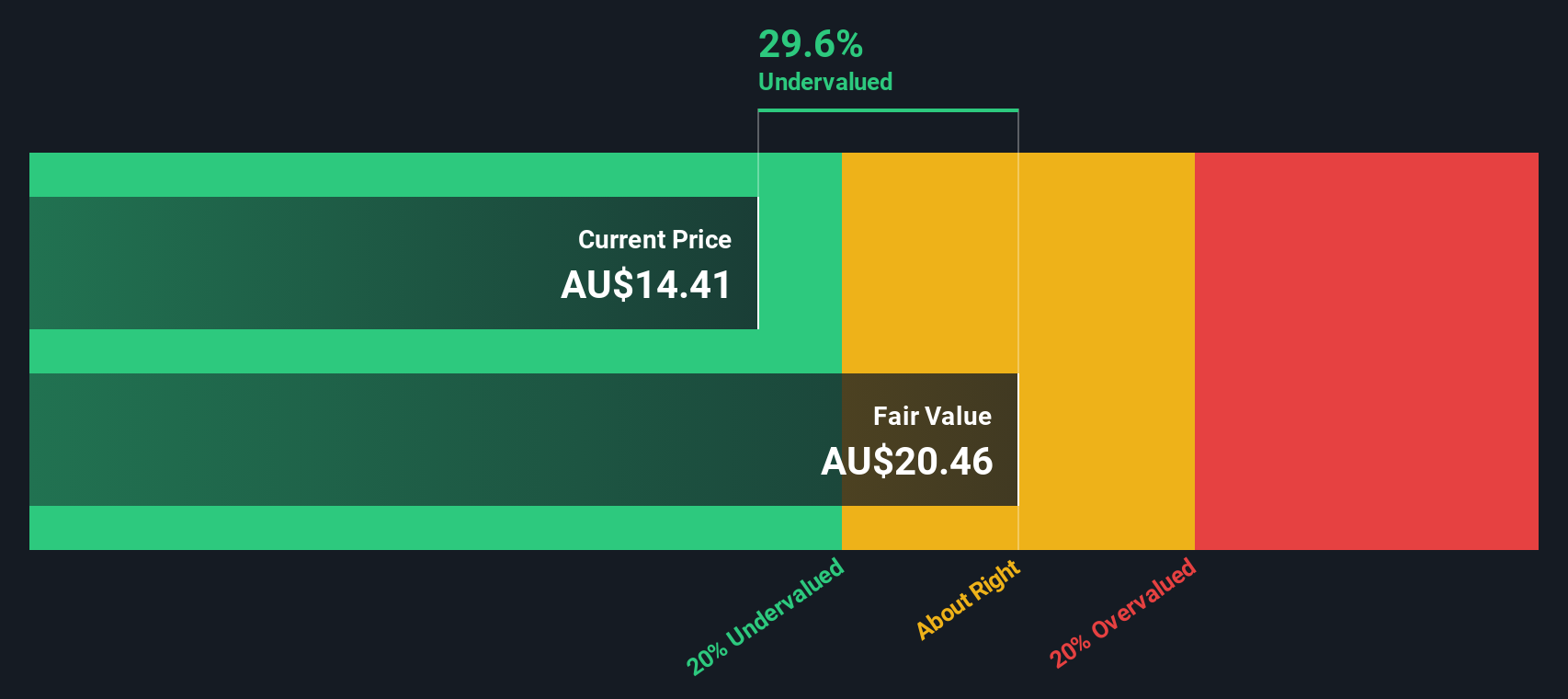

The DCF model arrives at an intrinsic value for Lynas Rare Earths of A$20.11 per share. This is slightly below the current share price, implying the stock is about 2.4% overvalued right now. Within the usual margin for error in valuation, this suggests the market price is very close to what the business is fundamentally worth.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Lynas Rare Earths's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

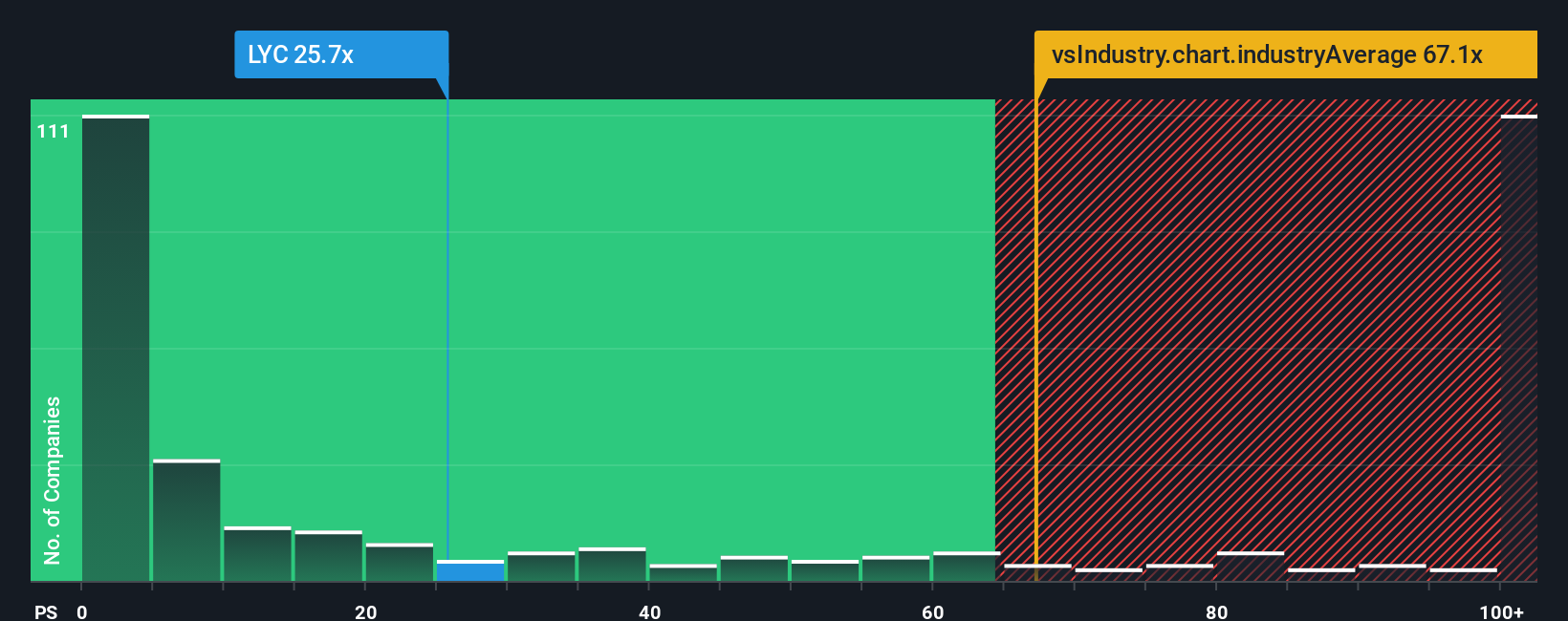

Approach 2: Lynas Rare Earths Price vs Sales

Price-to-Sales (P/S) is a preferred valuation multiple for companies like Lynas Rare Earths, especially in fast-growing sectors where profits can be volatile or affected by heavy reinvestment. This metric helps investors compare company value to its revenues, which are generally less affected by accounting choices or one-time items than earnings.

When using a sales-based multiple, it is important to remember that higher growth expectations and lower risk typically justify a higher P/S ratio. Conversely, slower growth or greater risk suggest a lower ratio is appropriate. For Lynas Rare Earths, the current P/S stands at an elevated 37.24x. This figure is sharply above both the industry average for metals and mining at 118.10x and the average among direct peers at 5.66x. This indicates investors are pricing in significant growth or strategic value.

A more refined approach involves looking at Simply Wall St’s proprietary "Fair Ratio." The Fair Ratio for Lynas is 3.84x, which adjusts for the company’s specific revenue growth, margins, risk, industry, and market cap. Unlike a simple comparison to industry or peer averages, the Fair Ratio offers a nuanced estimate of what is “normal” for the business in its unique context.

Lynas Rare Earths’s actual P/S ratio of 37.24x is substantially higher than its Fair Ratio of 3.84x. This suggests that, even considering its growth narrative and sector leadership, the stock is being valued at a hefty premium to what fundamentals indicate is reasonable.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

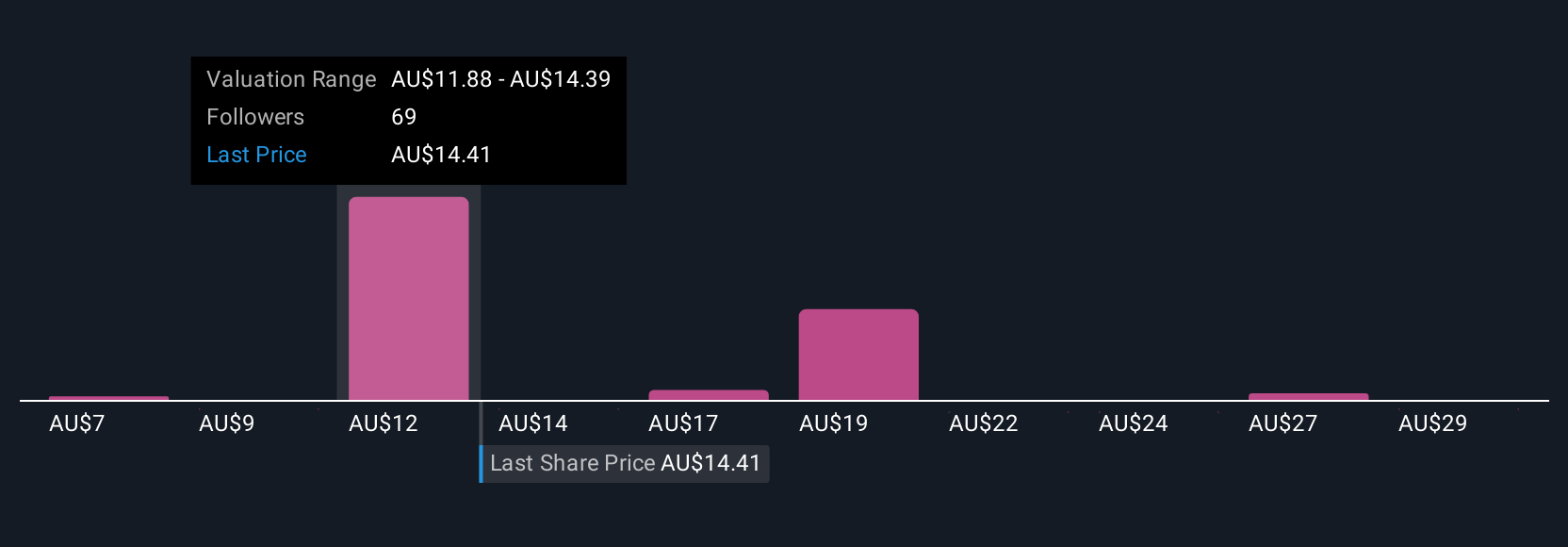

Upgrade Your Decision Making: Choose your Lynas Rare Earths Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, where you connect your own view of the business, such as what will drive Lynas’s growth or risk in the future, to a set of numbers such as expected revenue, profit margins, and a fair value estimate. This approach links what you believe about Lynas’s prospects and operating environment directly to a financial forecast, making it clear how your perspective shapes your estimate of what the stock is worth.

Narratives are straightforward and accessible on Simply Wall St’s Community page, where millions of investors share and update their views dynamically as new information, like company news or results, emerges. By comparing your Narrative’s Fair Value to the current share price, you can make smarter decisions about when to buy or sell, rather than relying only on historical metrics or someone else's estimates.

For Lynas Rare Earths, for example, one investor’s Narrative might be optimistic, assuming robust policy support and rising global demand, and project the company’s fair value at A$17.50 per share; another, more cautious view accounts for regulatory and technological risks and arrives at a fair value of just A$7.65 per share.

Do you think there's more to the story for Lynas Rare Earths? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives