- Australia

- /

- Metals and Mining

- /

- ASX:LYC

Here's Why We Think Lynas Rare Earths (ASX:LYC) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Lynas Rare Earths (ASX:LYC). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Lynas Rare Earths

How Fast Is Lynas Rare Earths Growing Its Earnings Per Share?

Over the last three years, Lynas Rare Earths has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, Lynas Rare Earths' EPS grew from AU$0.30 to AU$0.57, over the previous 12 months. It's not often a company can achieve year-on-year growth of 89%. The best case scenario? That the business has hit a true inflection point.

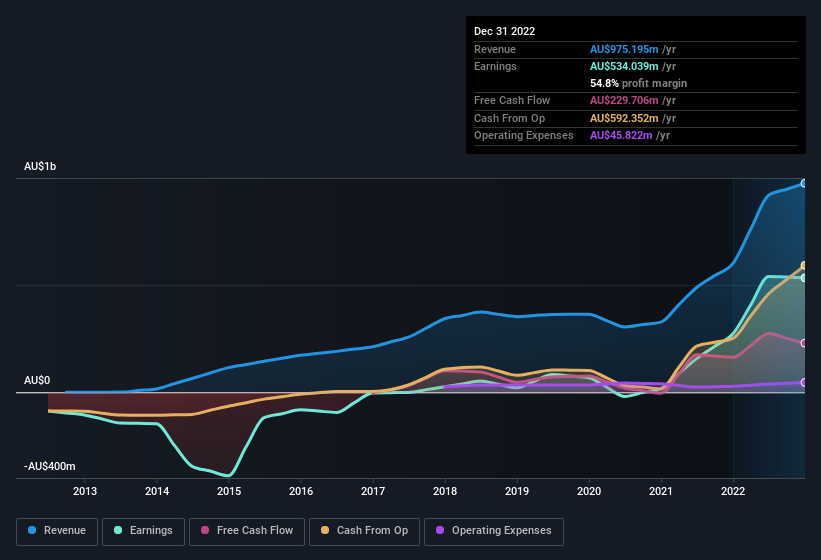

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Lynas Rare Earths shareholders is that EBIT margins have grown from 46% to 53% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Lynas Rare Earths.

Are Lynas Rare Earths Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's nice to see that there have been no reports of any insiders selling shares in Lynas Rare Earths in the previous 12 months. So it's definitely nice that Independent Non-Executive Director Vanessa Guthrie bought AU$40k worth of shares at an average price of around AU$8.01. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

On top of the insider buying, it's good to see that Lynas Rare Earths insiders have a valuable investment in the business. To be specific, they have AU$40m worth of shares. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 0.5%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Amanda Lacaze, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Lynas Rare Earths with market caps between AU$6.1b and AU$18b is about AU$3.8m.

Lynas Rare Earths offered total compensation worth AU$3.2m to its CEO in the year to June 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Lynas Rare Earths Worth Keeping An Eye On?

Lynas Rare Earths' earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Lynas Rare Earths belongs near the top of your watchlist. We should say that we've discovered 2 warning signs for Lynas Rare Earths (1 is potentially serious!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Lynas Rare Earths, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026