- Australia

- /

- Metals and Mining

- /

- ASX:LTR

Did Ford Deal Amendments Just Shift Liontown Resources' (ASX:LTR) Flexibility and Market Exposure?

Reviewed by Sasha Jovanovic

- Recently, Liontown Resources announced amendments to its agreements with Ford Motor Company, including reducing the volume of spodumene concentrate to be supplied from the Kathleen Valley project and deferring principal loan repayments by 12 months.

- This development provides Liontown with increased flexibility to sell additional lithium volumes on the spot market or establish new partnerships in response to evolving market conditions.

- We'll examine how these updated arrangements with Ford may alter Liontown’s investment narrative, especially in terms of liquidity and market exposure.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Liontown Resources Investment Narrative Recap

For investors considering Liontown Resources, the core belief hinges on the company converting its growing lithium production into stronger revenues and, ultimately, sustainable earnings as the sector evolves. The recent amendments to the Ford agreements, halving offtake volumes and deferring loan repayments, grant Liontown valuable near-term financial flexibility, but do not materially affect the primary operational catalyst: a successful underground ramp-up at Kathleen Valley, nor do they eliminate the acute risk posed by soft lithium prices and high costs. Of the recent company announcements, the completion of multiple follow-on equity offerings totaling A$392 million stands out. This influx of capital, paired with deferred loan repayments from Ford, provides a cash cushion that directly supports ongoing operations and development at Kathleen Valley, thus strengthening Liontown’s hand as it seeks to manage costs and market exposure during a period of price uncertainty. However, against these developments, investors should also be aware of potential risks to liquidity and operating resilience if lithium prices remain under pressure...

Read the full narrative on Liontown Resources (it's free!)

Liontown Resources' outlook anticipates A$725.1 million in revenue and A$62.7 million in earnings by 2028. This implies a 93.1% annual revenue growth rate and an A$111.8 million increase in earnings from the current A$-49.1 million.

Uncover how Liontown Resources' forecasts yield a A$0.654 fair value, a 35% downside to its current price.

Exploring Other Perspectives

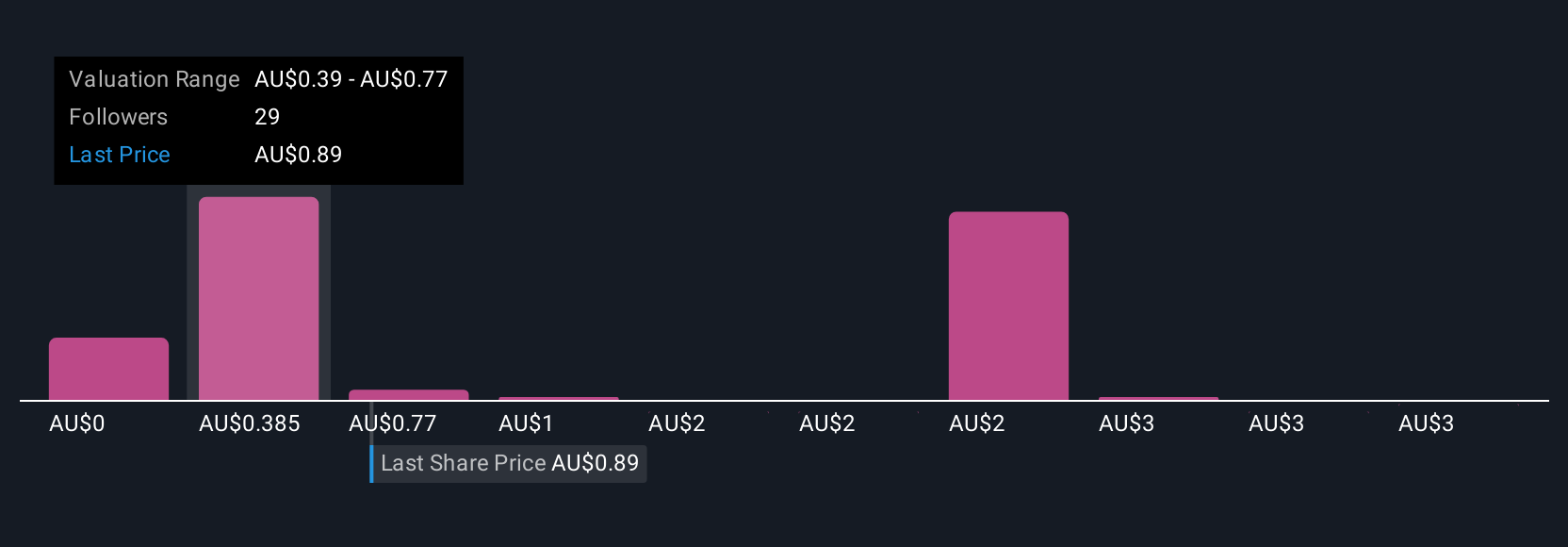

Eighteen members of the Simply Wall St Community assigned fair values for Liontown ranging from as low as A$0.30 to as high as A$3.00 per share. Given these sharply different outlooks and ongoing cost pressures from the underground ramp-up, it pays to review several perspectives before forming your own view.

Explore 18 other fair value estimates on Liontown Resources - why the stock might be worth less than half the current price!

Build Your Own Liontown Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liontown Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Liontown Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liontown Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives