- Australia

- /

- Office REITs

- /

- ASX:CMW

ASX Growth Companies Insiders Are Investing In

Reviewed by Simply Wall St

As the Australian market experiences modest gains with the ASX200 up by 0.2% and sectors like IT leading performance, investors are closely monitoring shifts in both local and international landscapes. In this environment, growth companies with high insider ownership often attract attention as they can signal confidence from those who understand the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Emerald Resources (ASX:EMR) | 18% | 38.9% |

| Medallion Metals (ASX:MM8) | 13.8% | 67.5% |

| Acrux (ASX:ACR) | 20.2% | 91.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 77.3% |

| Pointerra (ASX:3DP) | 23.8% | 126.4% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Cromwell Property Group (ASX:CMW)

Simply Wall St Growth Rating: ★★★★☆☆

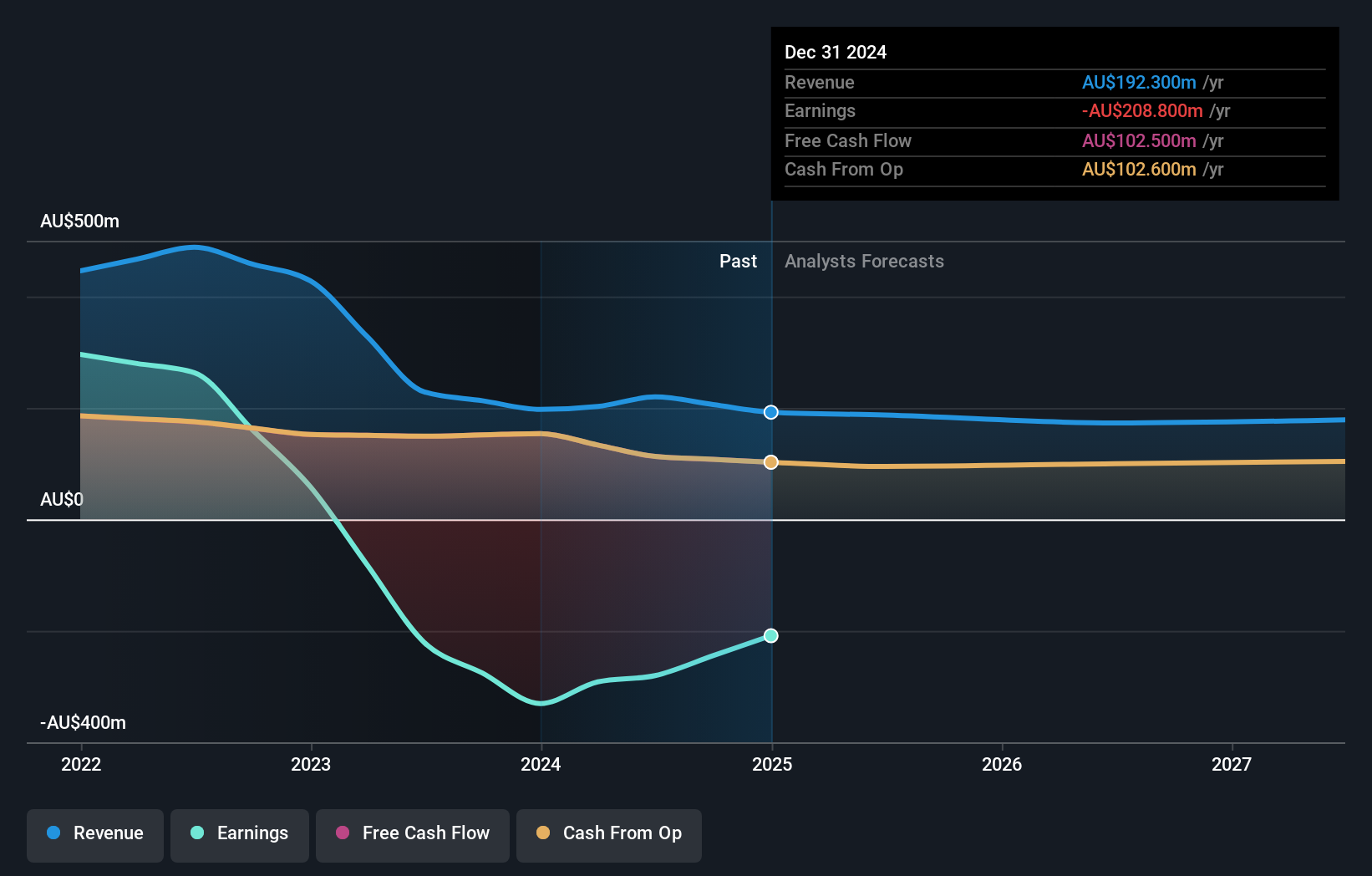

Overview: Cromwell Property Group (ASX:CMW) is a real estate investor and fund manager with operations across three continents, boasting a market cap of A$1.02 billion.

Operations: Cromwell Property Group generates revenue from three main segments: Co-Investments (A$127.50 million), Investment Portfolio (A$194.30 million), and Funds and Asset Management (A$94.90 million).

Insider Ownership: 14.0%

Cromwell Property Group shows substantial insider buying, suggesting confidence in its future prospects. Revenue growth is forecast at 7.4% annually, outpacing the Australian market's 5.9%. However, profitability remains a challenge as interest payments are not well covered by earnings and the dividend yield of 7.69% is unsustainable with current earnings. Despite these challenges, Cromwell is expected to achieve profitability within three years and trades at a good relative value compared to peers.

- Click here and access our complete growth analysis report to understand the dynamics of Cromwell Property Group.

- Upon reviewing our latest valuation report, Cromwell Property Group's share price might be too pessimistic.

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★☆

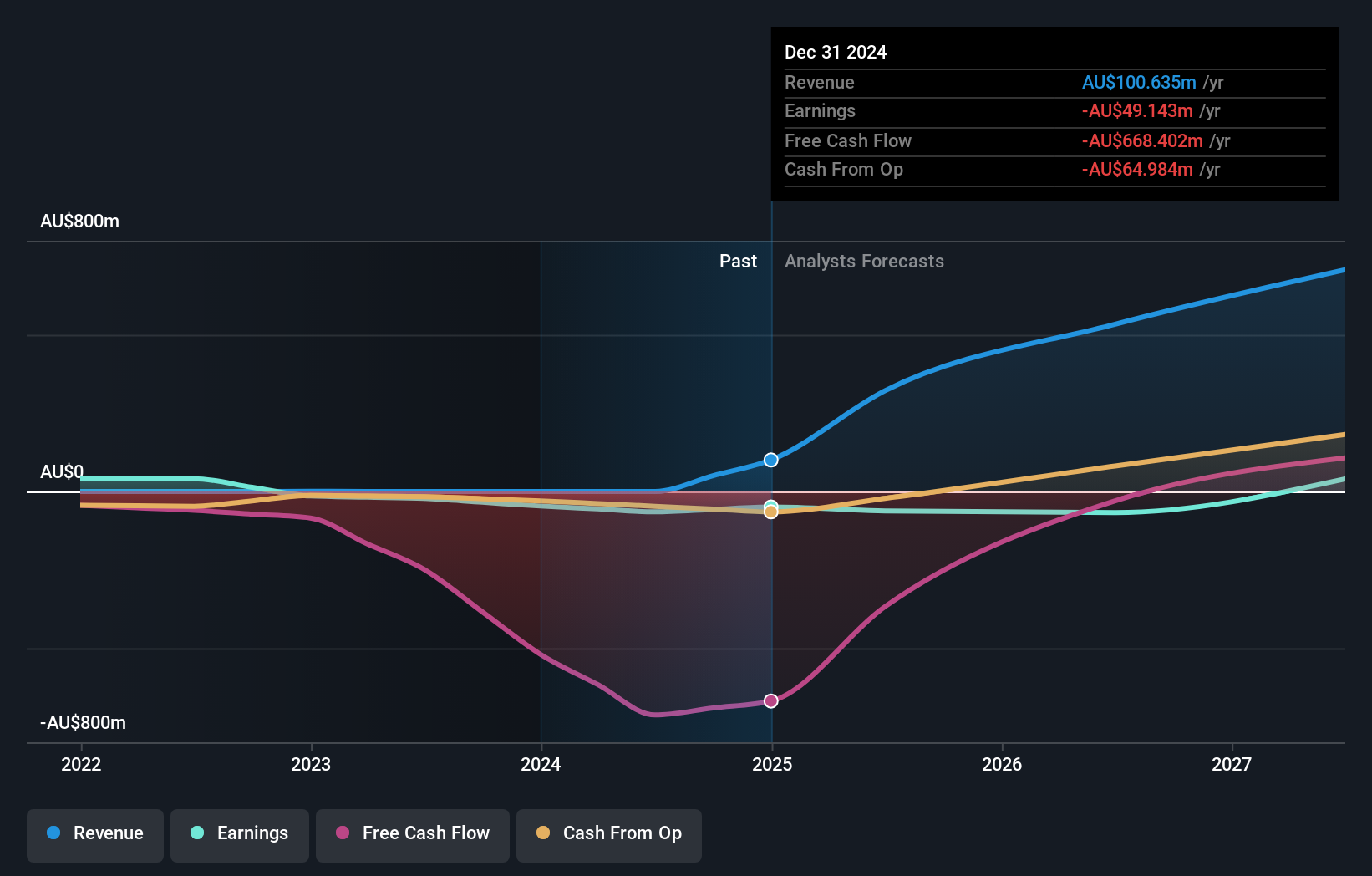

Overview: Liontown Resources Limited focuses on the exploration, evaluation, and development of mineral properties in Australia with a market cap of A$1.36 billion.

Operations: Liontown Resources Limited's revenue segments are currently not specified in monetary terms.

Insider Ownership: 15.2%

Liontown Resources is poised for significant growth, with revenue expected to increase by 40% annually, outpacing the Australian market. Although it currently makes less than A$1 million in revenue, it is forecast to become profitable within three years. Insider activity indicates more buying than selling recently, reflecting confidence despite low volumes. The stock trades at a substantial discount to its estimated fair value, suggesting potential upside as profitability improves.

- Get an in-depth perspective on Liontown Resources' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Liontown Resources is priced lower than what may be justified by its financials.

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

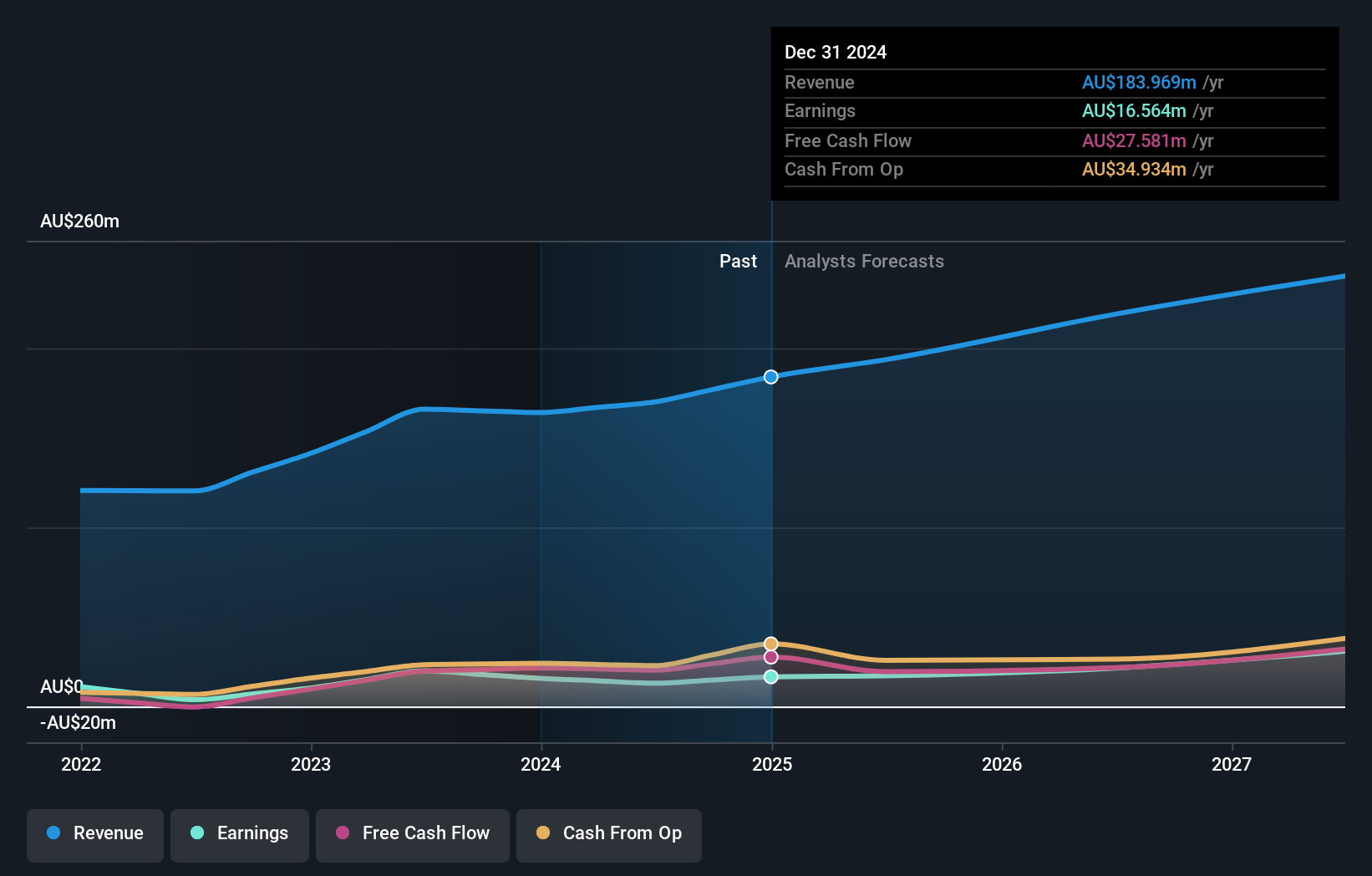

Overview: Nanosonics Limited is a global infection prevention company with a market cap of A$916.71 million.

Operations: The company generates revenue primarily from its Healthcare Equipment segment, amounting to A$170.01 million.

Insider Ownership: 15.4%

Nanosonics is set for significant earnings growth, projected at 24% annually, surpassing the Australian market's average. However, revenue growth is expected to be more modest at 8.7% per year. Despite recent board changes with long-serving members stepping down, the company trades below its estimated fair value by 39.3%. Profit margins have decreased from last year, but no substantial insider trading activity has been reported in recent months.

- Navigate through the intricacies of Nanosonics with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Nanosonics' current price could be inflated.

Next Steps

- Reveal the 97 hidden gems among our Fast Growing ASX Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CMW

Cromwell Property Group

Cromwell Property Group (ASX:CMW) is a real estate investor and fund manager with operations on three continents and a global investor base.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives