- Australia

- /

- Metals and Mining

- /

- ASX:LPD

Recent 18% pullback isn't enough to hurt long-term Lepidico (ASX:LPD) shareholders, they're still up 311% over 1 year

Lepidico Limited (ASX:LPD) shareholders might be concerned after seeing the share price drop 18% in the last week. But that isn't a problem when you consider how the share price has soared over the last year. Indeed, the share price is up a whopping 311% in that time. So we wouldn't blame sellers for taking some profits. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

While the stock has fallen 18% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Lepidico

With just AU$4,084,027 worth of revenue in twelve months, we don't think the market considers Lepidico to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Lepidico will find or develop a valuable new mine before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Some Lepidico investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

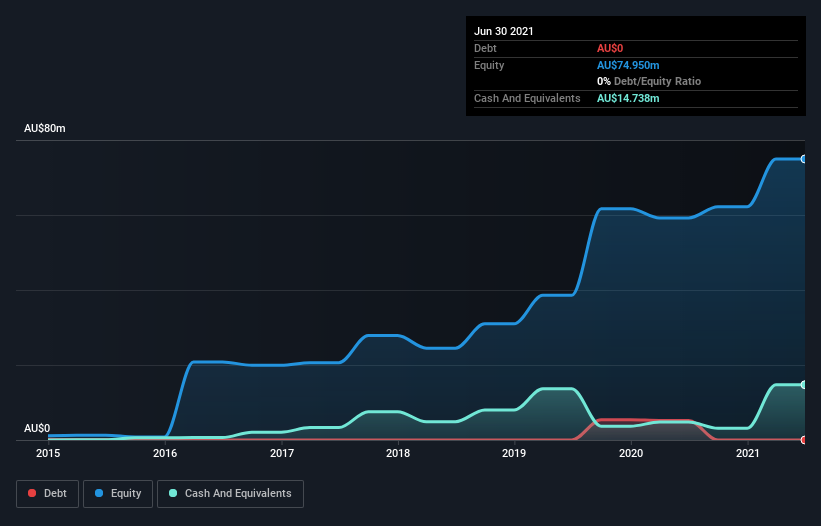

Lepidico has plenty of cash in the bank, with cash in excess of all liabilities sitting at AU$4.3m, when it last reported (June 2021). That allows management to focus on growing the business, and not worry too much about raising capital. And given that the share price has shot up 58% in the last year , it's fair to say investors are liking management's vision for the future. You can click on the image below to see (in greater detail) how Lepidico's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. However you can take a look at whether insiders have been buying up shares. It's often positive if so, assuming the buying is sustained and meaningful. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's nice to see that Lepidico shareholders have received a total shareholder return of 311% over the last year. That's better than the annualised return of 28% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Lepidico better, we need to consider many other factors. For example, we've discovered 3 warning signs for Lepidico that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LPD

Lepidico

Engages in the exploration, development, and production of lithium chemicals in Australia, Canada, Africa, the United Arab Emirates, Europe, and internationally.

Slight with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026