- Australia

- /

- Metals and Mining

- /

- ASX:KRM

Should You Be Adding Kingsrose Mining (ASX:KRM) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Kingsrose Mining (ASX:KRM). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Kingsrose Mining

How Fast Is Kingsrose Mining Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Kingsrose Mining's EPS went from AU$0.0014 to AU$0.0095 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Kingsrose Mining's EBIT margins have actually improved by 33.1 percentage points in the last year, to reach 36%, but, on the flip side, revenue was down 24%. That falls short of ideal.

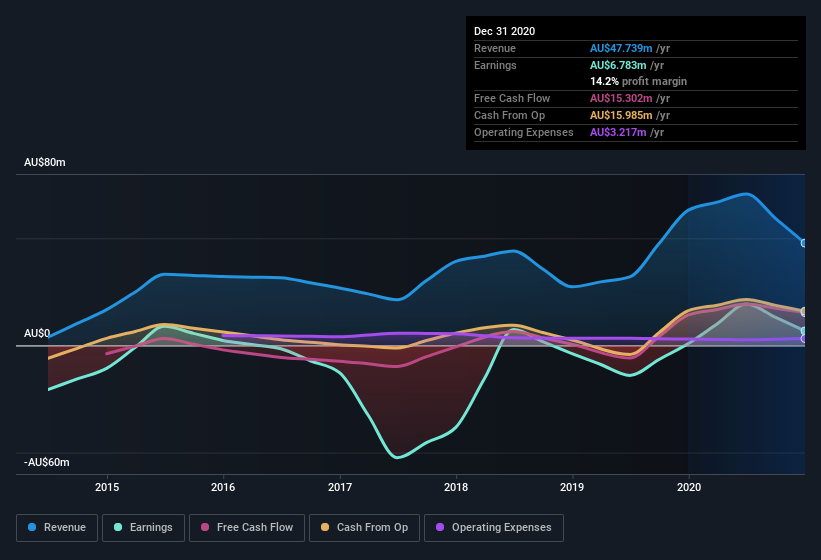

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Kingsrose Mining isn't a huge company, given its market capitalization of AU$37m. That makes it extra important to check on its balance sheet strength.

Are Kingsrose Mining Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Kingsrose Mining shares, in the last year. With that in mind, it's heartening that John Carlile, the Independent Non-Executive Director of the company, paid AU$59k for shares at around AU$0.04 each.

Should You Add Kingsrose Mining To Your Watchlist?

Kingsrose Mining's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Growth investors should find it difficult to look past that strong EPS move. And in fact, it could well signal a fundamental shift in the business economics. For me, this situation certainly piques my interest. However, before you get too excited we've discovered 3 warning signs for Kingsrose Mining that you should be aware of.

As a growth investor I do like to see insider buying. But Kingsrose Mining isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Kingsrose Mining, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kingsrose Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:KRM

Kingsrose Mining

Operates as a mineral exploration company in Norway and Finland.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.