- Australia

- /

- Metals and Mining

- /

- ASX:JMS

Exploring 3 Undervalued Small Caps In Global With Insider Buying

Reviewed by Simply Wall St

As global markets reach record highs propelled by favorable trade news and robust business activity in the services sector, small-cap stocks have captured investor attention with their potential for growth amid these dynamic conditions. In this context, identifying undervalued small-cap companies with insider buying can offer intriguing opportunities, as these factors may signal confidence from within the company and potential for value realization despite broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MCAN Mortgage | 11.3x | 6.4x | 48.25% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.5x | 7.0x | 20.22% | ★★★★★☆ |

| Nexus Industrial REIT | 6.7x | 3.0x | 15.38% | ★★★★☆☆ |

| Sagicor Financial | 9.7x | 0.4x | -96.71% | ★★★★☆☆ |

| CVS Group | 45.4x | 1.3x | 37.83% | ★★★★☆☆ |

| A.G. BARR | 19.3x | 1.8x | 46.71% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 15.31% | ★★★☆☆☆ |

| Chinasoft International | 25.4x | 0.8x | 8.05% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 29.1x | 0.7x | 29.52% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.6x | 48.14% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

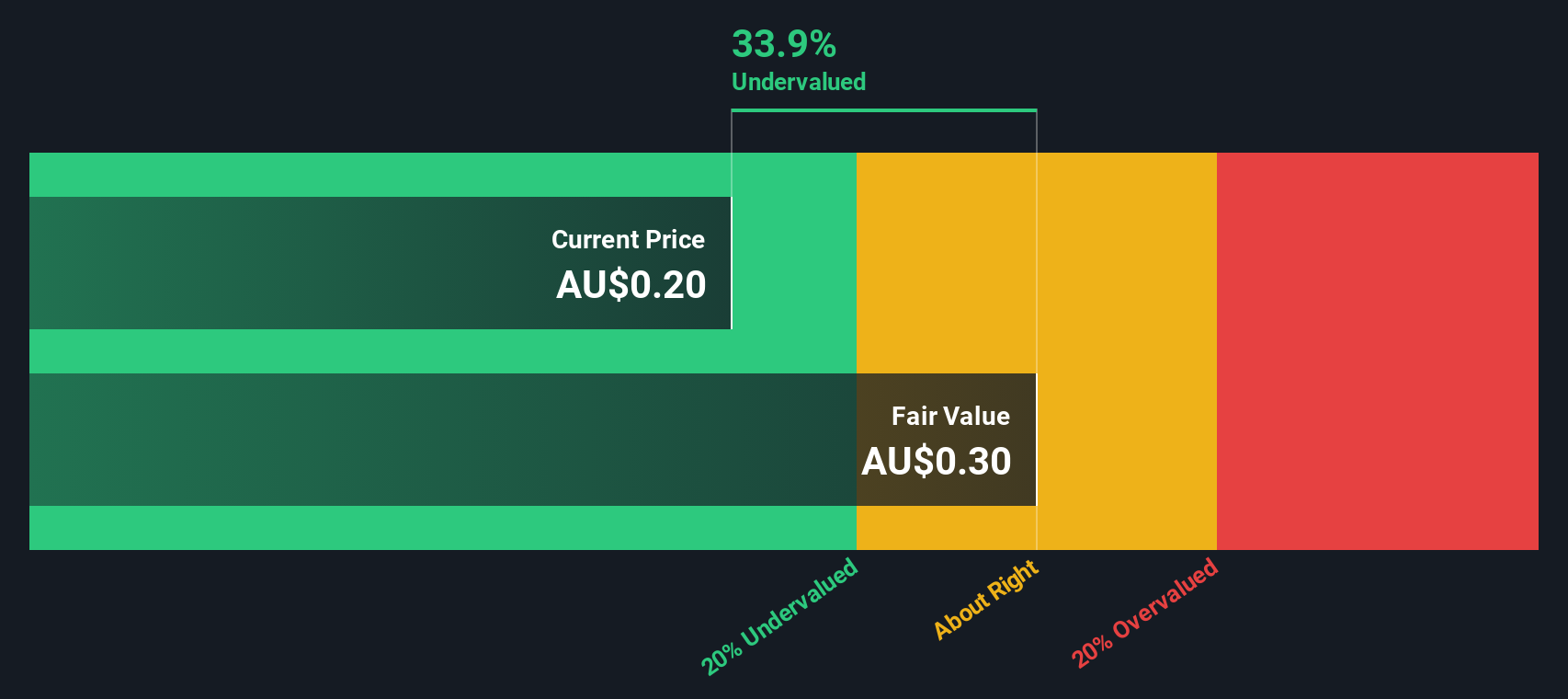

Jupiter Mines (ASX:JMS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jupiter Mines is a mining company focused on manganese production in South Africa, with a market capitalization of A$440 million.

Operations: The primary revenue stream comes from manganese operations in South Africa, with recent revenue recorded at A$9.49 million. The gross profit margin consistently stands at 1.00%. Operating expenses are a significant part of the cost structure, with general and administrative expenses frequently highlighted. Net income margins have shown variability, with the most recent figure being 4.06%.

PE: 10.7x

Jupiter Mines, a small-cap player, has recently seen insider confidence with Peter North acquiring 520,000 shares at A$88,399 in May 2025. Despite challenges like declining earnings over the past five years and reliance on higher-risk external borrowing for funding, the company remains intriguing for those seeking undervalued opportunities. The recent special call event in May suggests active strategic decisions are underway. While profit margins have dipped compared to last year, potential growth or turnaround could be on the horizon.

- Take a closer look at Jupiter Mines' potential here in our valuation report.

Evaluate Jupiter Mines' historical performance by accessing our past performance report.

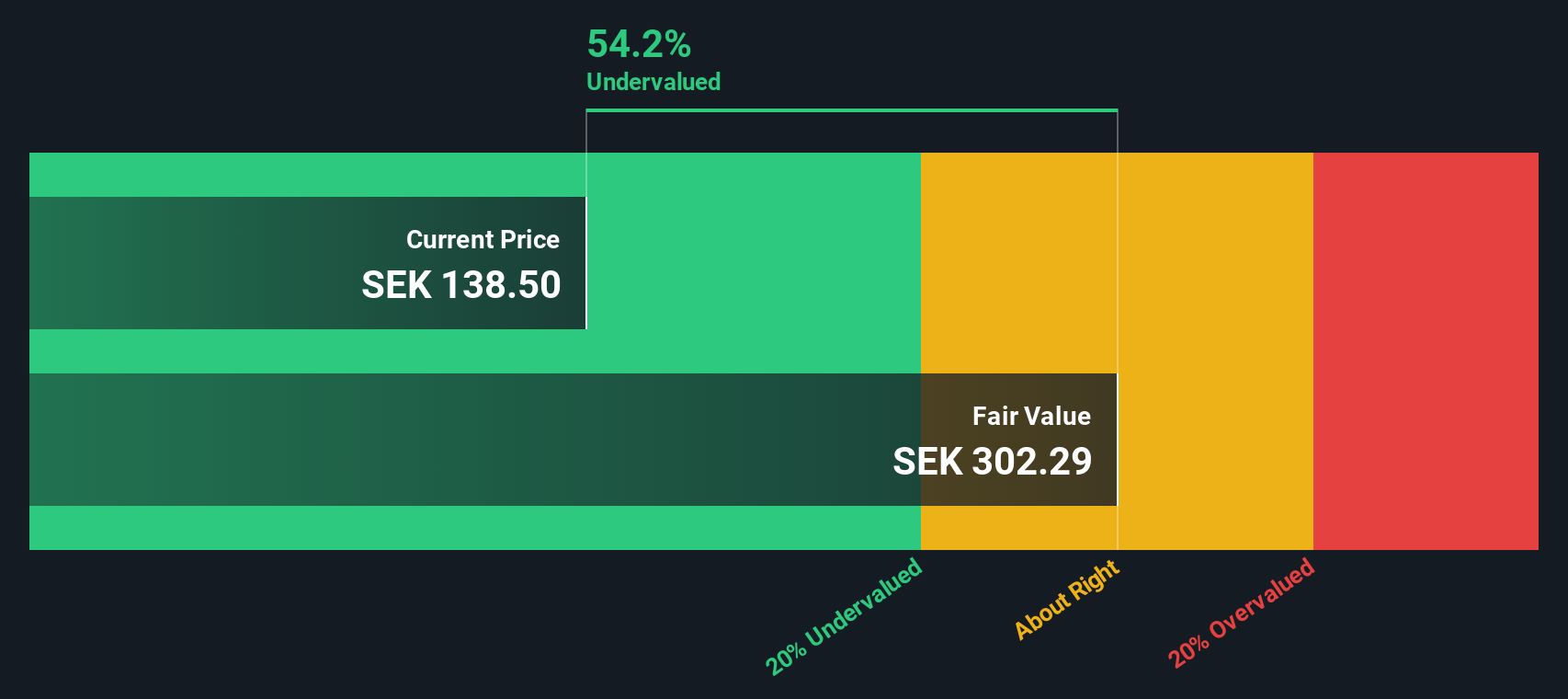

Surgical Science Sweden (OM:SUS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Surgical Science Sweden specializes in developing and providing virtual reality-based simulation solutions for medical training, with a market capitalization of approximately SEK 11.44 billion.

Operations: The company generates revenue primarily from Industry/OEM and Educational Products, with the latter slightly leading in contribution. Over recent periods, the net profit margin has shown variability, reaching 27.88% in September 2023 before declining to 14.89% by March 2025. Operating expenses have consistently included significant allocations for R&D and Sales & Marketing, reflecting ongoing investment in product development and market expansion efforts.

PE: 53.5x

Surgical Science Sweden, a company in the medical simulation industry, has shown promising growth with Q1 2025 sales reaching SEK 250.69 million, up from SEK 188.24 million year-on-year. Net income also increased to SEK 33.24 million from SEK 23.79 million last year, indicating stronger financial performance despite a reduced profit margin of 14.9%. Insider confidence is evident as Tom Englund purchased shares valued at approximately SEK 586,000 in May, reflecting belief in future growth potential amidst strategic board changes and earnings forecasts predicting a significant annual increase of over 32%.

- Dive into the specifics of Surgical Science Sweden here with our thorough valuation report.

Assess Surgical Science Sweden's past performance with our detailed historical performance reports.

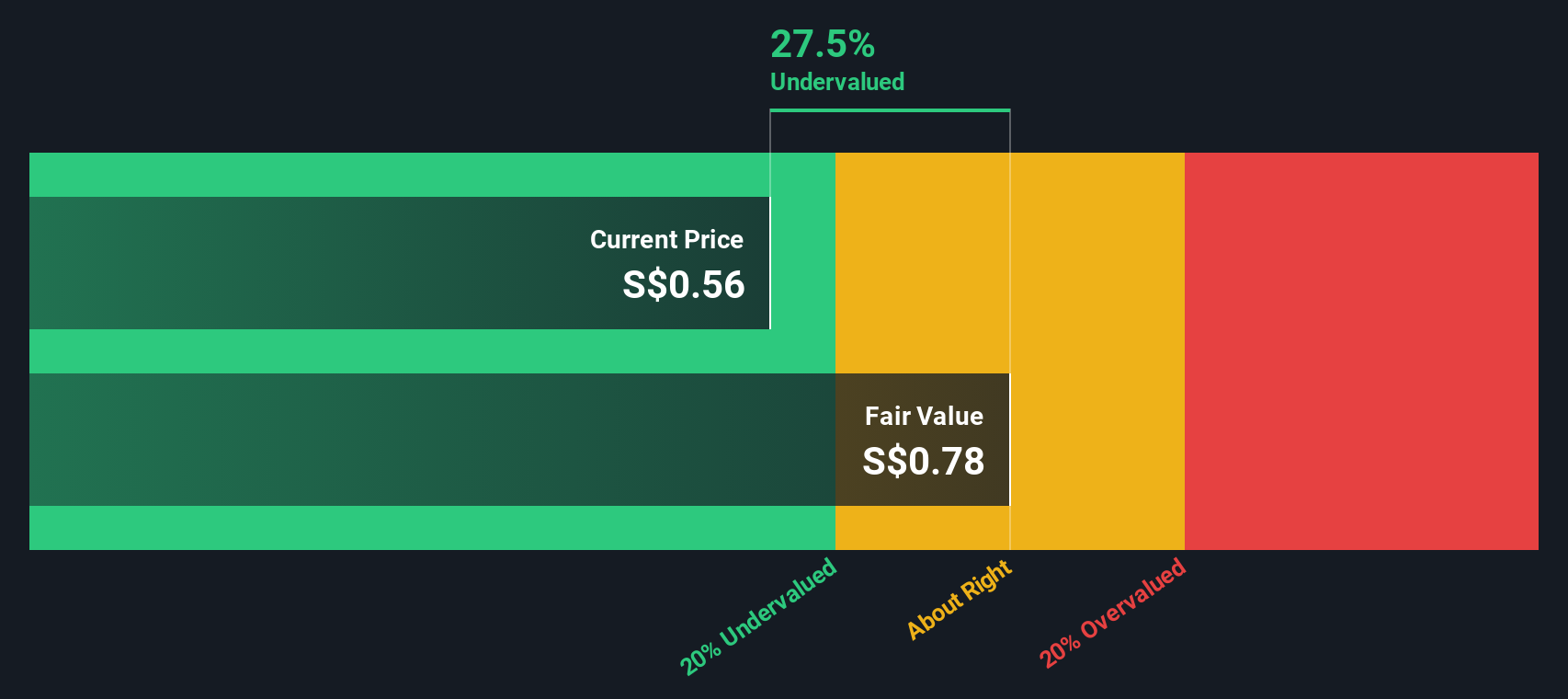

Daiwa House Logistics Trust (SGX:DHLU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daiwa House Logistics Trust focuses on investing in logistics and industrial properties, with a market capitalization of S$0.65 billion.

Operations: DHLU's revenue primarily stems from its investments in logistics and industrial properties, with a recent revenue figure of SGD 57.10 million. Over the observed periods, the gross profit margin has fluctuated slightly around 76%, reflecting its efficiency in managing costs relative to sales. Operating expenses have consistently been a significant component of total costs, impacting net income margins which have shown variability across different timeframes.

PE: 11.5x

Daiwa House Logistics Trust (DHLT) is navigating challenging waters, with earnings projected to decline 4.9% annually over the next three years. Despite its small cap status, insider confidence is evident through recent share purchases in Q2 2025. However, DHLT's financial position shows vulnerabilities; operating cash flow inadequately covers debt, and reliance on external borrowing heightens risk exposure. While large one-off items skew earnings quality, these factors give a mixed outlook for potential investors considering future growth prospects.

Taking Advantage

- Click here to access our complete index of 109 Undervalued Global Small Caps With Insider Buying.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JMS

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)