Exploring Three ASX Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As the Australian market navigates through a period of macroeconomic concerns and fluctuating commodity prices, investors are closely watching the ASX for signs of resilience and growth potential. In this context, companies with significant insider ownership can be particularly compelling, as high insider stakes often align management’s interests with those of shareholders, potentially leading to more prudent decision-making and long-term strategic focus amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Gratifii (ASX:GTI) | 15.6% | 112.4% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

| Alpha HPA (ASX:A4N) | 26.3% | 95.9% |

| Plenti Group (ASX:PLT) | 12.6% | 106.4% |

| Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Underneath we present a selection of stocks filtered out by our screen.

IperionX (ASX:IPX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$546.63 million.

Operations: The firm is primarily involved in the exploration and development of mineral properties in the United States.

Insider Ownership: 15.2%

Revenue Growth Forecast: 76.5% p.a.

IperionX, a growth company with high insider ownership in Australia, recently completed a A$50 million follow-on equity offering and announced significant partnerships aimed at enhancing its titanium alloy fastener production for various sectors including defense and aerospace. Despite experiencing a net loss of US$10.5 million in the last half-year, IperionX is expected to become profitable within three years, with revenue growth projected at 76.5% annually. The company's innovative approach to titanium processing underscores its potential in critical high-performance markets.

- Navigate through the intricacies of IperionX with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that IperionX's current price could be inflated.

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mesoblast Limited, operating in Australia, the United States, Singapore, and Switzerland, focuses on developing regenerative medicine products with a market capitalization of approximately A$1.34 billion.

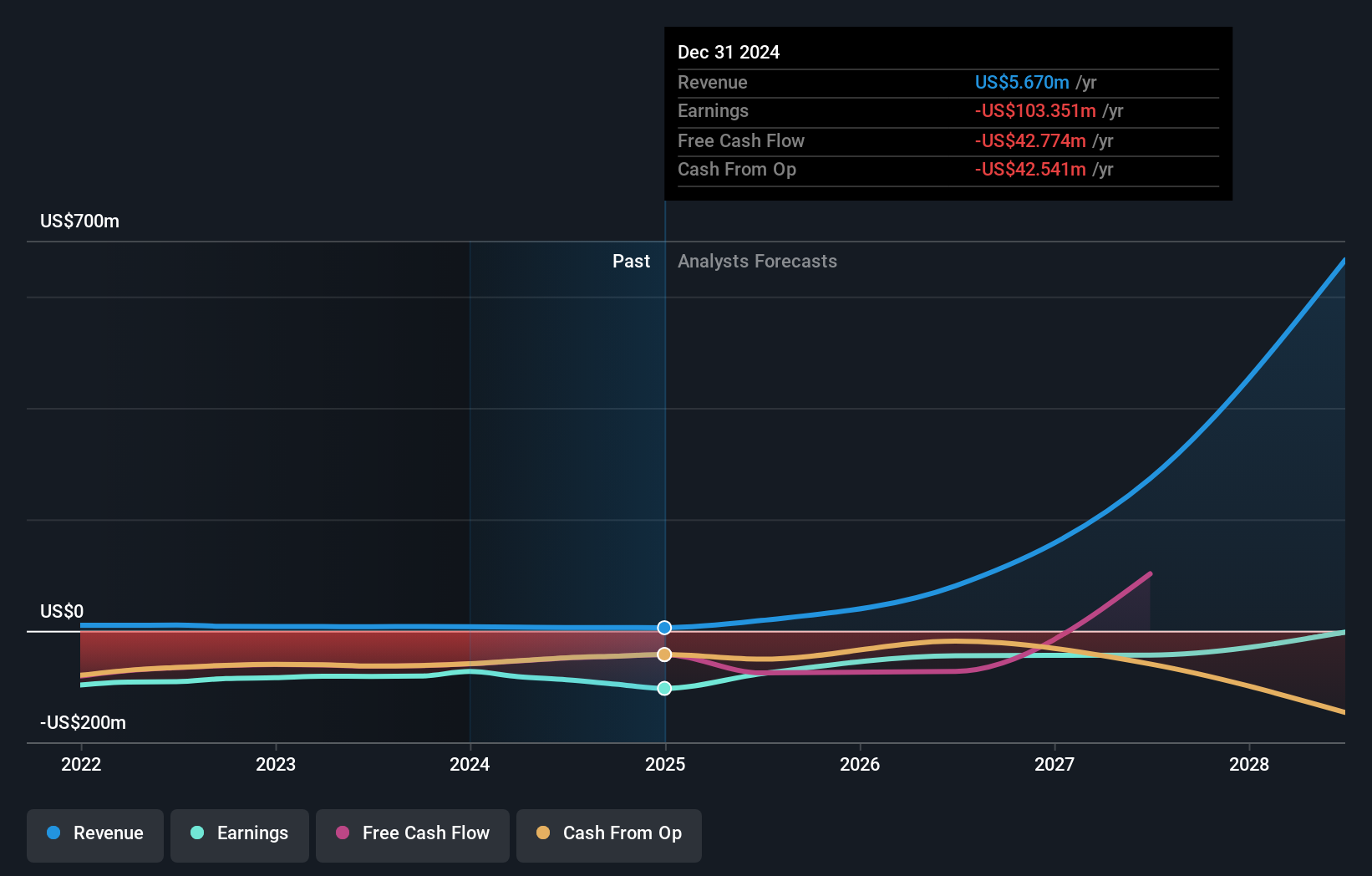

Operations: The company generates revenue primarily from its development of adult stem cell technology platform, totaling $7.47 million.

Insider Ownership: 22.2%

Revenue Growth Forecast: 55.3% p.a.

Mesoblast Limited, an Australian growth company with high insider ownership, has seen substantial insider buying over the past three months and no significant selling. Despite a volatile share price recently, Mesoblast is trading at 92.7% below its estimated fair value. Revenue is expected to grow by 55.3% annually, outpacing the market's 5% growth rate. The firm aims to become profitable within three years with projected earnings growth of 56.75% per year, indicating strong future potential despite current unprofitability and shareholder dilution over the past year.

- Click here to discover the nuances of Mesoblast with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Mesoblast's share price might be too pessimistic.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is a company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally, with a market capitalization of A$5.79 billion.

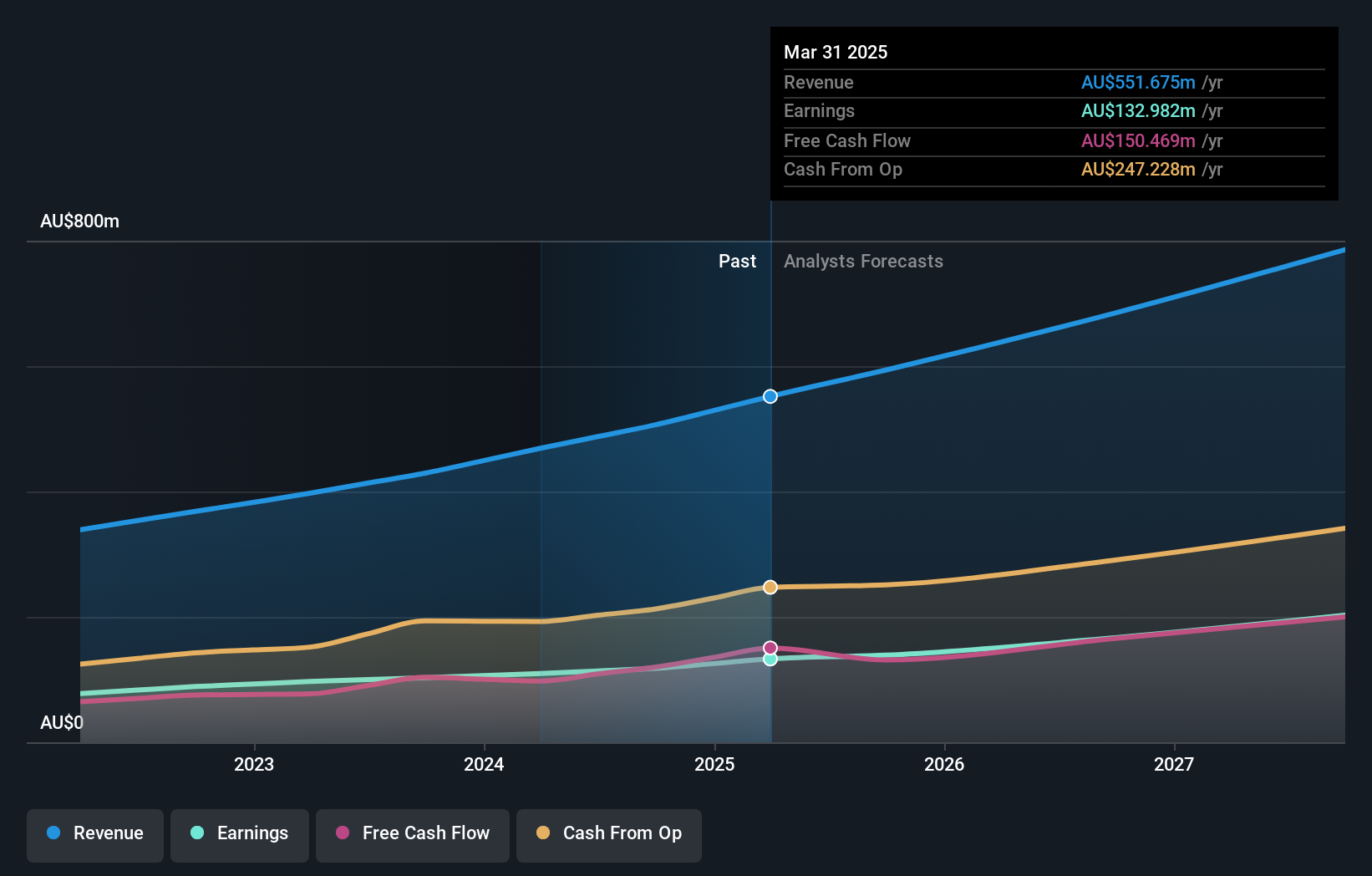

Operations: The company generates revenue through three primary segments: software (A$317.24 million), corporate (A$83.83 million), and consulting (A$68.13 million).

Insider Ownership: 12.3%

Revenue Growth Forecast: 11.1% p.a.

Technology One Limited, an Australian growth company with substantial insider ownership, reported a revenue increase to A$240.83 million and net income to A$48 million for the half-year ended March 31, 2024. Earnings per share also rose from the previous year. The firm's earnings are expected to grow by 14.22% annually, outperforming the Australian market forecast of 13.6%. Despite a high price-to-earnings ratio of 52.9x compared to the industry average of 61.3x, Technology One shows promising financial health and growth potential but with slower than ideal revenue growth projections at 11.1% annually.

- Unlock comprehensive insights into our analysis of Technology One stock in this growth report.

- Our valuation report here indicates Technology One may be overvalued.

Make It Happen

- Delve into our full catalog of 91 Fast Growing ASX Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.