Quote of the Day: “Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” - Peter Lynch

We have devoted most of our recent newsletters to deeper dives on topics including ETFs , gold, wind, solar, nuclear energy, green hydrogen, and Australia .

Away from those topics, market headlines continue to be dominated by AI and semiconductors.

But what else is happening in the market? This week, we decided to take a look at all the other sectors and key underlying factors affecting equity markets.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🇺🇸 US markets move to T+1 Settlement (WSJ)

- Our take: Trades on North American exchanges moved from T+3 to T+2 settlement in 2017, and as of 28th May, they settled in just one day. For most investors this makes little difference except that you can withdraw cash one day earlier after selling shares. It does make a difference for brokers and banks with large trading operations, as they only have to satisfy capital requirements for one day at a time. Generally, these changes lead to better liquidity.

-

🎟️ US Department of Justice takes on Live Nation over Ticketmaster monopoly (FT)

- Our take: When a company has an effective monopoly due to its intellectual property, it’s fairly immune to regulatory action. When it simply owns the largest operators in the industry, antitrust bodies have a better chance of breaking up the monopoly. Still, these cases usually go on for years before they are resolved.

-

🧑🔬 Malaysia plans to train 60,000 engineers to become chip hub (Nikkei)

- Our take: Designing and manufacturing chips is really hard, which is why the industry has become concentrated amongst the few companies and countries that are really good at it. All these new investments going into the industry could result in a more competitive landscape - but it’s not going to happen overnight.

-

🎥 Zoom video’s price-to-sales multiple has fallen from 67x to 4x in 4 years (CNBC)

- Our take: Zoom was the ultimate ‘work from home’ stock in 2020 and its market cap catapulted to over $160 billion. Four years later, the market value is 85% lower, despite revenue rising every year. Price multiples should be expected to fall as a company’s growth slows, just not as quickly as they have for Zoom. This is a reminder that the price you exit an investment at in the future will reflect future expectations at that time.

-

🏢 Office vacancies could hit 20% next year (Sherwood)

- Our Take: According to a report by CBRE, at a high level, a small percentage of buildings are doing very poorly (mostly older buildings in downtown areas that aren’t walking distance to amenities), while most of the office stock is doing okay. The same report shows about 67% of office buildings are more than 90% leased, while just 8% are at or below 50% occupancy. If you’re investing in REITs, make sure you’re aware of what type of real estate exposure it has, whether it be commercial, residential, industrial or other forms.

-

🤖 Apple and OpenAI have signed a deal (Android Authority)

- Our Take: This deal essentially includes providing chatbot functionality in iOS 18. While Apple still wants to provide Gemini as an option, it seems they’re keeping their own options open, by having ChatGPT, and Gemini, while also working on their own chatbot. When you’re a manufacturer, and we’re in the early days of generative AI, not having all your eggs in one AI basket makes sense to hedge your bets.

-

🛰️ Starlink passes the 3 million subscriber mark (NextBigFuture)

- Our take: Three million is small change compared to the 1.5 billion odd global broadband connections, so telco companies aren’t in any trouble yet. Starlink is also very expensive compared to the other options, so its addressable market at current prices is limited. Lowering prices would be a sign that the company plans to go big - and it could probably do that as it scales. Hopefully SpaceX will be publicly listed by the time that happens.

🌎 Global Market Themes

After a minor correction in April, global equity indexes are back in record territory.

There’s a lot less talk about a recession and the soft landing scenario seems to be playing out - well, for now at least. All this is happening despite the increased geopolitical risks, and the fact that rate cuts keep being pushed further into the future.

📈 Inflation And Interest Rates Show Little Signs Of Moving

Well, the Fed pivot never happened, and rate cuts seem to now be perpetually three months away. The path forward for US inflation appears to be uncertain, while European policymakers seem more confident that it is under control.

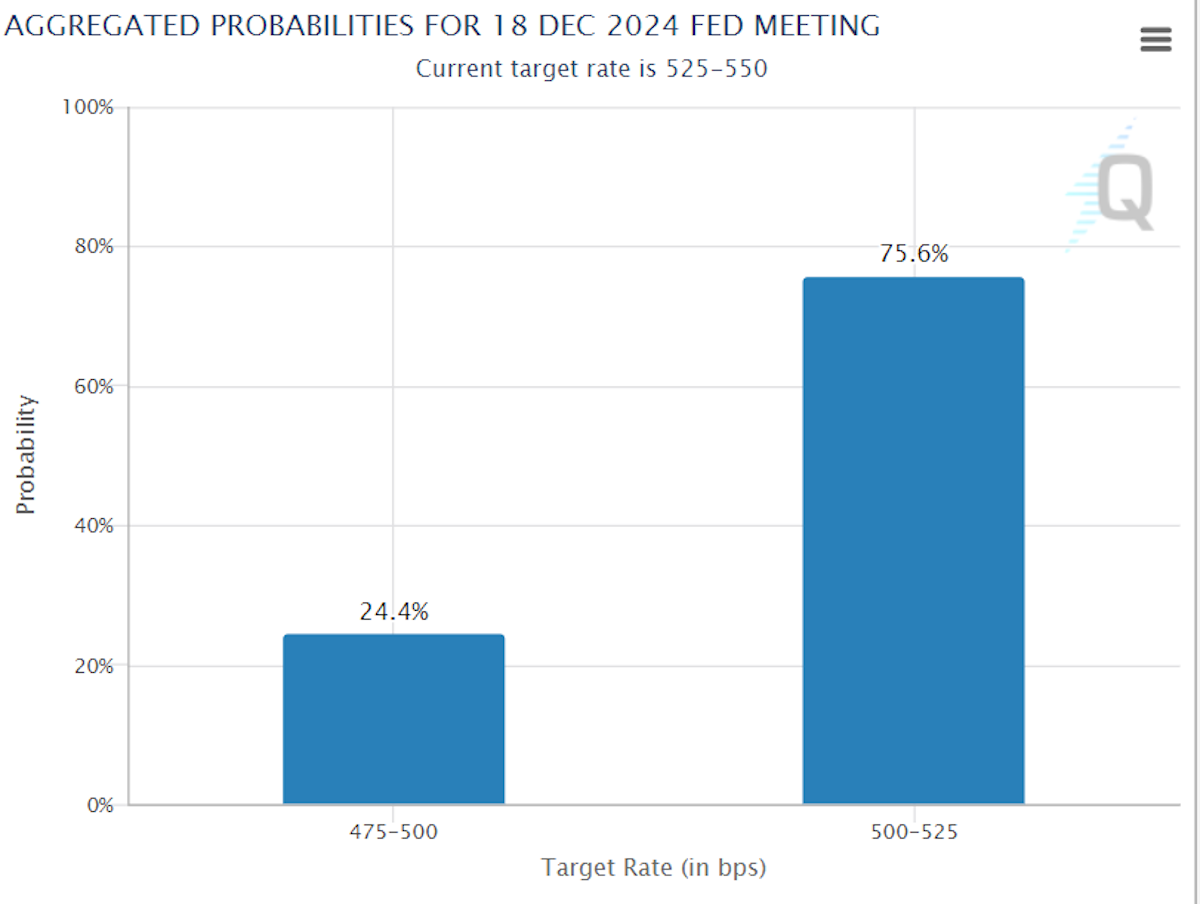

The Fed Fund futures market now implies a 75% chance that the benchmark rate will be just 0.25% lower after the December meeting, and no chance that rates will be more than 0.5% lower.

This implies that the ‘higher for longer’ scenario is playing out, unless a financial crisis causes rates to fall faster.

🏦 US Equities

The ‘magnificent seven’ have continued to drive US indexes higher.

But there has been some sector rotation happening in the background. Year to date, the telecom sector has been the star performer - mostly due to Meta and Alphabet . Unsurprisingly, tech stocks have also outperformed.

The utilities sector has emerged as a star performer over the last few months. Interestingly, the sector reported the second-highest increase in earnings growth for the first quarter amongst sectors in the US market, despite the largest drop in revenue.

Utilities underperformed through most of 2023, so there has been some mean reversion at play here. The sector has also emerged as a beneficiary of AI due to data center power demands. The market is definitely running ahead of analyst forecasts, though - EPS growth is expected to slow dramatically over the next few quarters.

The energy sector and certain industries in the basic materials sectors are also beginning to outperform. Marathon Oil’s acquisition by ConocoPhillips is the latest in a string of mergers in the oil and gas industry.

Energy giants are making acquisitions to increase efficiency rather than expanding their own production. This should result in higher margins, but could also keep supply tight going forward.

Metal and mining companies are benefiting from record prices in gold, silver and copper. Despite higher metals prices, and rising revenue, earnings are still declining. But analysts expect a strong recovery in profits later in the year. There’s also signs of increased M&A activity in the sector, after a decade with few deals.

The underperforming sectors have been real estate , consumer discretionary, and healthcare - but underlying fundamentals have been very different within those sectors.

The consumer discretionary sector was dragged down by sector heavyweights Tesla and Nike . Away from those two stocks, price and financial performance across consumer discretionary stocks has varied widely, and even within different segments of that industry. As is often the case, performance in retail industries on the whole has varied widely too.

The healthcare sector has underperformed since 2021 and continues to do so.

So far during earnings season, the sector has reported the biggest year-on-year decline in earnings, down 25.4% . Most of this decline was due to one company, Bristol Myers Squibb , after the company’s bottom line was hit by a $12 billion one off charge.

Excluding this company, the sector would be reporting a 7% drop in earnings, which would still put it in the bottom three sectors.

Despite lagging performance, the healthcare sector is still the most expensive in the US market when price/earnings ratios are compared to expected earnings growth, as the chart below clearly reflects…

Earnings estimates for the first quarter have continually been revised lower over the last year - but analysts are now expecting earnings growth to outpace all other sectors over the next four quarters. Either analysts are right, or share prices may need to fall further.

Lastly, the real estate sector remains under pressure. Revenue and earnings have actually recovered substantially over the last few quarters. But sentiment around the sector remains weak - and high interest rates make the yields on REITs seem less attractive.

🧢 What Happened To Small Caps?

Small cap shares have on average continued to underperform large caps, even when the big tech stocks are excluded.

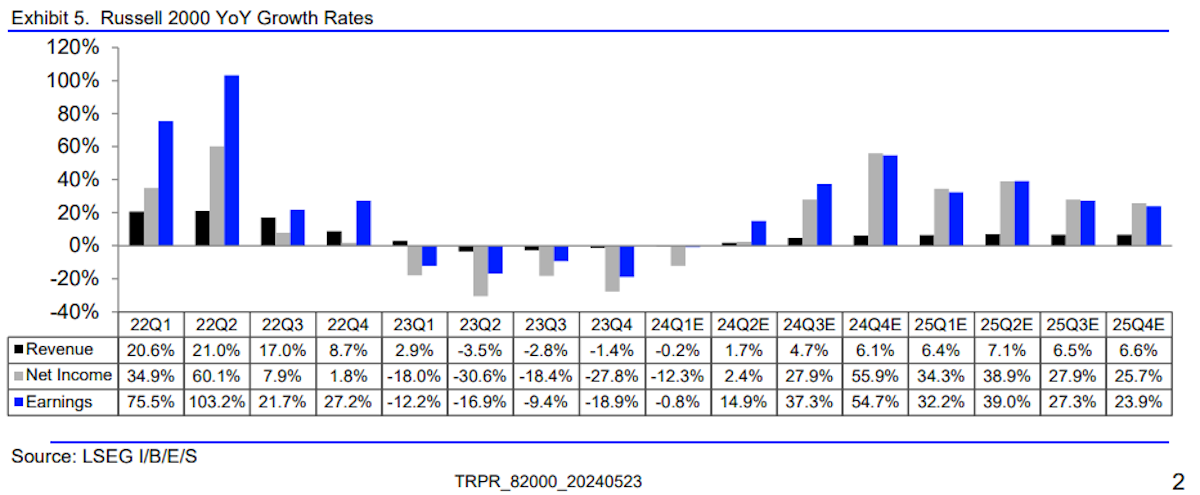

The chart below from LSEG I/B/E/S illustrates year-on-year revenue, net income and earnings growth rates for the Russell 2000 index of small cap stocks.

As of 24th May, it shows first quarter revenue and profits beginning to recover, but clearly shows that the earnings recession for smaller companies isn’t over.

And while revenue was flat from a year earlier, profits were still down 12%. By contrast, large cap stocks grew earnings by 8% on revenue growth of 3.8%. Clearly, smaller companies have had a harder time managing rising costs.

✨ The good news is that if analysts are even vaguely right, smaller companies could experience a very strong recovery in the third and fourth quarter.

🇪🇺 🇬🇧 Europe And The UK

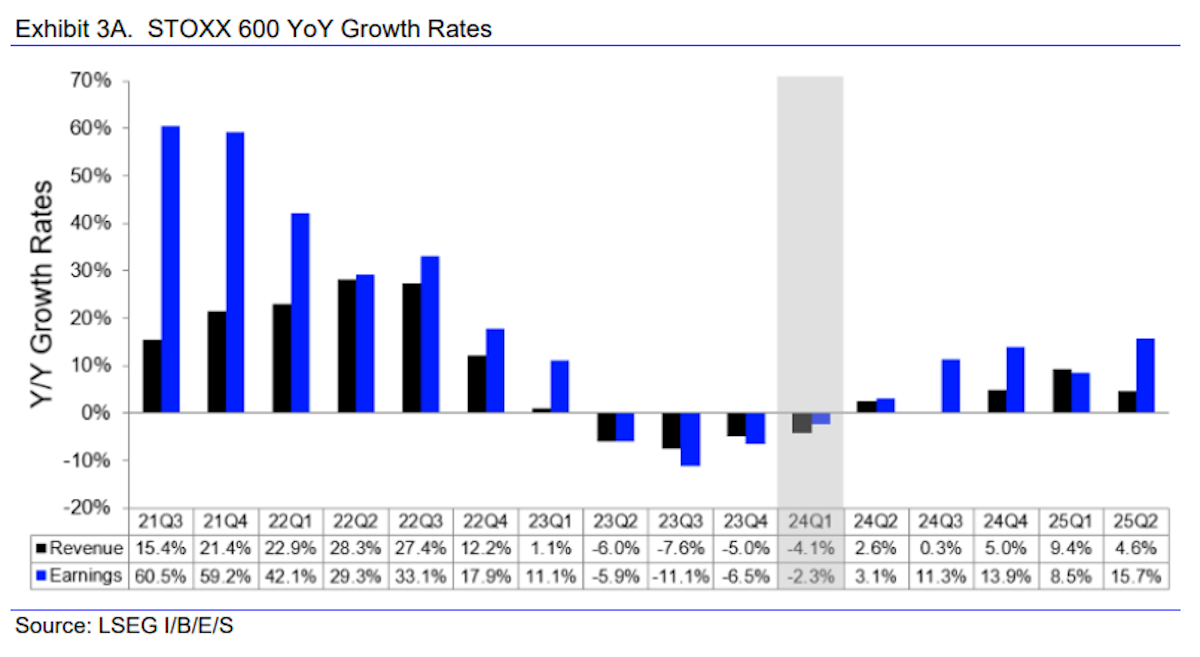

European companies are only about halfway through earnings season, so the data is subject to change. The chart below reflects quarterly growth rates for companies in the Euro Stoxx 600 index.

European companies are also still reporting declining revenue and earnings compared to a year ago, although the decline has slowed significantly. Growth rates are also expected to turn positive during the current quarter and improve over the next four quarters.

✨ Sentiment in Europe is also improving as inflation is closer to target levels and natural gas prices are lower. These factors, and the fact that European equities are trading on lower valuations than their US counterparts have all contributed to positive year-to-date returns for European indexes.

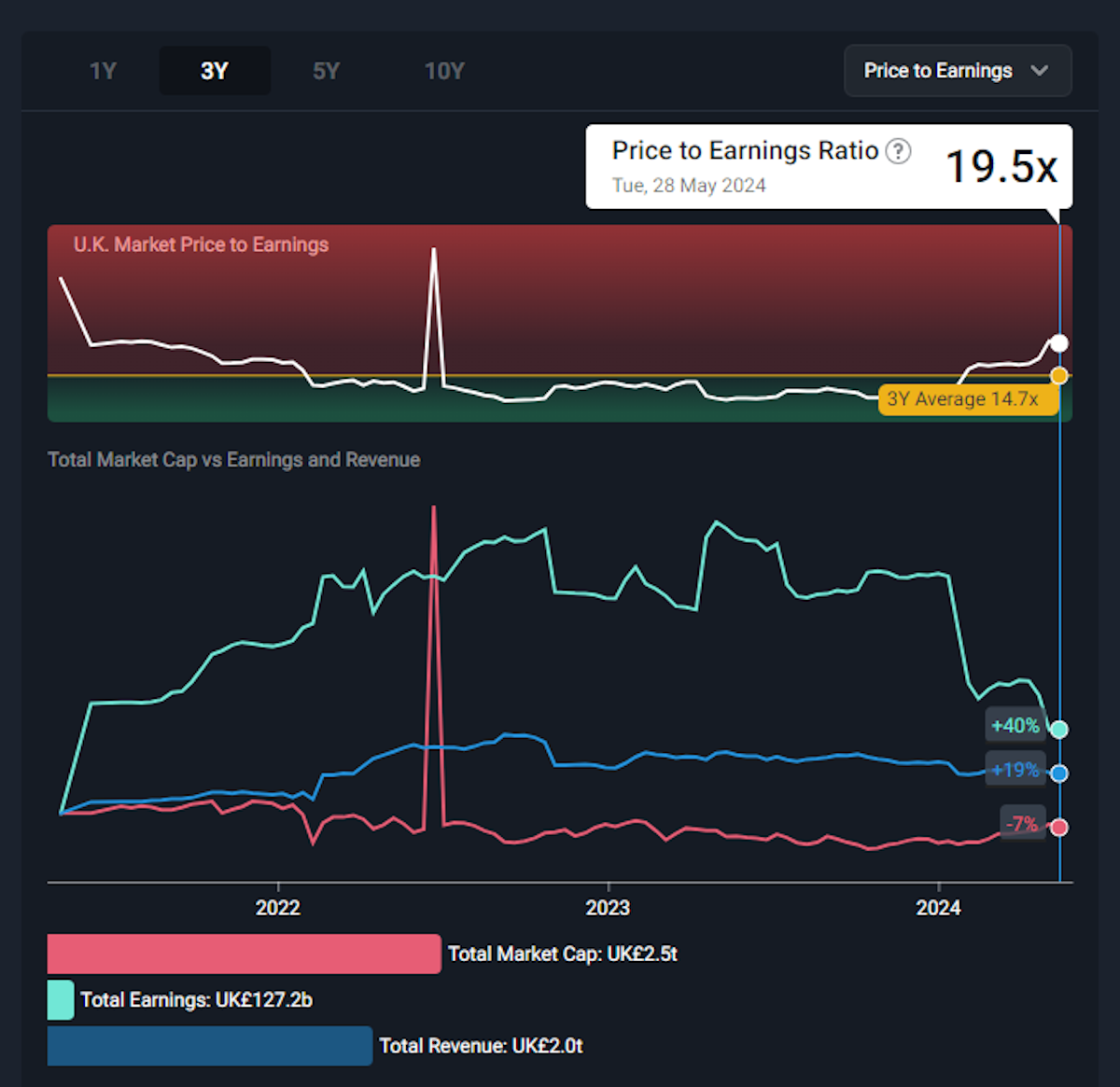

The UK economy is facing even more challenges than the rest of Europe. But investors are looking beyond the current challenges, and average stock prices and valuations are rising. The UK’s largest companies have a lot more global exposure, including exposure to commodity producers. As the chart below shows, this is also leading to improving sentiment despite sharp declines in revenue and earnings.

🌏 Asia And Emerging Markets

Performance amongst stocks markets in Asia and other emerging markets has also been very varied.

✨ India and Japan have continued to outperform, although momentum is slowing. Fundamentals in both of these markets have improved, which has made them top picks for global funds.

Elsewhere, it’s been more of a case of mean reversion, with markets that lagged last year beginning to catch up - China being the main example. China’s stock market may have recovered slightly, but the underlying economic weakness remains.

This is weighing on other markets in SE Asia, as these countries rely on trade with China, which we covered in November last year.

💡 The Insight: The Focus May Be Shifting from Macro To Micro

Over the last few years, macro factors have played a massive role in the financial performance of companies and their valuations.

Supply chain disruptions, energy prices, inflation, rising interest rates, and recession worries have dominated the investment landscape.

Global growth is now slowing, and interest rates are still high, but there is also less uncertainty. This is giving investors and business leaders more confidence to make investments and decisions.

As macro factors evolve more slowly, company specific news and events will have more of an impact on financial performance for companies.

There’s already been an increase in M&A activity and corporate deals. Companies in the same sectors and industries are also reporting very different numbers - some great and some terrible.

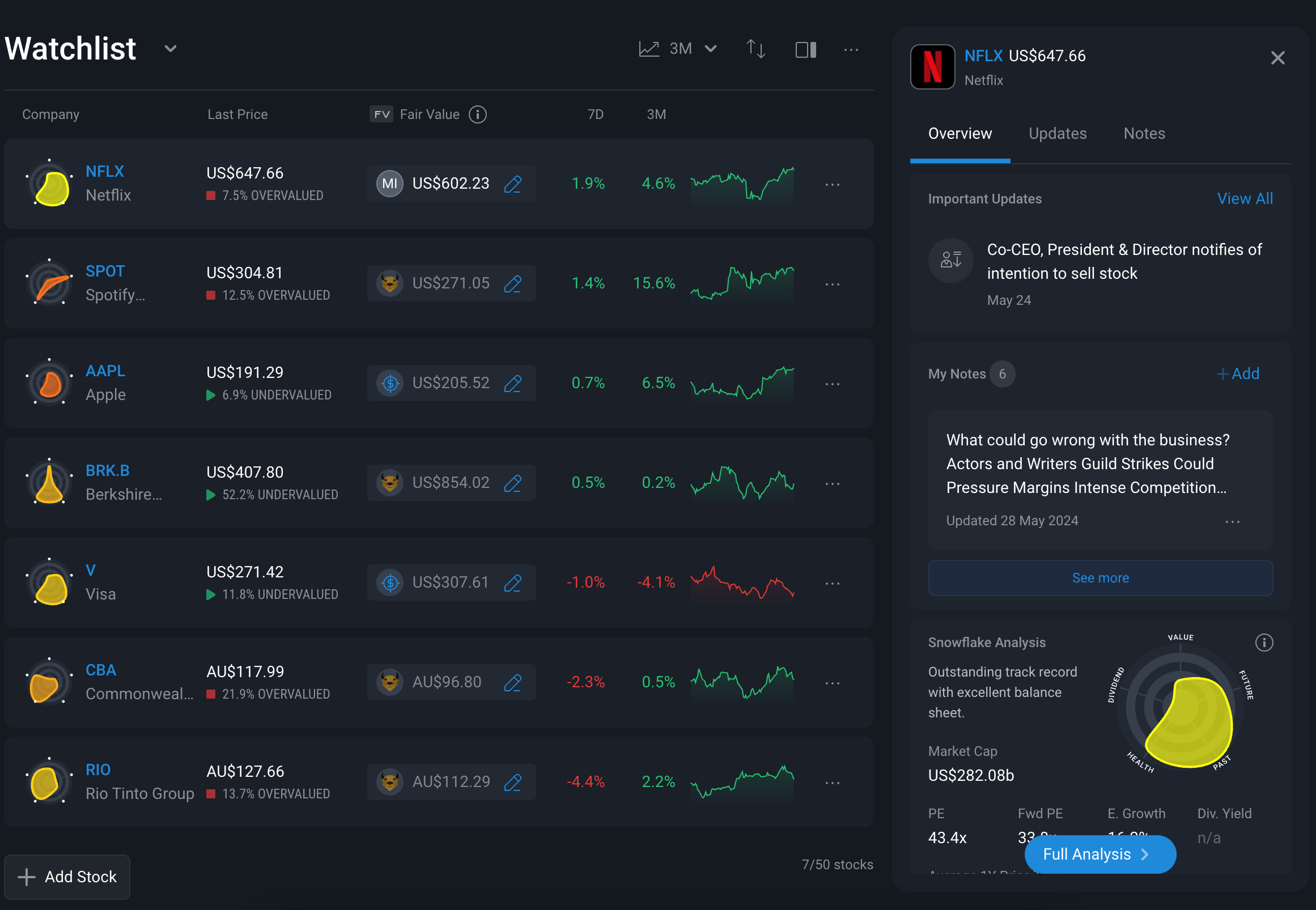

This means investors will need to pay more attention to the companies in their portfolios and watchlists, rather than the macro environment - though it shouldn’t be ignored completely.

As always, you can check your portfolio’s holdings to make sure you’re exposed to what you have conviction in, and check your watchlist for any opportunities that may now meet your requirements.

Key Events During The Next Week

Monday

- 🇺🇸 US ISM Manufacturing PMI is forecast to rise slightly, from 49.1 to 50.

Tuesday

- 🇺🇸 US job Openings are expected to continue their gradual decline, falling from 8.49 million to 8.49 million.

Wednesday

- 🇦🇺 Australia’s 1st quarter GDP growth rate is expected to be reported at 1.2%, compared to 1.5% in the 4th quarter.

- 🇺🇸 A US ADP employment report will be published. 192k new jobs were reported in the previous report.

- 🇨🇦 Canada’s central bank is expected to keep its benchmark rate at 5%.

Thursday

- 🇦🇺 Trade data is due in Australia. The trade surplus was previously $5B.

- 🇪🇺 The ECB’s rate decision will be announced, with odds of a 0.25% cut to 4.25% increasing.

Friday

- 🇨🇦 Canada’s unemployment rate (currently 6.1%) will be published.

- 🇺🇸 US unemployment data is also due. The unemployment rate is forecast to be unchanged at 3.9%, while non-farm payrolls are expected to increase by 151k, after rising 175k during the prior period.

As for the companies reporting this week, we have:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.