- Australia

- /

- Capital Markets

- /

- ASX:PNI

ASX Growth Companies With High Insider Ownership Expecting Up To 55% Revenue Growth

Reviewed by Simply Wall St

The Australian stock market has shown resilience, with the ASX200 up 10% over the past ten months, despite a quiet September. As critical minerals and healthcare sectors gain momentum amid geopolitical shifts, investors are increasingly looking at growth companies with high insider ownership as potential opportunities.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 89.9% |

| Titomic (ASX:TTT) | 11.3% | 74.9% |

| Pointerra (ASX:3DP) | 19% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 21.1% | 144.4% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Emerald Resources (ASX:EMR) | 18.1% | 38.9% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| Adveritas (ASX:AV1) | 18.8% | 96.8% |

| Acrux (ASX:ACR) | 15.9% | 121.1% |

Let's review some notable picks from our screened stocks.

IperionX (ASX:IPX)

Simply Wall St Growth Rating: ★★★★★★

Overview: IperionX Limited focuses on developing mineral properties in the United States and has a market capitalization of A$3.05 billion.

Operations: IperionX Limited does not currently report any revenue segments.

Insider Ownership: 16.9%

Revenue Growth Forecast: 55.5% p.a.

IperionX is poised for significant growth, with insider buying indicating confidence in its future. The company is expected to outpace the market with a 55.5% annual revenue growth forecast and become profitable within three years. Recent inclusion in the S&P/ASX 200 Index underscores its growing prominence. Despite past shareholder dilution, IperionX's strategic U.S. titanium expansion, backed by substantial DoD funding, aims to establish it as a cost leader in titanium production.

- Navigate through the intricacies of IperionX with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, IperionX's share price might be too optimistic.

Meeka Metals (ASX:MEK)

Simply Wall St Growth Rating: ★★★★★★

Overview: Meeka Metals Limited is involved in the exploration and development of gold properties in Western Australia, with a market cap of A$642.91 million.

Operations: The company's revenue segment is derived from exploration activities, generating A$0.33 million.

Insider Ownership: 11.9%

Revenue Growth Forecast: 44.1% p.a.

Meeka Metals is positioned for growth with a forecasted 44.1% annual revenue increase, surpassing the Australian market average. Despite a recent net loss of A$4.24 million, the company aims to achieve profitability within three years and boasts significant insider ownership. Trading at 62.3% below its estimated fair value, Meeka's strategic initiatives include ramping up production at its Murchison Gold Project and potential acquisitions to enhance mill capacity, reflecting robust future prospects despite recent shareholder dilution.

- Take a closer look at Meeka Metals' potential here in our earnings growth report.

- The analysis detailed in our Meeka Metals valuation report hints at an deflated share price compared to its estimated value.

Pinnacle Investment Management Group (ASX:PNI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pinnacle Investment Management Group Limited is an investment management company based in Australia with a market cap of A$4.17 billion.

Operations: Pinnacle generates revenue primarily from its Funds Management Operations, amounting to A$65.47 million.

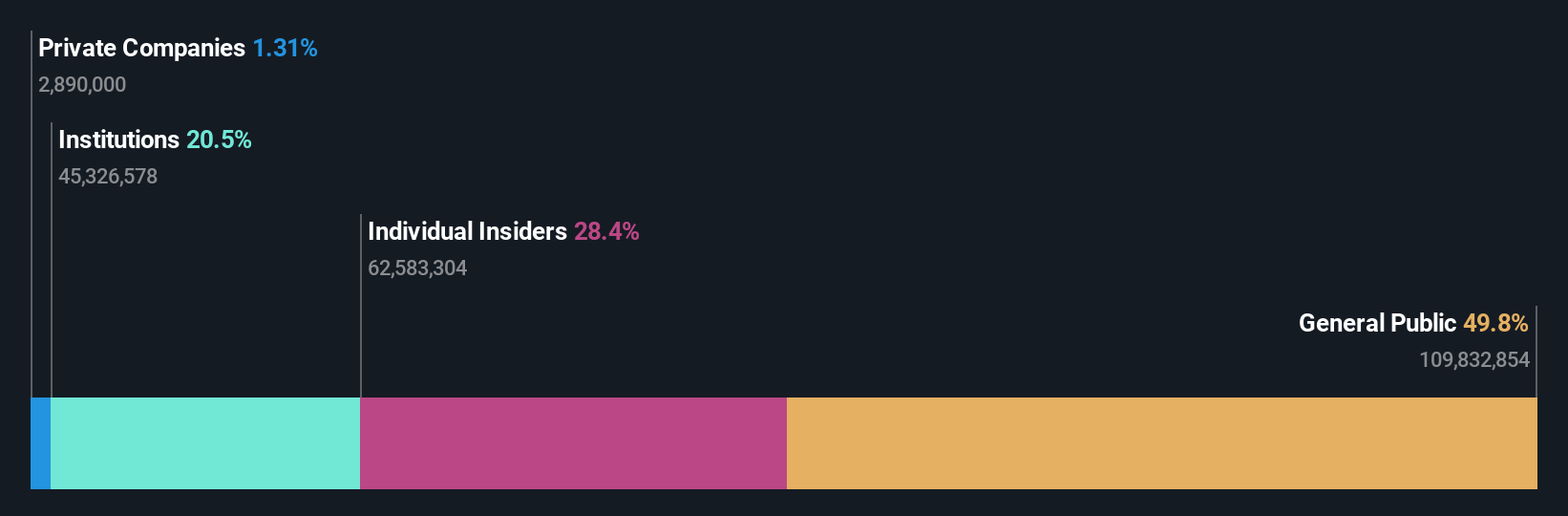

Insider Ownership: 26.5%

Revenue Growth Forecast: 10.1% p.a.

Pinnacle Investment Management Group demonstrates growth potential with forecasted earnings and revenue increases of 13.18% and 10.1% per year, respectively, outpacing the broader Australian market. Despite a dividend yield of 3.17% not being well-covered by earnings or cash flows, insider transactions show more buying than selling recently, indicating confidence in future prospects. Recent executive changes include Terence Kwong's appointment as Company Secretary, potentially strengthening Pinnacle's strategic direction given his extensive financial services background.

- Unlock comprehensive insights into our analysis of Pinnacle Investment Management Group stock in this growth report.

- According our valuation report, there's an indication that Pinnacle Investment Management Group's share price might be on the expensive side.

Make It Happen

- Investigate our full lineup of 105 Fast Growing ASX Companies With High Insider Ownership right here.

- Seeking Other Investments? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNI

Pinnacle Investment Management Group

Operates as an investment management company in Australia.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives