- Australia

- /

- Specialty Stores

- /

- ASX:CTT

ASX Penny Stocks: Aussie Broadband Leads 3 Promising Picks

Reviewed by Simply Wall St

As Australian shares are poised to open the week on a positive note, investors are eager to leave behind recent market turbulence and focus on more stable prospects. In this context, penny stocks continue to attract attention for their potential to offer both affordability and growth opportunities. Despite the term's old-fashioned feel, these smaller or newer companies can present significant value when backed by strong financials, making them an intriguing option for those looking to explore untapped areas of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.57 | A$121.31M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.00 | A$150.57M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.785 | A$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.32 | A$68.87M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.38 | A$370.04M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$115.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.13 | A$148.52M | ✅ 3 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$813.53M | ✅ 5 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.66 | A$432.08M | ✅ 4 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.41 | A$1.1B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 981 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Aussie Broadband (ASX:ABB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market capitalization of A$1.14 billion.

Operations: The company's revenue is derived from several segments, including Residential (A$628.51 million), Wholesale (A$143.55 million), Business (A$102.99 million), and Enterprise and Government (A$93.51 million).

Market Cap: A$1.14B

Aussie Broadband Limited, with a market cap of A$1.14 billion, shows promise in the penny stock realm due to its diverse revenue streams across residential, wholesale, business, and enterprise sectors. The company's financial health is supported by satisfactory debt levels and well-covered interest payments. Despite a low return on equity (5%), earnings have grown 25% over the past year—outpacing industry averages—and are forecasted to continue growing robustly. Recent board changes include the addition of Graeme Barclay as a Non-Executive Director, bringing extensive telecommunications experience that could enhance strategic growth initiatives.

- Unlock comprehensive insights into our analysis of Aussie Broadband stock in this financial health report.

- Understand Aussie Broadband's earnings outlook by examining our growth report.

Cettire (ASX:CTT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally, with a market capitalization of A$263.05 million.

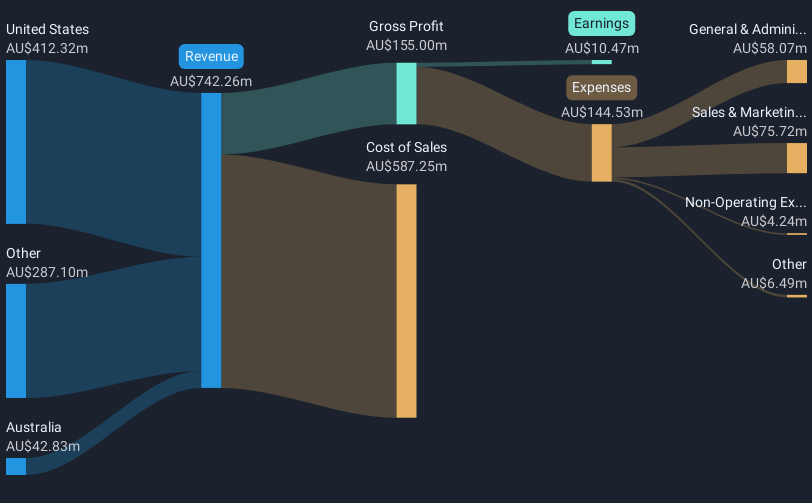

Operations: The company's revenue is primarily generated from online retail sales, amounting to A$781.98 million.

Market Cap: A$263.05M

Cettire Limited, with a market cap of A$263.05 million, operates in the online luxury retail sector and has demonstrated significant revenue generation at A$781.98 million. Despite negative earnings growth over the past year and lower profit margins (0.3% compared to 3.6% previously), Cettire is debt-free, which provides financial flexibility. The company is trading significantly below its estimated fair value, suggesting potential upside if operational efficiencies improve. Recent board changes include Steven Fisher as Chair and Daniel Agostinelli joining as an Independent Non-Executive Director, both bringing extensive retail experience that may bolster strategic execution amidst ongoing market challenges.

- Jump into the full analysis health report here for a deeper understanding of Cettire.

- Learn about Cettire's future growth trajectory here.

IGO (ASX:IGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGO Limited is an exploration and mining company in Australia that focuses on discovering, developing, and operating assets for metals essential to clean energy, with a market cap of A$2.64 billion.

Operations: The company's revenue is primarily derived from its Nova Operation, which contributed A$460.8 million, and the Forrestania Operation, which added A$153 million.

Market Cap: A$2.64B

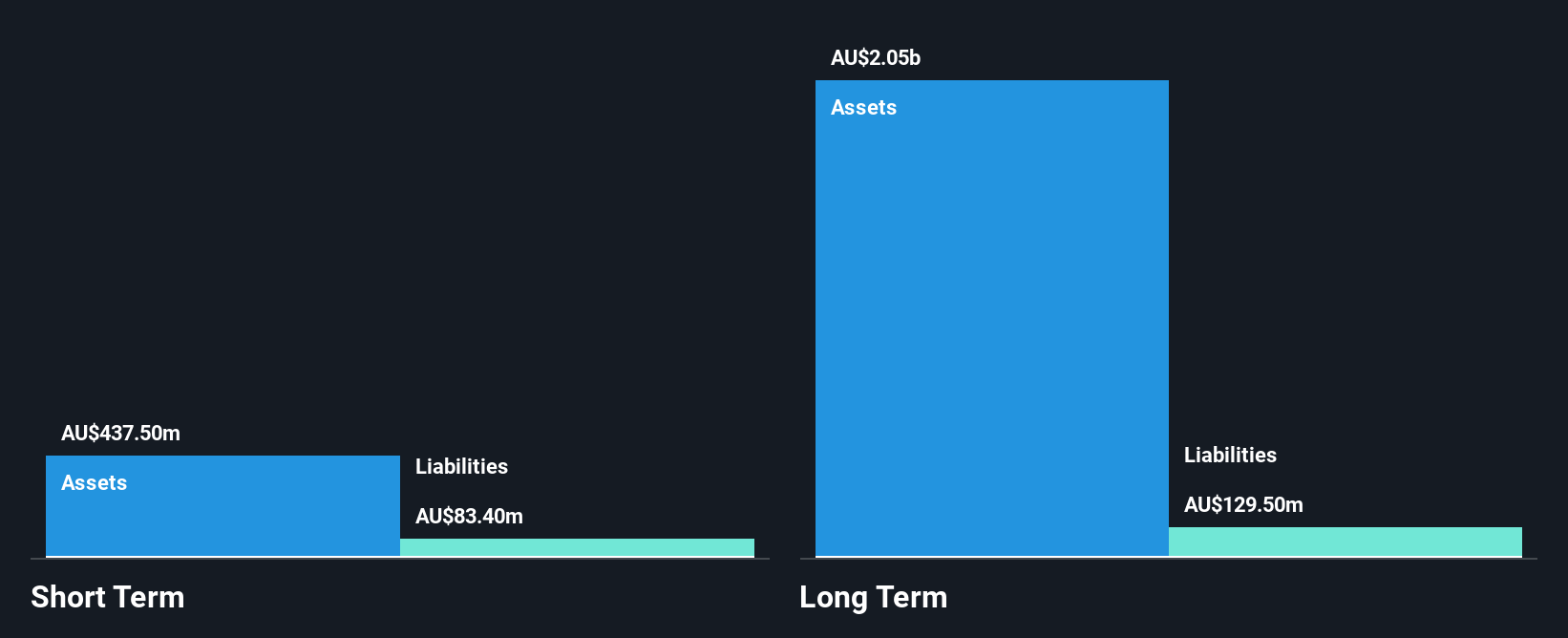

IGO Limited, with a market cap of A$2.64 billion, operates in the exploration and mining sector focusing on clean energy metals. Despite being debt-free and having short-term assets (A$437.5 million) covering both short- and long-term liabilities, IGO is currently unprofitable with a significant net loss of A$782.1 million reported for the half-year ending December 2024. The company's management team has limited tenure experience, which could impact strategic stability amid recent executive changes including the planned retirement of CFO Kathleen Bozanic by year-end 2025 and other key personnel shifts affecting continuity in leadership roles.

- Dive into the specifics of IGO here with our thorough balance sheet health report.

- Gain insights into IGO's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Discover the full array of 981 ASX Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are the new gold rush. Find out which 21 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTT

Cettire

Engages in the online luxury goods retailing business in Australia, the United States, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives