- Australia

- /

- Metals and Mining

- /

- ASX:GRR

Grange Resources (ASX:GRR) Is Up 8.9% After Strong Q3 Production and Lower Costs – What’s Changed

Reviewed by Sasha Jovanovic

- Grange Resources recently reported a strong third quarter, with higher concentrate and pellet production, lower unit costs, and improved safety performance at its Savage River operations.

- Continued progress on key growth initiatives, including the North Pit Underground project and the Southdown magnetite project, signals a clear focus on operational expansion and future potential.

- We’ll consider how Grange Resources’ production gains and disciplined cost management inform its broader investment narrative moving forward.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Grange Resources' Investment Narrative?

For investors considering Grange Resources, the bigger picture is about believing in the company's ability to convert recent operational strength into sustainable long-term performance. The latest quarterly update signals a positive shift: higher production, better realised prices, and improved cost control at Savage River helped boost cash flow and reinforce management’s focus on disciplined growth. These results may reframe the most important short-term catalyst, which had been concerns around cost inflation and declining earnings, by highlighting improved operational momentum and management execution. At the same time, risk from index exclusion or weakening market sentiment could be less pronounced if the company can maintain this operational consistency. Still, continued declines in sales and margins seen in recent results keep pressure on earnings recovery and market confidence. Taken together, the recent performance offers a potential turning point, though challenges remain.

But investors should weigh the pressures from declining margins just as closely.

Exploring Other Perspectives

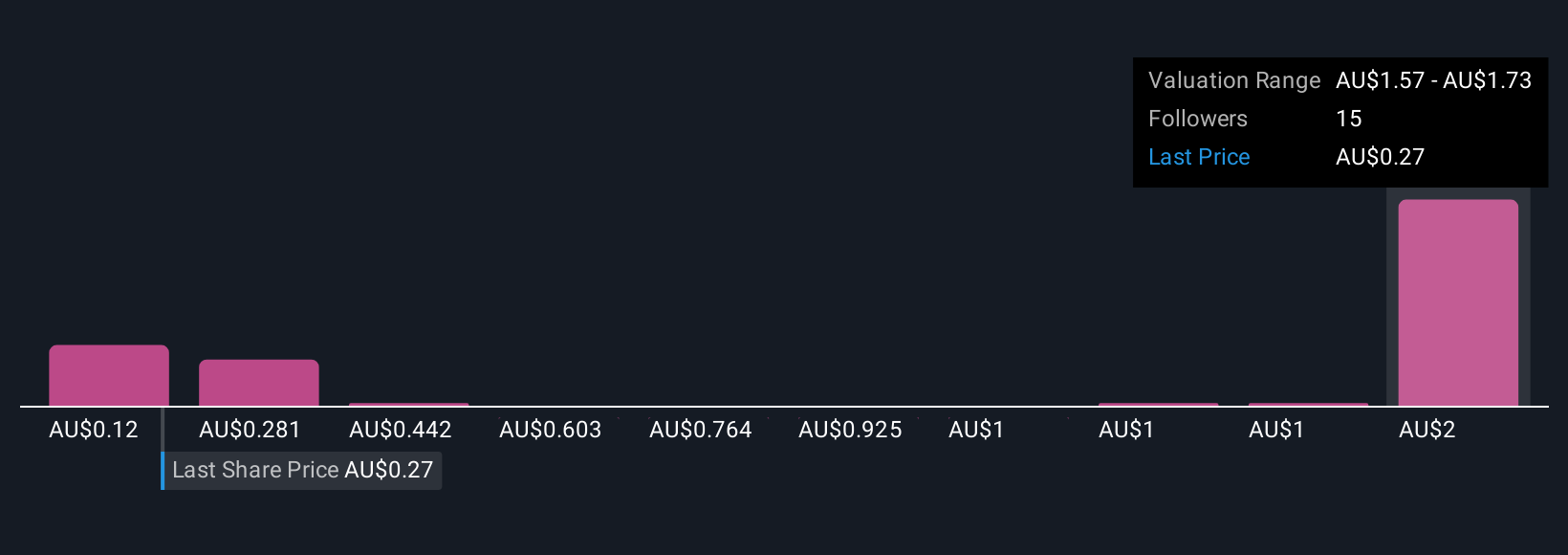

Explore 14 other fair value estimates on Grange Resources - why the stock might be worth over 7x more than the current price!

Build Your Own Grange Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Grange Resources research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Grange Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Grange Resources' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GRR

Grange Resources

Owns and operates integrated iron ore mining and pellet production business in Australia and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)