- Australia

- /

- Metals and Mining

- /

- ASX:GOR

3 ASX Stocks Estimated To Be Trading Up To 49.4% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian stock market has shown resilience, closing nearly flat despite initial predictions of a decline and contrasting with significant drops in major U.S. indices. This unexpected stability, led by gains in sectors like Real Estate and Energy, presents an intriguing environment for identifying undervalued stocks that could offer potential value to investors. In such a market landscape, discerning intrinsic value becomes crucial for pinpointing stocks that may be trading below their true worth.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$6.34 | A$12.27 | 48.3% |

| Cettire (ASX:CTT) | A$1.60 | A$3.01 | 46.8% |

| Telix Pharmaceuticals (ASX:TLX) | A$23.84 | A$45.36 | 47.4% |

| Aussie Broadband (ASX:ABB) | A$3.54 | A$6.42 | 44.8% |

| Ingenia Communities Group (ASX:INA) | A$4.68 | A$9.18 | 49% |

| Charter Hall Group (ASX:CHC) | A$14.66 | A$28.67 | 48.9% |

| Gold Road Resources (ASX:GOR) | A$2.09 | A$4.13 | 49.4% |

| Vault Minerals (ASX:VAU) | A$0.335 | A$0.66 | 49.1% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Genesis Minerals (ASX:GMD) | A$2.53 | A$4.85 | 47.9% |

Let's dive into some prime choices out of the screener.

Gold Road Resources (ASX:GOR)

Overview: Gold Road Resources Limited, along with its subsidiaries, focuses on the exploration of gold properties in Western Australia and has a market capitalization of A$2.23 billion.

Operations: The company generates revenue from its Development and Production segment, amounting to A$454.82 million.

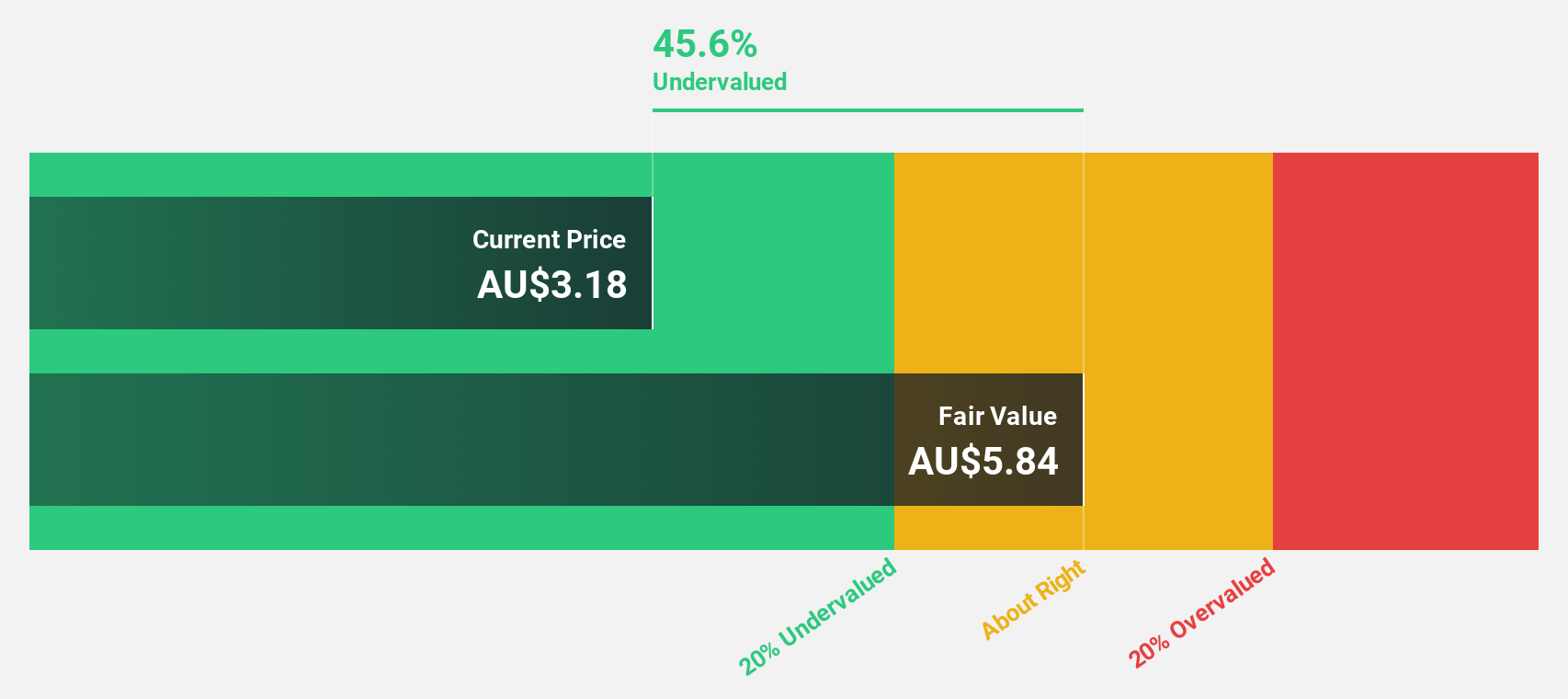

Estimated Discount To Fair Value: 49.4%

Gold Road Resources is trading at A$2.09, significantly below its estimated fair value of A$4.13, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow annually by 21.5%, outpacing the Australian market's growth rate of 12.5%. Despite a low projected return on equity of 13.3% in three years, revenue growth is expected to surpass the market average at 9.2% per year, highlighting potential for future gains amidst M&A interest in the sector.

- Our comprehensive growth report raises the possibility that Gold Road Resources is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Gold Road Resources' balance sheet health report.

Infomedia (ASX:IFM)

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$547.15 million.

Operations: The company's revenue primarily comes from its Publishing - Periodicals segment, generating A$140.83 million.

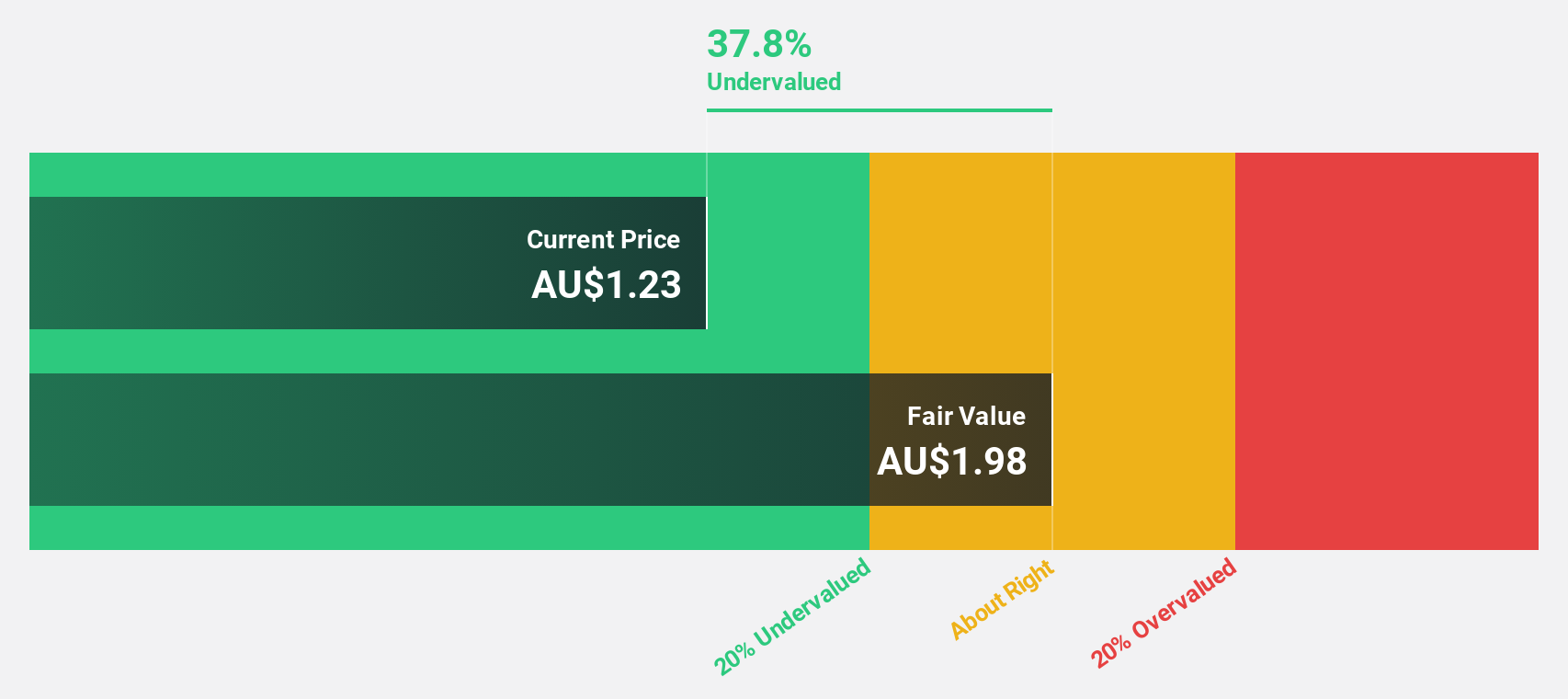

Estimated Discount To Fair Value: 35.5%

Infomedia is trading at A$1.44, below its estimated fair value of A$2.22, highlighting potential undervaluation based on cash flows. Earnings grew 32.4% last year and are forecast to rise by 21% annually, outpacing the Australian market's growth rate of 12.5%. Despite a dividend not well covered by earnings, revenue is expected to grow faster than the market average at 6.8% per year amidst active M&A exploration for shareholder value enhancement.

- According our earnings growth report, there's an indication that Infomedia might be ready to expand.

- Unlock comprehensive insights into our analysis of Infomedia stock in this financial health report.

Vault Minerals (ASX:VAU)

Overview: Vault Minerals Limited is involved in the exploration, production, and mining of gold and gold/copper concentrates in Canada and Australia with a market cap of A$2.24 billion.

Operations: The company's revenue segments include Deflector at A$22.42 million, Mount Monger at A$15.96 million, and King of The Hills at A$581.62 million.

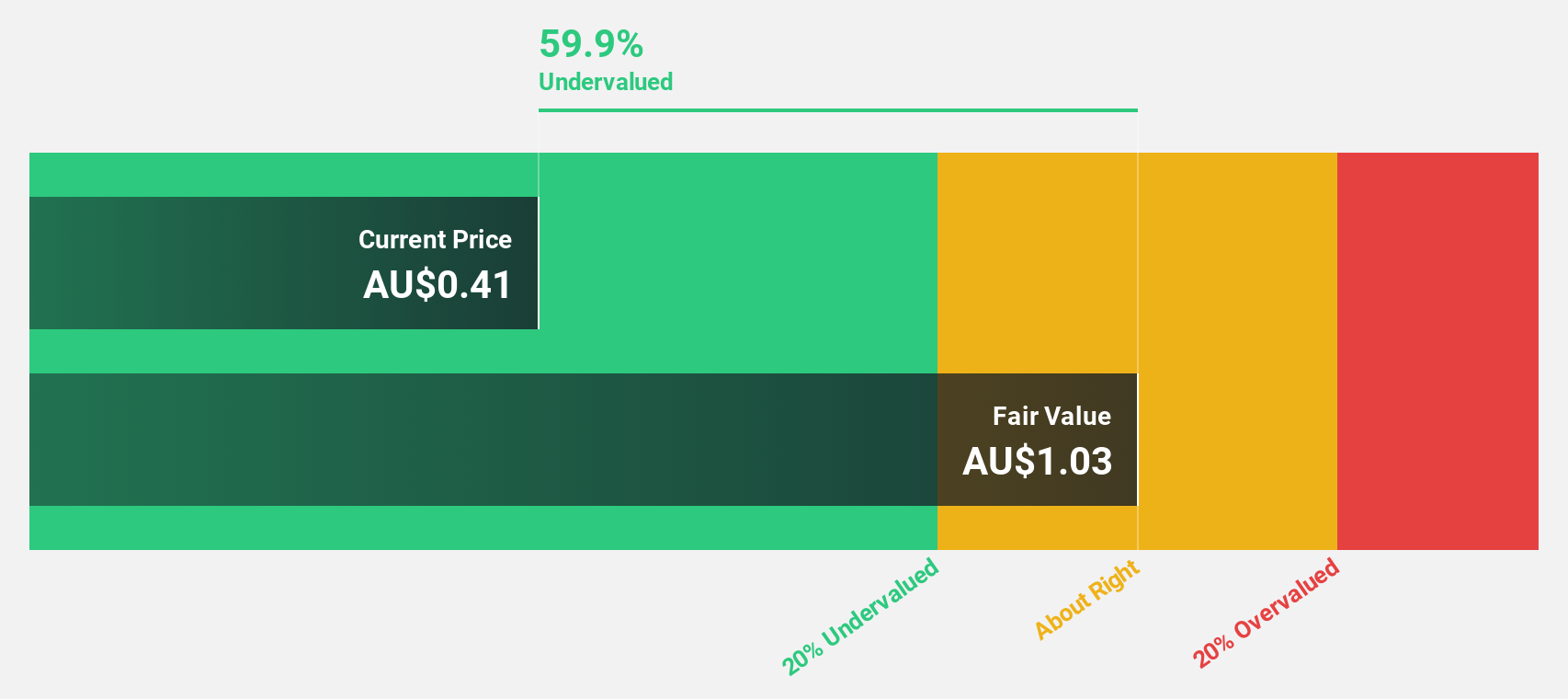

Estimated Discount To Fair Value: 49.1%

Vault Minerals is trading at A$0.34, significantly below its fair value estimate of A$0.66, suggesting undervaluation based on cash flows. Revenue is expected to grow annually by 12.9%, surpassing the Australian market's 5.9% growth rate, while earnings are projected to increase by 25.38% per year and become profitable within three years despite recent shareholder dilution and low forecasted return on equity of 8.8%. Recent AGM approved a new constitution adoption.

- The analysis detailed in our Vault Minerals growth report hints at robust future financial performance.

- Get an in-depth perspective on Vault Minerals' balance sheet by reading our health report here.

Summing It All Up

- Reveal the 43 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GOR

Gold Road Resources

Engages in the exploration of gold properties in Western Australia.

Excellent balance sheet with reasonable growth potential.