- Australia

- /

- Construction

- /

- ASX:DUR

Discover 3 ASX Penny Stocks With Market Caps As Low As A$50M

Reviewed by Simply Wall St

As the Australian market navigates a quiet start to January, with the ASX 200 opening slightly lower amid global economic uncertainties and currency fluctuations, investors are keenly observing opportunities in various sectors. Penny stocks, often associated with smaller or newer companies, remain an intriguing area for those looking to uncover potential value despite their somewhat outdated label. These stocks can offer growth prospects at attractive price points when underpinned by strong financials and sound fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$65.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$238.78M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.665 | A$842.94M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.995 | A$112.19M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$318.31M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$202.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.905 | A$103.99M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Camplify Holdings (ASX:CHL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Camplify Holdings Limited operates peer-to-peer digital marketplace platforms connecting RV owners to hirers across Australia, New Zealand, the United Kingdom, Spain, Germany, Austria, and the Netherlands with a market cap of A$50.05 million.

Operations: The company's revenue is primarily derived from its Hire segment, which generated A$34.49 million, supplemented by A$5.17 million from Membership services.

Market Cap: A$50.05M

Camplify Holdings Limited, with a market cap of A$50.05 million, primarily generates revenue from its Hire segment (A$34.49 million) and Membership services (A$5.17 million). Despite being unprofitable, its short-term assets exceed liabilities, indicating solid liquidity management. The company has experienced board members with an average tenure of eight years and recently appointed Andrew McEvoy as Chair, reflecting strategic leadership changes. Analysts agree on potential stock price growth; however, Camplify's negative return on equity (-13.92%) and increased losses over five years highlight ongoing financial challenges despite its stable weekly volatility at 8%.

- Click here and access our complete financial health analysis report to understand the dynamics of Camplify Holdings.

- Evaluate Camplify Holdings' prospects by accessing our earnings growth report.

Duratec (ASX:DUR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Duratec Limited, with a market cap of A$378.06 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

Operations: Duratec Limited generates its revenue from several key segments, including Defence (A$220.16 million), Mining & Industrial (A$155.64 million), Buildings & Facades (A$111.33 million), and Energy (A$46.64 million).

Market Cap: A$378.06M

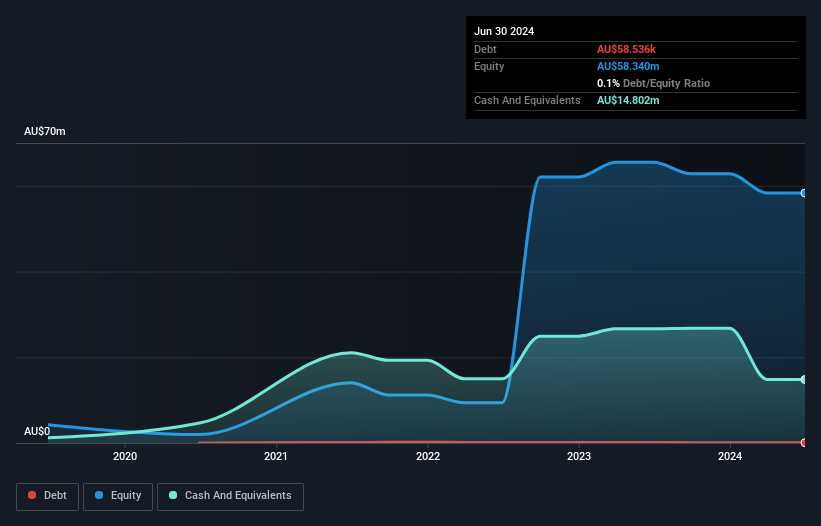

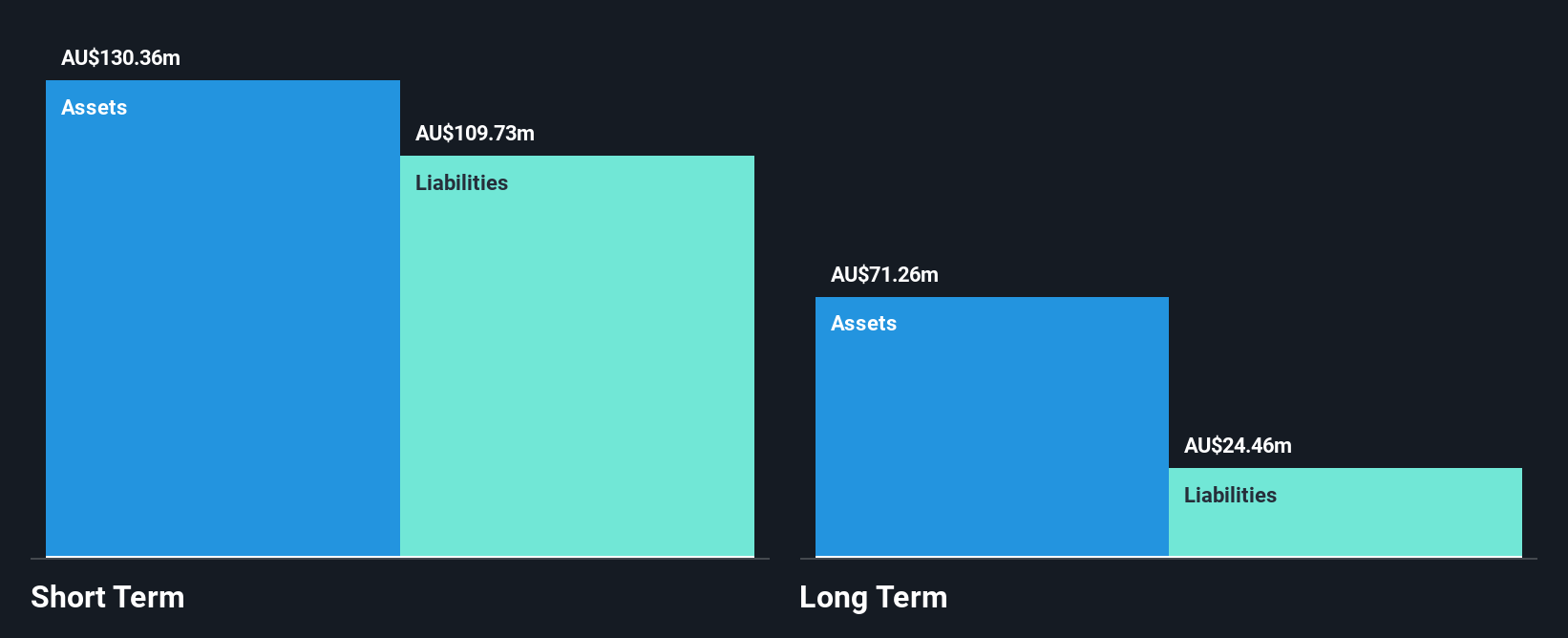

Duratec Limited, with a market cap of A$378.06 million, is notable for its strong financial position and growth potential. The company has no debt and boasts high-quality earnings, with short-term assets (A$161.3M) covering both short-term (A$140.6M) and long-term liabilities (A$25.6M). Despite a recent slowdown in annual earnings growth to 11.6%, it remains robust over five years at 24.8% per year, supported by an experienced management team and board of directors averaging 14.4 years tenure each. Trading at a discount to estimated fair value, Duratec forecasts revenue between A$600 million to A$640 million for FY2025.

- Navigate through the intricacies of Duratec with our comprehensive balance sheet health report here.

- Examine Duratec's earnings growth report to understand how analysts expect it to perform.

Southern Cross Media Group (ASX:SXL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Southern Cross Media Group Limited, along with its subsidiaries, produces audio content for broadcast and digital networks in Australia and has a market cap of A$143.94 million.

Operations: The company's revenue is derived from Broadcast Radio (A$366.62 million), Television (A$97.49 million), and Digital Audio (A$35.03 million).

Market Cap: A$143.94M

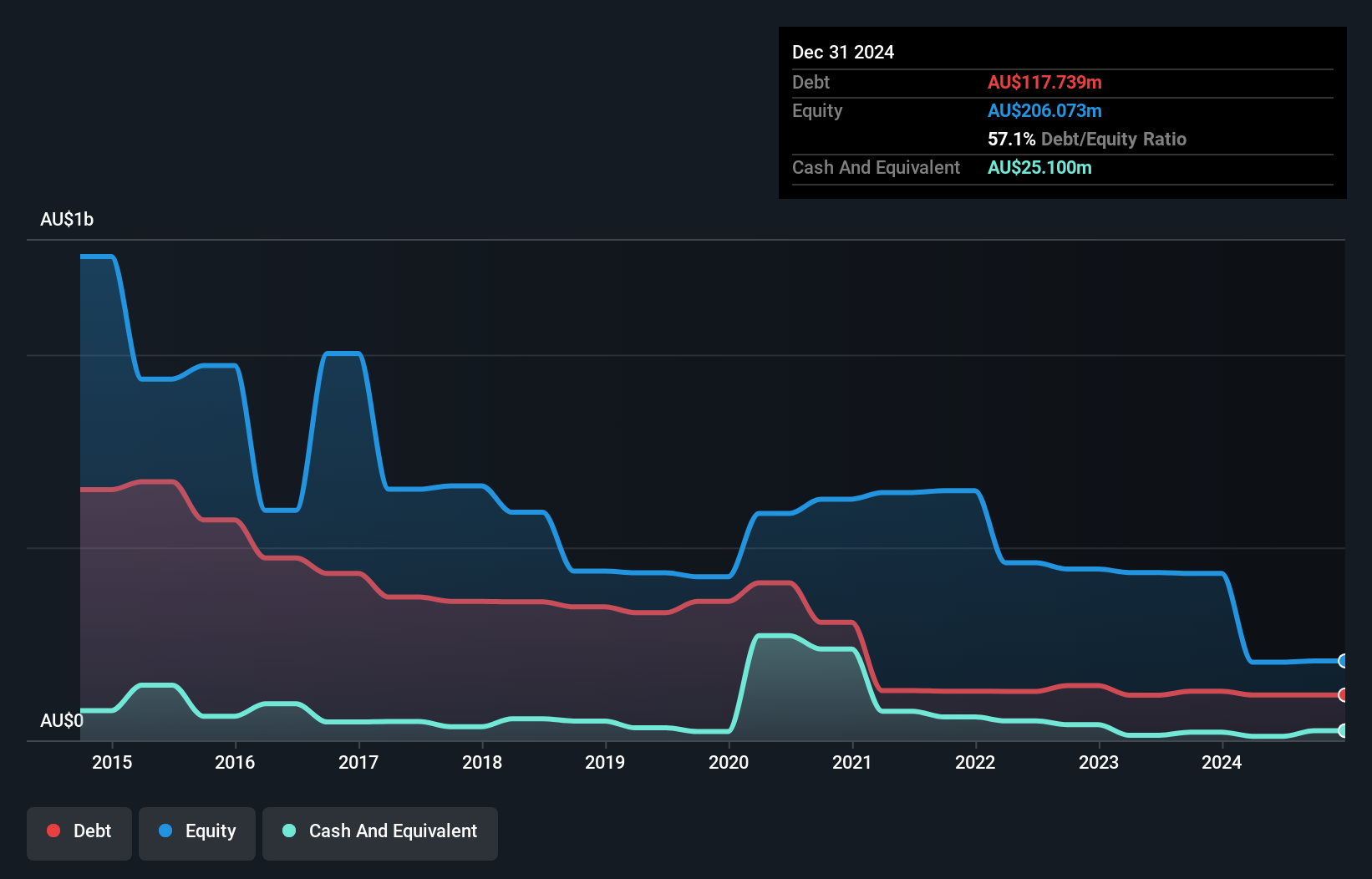

Southern Cross Media Group, with a market cap of A$143.94 million, is navigating financial challenges while pursuing strategic asset sales to bolster its position. The company recently initiated the sale of regional television licences to Network 10, expecting net proceeds between US$10 million and $15 million over five years. This move aims to reduce net debt and improve earnings sustainability amidst high long-term liabilities (A$414.6M) not covered by short-term assets (A$116.9M). Despite being unprofitable with rising losses, Southern Cross maintains a cash runway exceeding three years and trades below estimated fair value compared to peers.

- Click here to discover the nuances of Southern Cross Media Group with our detailed analytical financial health report.

- Understand Southern Cross Media Group's earnings outlook by examining our growth report.

Make It Happen

- Gain an insight into the universe of 1,052 ASX Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DUR

Duratec

Engages in the provision of assessment, protection, remediation, and refurbishment services to a range of assets, primarily steel and concrete infrastructure in Australia.

Excellent balance sheet with reasonable growth potential.