The Australian market has shown resilience, closing nearly flat with a slight rise of 0.03%, despite predictions of a downturn and significant drops in major U.S. indices. This unexpected stability highlights the potential for strategic investments even amid fluctuating global conditions. Penny stocks, though an older term, remain relevant for investors seeking opportunities in smaller or newer companies that may offer value and growth potential when backed by solid financial fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$325.58M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$237.13M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$202.29M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.945 | A$111.91M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.13 | A$330.52M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.905 | A$103.99M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.91 | A$483.46M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.10 | A$326.82M | ★★★★☆☆ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Dropsuite (ASX:DSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dropsuite Limited operates a global cloud-based software platform, with a market capitalization of A$330.22 million.

Operations: The company generates revenue primarily from the provision of backup services, amounting to A$35.46 million.

Market Cap: A$330.22M

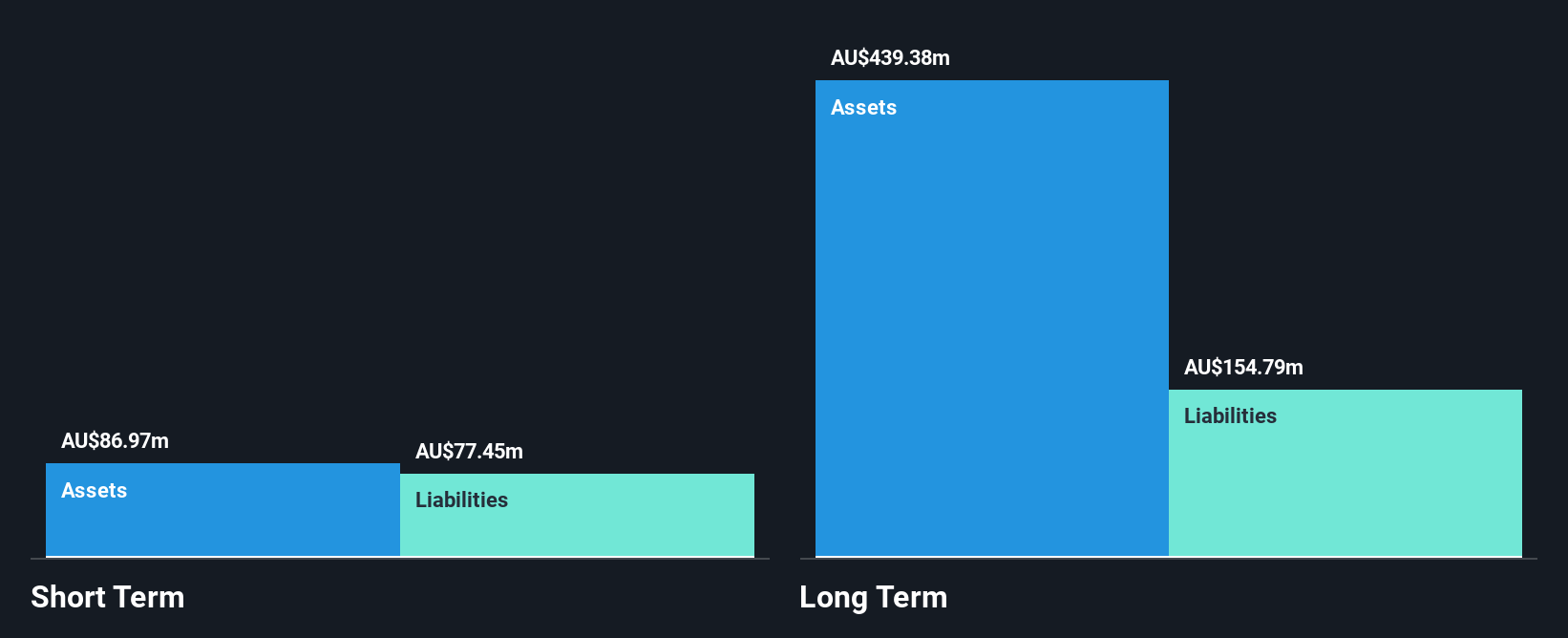

Dropsuite Limited, with a market cap of A$330.22 million and revenue of A$35.46 million, has shown significant growth in profitability over the past five years despite recent negative earnings growth. The company's management and board are experienced, with average tenures of 2.3 and 7.9 years respectively, contributing to its strategic direction. Dropsuite maintains high-quality earnings and a strong balance sheet with short-term assets exceeding liabilities by a wide margin, while remaining debt-free—a positive indicator for potential stability in the volatile penny stock market segment. However, recent profit margins have declined from last year’s figures.

- Unlock comprehensive insights into our analysis of Dropsuite stock in this financial health report.

- Explore Dropsuite's analyst forecasts in our growth report.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of gold and silver mineral properties with a market capitalization of A$332.50 million.

Operations: The company's revenue is primarily derived from its Chatree segment, which generated A$133.09 million.

Market Cap: A$332.5M

Kingsgate Consolidated, with a market cap of A$332.50 million, primarily generates revenue from its Chatree segment, amounting to A$133.09 million. The company trades at a significant discount to its estimated fair value and has shown impressive earnings growth of 4116.1% over the past year, although future earnings are expected to decline by an average of 13.3% annually over the next three years. Despite having satisfactory debt levels and outstanding return on equity at 80.7%, Kingsgate faces challenges with short-term assets not covering liabilities and an inexperienced management team averaging 1.4 years in tenure.

- Get an in-depth perspective on Kingsgate Consolidated's performance by reading our balance sheet health report here.

- Learn about Kingsgate Consolidated's future growth trajectory here.

Web Travel Group (ASX:WEB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Web Travel Group Limited offers online travel booking services across Australia, New Zealand, the United Arab Emirates, the United Kingdom, and other international markets with a market cap of A$1.78 billion.

Operations: The company's revenue is primarily derived from its Business to Business Travel (B2B) segment, which generated A$323.2 million.

Market Cap: A$1.78B

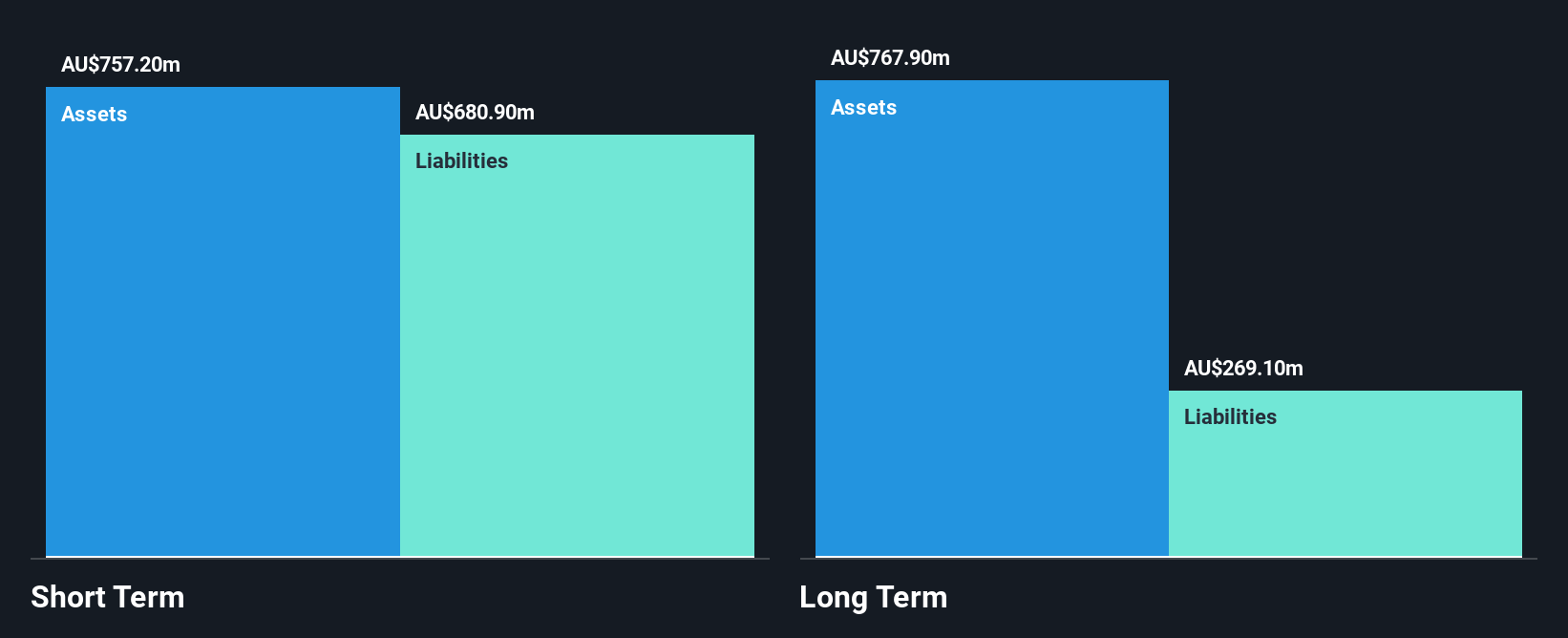

Web Travel Group Limited, with a market cap of A$1.78 billion, primarily derives its revenue from the B2B travel segment. Recent earnings show a net income surge to A$228.1 million for the half-year ended September 2024, reflecting significant growth compared to previous results. The company maintains strong financial health with short-term assets exceeding both short and long-term liabilities and has more cash than debt. An experienced board and management team support its operations, while recent strategic moves include a share buyback program worth up to A$150 million and the appointment of Rachel Wiseman as an independent Non-Executive Director effective January 2025.

- Jump into the full analysis health report here for a deeper understanding of Web Travel Group.

- Assess Web Travel Group's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Reveal the 1,052 hidden gems among our ASX Penny Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DSE

Dropsuite

Provides cloud-based suite of data backup and archiving solutions in Australia, Singapore, Europe, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives