The Australian market is poised for a positive start, with the ASX200 expected to open over one percent higher, reflecting a mixed yet optimistic sentiment influenced by global economic factors. For investors looking beyond the established giants, penny stocks—though an old-fashioned term—remain relevant as they often represent smaller or newer companies that could offer unique growth opportunities. With solid financial foundations and resilience in balance sheets, these stocks may provide potential upside without many of the typical risks associated with this investment area.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.725 | A$229.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.78 | A$143.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.96 | A$1.18B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.595 | A$75.24M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.65 | A$408.58M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.615 | A$117.51M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.27 | A$2.59B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.35 | A$158.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.31 | A$776.54M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.78 | A$872.34M | ✅ 5 ⚠️ 3 View Analysis > |

Click here to see the full list of 997 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Aspen Group (ASX:APZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aspen Group (ASX:APZ) is a prominent provider of quality accommodation in residential, retirement, and park communities with a market capitalization of A$650.61 million.

Operations: The company's revenue segments include residential, retirement, and park communities.

Market Cap: A$650.61M

Aspen Group, with a market cap of A$650.61 million, has demonstrated solid financial performance despite some challenges. The company's short-term assets (A$76.7M) comfortably cover its short-term liabilities (A$55.5M), although they fall short against long-term liabilities (A$168.4M). Recent earnings growth of 12.8% outpaced the REITs industry average and was supported by a significant one-off gain of A$52.9M last year, impacting profit margins which declined from 67.1% to 57.8%. Aspen's recent follow-on equity offerings raised over A$70 million, potentially strengthening its capital position and supporting future growth initiatives while maintaining stable weekly volatility at 6%.

- Click to explore a detailed breakdown of our findings in Aspen Group's financial health report.

- Gain insights into Aspen Group's outlook and expected performance with our report on the company's earnings estimates.

GR Engineering Services (ASX:GNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services to the mining and mineral processing sectors both in Australia and internationally, with a market cap of A$471.94 million.

Operations: The company generates revenue from two primary segments: Oil and Gas, contributing A$96.61 million, and Mineral Processing, which accounts for A$412.30 million.

Market Cap: A$471.94M

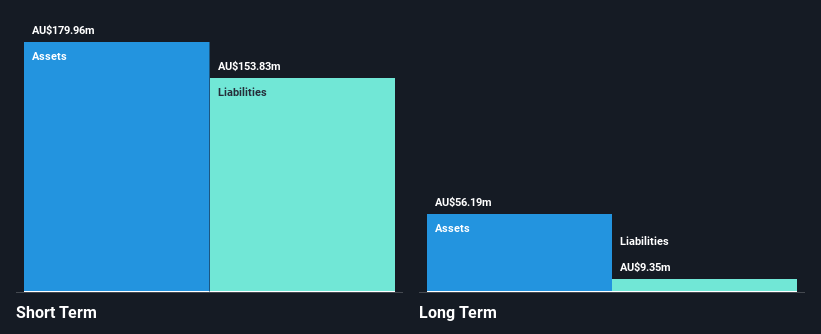

GR Engineering Services, with a market cap of A$471.94 million, shows robust financial health and growth potential. Its short-term assets of A$180 million exceed both long-term (A$9.4 million) and short-term liabilities (A$153.8 million), highlighting strong liquidity. The company is debt-free, enhancing its financial stability and reducing risk exposure. Recent earnings growth of 34.3% surpasses industry averages, supported by high-quality earnings and an outstanding return on equity at 53%. Despite an unstable dividend track record, GR Engineering declared a fully franked interim dividend increase to 10 cents per share for the half-year ended December 2024, reflecting confidence in future cash flows.

- Take a closer look at GR Engineering Services' potential here in our financial health report.

- Explore historical data to track GR Engineering Services' performance over time in our past results report.

SiteMinder (ASX:SDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SiteMinder Limited develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.23 billion.

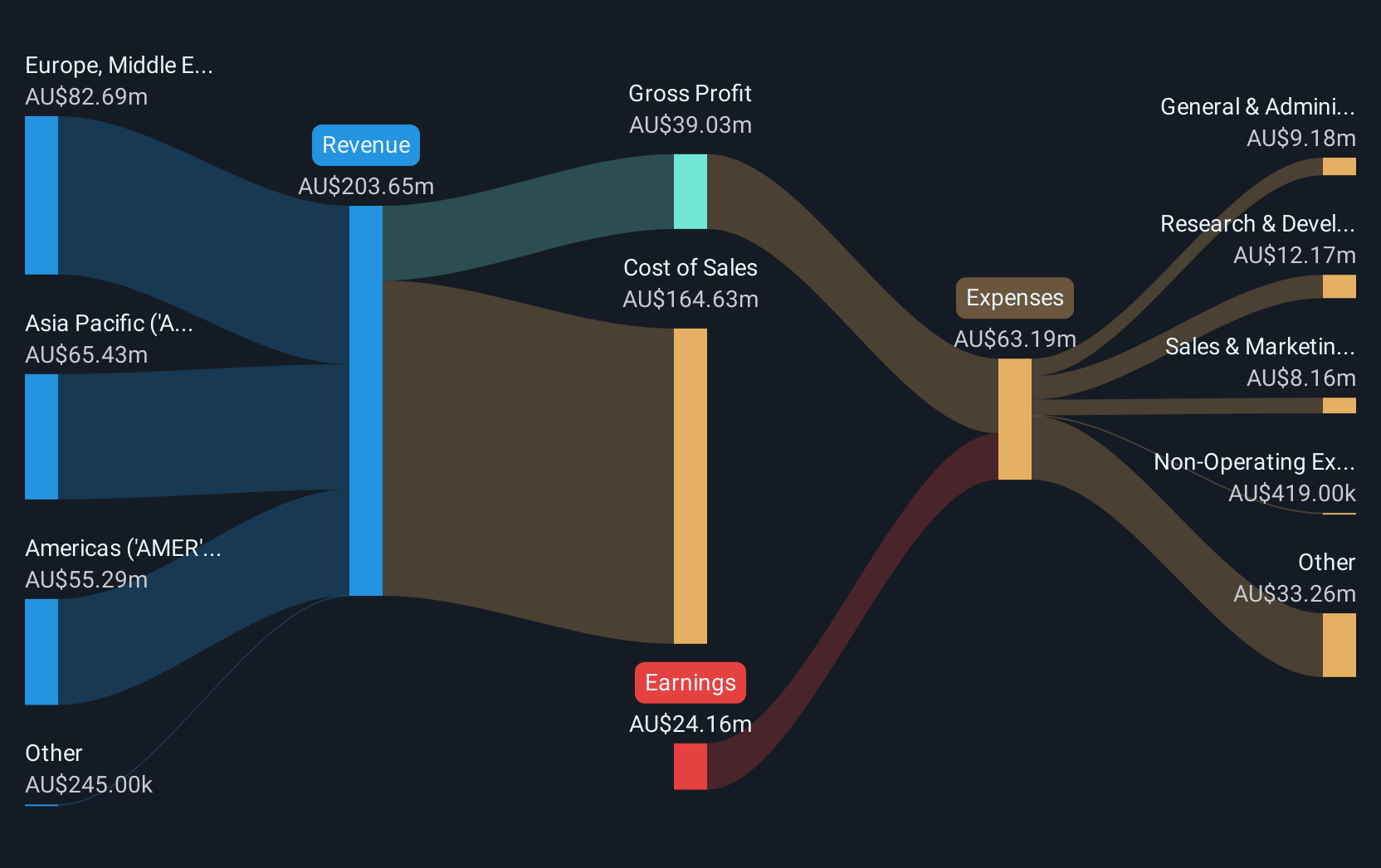

Operations: SiteMinder's revenue is derived from its Software & Programming segment, which generated A$203.65 million.

Market Cap: A$1.23B

SiteMinder Limited, with a market cap of A$1.23 billion, recently reported half-year sales of A$104.45 million, up from A$91.72 million the previous year, though it remains unprofitable with a net loss of A$13.89 million. Despite trading at 71.6% below its estimated fair value and having no debt, SiteMinder's negative return on equity reflects ongoing challenges in achieving profitability. The company benefits from an experienced board and management team while maintaining sufficient cash runway for over three years based on current free cash flow levels, although short-term liabilities slightly exceed short-term assets by approximately A$1 million.

- Jump into the full analysis health report here for a deeper understanding of SiteMinder.

- Assess SiteMinder's future earnings estimates with our detailed growth reports.

Taking Advantage

- Gain an insight into the universe of 997 ASX Penny Stocks by clicking here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 21 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDR

SiteMinder

Develops, markets, and sells online guest acquisition platform and commerce solutions for accommodation providers in Australia and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives