- Australia

- /

- Metals and Mining

- /

- ASX:GGP

Greatland Resources (ASX:GGP): Valuation Check After Telfer–Havieron Expansion, Electrification and Mine-Life Extension Plans

Reviewed by Simply Wall St

Greatland Resources (ASX:GGP) has caught attention after outlining an ambitious plan to extend Telfer’s mine life and fully integrate ore from its Havieron gold copper project into a single production outlook.

See our latest analysis for Greatland Resources.

The market seems to be warming to that strategy, with a 90 day share price return of 53.25% and a year to date share price return of 29.32% pointing to building momentum at the current A$9.44 level.

If this kind of turnaround story has your attention, it could be a good moment to broaden your watchlist and uncover fast growing stocks with high insider ownership.

With a lofty intrinsic value estimate, only a small discount to analyst targets and ambitious growth plans at Telfer and Havieron, is Greatland still misunderstood by the market, or are investors already paying up for future expansion?

Price-to-Earnings of 18.8x, Is it justified?

Greatland Resources is trading on a price to earnings ratio of 18.8 times at A$9.44, which screens as undervalued relative to many peers but slightly rich versus its own fair ratio.

The price to earnings multiple compares what investors pay today for each dollar of current earnings. It is a key lens for a newly profitable gold and copper producer like Greatland. Because the company has only recently moved into the black, this earnings based yardstick helps frame whether the market is already incorporating a sizeable share of future cash flows from Telfer and Havieron.

On one hand, Greatland looks attractively priced. Its 18.8 times multiple sits below both the Australian metals and mining sector average of 22.3 times and a much higher 67.4 times peer average, which hints that the market is not fully crediting its high return on equity and improving profitability. On the other hand, that same multiple sits above an estimated fair price to earnings level of 17.9 times. This suggests some room for the valuation to drift lower if sentiment cools and converges toward the fair ratio as earnings expectations reset.

Explore the SWS fair ratio for Greatland Resources

Result: Price-to-Earnings of 18.8x (UNDERVALUED)

However, risks remain if copper and gold prices weaken or Havieron ramps more slowly than expected, which could crimp cash flow and compress the current valuation.

Find out about the key risks to this Greatland Resources narrative.

Another View, Fair Value Still Looks Higher

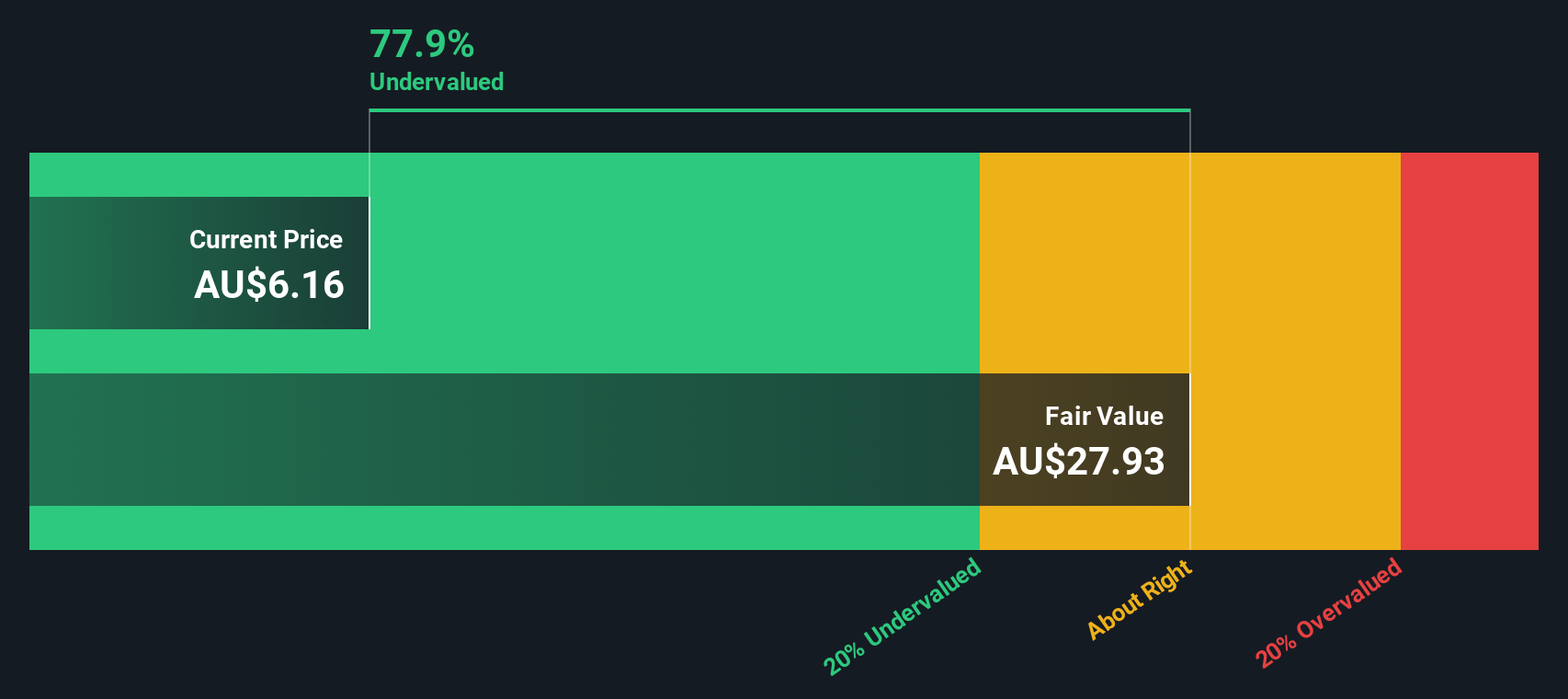

While the 18.8 times earnings multiple paints Greatland as modestly undervalued versus peers, our DCF model is far more optimistic. It points to a fair value of about A$17.03 per share, roughly 44.6% above today’s price. Is the market missing something, or is the model too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Greatland Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Greatland Resources Narrative

If you see the outlook differently or want to dig into the numbers yourself, you can build a personalised view in just minutes with Do it your way.

A great starting point for your Greatland Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity. Use Simply Wall St’s powerful screener now to pinpoint your next move before the market catches on.

- Capitalize on mispriced quality by targeting these 907 undervalued stocks based on cash flows that combine strong cash flows with compelling long term upside.

- Ride the next wave of innovation by focusing on these 26 AI penny stocks positioned at the forefront of intelligent automation and data driven disruption.

- Lock in steady income potential by zeroing in on these 13 dividend stocks with yields > 3% that can support long term compounding through consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GGP

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)