- Australia

- /

- Metals and Mining

- /

- ASX:ETM

Does Greenland Minerals Limited's (ASX:GGG) CEO Pay Compare Well With Peers?

John Mair has been the CEO of Greenland Minerals Limited (ASX:GGG) since 2014. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for Greenland Minerals

How Does John Mair's Compensation Compare With Similar Sized Companies?

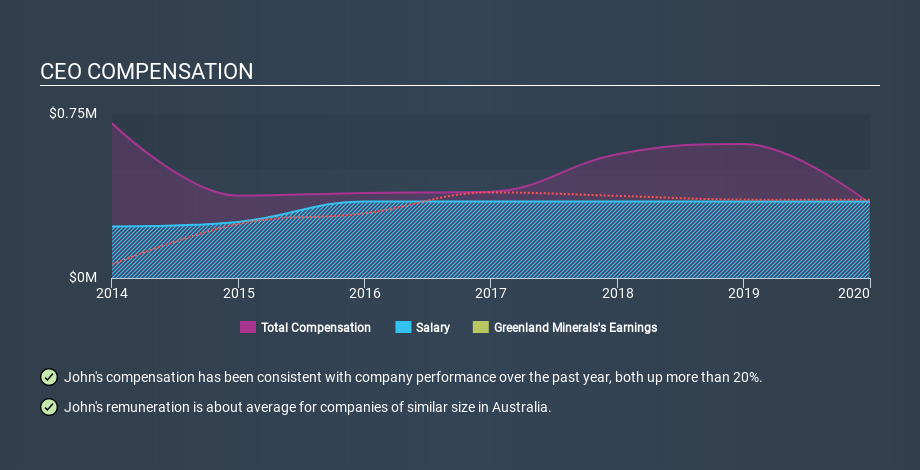

Our data indicates that Greenland Minerals Limited is worth AU$173m, and total annual CEO compensation was reported as AU$341k for the year to December 2019. That's actually a decrease on the year before. Notably, the salary of AU$350k is the vast majority of the CEO compensation. We looked at a group of companies with market capitalizations under AU$304m, and the median CEO total compensation was AU$384k.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Greenland Minerals stands. Talking in terms of the sector, salary represented approximately 70% of total compensation out of all the companies we analysed, while other remuneration made up 30% of the pie. It's interesting to note that Greenland Minerals pays out a greater portion of remuneration through salary, in comparison to the wider industry.

So John Mair receives a similar amount to the median CEO pay, amongst the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context. You can see a visual representation of the CEO compensation at Greenland Minerals, below.

Is Greenland Minerals Limited Growing?

Earnings per share at Greenland Minerals Limited are much the same as they were three years ago, albeit slightly lower, based on the trend. It saw its revenue drop 52% over the last year.

The lack of earnings per share growth in the last three years is unimpressive. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Greenland Minerals Limited Been A Good Investment?

Boasting a total shareholder return of 41% over three years, Greenland Minerals Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

John Mair is paid around what is normal for the leaders of comparable size companies.

We're not seeing great strides in earnings per share, but the company has clearly pleased some investors, given the returns over the last three years. So we think most shareholders wouldn't be too worried about CEO compensation, which is close to the median for similar sized companies. On another note, Greenland Minerals has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:ETM

Energy Transition Minerals

Energy Transition Minerals Ltd involves in the mineral exploration and evaluation activities in Australia.

Flawless balance sheet slight.