- Australia

- /

- Metals and Mining

- /

- ASX:FMG

Fortescue (ASX:FMG): Assessing Valuation as Stronger Iron Ore and Copper Prices Boost Earnings Outlook

Reviewed by Kshitija Bhandaru

Fortescue (ASX:FMG) is gaining attention as rising spot prices for iron ore and copper, supported by China’s steadier economic outlook, are driving expectations of improved earnings even after a period of revenue weakness.

See our latest analysis for Fortescue.

Momentum around Fortescue has picked up lately, as investors respond to firmer iron ore and copper prices. This follows from China’s steadier economic signals and clearer headlines regarding the shipping division’s recent power issues. While the share price return is up 12.8% over the past three months, the real story is the 4.5% total shareholder return over the past year, adding to a robust multi-year trend.

If commodity market shifts have you looking for your next opportunity, now is the moment to broaden your search and discover fast growing stocks with high insider ownership

With spot prices and sentiment on the upswing, the real question is whether Fortescue’s current valuation still leaves room for upside or if markets are already factoring in all the expected growth ahead.

Most Popular Narrative: 5.6% Overvalued

Fortescue’s prevailing narrative fair value stands at A$18.14, modestly below the last close of A$19.16. This creates a contrast between recent market optimism and more measured analyst confidence.

The market appears to be pricing in continued robust iron ore demand from China, driven by a belief in ongoing mega-infrastructure projects and resilient steel consumption. This assumes that elevated Chinese demand can offset global industry headwinds. Should this prove optimistic, Fortescue's future revenue could disappoint.

Curious which single market dynamic is the linchpin for this price target? The analyst narrative weighs future Chinese demand against eroding cost advantages. Dig deeper to see the stark financial assumptions that tilt the fair value just below today’s price.

Result: Fair Value of $18.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust operational performance and successful investment in green technology could support earnings beyond current analyst estimates and challenge the overvalued narrative.

Find out about the key risks to this Fortescue narrative.

Another View: DCF Model Paints a Different Picture

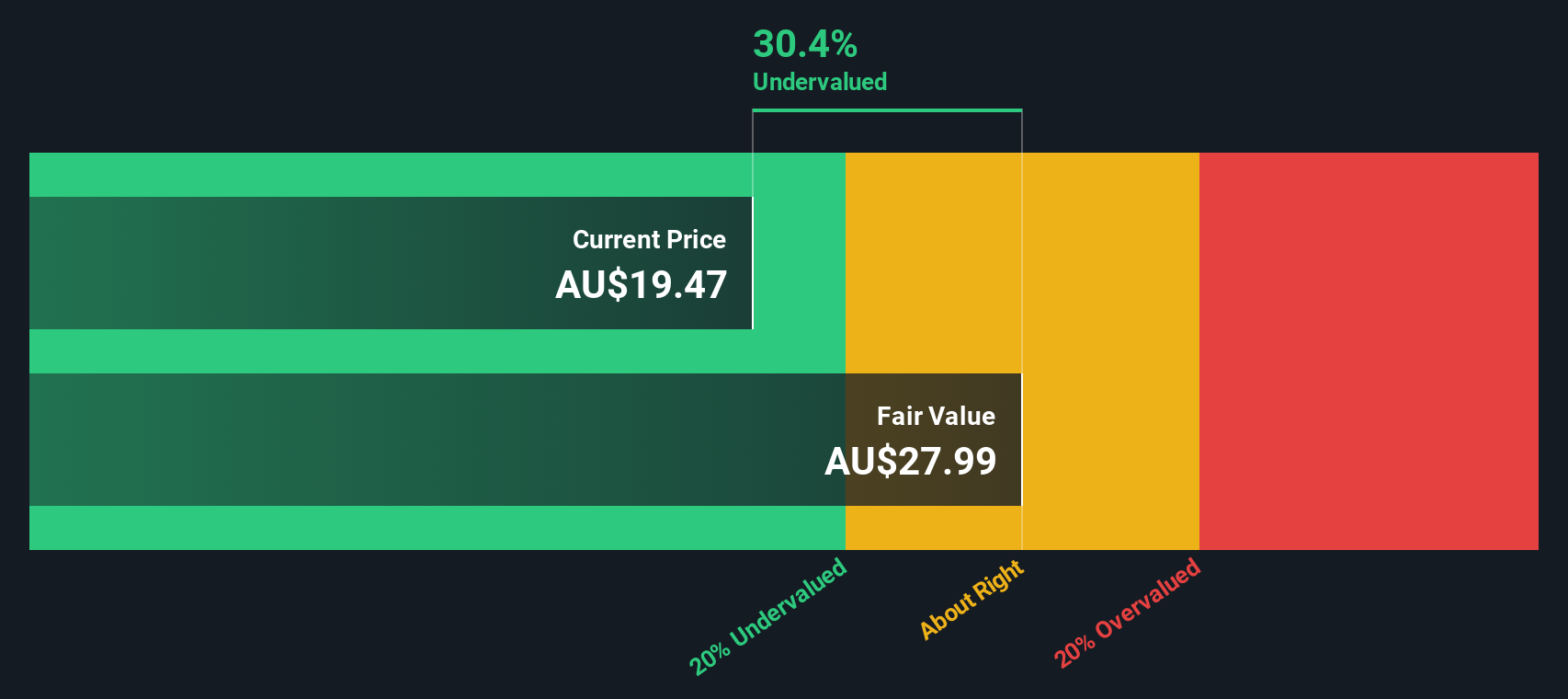

Looking beyond analyst price targets, our SWS DCF model suggests Fortescue is actually trading well below its estimated fair value. Shares are currently 31% undervalued compared to what future cash flows might justify. While market multiples focus on current earnings power, the DCF approach takes the long term into account. Does this deeper value signal a hidden opportunity, or does it simply reflect greater forecast uncertainty?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fortescue Narrative

If you see the data differently or want to shape your own story, building a custom Fortescue outlook takes just a few minutes. Do it your way

A great starting point for your Fortescue research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Can’t-Miss Investment Ideas?

Don’t let today’s momentum in Fortescue make you overlook other compelling opportunities. The Simply Wall St Screener can help you find stocks with breakout potential across diverse themes.

- Supercharge your search for income by targeting companies with strong yields through these these 19 dividend stocks with yields > 3% built for reliable returns.

- Capture the explosive rise of artificial intelligence by following these 24 AI penny stocks emerging at the forefront of tomorrow’s market.

- Seize bargains in plain sight by zeroing in on these 898 undervalued stocks based on cash flows that may be trading for less than their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FMG

Fortescue

Engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026