- Australia

- /

- Metals and Mining

- /

- ASX:EVN

Investors Still Waiting For A Pull Back In Evolution Mining Limited (ASX:EVN)

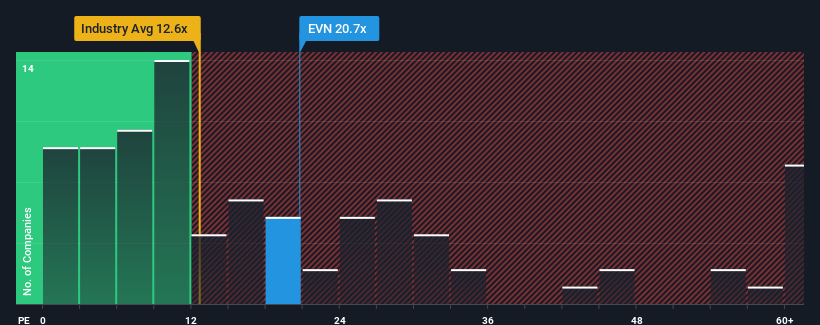

It's not a stretch to say that Evolution Mining Limited's (ASX:EVN) price-to-earnings (or "P/E") ratio of 20.7x right now seems quite "middle-of-the-road" compared to the market in Australia, where the median P/E ratio is around 19x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Evolution Mining as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Evolution Mining

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Evolution Mining's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 147% last year. As a result, it also grew EPS by 5.0% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 20% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is not materially different.

With this information, we can see why Evolution Mining is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Evolution Mining maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Evolution Mining, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Evolution Mining, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Evolution Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EVN

Evolution Mining

Engages in the exploration, mine development and operation, and sale of gold and gold-copper concentrates in Australia and Canada.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

BABA Analysis: Buying the Fear, Holding the Cloud

Q3 Outlook modestly optimistic

A fully integrated LNG business seems to be ignored by the market.

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale