- Australia

- /

- Metals and Mining

- /

- ASX:EVN

Evolution Mining (ASX:EVN): Evaluating Valuation After Latest Dividend Reinvestment Plan Update

Evolution Mining (ASX:EVN) has caught attention with its latest update on the Dividend Reinvestment Plan for the fiscal year ending June 30, 2025. The company confirmed both the DRP price, set at $8.73 per share, and a strong shareholder participation rate of 55.65%, resulting in over 16 million new shares issued. For current and prospective investors, this offers clear insight into Evolution’s capital management approach and could influence your view on the company’s financial direction.

This DRP announcement arrives at a time of momentum for Evolution Mining. Over the past year, the stock has climbed 135%, outperforming many peers and signaling positive market sentiment. In the past month, shares surged over 24%, hinting at renewed optimism from investors and reflecting Evolution’s consistent focus on delivering shareholder value through initiatives like the dividend plan.

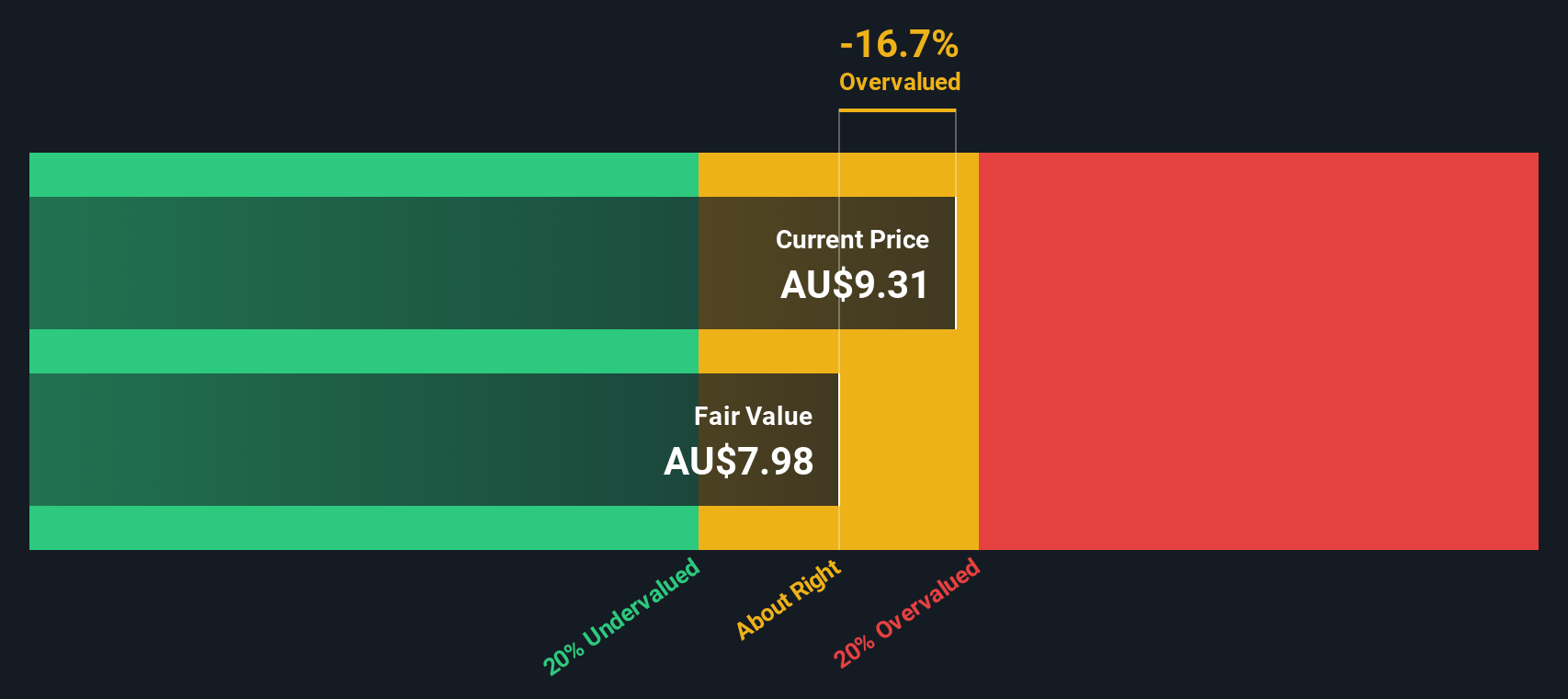

With the stock’s impressive gains alongside this capital return news, some investors may be asking whether Evolution Mining is now trading at a value that still leaves room for upside, or if the market has already factored in its future growth potential.

Most Popular Narrative: 32% Overvalued

According to the most widely followed analyst narrative, Evolution Mining shares are considered overvalued by a margin of 32% compared to their fair value estimate.

Strong investor demand for gold as a safe haven, driven by ongoing global economic uncertainty, is supporting elevated gold prices and market expectations for Evolution Mining's future revenue and profitability. If this optimism is already priced in and conditions or sentiment shift, future top-line growth could disappoint.

Curious what has pushed Evolution Mining’s valuation into red-hot territory? The most widely tracked narrative is built on ambitious gains in revenue, profit margins, and cash flow, all underpinned by big-picture assumptions about gold’s place in global markets. Want to see the full breakdown behind this lofty figure and the critical forecasts that make analysts either confident or cautious? The numbers may surprise you.

Result: Fair Value of $7.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if gold prices remain high or production costs stay low, Evolution Mining's earnings outlook could improve, which may challenge the current view that the stock is overvalued.

Find out about the key risks to this Evolution Mining narrative.Another View: DCF Model Offers a Reality Check

While analysts see Evolution Mining as overvalued, our SWS DCF model takes a different approach and suggests the shares may actually be priced above their fair value as well. Which method tells the truest story for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Evolution Mining Narrative

If you want to look beneath the surface and reach your own conclusions, it's easy to craft your own take using our data-driven tools in just a few minutes. Do it your way

A great starting point for your Evolution Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment opportunities?

Smart investors never stop at just one company. Unlock fresh possibilities that others might be overlooking by using Simply Wall Street’s powerful Stock Screener today.

- Capitalize on breakthrough trends in quantum computing by checking out quantum computing stocks to spot firms pushing the edge of what’s possible.

- Boost your portfolio’s income potential as you target steady growers with dividend stocks with yields > 3% for stocks delivering reliable yields above 3%.

- Seize chances in undervalued markets and get a head start by using undervalued stocks based on cash flows to uncover stocks poised for a value-driven comeback.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolution Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EVN

Evolution Mining

Engages in the exploration, mine development and operation, and sale of gold and gold-copper concentrates in Australia and Canada.

Outstanding track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Superintelligence Pivot: Meta’s $135 Billion Bet on the Energy-Compute Nexus

The Privacy Fortress: Apple’s Lean AI Path and the $100 Billion Buyback Engine

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.