- Australia

- /

- Construction

- /

- ASX:LYL

Discovering Undiscovered Gems in Australia July 2025

Reviewed by Simply Wall St

As the Australian market experiences a dynamic phase with materials leading the charge and utilities lagging, investors are keenly observing sectors influenced by fluctuating commodity prices such as iron ore and gold. In this environment, identifying promising small-cap stocks involves looking for companies that can capitalize on these sectoral shifts and demonstrate resilience amidst broader economic changes.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Euroz Hartleys Group | NA | 5.92% | -17.96% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.56 billion.

Operations: Emerald Resources generates revenue primarily from its mine operations, totaling A$427.32 million.

Emerald Resources, a nimble player in the mining sector, is making waves with its impressive financial performance. Over the past year, earnings surged by 32%, outpacing the industry average of 14%. Trading at a notable 23% below its fair value estimate, it offers potential upside for investors. The company’s interest payments are comfortably covered by EBIT at nearly 30 times over. With gold production expected to reach up to 125Koz in 2026 due to Okvau's expansion and high-quality earnings backing it up, Emerald seems poised for continued growth in an ever-competitive market landscape.

Lycopodium (ASX:LYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lycopodium Limited is an Australian company offering engineering and project delivery services across the resources, rail infrastructure, and industrial processes sectors, with a market capitalization of A$456.65 million.

Operations: Lycopodium's primary revenue stream is derived from the resources sector, contributing A$347.83 million. The process industries and rail infrastructure segments add A$10.84 million and A$10.14 million, respectively.

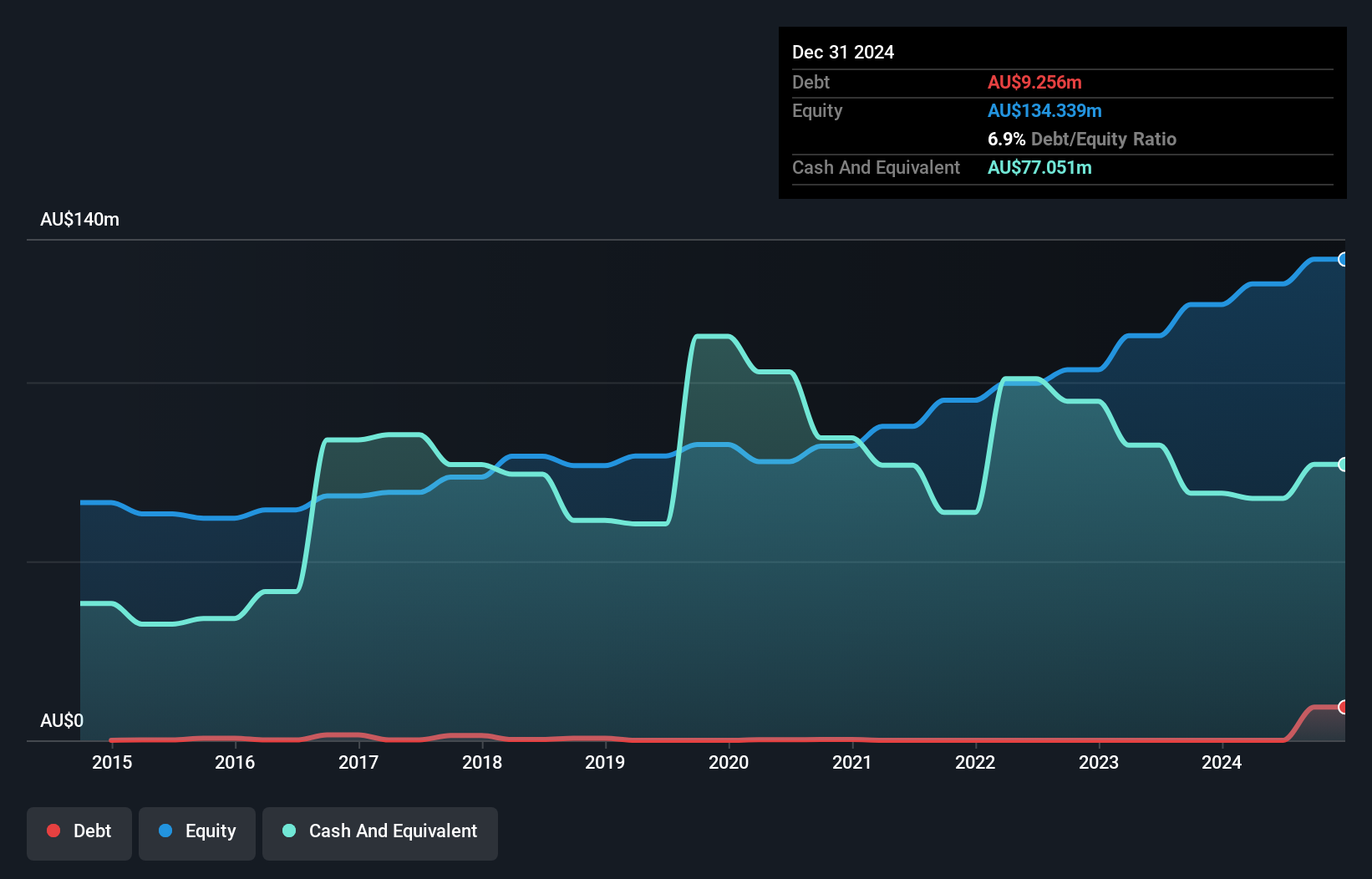

Lycopodium, a relatively small player in the construction sector, is trading at A$8.9% below its estimated fair value, suggesting potential upside for investors. Despite an increase in debt to equity from 0% to 6.9% over five years, it holds more cash than total debt, indicating a solid financial footing. The company boasts high-quality earnings and positive free cash flow of A$37 million as of September 2024. However, its earnings growth was negative at -19.3%, contrasting sharply with the industry average of 28.7%. Recent board changes include Rob Radici's appointment as Non-Executive Director, bringing extensive experience across multiple sectors.

- Click here and access our complete health analysis report to understand the dynamics of Lycopodium.

Understand Lycopodium's track record by examining our Past report.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.62 billion.

Operations: The primary revenue stream for MFF Capital Investments Limited comes from its equity investments, generating A$1.01 billion.

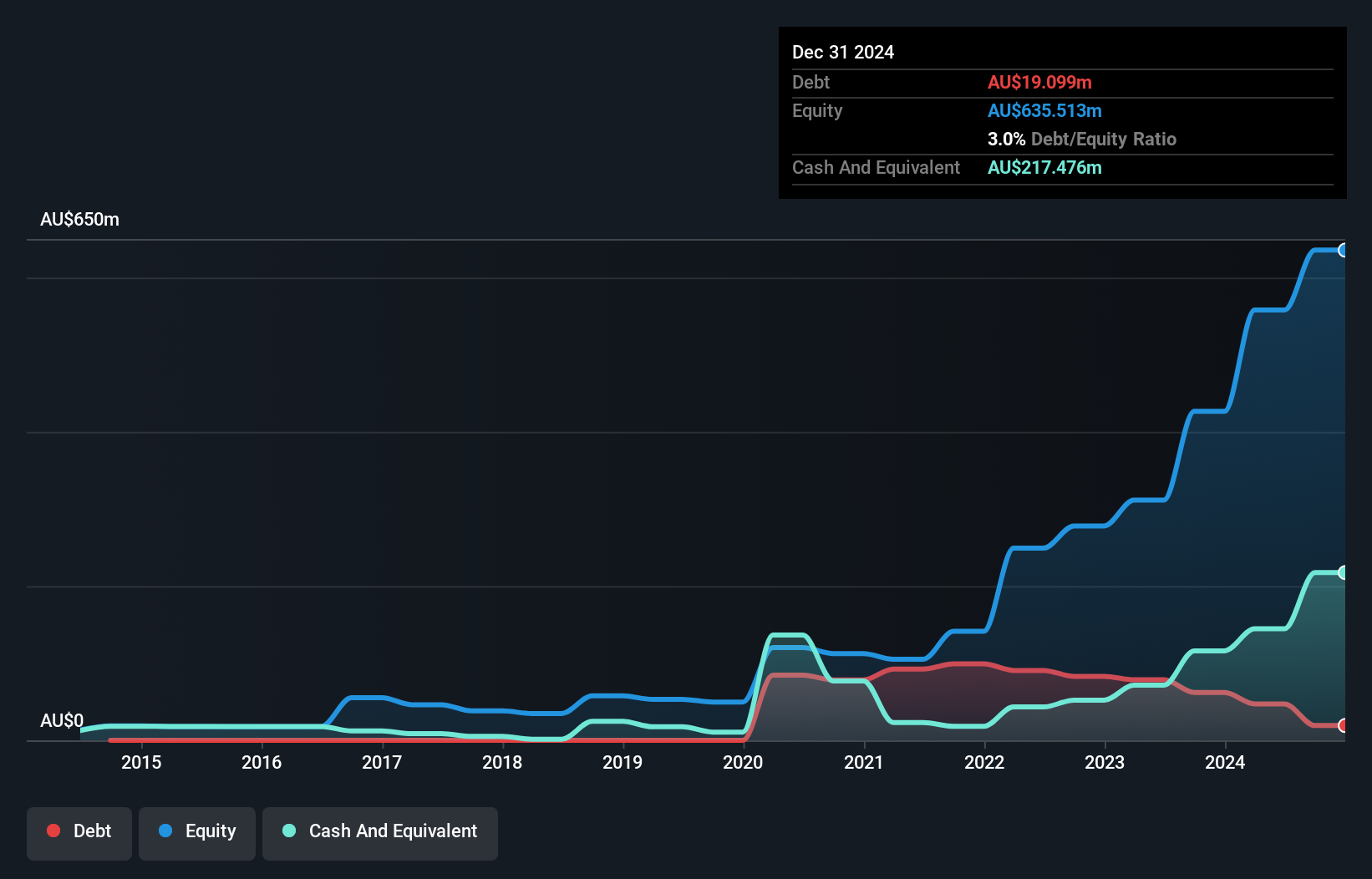

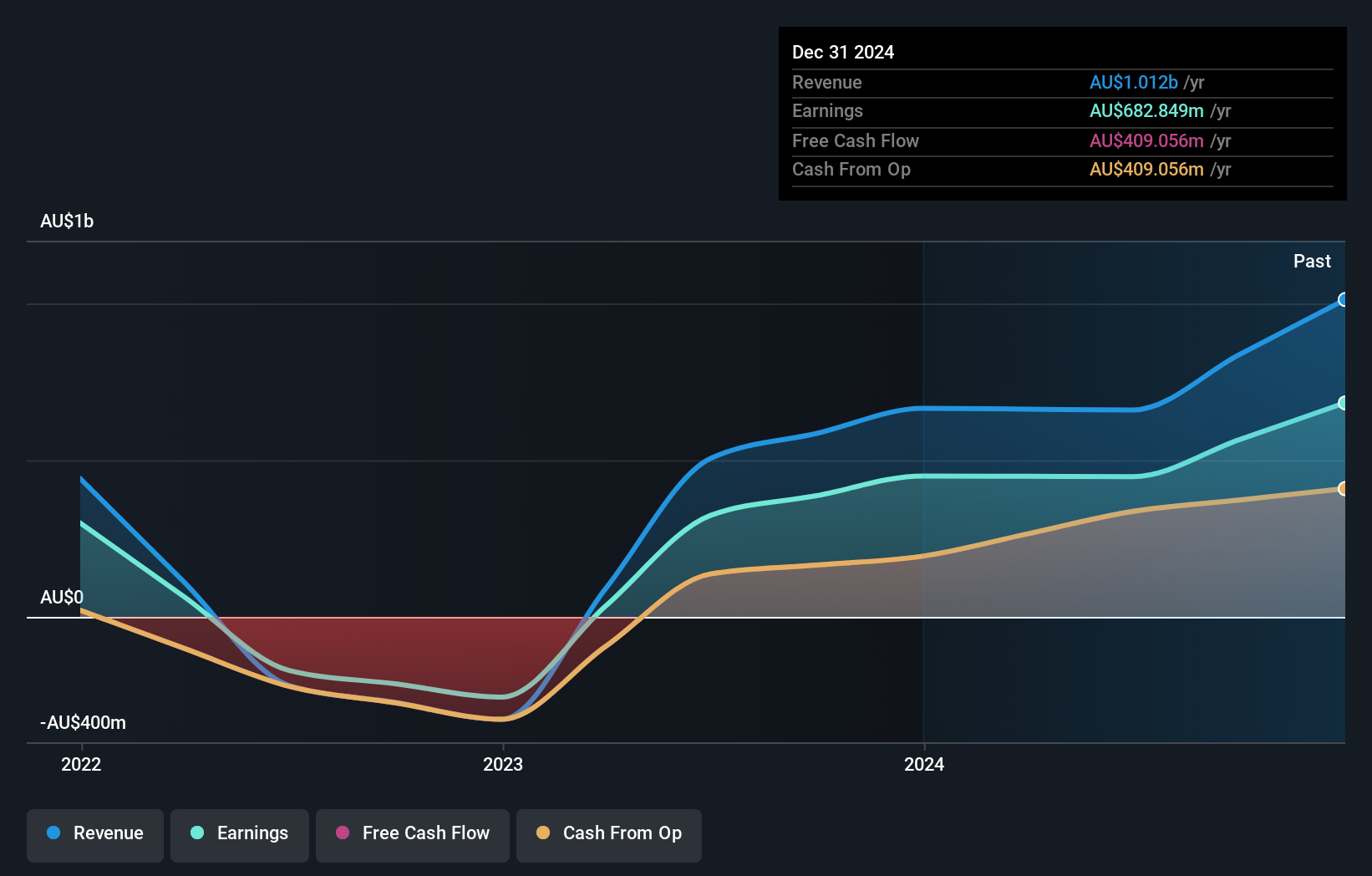

MFF Capital Investments, a compact player in the market, is trading at 41.8% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings surged by 51.9%, outpacing the capital markets industry average of 23.6%. The company has high-quality earnings and remains free cash flow positive with A$372 million in levered free cash flow as of September 2024. MFF's debt to equity ratio rose slightly to 0.7% over five years but is well-managed with interest payments covered by EBIT at a robust 69 times coverage, indicating sound financial health despite increased leverage.

- Take a closer look at MFF Capital Investments' potential here in our health report.

Evaluate MFF Capital Investments' historical performance by accessing our past performance report.

Seize The Opportunity

- Reveal the 50 hidden gems among our ASX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYL

Lycopodium

Provides engineering and project delivery services in the resources, rail infrastructure, and industrial processes sectors in Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives