- Australia

- /

- Metals and Mining

- /

- ASX:USL

The E2 Metals (ASX:E2M) Share Price Is Down 37% So Some Shareholders Are Getting Worried

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in E2 Metals Limited (ASX:E2M) have tasted that bitter downside in the last year, as the share price dropped 37%. That's well bellow the market return of 3.5%. E2 Metals hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Unfortunately the share price momentum is still quite negative, with prices down 33% in thirty days.

See our latest analysis for E2 Metals

E2 Metals recorded just AU$3,709 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that E2 Metals will find or develop a valuable new mine before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

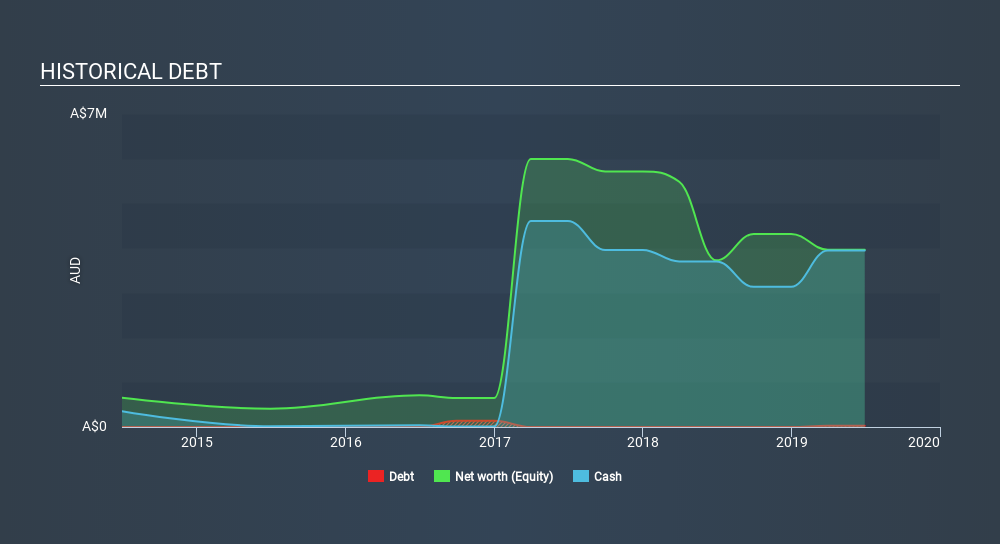

When it last reported its balance sheet in June 2019, E2 Metals had cash in excess of all liabilities of AU$3.8m. While that's nothing to panic about, there is some possibility the company will raise more capital, especially if profits are not imminent. We'd venture that shareholders are concerned about the need for more capital, because the share price has dropped 37% in the last year . The image below shows how E2 Metals's balance sheet has changed over time; if you want to see the precise values, simply click on the image. You can click on the image below to see (in greater detail) how E2 Metals's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

While E2 Metals shareholders are down 37% for the year, the market itself is up 3.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 31%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand E2 Metals better, we need to consider many other factors. For instance, we've identified 6 warning signs for E2 Metals (4 are a bit concerning) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:USL

Unico Silver

Engages in the exploration and evaluation of mineral deposits in Australia and Argentina.

Flawless balance sheet moderate.

Market Insights

Community Narratives