- Australia

- /

- Metals and Mining

- /

- ASX:DRR

Top 3 Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

In a week marked by significant declines across major indices, including the S&P 500 and Russell 2000, concerns over an economic slowdown have taken center stage. With fewer job openings and disappointing manufacturing data adding to investor anxiety, small-cap stocks have not been immune to these broader market pressures. Amid such volatility, identifying undervalued small-cap stocks with strong insider buying can offer potential opportunities for investors.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Orion Group Holdings | NA | 0.3x | 36.73% | ★★★★★★ |

| Delek US Holdings | NA | 0.1x | 22.67% | ★★★★★☆ |

| Sagicor Financial | 1.3x | 0.3x | -37.32% | ★★★★☆☆ |

| Norcros | 7.9x | 0.5x | -0.95% | ★★★☆☆☆ |

| German American Bancorp | 13.8x | 4.6x | 46.81% | ★★★☆☆☆ |

| Studsvik | 20.4x | 1.2x | 42.10% | ★★★☆☆☆ |

| MYR Group | 31.7x | 0.4x | 46.89% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Metals Acquisition | NA | 2.5x | 46.47% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -42.12% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

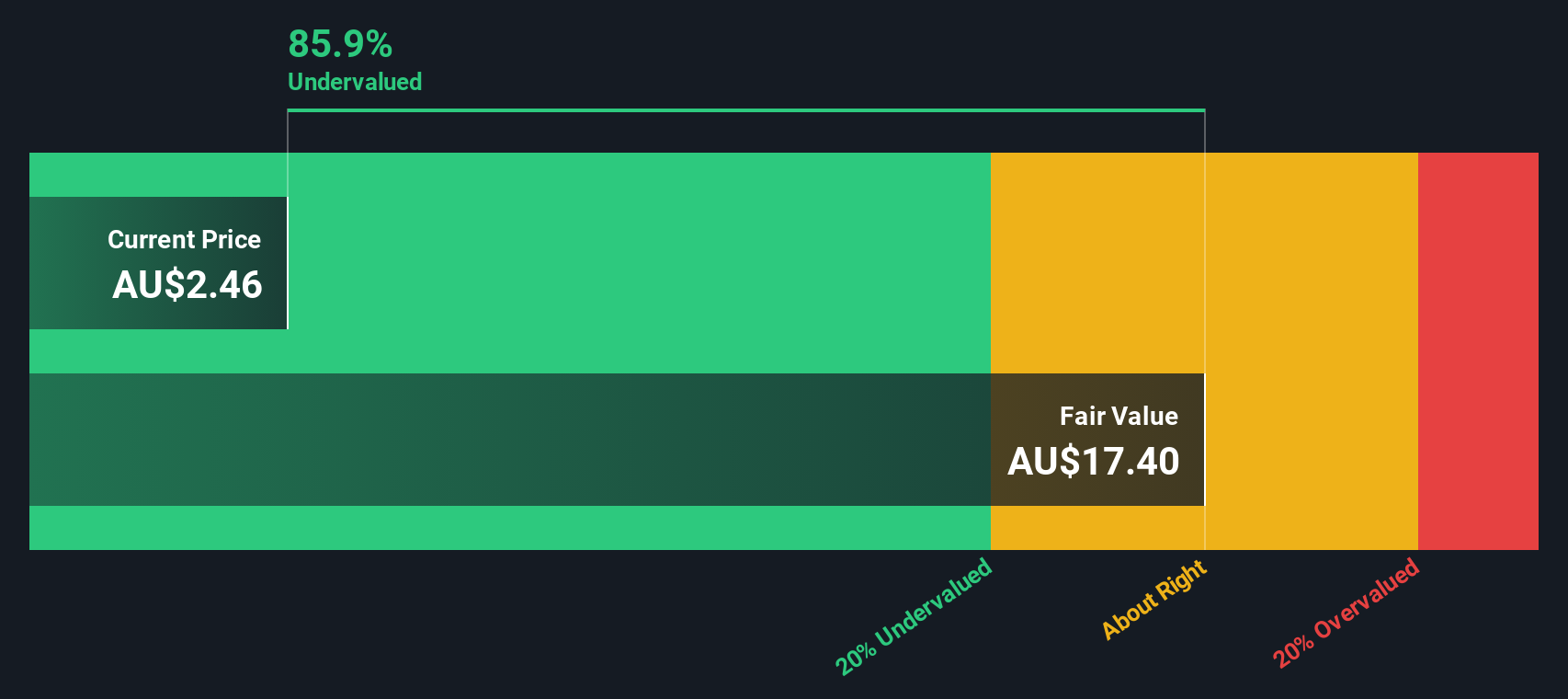

De Grey Mining (ASX:DEG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: De Grey Mining is an Australian-based gold exploration company with a market cap of approximately A$1.55 billion, primarily focused on developing its Mallina Gold Project in Western Australia.

Operations: De Grey Mining's primary revenue stream is derived from exploration activities, with the most recent quarter reporting A$0.04154 million in revenue. Despite a gross profit margin of 1.00%, the company experienced a net income margin of -414.58% due to substantial operating expenses totaling A$28.35 million and non-operating expenses of -A$11.09 million in the same period.

PE: -171.2x

De Grey Mining, a small-cap gold exploration company, recently reported a net loss of A$17.22 million for the fiscal year ending June 30, 2024, slightly improved from last year's A$19.01 million loss. The company has ambitious plans with approximately 28,000 meters of drilling scheduled at priority prospects like Lowe and Heckmair in H2 2024. Insider confidence is evident as key personnel have been purchasing shares over the past six months. Despite low revenue (A$42K), ongoing exploration activities could unlock significant value.

- Take a closer look at De Grey Mining's potential here in our valuation report.

Understand De Grey Mining's track record by examining our Past report.

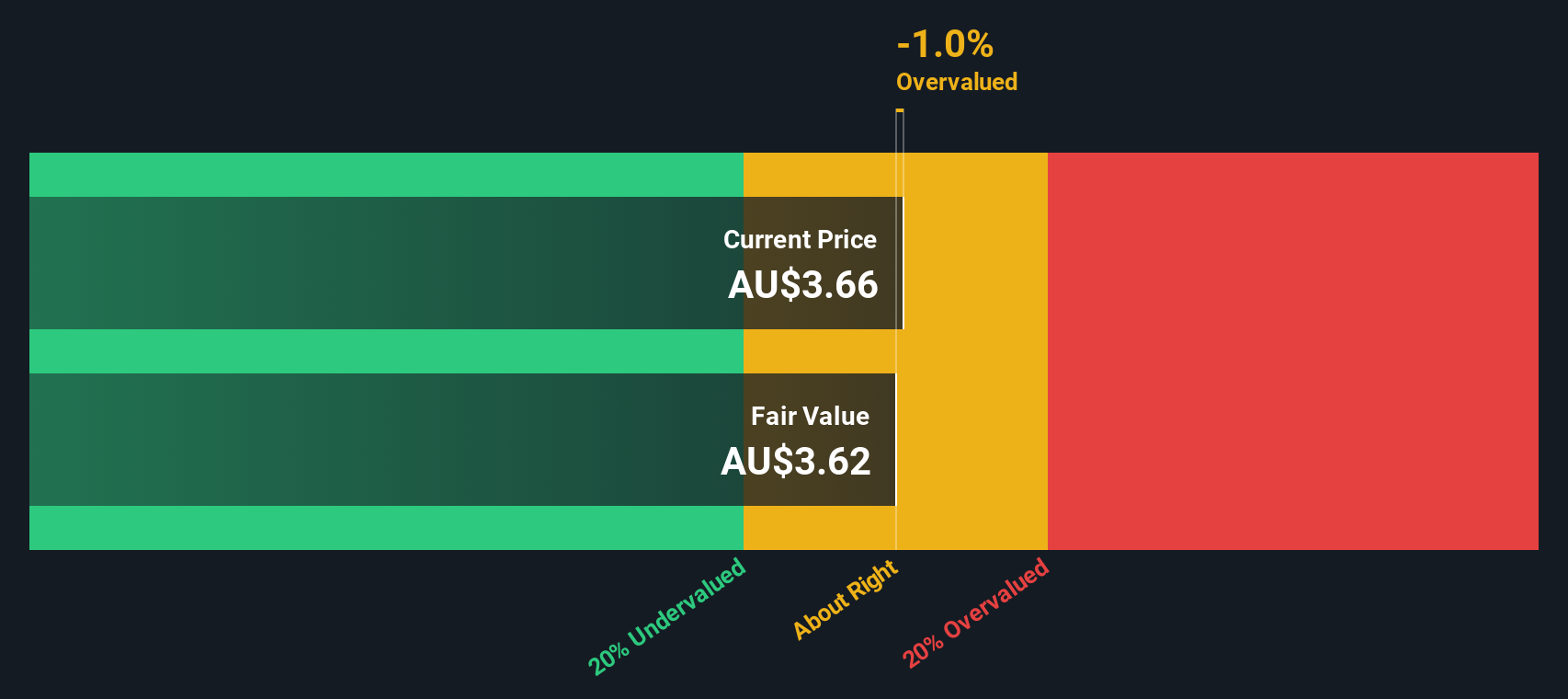

Deterra Royalties (ASX:DRR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Deterra Royalties focuses on managing and acquiring royalty arrangements, with a market cap of A$2.23 billion.

Operations: The company's primary revenue stream comes from royalty arrangements, generating A$240.51 million as of September 2024. The net income margin has shown fluctuations, reaching 64.40% in the same period, with cost of goods sold (COGS) recorded at A$9.08 million and operating expenses at A$3.98 million.

PE: 12.6x

Deterra Royalties, a small-cap company, recently reported net income of A$154.89 million for the year ending June 30, 2024, slightly up from A$152.46 million the previous year. Basic earnings per share rose to A$0.293 from A$0.2885. Despite a forecasted annual earnings decline of 6.6% over the next three years and reliance on external borrowing for funding, insider confidence is evident with recent share purchases in August 2024. The company also declared an ordinary dividend of A$0.144 per share for the six months ending June 30, payable on September 24, 2024.

- Get an in-depth perspective on Deterra Royalties' performance by reading our valuation report here.

Examine Deterra Royalties' past performance report to understand how it has performed in the past.

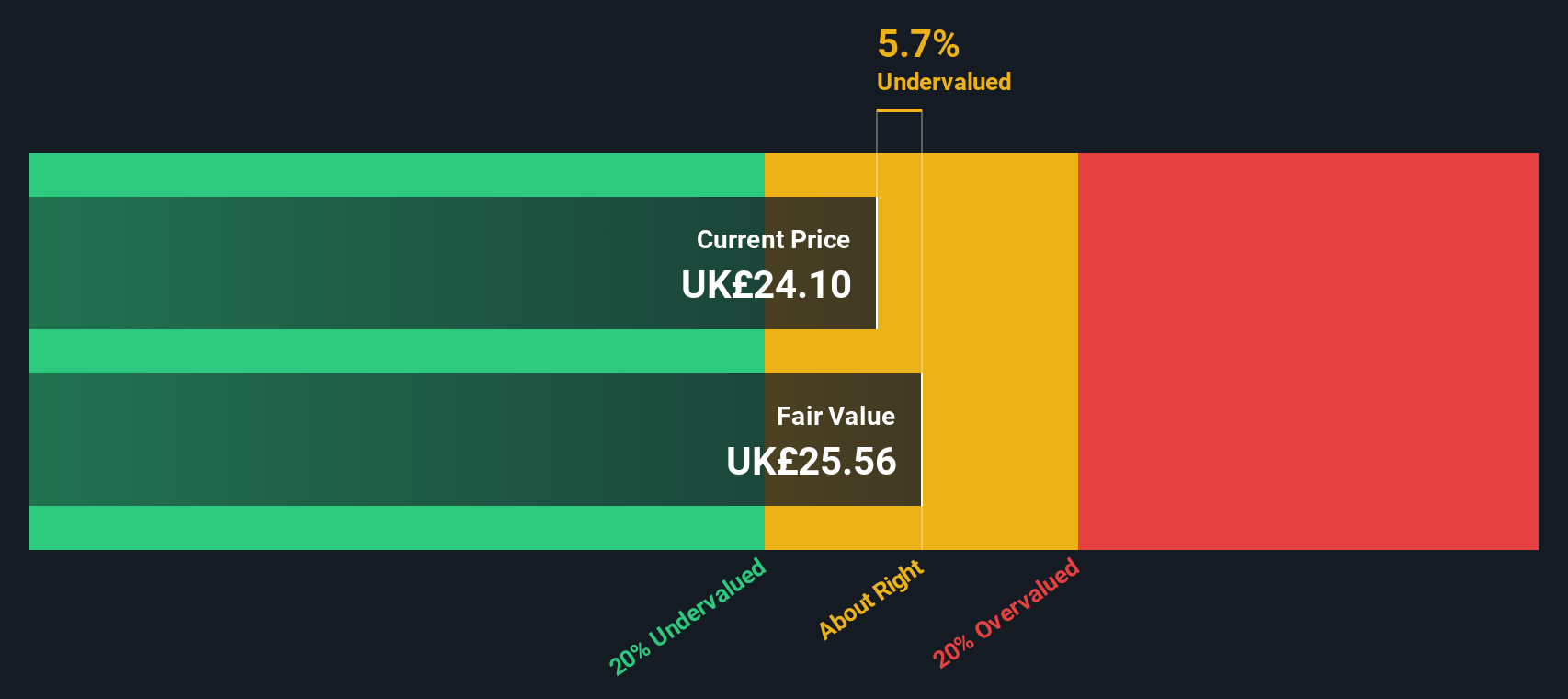

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genus is a biotechnology company specializing in animal genetics, with operations focused on improving livestock breeding through advanced genetic technologies and a market cap of approximately £2.50 billion.

Operations: The company's revenue streams primarily come from Genus ABS (£314.9 million) and Genus PIC (£352.5 million). Over the observed periods, the gross profit margin has shown significant variability, peaking at 68.02% as of March 31, 2024. Operating expenses and R&D costs are considerable components of the cost structure, with operating expenses reaching £403.05 million in March 2024 and R&D expenses varying across periods but noted at £93.3 million in recent quarters.

PE: 159.3x

Genus, a small cap stock, recently proposed a final dividend of 21.7 pence per share, maintaining last year's payout. For the year ending June 30, 2024, sales were GBP 668.8 million with net income dropping to GBP 7.9 million from GBP 33.3 million previously. Despite lower profit margins and reliance on external borrowing for funding, insider confidence is evident with recent share purchases in Q2 and Q3 of this year. Future earnings are forecasted to grow annually by nearly 39%.

- Click here to discover the nuances of Genus with our detailed analytical valuation report.

Review our historical performance report to gain insights into Genus''s past performance.

Make It Happen

- Access the full spectrum of 179 Undervalued Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRR

Flawless balance sheet with acceptable track record.