- Australia

- /

- Metals and Mining

- /

- ASX:CYL

Catalyst Metals (ASX:CYL) Is Up 6.6% After Reporting Strong FY25 Sales and Profit Growth - What's Changed

Reviewed by Simply Wall St

- Catalyst Metals Limited has reported its full-year earnings for the period ended June 30, 2025, announcing sales of A$361.41 million and net income of A$119.27 million, both well above figures from the previous year.

- The company’s basic earnings per share from continuing operations surged to A$0.4048, highlighting a pronounced improvement in profitability and operational output.

- We’ll explore how Catalyst Metals’ substantial jump in both sales and earnings may shape its future investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Catalyst Metals' Investment Narrative?

To look at Catalyst Metals now is to consider a company that’s just delivered a tremendous leap in profitability and operational scale, with its recent A$361.41 million in sales and A$119.27 million net income putting it well ahead of last year’s benchmarks. For anyone considering holding shares, the big picture is about believing in Catalyst’s ability to sustain this sharp earnings momentum while executing on resource development like the Trident Gold Project. Historically, short-term catalysts have included production volume growth and successful exploration, but the magnitude of this year’s financial results may reset market expectations, potentially increasing attention on operational consistency, project delivery, and the integration of recent capital raisings. Risks haven’t disappeared though: insufficient board independence remains a concern, and the high level of non-cash earnings could complicate future profit quality assessments. The latest earnings report materially changes the conversation around near-term performance, but risk awareness is still essential.

But investors should also note ongoing concerns about board independence and earnings quality.

Exploring Other Perspectives

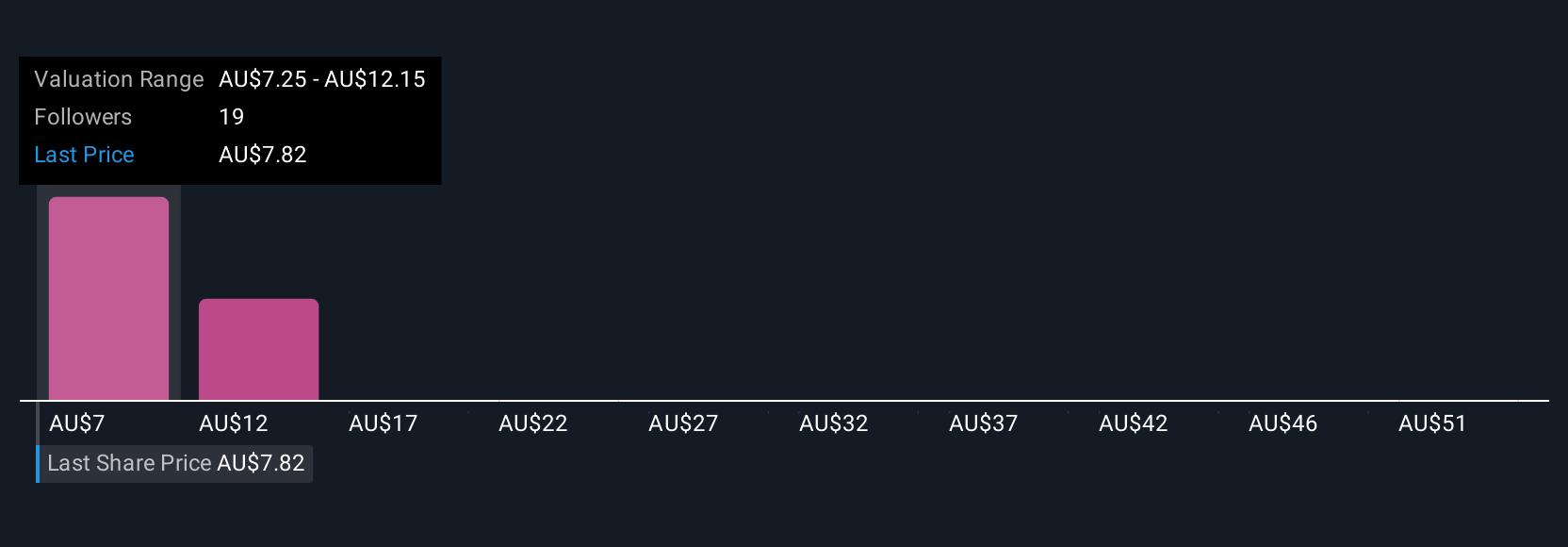

Explore 11 other fair value estimates on Catalyst Metals - why the stock might be worth less than half the current price!

Build Your Own Catalyst Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Catalyst Metals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Catalyst Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Catalyst Metals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

Catalyst Metals

Engages in the mineral exploration and evaluation in Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives