- Australia

- /

- Metals and Mining

- /

- ASX:CYL

3 ASX Growth Stocks With Insider Ownership Up To 46% Earnings Growth

Reviewed by Simply Wall St

The Australian market has shown resilience with the ASX200 inching up 0.34% to 8,234 points, driven by strong performances in the IT and Health Care sectors. In this environment, identifying growth companies with significant insider ownership can be a strategic move, as these firms often benefit from aligned interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12.3% | 117.7% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Catalyst Metals (ASX:CYL) | 14.8% | 33.1% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 66.7% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

Let's dive into some prime choices out of the screener.

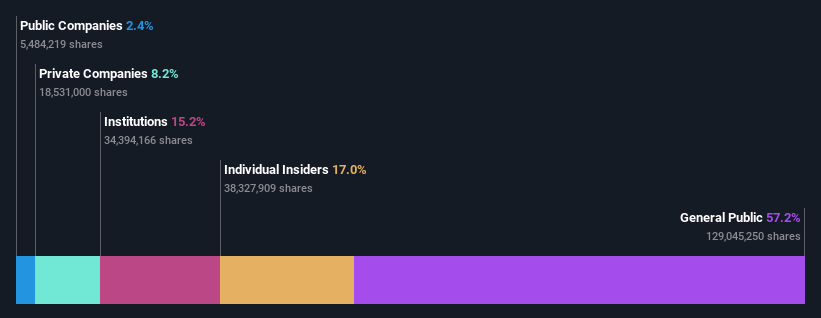

Catalyst Metals (ASX:CYL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Catalyst Metals Limited is an Australian company focused on exploring and evaluating mineral properties, with a market cap of A$784.16 million.

Operations: The company's revenue is derived from its operations in Tasmania, contributing A$75.08 million, and Western Australia, generating A$243.77 million.

Insider Ownership: 14.8%

Earnings Growth Forecast: 33.1% p.a.

Catalyst Metals demonstrates strong growth potential with forecasted revenue and earnings growth rates significantly above the Australian market. Recently added to the S&P/ASX Emerging Companies Index, it has shown substantial improvement in financials, reporting A$317.01 million in sales and a net income of A$23.56 million for FY2024. Despite no recent insider buying or selling activity, its focus on expanding gold production and resource development positions it well for future growth opportunities.

- Take a closer look at Catalyst Metals' potential here in our earnings growth report.

- Our expertly prepared valuation report Catalyst Metals implies its share price may be too high.

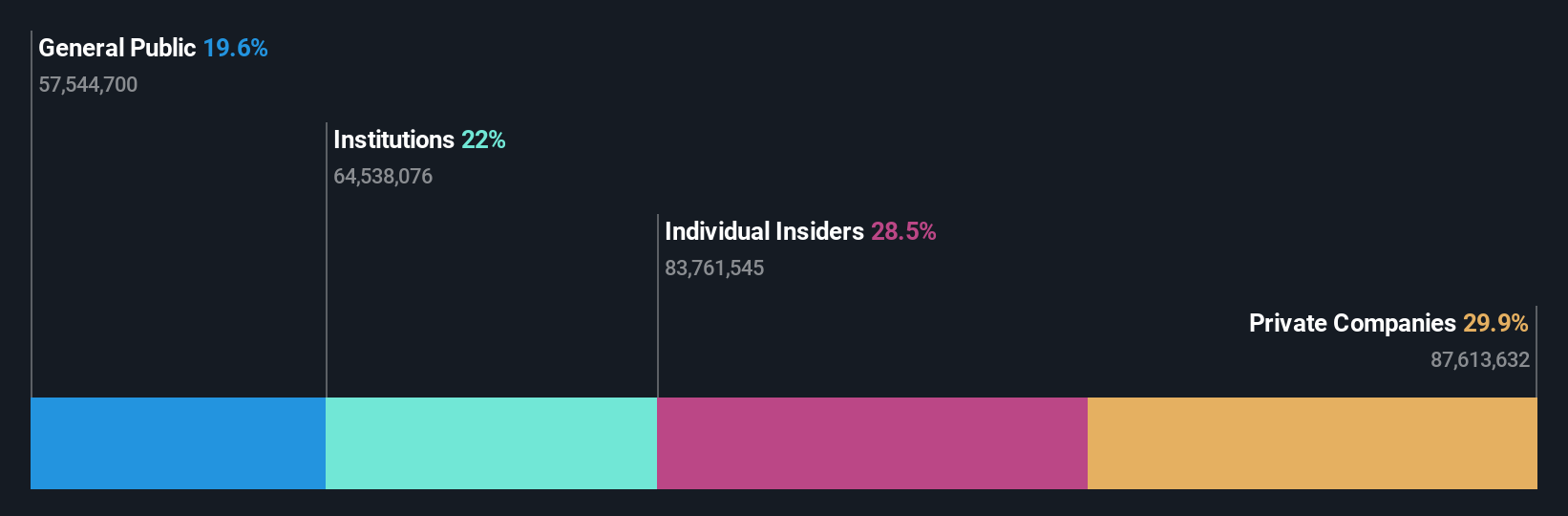

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited owns, operates, and franchises quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$3.94 billion.

Operations: The company's revenue is primarily generated from its quick service restaurant operations, amounting to A$364.99 million.

Insider Ownership: 13%

Earnings Growth Forecast: 46.7% p.a.

Guzman y Gomez shows promising growth potential with forecasted revenue growth of 17.8% annually, outpacing the Australian market. The company is expected to become profitable in three years, although its return on equity is projected to remain low at 11.6%. Recent inclusion in multiple S&P/ASX indices highlights its growing market presence. Despite reporting a net loss of A$13.75 million for FY2024, revenue increased significantly to A$342.21 million from A$259.04 million the previous year.

- Click here and access our complete growth analysis report to understand the dynamics of Guzman y Gomez.

- Insights from our recent valuation report point to the potential overvaluation of Guzman y Gomez shares in the market.

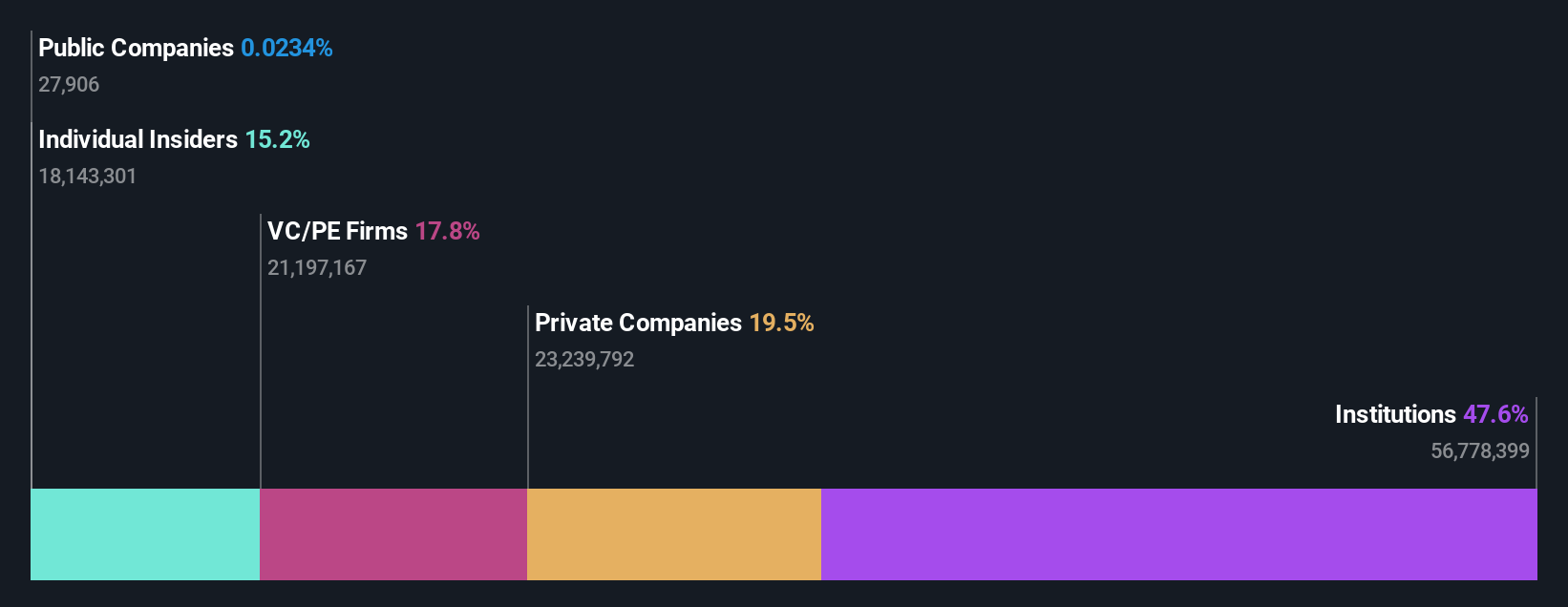

Qualitas (ASX:QAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qualitas (ASX:QAL) is a real estate investment firm specializing in direct investments across various real estate classes and geographies, distressed debt acquisitions and restructuring, third-party capital raisings, and consulting services, with a market cap of A$781.66 million.

Operations: Qualitas generates revenue through its Direct Lending segment, which accounts for A$26.79 million, and its Funds Management segment, contributing A$13.61 million.

Insider Ownership: 27.2%

Earnings Growth Forecast: 22.4% p.a.

Qualitas Limited demonstrates growth potential with earnings expected to rise significantly at 22.4% annually, surpassing the Australian market's average. Recent insider buying indicates confidence in future prospects, while no substantial insider selling has occurred. Despite a low forecasted return on equity of 9.1%, revenue is projected to grow faster than the market at 14.7% per year. Recent board changes include Darren Steinberg's appointment, enhancing governance with his extensive property and funds management experience.

- Click to explore a detailed breakdown of our findings in Qualitas' earnings growth report.

- In light of our recent valuation report, it seems possible that Qualitas is trading beyond its estimated value.

Next Steps

- Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 94 more companies for you to explore.Click here to unveil our expertly curated list of 97 Fast Growing ASX Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives