- Australia

- /

- Metals and Mining

- /

- ASX:CMM

Capricorn Metals And 2 Other ASX Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The ASX200 has been up 0.42% at 8,134 points, nearing its record high of 8,148 set in August. Despite global uncertainties, the Australian market remains resilient with sectors like Real Estate and Telecommunications showing positive momentum. In this environment, growth companies with high insider ownership can offer unique advantages as they often align management interests with those of shareholders. This article will explore Capricorn Metals and two other ASX-listed growth stocks that exhibit strong insider ownership.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.5% |

| Acrux (ASX:ACR) | 14.6% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

We're going to check out a few of the best picks from our screener tool.

Capricorn Metals (ASX:CMM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricorn Metals Ltd is an Australian company focused on the evaluation, exploration, development, and production of gold properties with a market cap of A$2.36 billion.

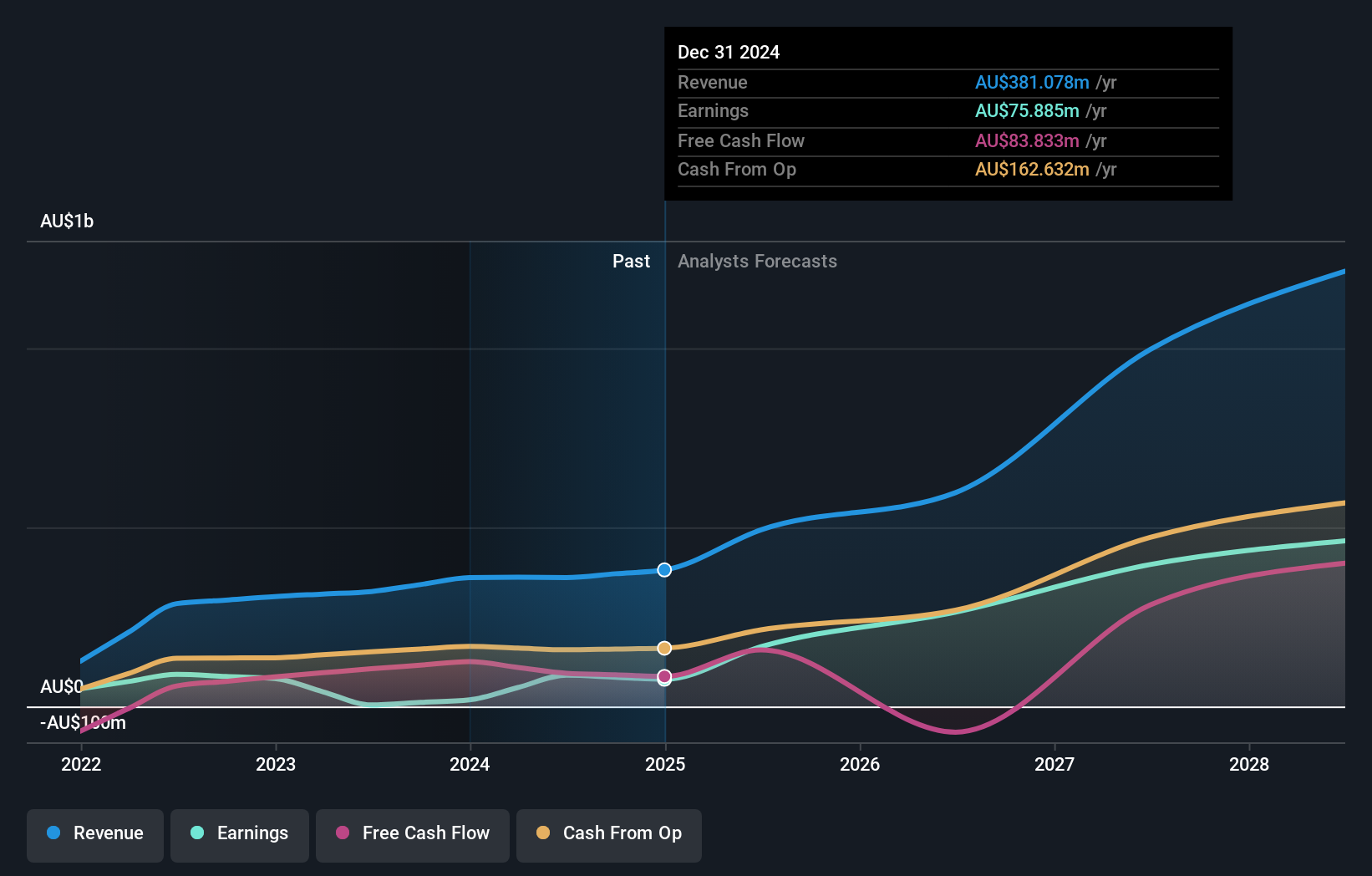

Operations: Capricorn Metals' revenue primarily comes from its Karlawinda gold property, generating A$359.73 million.

Insider Ownership: 11.9%

Capricorn Metals has demonstrated significant growth, with earnings increasing by a very large amount over the past year. Forecasts indicate its earnings will grow significantly at 20.2% annually, outpacing the Australian market. Recent updates include a major expansion study at the Karlawinda Gold Project and an increase in Mineral Reserves to 57.7 million tonnes containing 1,428 koz gold, supporting a pre-expansion life of mine exceeding 13 years. The stock trades at 52.9% below its estimated fair value.

- Dive into the specifics of Capricorn Metals here with our thorough growth forecast report.

- The analysis detailed in our Capricorn Metals valuation report hints at an inflated share price compared to its estimated value.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$7.47 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: Revenue segments (in millions of A$): Energy: 16, Lithium: 1409, Iron Ore: 2578, Mining Services: 3380, Other Commodities: 19

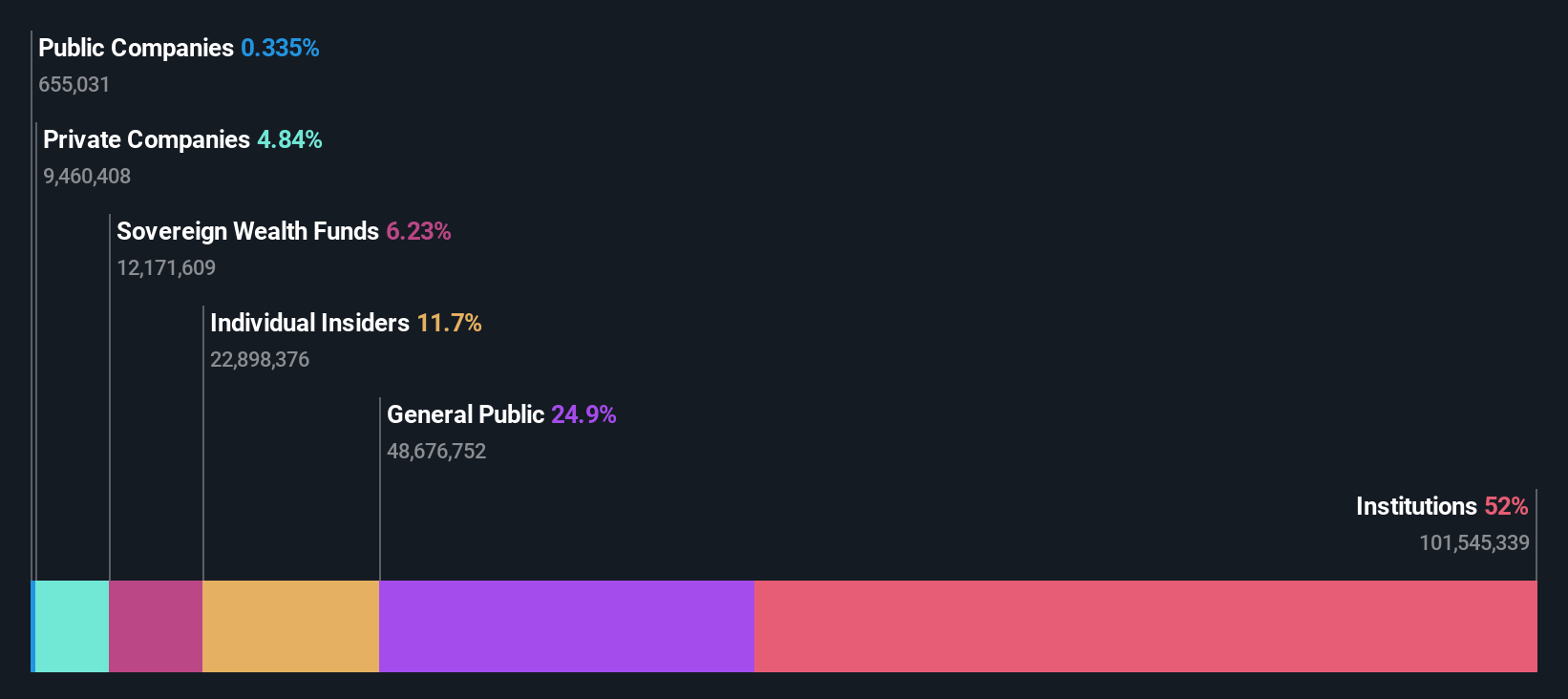

Insider Ownership: 11.7%

Mineral Resources has shown moderate revenue growth, with sales rising to A$5.28 billion for the year ended June 30, 2024, but net income dropped to A$125 million from A$243 million. Insider activity has been positive with more shares bought than sold recently. Despite lower profit margins and earnings per share compared to last year, earnings are forecasted to grow significantly at 38.7% annually, outpacing the Australian market's growth rate of 12.3%.

- Click to explore a detailed breakdown of our findings in Mineral Resources' earnings growth report.

- Our comprehensive valuation report raises the possibility that Mineral Resources is priced higher than what may be justified by its financials.

PolyNovo (ASX:PNV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally with a market cap of A$1.78 billion.

Operations: Revenue from the development, manufacturing, and commercialization of NovoSorb Technology is A$103.23 million.

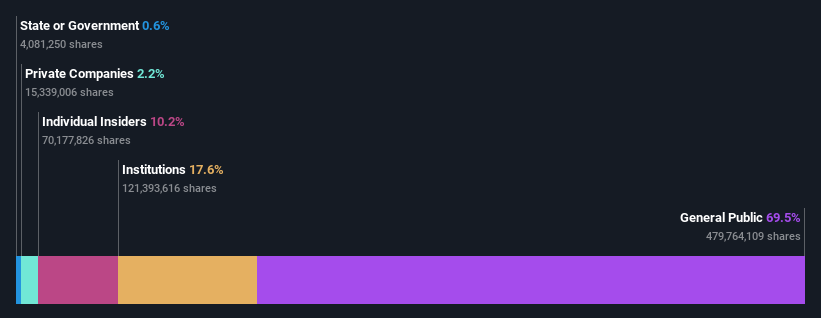

Insider Ownership: 10.3%

PolyNovo has demonstrated strong revenue growth, reporting A$104.76 million for the year ended June 30, 2024, up from A$66.54 million a year ago. The company turned profitable with a net income of A$5.26 million compared to a loss of A$4.92 million previously. Earnings are forecasted to grow significantly at 38.3% annually, outpacing the Australian market's growth rate of 12.3%. Insider ownership remains high but recent insider trading activity is limited.

- Take a closer look at PolyNovo's potential here in our earnings growth report.

- The valuation report we've compiled suggests that PolyNovo's current price could be inflated.

Summing It All Up

- Discover the full array of 98 Fast Growing ASX Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CMM

Capricorn Metals

Engages in the evaluation, exploration, development, and production of gold properties in Australia.

Exceptional growth potential with outstanding track record.