- Australia

- /

- Real Estate

- /

- ASX:CWP

ASX Growth Companies With High Insider Ownership You Need To Know

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 5.0%, driven by declines in every sector, yet over the last year, it has risen by 4.4% with earnings forecasted to grow by 13% annually. In this fluctuating environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.5% |

| Catalyst Metals (ASX:CYL) | 17.5% | 75.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 49.4% |

| Lotus Resources (ASX:LOT) | 12.4% | 58.0% |

| Adveritas (ASX:AV1) | 21.1% | 103.9% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 77.9% |

Here we highlight a subset of our preferred stocks from the screener.

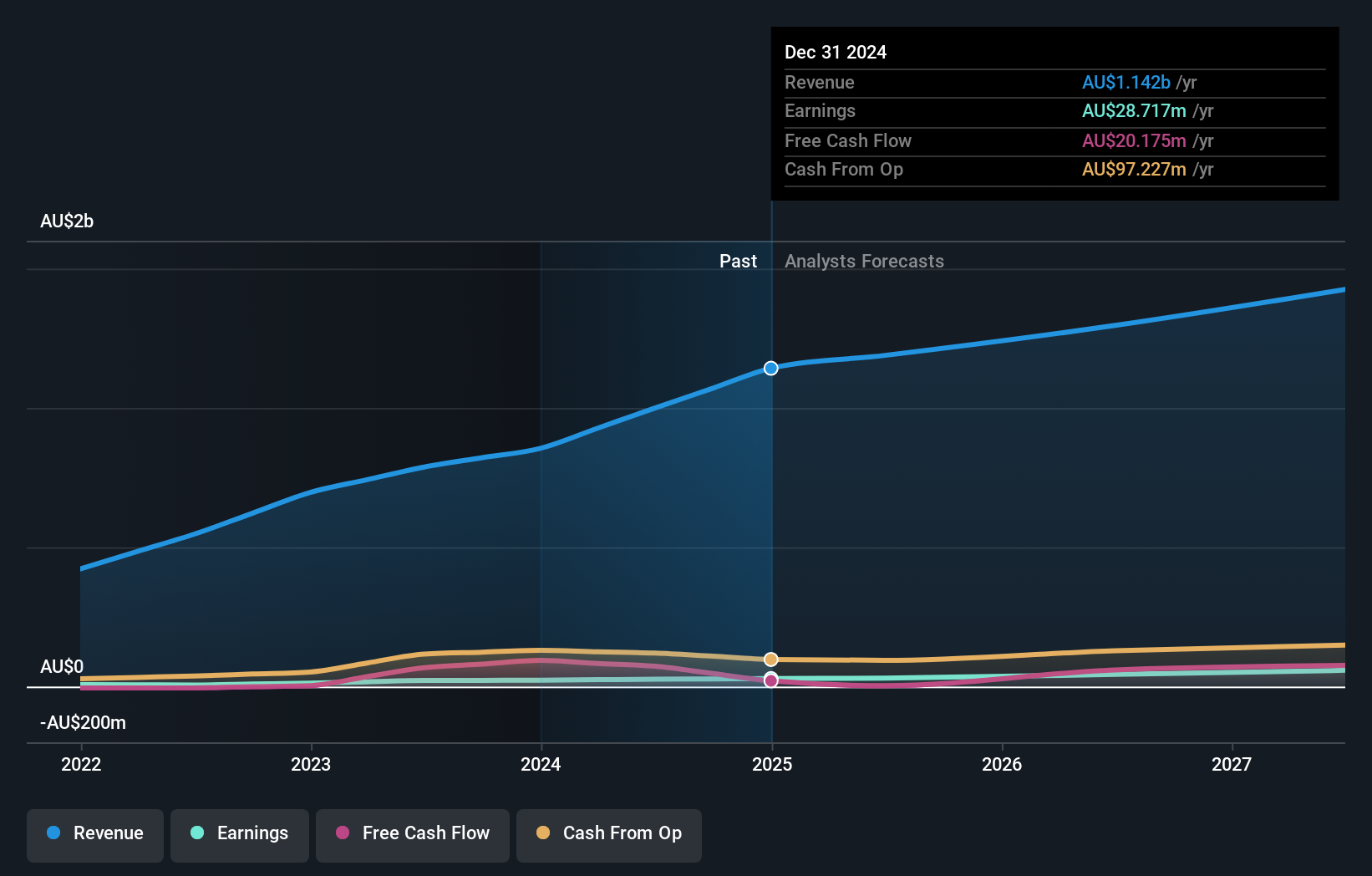

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aussie Broadband Limited offers telecommunications services to residential and business customers in Australia, with a market cap of A$916.11 million.

Operations: The company's revenue segments include Business (A$94.21 million), Wholesale (A$125.25 million), Residential (A$549.59 million), and Enterprise and Government (A$85.85 million).

Insider Ownership: 10.8%

Revenue Growth Forecast: 14.8% p.a.

Aussie Broadband shows promising growth potential with forecasted annual earnings growth of 23.7% and revenue growth of 14.8%, both outpacing the Australian market averages. Despite recent insider selling, the company has seen significant insider buying over the past three months, indicating confidence from key stakeholders. Recent moves include seeking acquisitions and investments, backed by a A$120 million equity raising aimed at expanding its fibre assets and maintaining strong residential revenue streams.

- Click to explore a detailed breakdown of our findings in Aussie Broadband's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Aussie Broadband shares in the market.

Capricorn Metals (ASX:CMM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricorn Metals Ltd is an Australian company focused on the evaluation, exploration, development, and production of gold properties with a market cap of A$2.11 billion.

Operations: Revenue segments for Capricorn Metals Ltd include A$356.94 million from Karlawinda.

Insider Ownership: 12.3%

Revenue Growth Forecast: 13.6% p.a.

Capricorn Metals demonstrates solid growth potential with forecasted annual earnings growth of 27.05% and revenue growth of 13.6%, both surpassing the Australian market averages. Despite a decline in profit margins from 25.4% to 5.2%, the company's return on equity is projected to be high at 32.5% in three years, indicating strong future profitability. Insider ownership remains significant, and recent presentations at industry forums underscore ongoing engagement and strategic planning by top executives.

- Dive into the specifics of Capricorn Metals here with our thorough growth forecast report.

- Our valuation report here indicates Capricorn Metals may be overvalued.

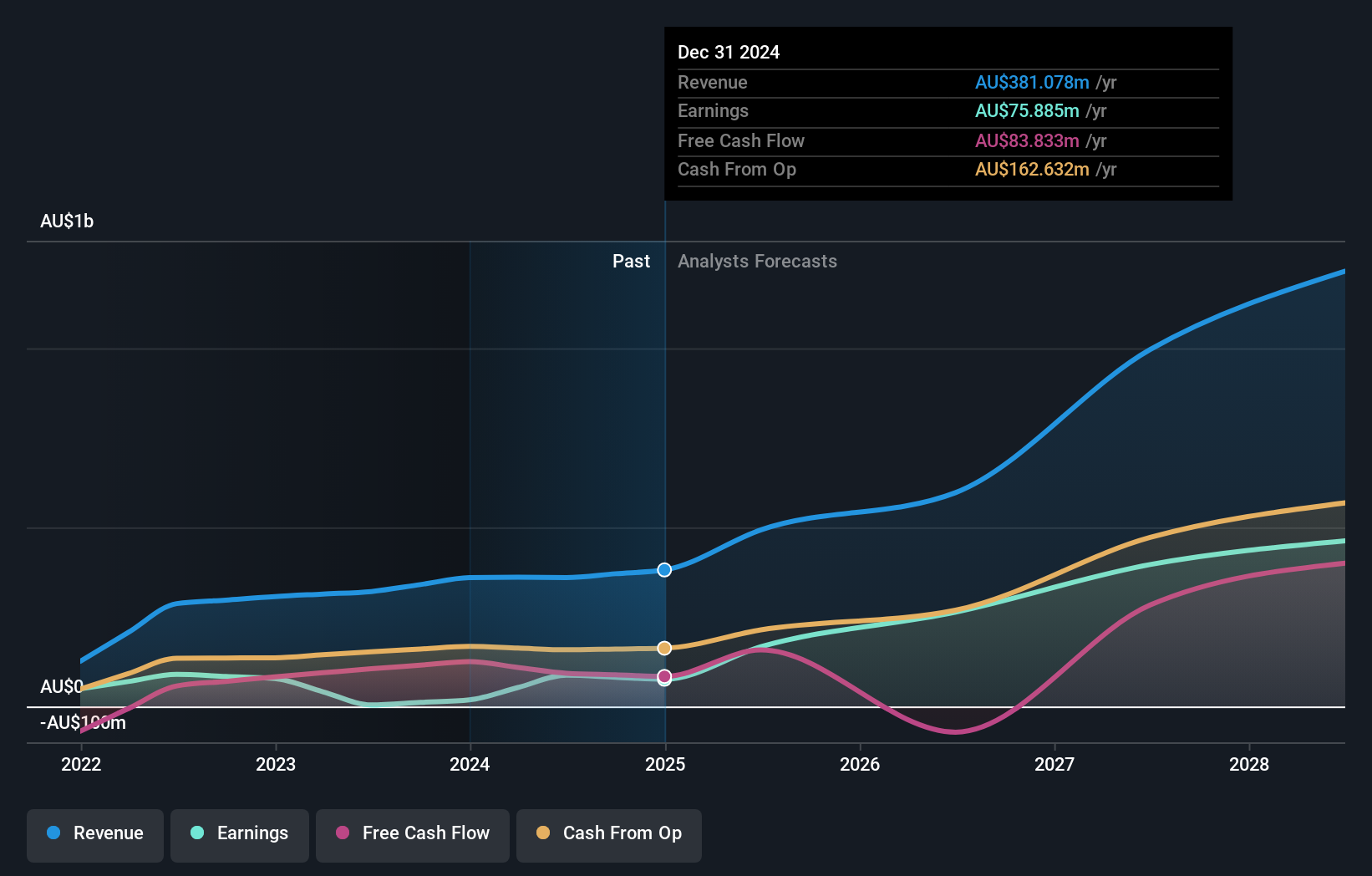

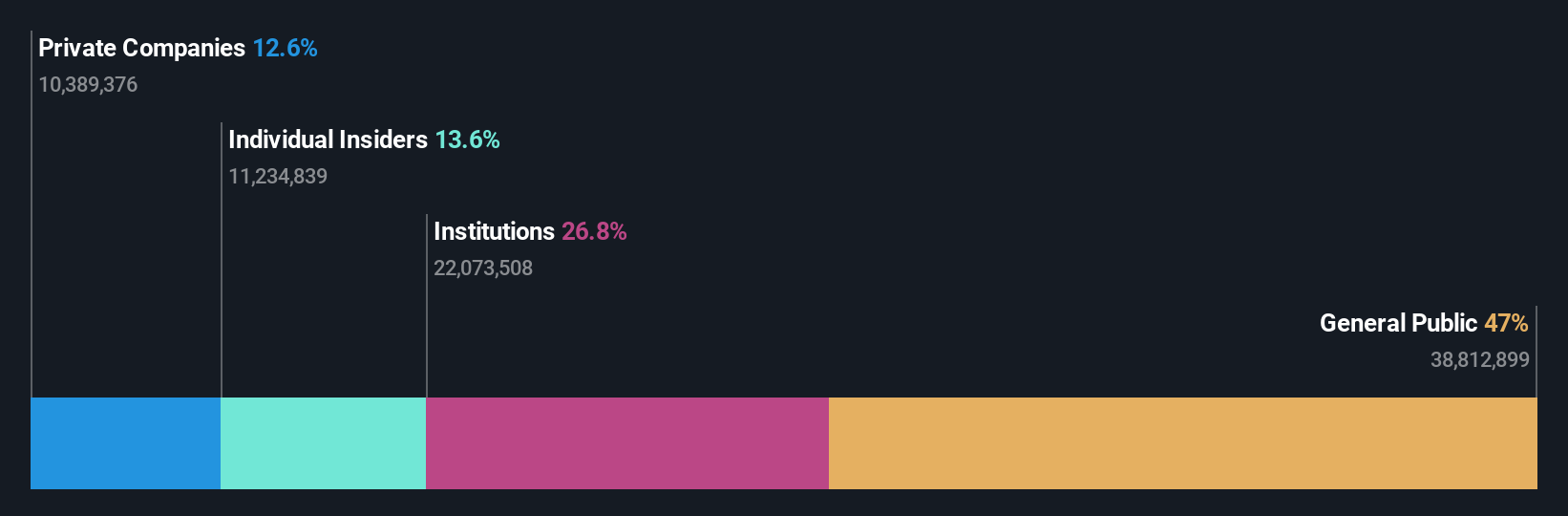

Cedar Woods Properties (ASX:CWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cedar Woods Properties Limited is an Australian company involved in property investment and development, with a market cap of A$403.03 million.

Operations: Cedar Woods generates revenue primarily from property development and investment activities, amounting to A$362.23 million.

Insider Ownership: 13.5%

Revenue Growth Forecast: 11.8% p.a.

Cedar Woods Properties shows promising growth potential with forecasted annual earnings growth of 20.04%, outpacing the Australian market's 12.8%. Revenue is expected to grow at 11.8% per year, also above the market average of 5.1%. Despite a decline in profit margins from 10.4% to 7%, insider ownership remains robust with no substantial share sales in the past three months and modest insider buying activity, signaling confidence from within the company’s leadership.

- Take a closer look at Cedar Woods Properties' potential here in our earnings growth report.

- Our expertly prepared valuation report Cedar Woods Properties implies its share price may be too high.

Next Steps

- Click here to access our complete index of 91 Fast Growing ASX Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CWP

Cedar Woods Properties

Engages in property investment and development activities in Australia.

Good value with proven track record.

Market Insights

Community Narratives