- Australia

- /

- Metals and Mining

- /

- ASX:CMM

3 ASX Stocks Estimated To Be Trading Below Intrinsic Value By Up To 45.6%

Reviewed by Simply Wall St

The Australian market has shown mixed performance, with the ASX200 closing slightly down by 0.08% at 8,151 points, while sectors like Energy and Real Estate led gains. In this environment of sectoral shifts and varied investor sentiment, identifying stocks that are potentially trading below their intrinsic value can be a strategic approach for investors looking to capitalize on undervaluation opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Austal (ASX:ASB) | A$5.13 | A$9.43 | 45.6% |

| Regis Healthcare (ASX:REG) | A$7.17 | A$14.13 | 49.3% |

| Charter Hall Group (ASX:CHC) | A$18.05 | A$34.25 | 47.3% |

| Integral Diagnostics (ASX:IDX) | A$2.36 | A$4.26 | 44.6% |

| Nuix (ASX:NXL) | A$2.37 | A$4.25 | 44.3% |

| Pantoro Gold (ASX:PNR) | A$3.12 | A$5.44 | 42.7% |

| Polymetals Resources (ASX:POL) | A$0.885 | A$1.53 | 42.1% |

| PointsBet Holdings (ASX:PBH) | A$1.09 | A$2.09 | 47.9% |

| Electro Optic Systems Holdings (ASX:EOS) | A$1.20 | A$2.05 | 41.5% |

| Superloop (ASX:SLC) | A$2.53 | A$4.47 | 43.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Austal (ASX:ASB)

Overview: Austal Limited designs, manufactures, and supports vessels for commercial and defense customers globally, with a market cap of A$2.15 billion.

Operations: The company generates revenue through its USA Support segment with A$310.21 million, USA Shipbuilding at A$916.49 million, Australasia Support totaling A$156.69 million, and Australasia Shipbuilding contributing A$197.62 million.

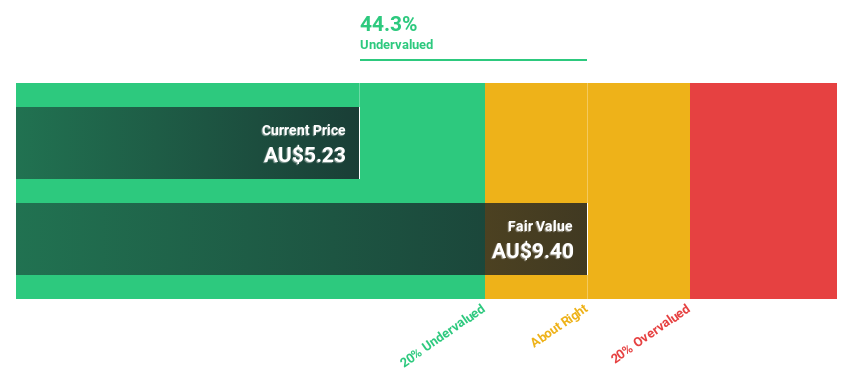

Estimated Discount To Fair Value: 45.6%

Austal's stock, trading at A$5.13, is significantly undervalued relative to its estimated fair value of A$9.43, presenting a potential opportunity for investors focused on cash flow valuation. Despite recent shareholder dilution from equity offerings totaling A$220 million, Austal's earnings are forecasted to grow at 20% annually, outpacing the Australian market average. However, its Return on Equity remains low at 5.2%. Recent contract wins and strategic M&A activities could enhance future financial performance.

- The growth report we've compiled suggests that Austal's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Austal stock in this financial health report.

Capricorn Metals (ASX:CMM)

Overview: Capricorn Metals Ltd is involved in the evaluation, exploration, development, and production of gold properties in Australia with a market cap of A$4.10 billion.

Operations: The company's revenue is primarily derived from its Karlawinda gold project, contributing A$379.47 million.

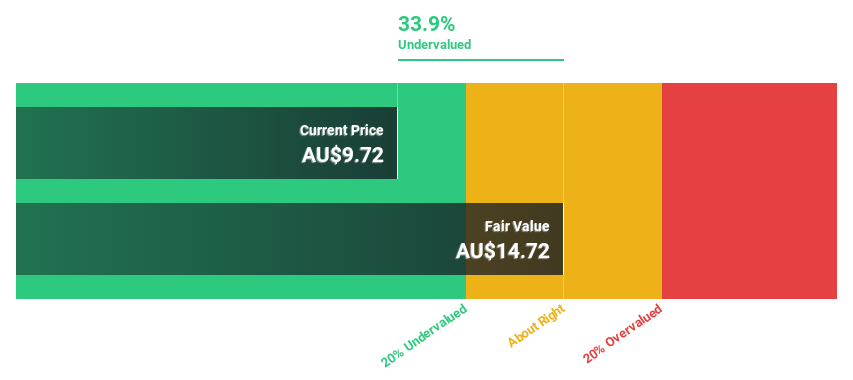

Estimated Discount To Fair Value: 35.1%

Capricorn Metals is trading at A$9.52, well below its estimated fair value of A$14.66, suggesting it could be undervalued based on cash flow analysis. Despite a recent decline in net income to A$43.11 million, the company has experienced substantial earnings growth of 308% over the past year and forecasts robust annual revenue and profit growth rates exceeding both 20% and market averages. Executive changes may introduce some uncertainty but leadership remains stable under Executive Chairman Mark Clark.

- Our earnings growth report unveils the potential for significant increases in Capricorn Metals' future results.

- Dive into the specifics of Capricorn Metals here with our thorough financial health report.

Nanosonics (ASX:NAN)

Overview: Nanosonics Limited is an infection prevention company operating globally with a market capitalization of A$1.45 billion.

Operations: The company's revenue primarily comes from its Healthcare Equipment segment, which generated A$183.97 million.

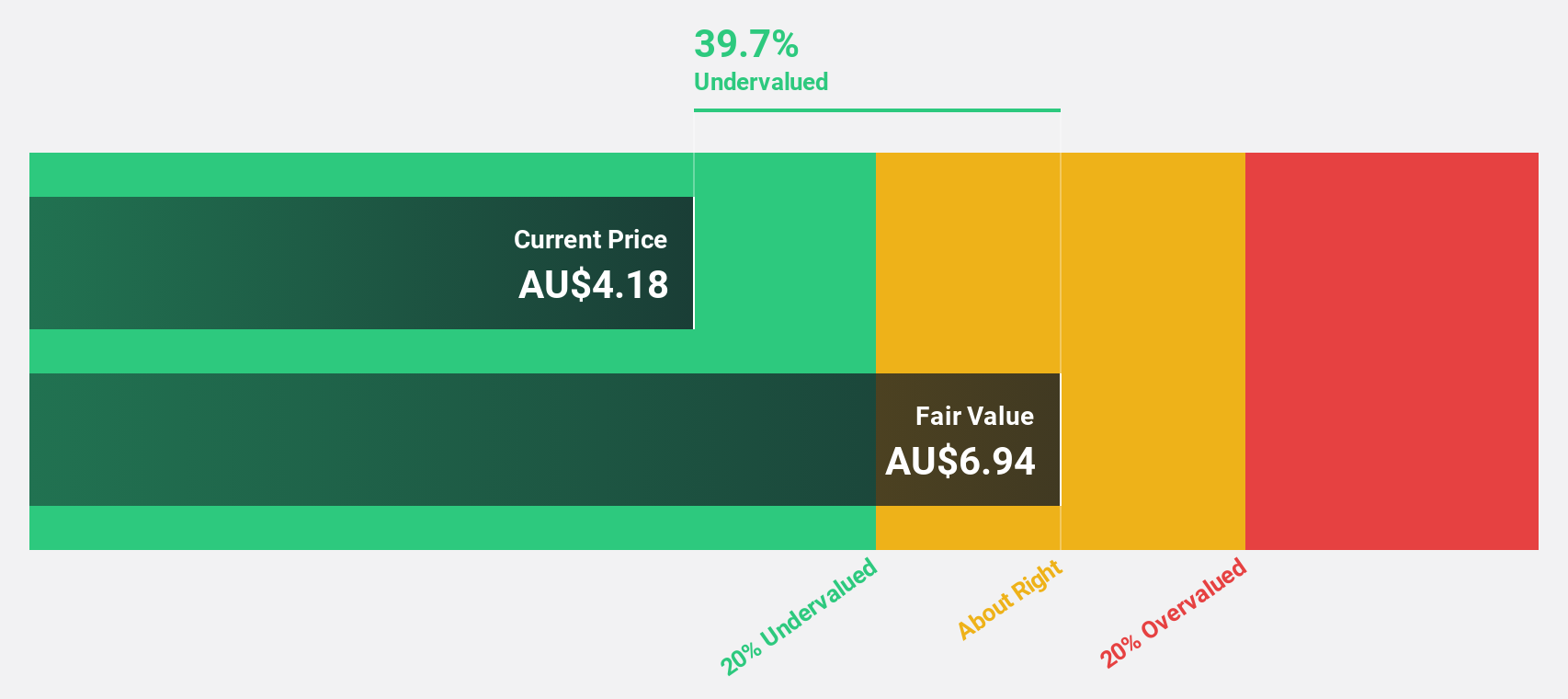

Estimated Discount To Fair Value: 31.4%

Nanosonics, trading at A$4.77, is priced below its estimated fair value of A$6.96, potentially indicating undervaluation based on cash flows. Recent earnings show a net income increase to A$9.76 million from A$6.17 million year-on-year, with revenue guidance for early 2025 revised upwards to 11%-14%. Despite slower revenue growth forecasts of 9.9% annually compared to the market's 6%, expected annual earnings growth of over 24% remains robust against market averages.

- Our expertly prepared growth report on Nanosonics implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Nanosonics' balance sheet health report.

Seize The Opportunity

- Click this link to deep-dive into the 37 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CMM

Capricorn Metals

Engages in the evaluation, exploration, development, and production of gold properties in Australia.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives