- Australia

- /

- Specialty Stores

- /

- ASX:PMV

Top ASX Dividend Stocks To Boost Your Income

Reviewed by Simply Wall St

The ASX200 closed up 1.25% at 7777.7 points, marking its second consecutive positive session and recovering some of the losses from earlier in the week. The recent uptick in China's inflation data has positively influenced sentiment across Asian markets, boosting commodities and lifting all sectors into positive territory. In such a volatile market environment, dividend stocks can offer a reliable income stream while providing potential for capital appreciation. Here are three top ASX dividend stocks that could help boost your income amidst these dynamic conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 6.67% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.27% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.41% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 7.34% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.72% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.03% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.71% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.64% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.47% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.08% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

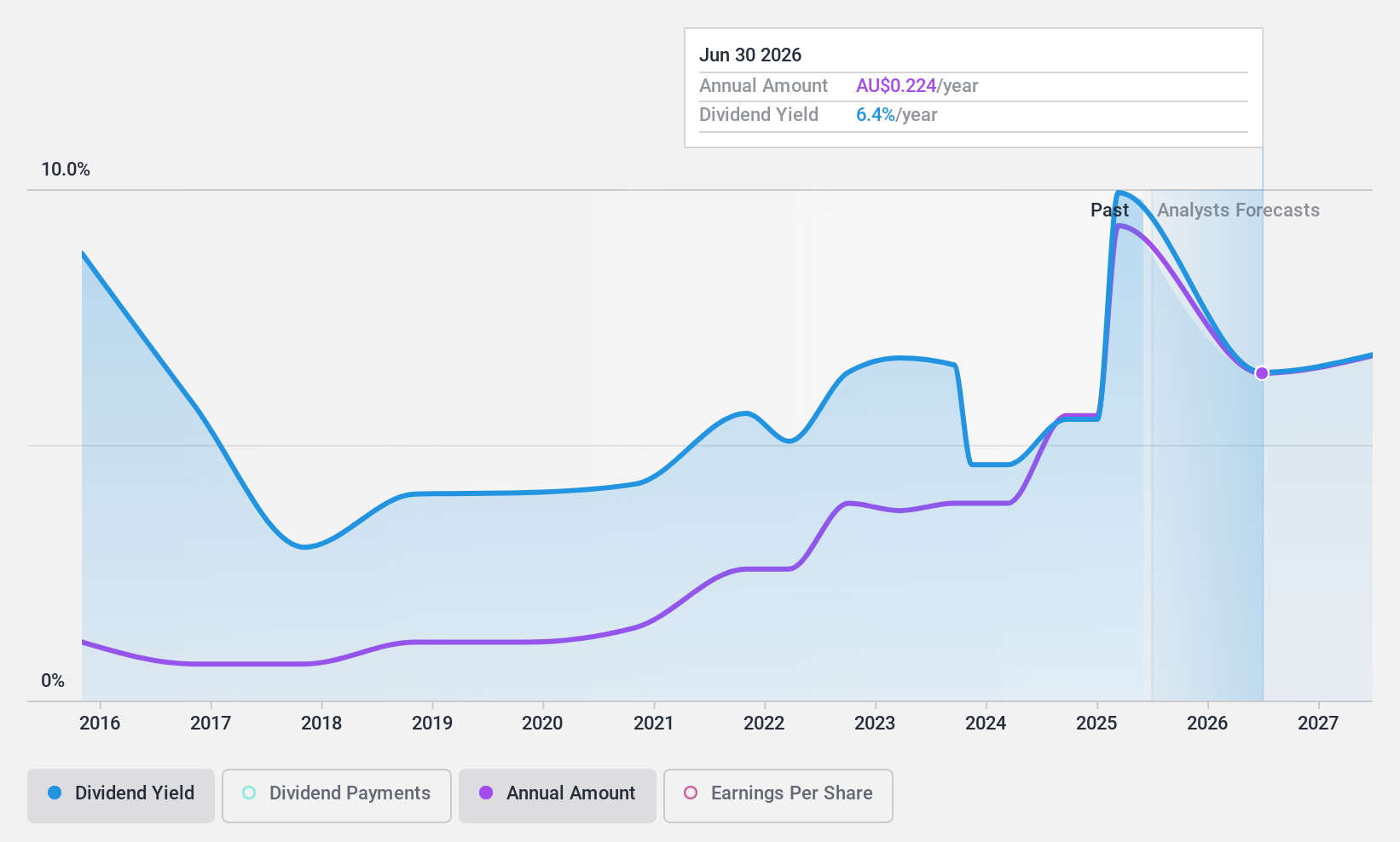

Bisalloy Steel Group (ASX:BIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bisalloy Steel Group Limited manufactures and sells quenched and tempered, high-tensile, and abrasion-resistant steel plates in Australia, Indonesia, Thailand, and internationally with a market cap of A$204.51 million.

Operations: Bisalloy Steel Group Limited generates revenue from the production and distribution of high-performance steel plates across various regions, including Australia, Indonesia, Thailand, and international markets.

Dividend Yield: 3.1%

Bisalloy Steel Group's dividend payments have been volatile over the past decade, with an annual drop of over 20% at times. However, the current payout ratio of 58.6% indicates dividends are covered by earnings, and a cash payout ratio of 82.2% shows coverage by cash flows. Despite a lower-than-top-tier yield (3.13%), its Price-To-Earnings ratio (14.4x) is attractive compared to the broader Australian market (18.9x).

- Get an in-depth perspective on Bisalloy Steel Group's performance by reading our dividend report here.

- Our valuation report unveils the possibility Bisalloy Steel Group's shares may be trading at a premium.

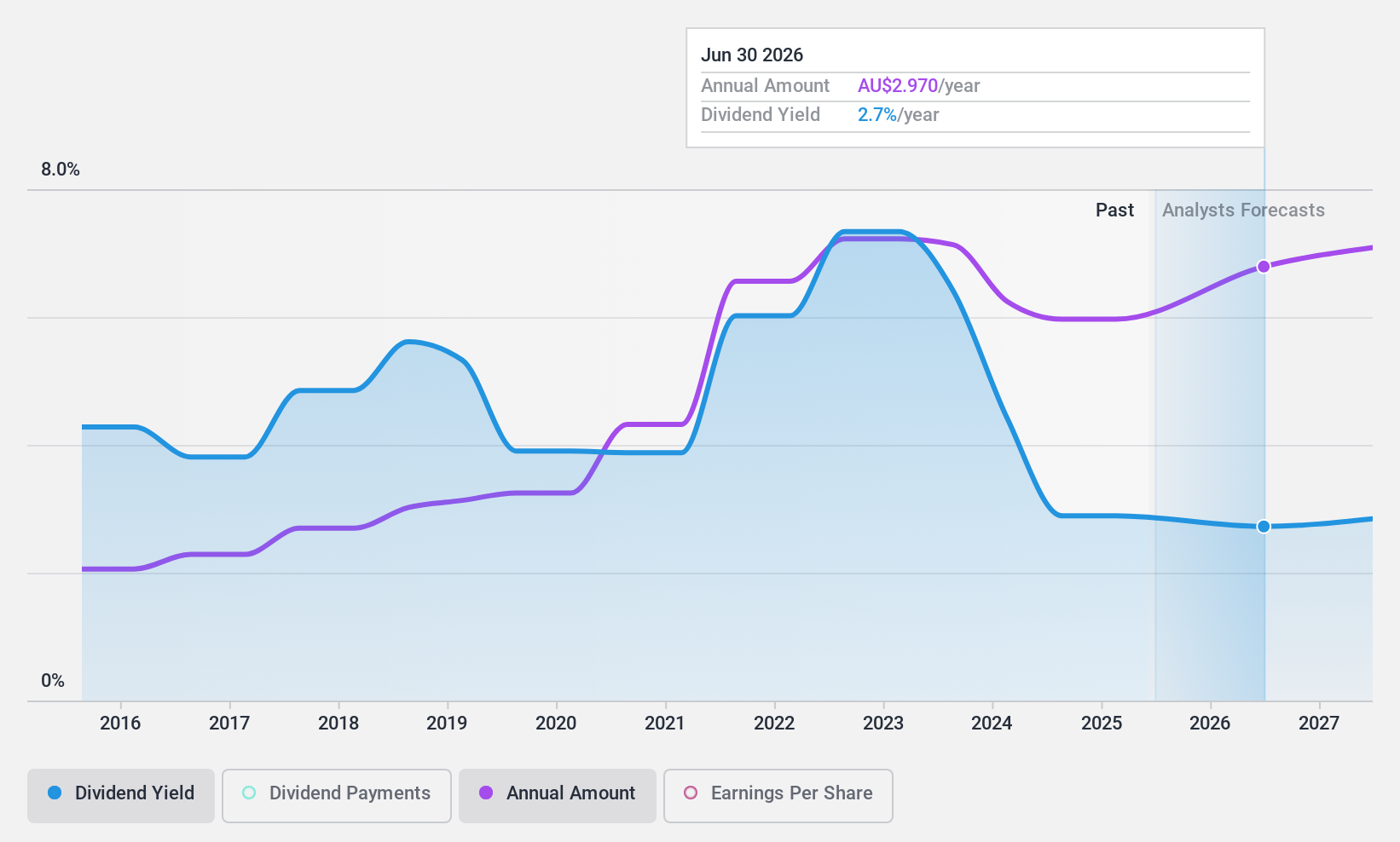

JB Hi-Fi (ASX:JBH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Hi-Fi Limited, along with its subsidiaries, operates as a retailer of home consumer products and has a market cap of approximately A$7.37 billion.

Operations: JB Hi-Fi Limited generates revenue from three main segments: The Good Guys (A$2.66 billion), JB Hi-Fi Australia (A$6.57 billion), and JB Hi-Fi New Zealand (A$277.80 million).

Dividend Yield: 4.1%

JB Hi-Fi's dividend yield (4.05%) is lower than the top 25% of Australian dividend payers (6.32%). However, its payout ratio (65%) and cash payout ratio (46.8%) indicate dividends are well-covered by earnings and cash flows. Despite a history of volatile dividends over the past decade, JB Hi-Fi has managed to increase its payments during this period. The stock is trading at 8.8% below its estimated fair value, adding a potential value aspect for investors.

- Click here to discover the nuances of JB Hi-Fi with our detailed analytical dividend report.

- According our valuation report, there's an indication that JB Hi-Fi's share price might be on the expensive side.

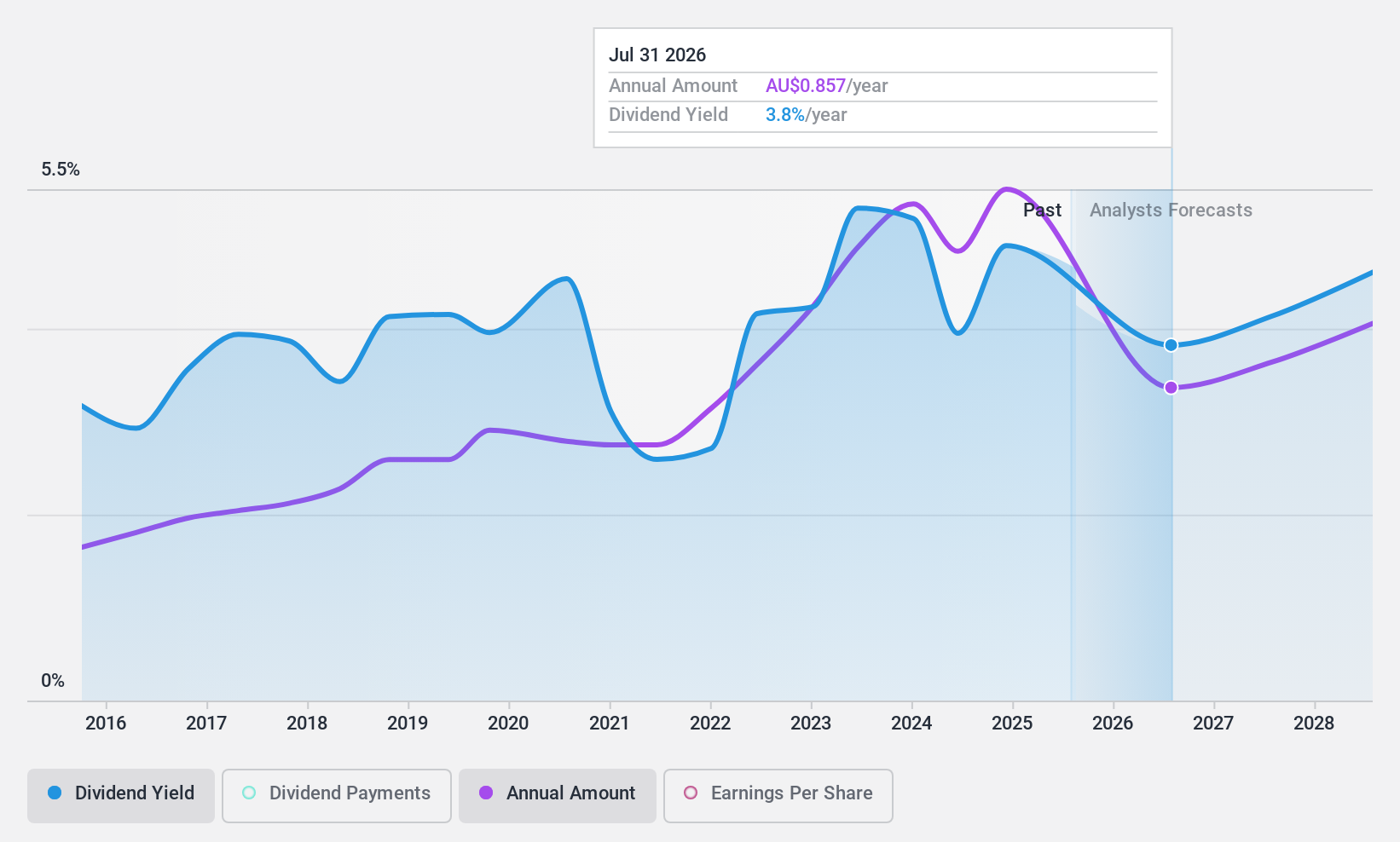

Premier Investments (ASX:PMV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Premier Investments Limited operates various specialty retail fashion chains in Australia, New Zealand, Asia, and Europe with a market cap of A$4.86 billion.

Operations: Premier Investments Limited generates revenue primarily from its retail segment, which brought in A$1.63 billion, and its investment segment, which contributed A$217.83 million.

Dividend Yield: 4.5%

Premier Investments offers a dividend yield of 4.47%, below the top 25% of Australian dividend payers (6.32%). Its payout ratio (71.5%) and cash payout ratio (55%) suggest dividends are well-covered by earnings and cash flows. The company has maintained stable and growing dividends over the past decade, indicating reliability for income-focused investors. Additionally, Premier Investments is trading at 45.2% below its estimated fair value, presenting potential value for investors seeking both income and growth opportunities.

- Dive into the specifics of Premier Investments here with our thorough dividend report.

- Our expertly prepared valuation report Premier Investments implies its share price may be lower than expected.

Key Takeaways

- Take a closer look at our Top ASX Dividend Stocks list of 30 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PMV

Premier Investments

Operates various specialty retail fashion chains in Australia, New Zealand, Asia, and Europe.

Flawless balance sheet established dividend payer.