- Australia

- /

- Metals and Mining

- /

- ASX:BHP

BHP Group (ASX:BHP) Sees 11% Share Price Decline Over the Past Week

Reviewed by Simply Wall St

BHP Group (ASX:BHP) experienced a 11% decline in share price over the past week, a movement reflecting broader market volatility rather than isolating company-specific factors. The retirement of Ken MacKenzie as an independent Non-executive Director was a key event, but given the 12% drop in the broader market amid global tariff uncertainties, it's unlikely this board change exerted a significant effect on the company’s trajectory. Financial markets, especially industries entwined with global trade, were broadly impacted by fear of an economic slowdown, suggesting BHP's price move was part of a wider market trend.

The recent changes at BHP Group, particularly the departure of Ken MacKenzie, seem to reflect broader market volatility rather than being isolated company-specific issues. In the past week, BHP's share price declined by 11%, aligning with a similar drop in the broader market. This correlates with the economic uncertainties and potential slowdowns in global trade impacting the entire sector. Over a longer period, however, BHP's shares have seen a total return of 72.81% over five years, indicating a historically strong performance despite recent fluctuations.

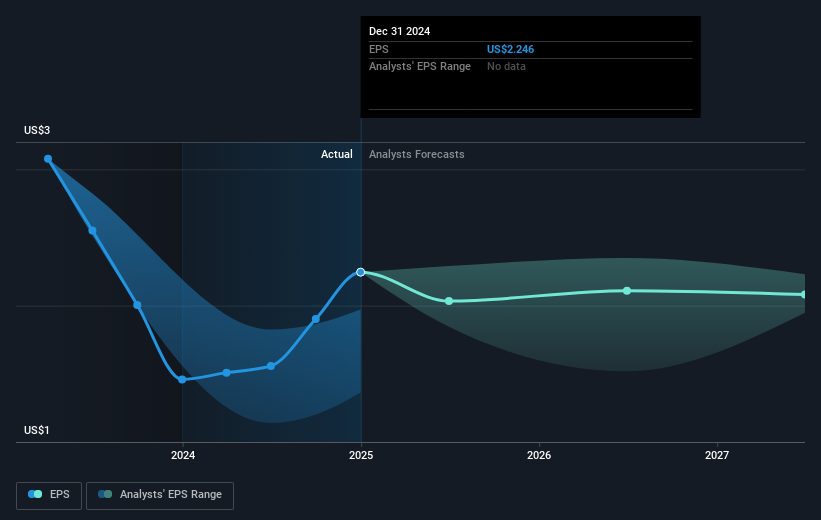

Relative to the industry, BHP underperformed in the past year, returning less than the Australian Metals and Mining industry, which saw a 19.8% decline. This context suggests that while BHP's long-term performance is robust, short-term challenges persist. The broader economic conditions remain a pivotal factor affecting revenue and earnings forecasts. Analysts project a revenue decline of 2.5% annually and earnings reduction, potentially reaching $10.7 billion over the next few years. However, the company's strategic expansions into copper and potash markets could balance these forecasts by adding diversity and stability to its revenue streams.

The current share price of A$38.32 is notably below the analysts' consensus price target of A$44.33, reflecting a discount to perceived fair value. This gap suggests that analysts believe BHP's long-term potential remains strong despite anticipated short-term earnings and revenue adjustments. As BHP progresses with its diversification efforts and addresses liabilities, such as those from the Samarco dam incident, the market's perception might align more closely with analyst expectations.

Click to explore a detailed breakdown of our findings in BHP Group's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHP Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BHP

BHP Group

Operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives