- Australia

- /

- Metals and Mining

- /

- ASX:AX8

Shareholders May Not Be So Generous With Accelerate Resources Limited's (ASX:AX8) CEO Compensation And Here's Why

In the past three years, the share price of Accelerate Resources Limited (ASX:AX8) has struggled to grow and now shareholders are sitting on a loss. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 08 November 2021. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

View our latest analysis for Accelerate Resources

Comparing Accelerate Resources Limited's CEO Compensation With the industry

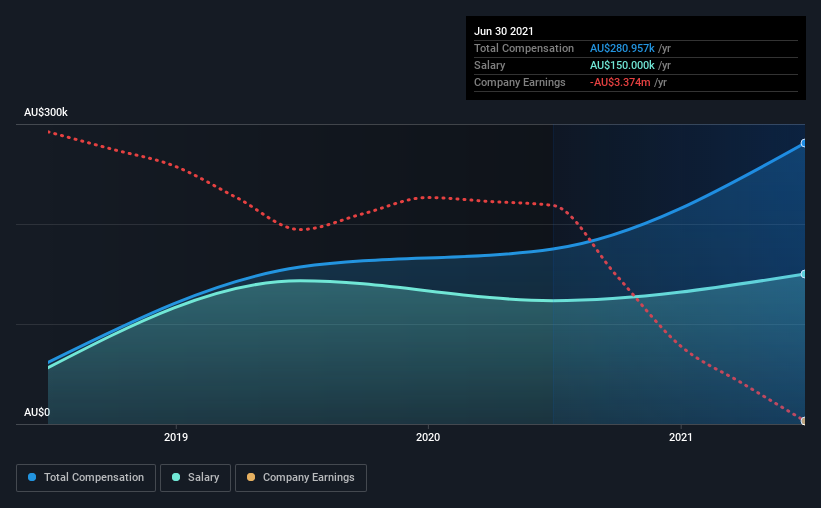

Our data indicates that Accelerate Resources Limited has a market capitalization of AU$10m, and total annual CEO compensation was reported as AU$281k for the year to June 2021. That's a notable increase of 61% on last year. In particular, the salary of AU$150.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below AU$267m, reported a median total CEO compensation of AU$357k. From this we gather that Yaxi Zhan is paid around the median for CEOs in the industry. Moreover, Yaxi Zhan also holds AU$225k worth of Accelerate Resources stock directly under their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$150k | AU$123k | 53% |

| Other | AU$131k | AU$52k | 47% |

| Total Compensation | AU$281k | AU$175k | 100% |

Talking in terms of the industry, salary represented approximately 60% of total compensation out of all the companies we analyzed, while other remuneration made up 40% of the pie. Accelerate Resources sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Accelerate Resources Limited's Growth Numbers

Accelerate Resources Limited has seen its earnings per share (EPS) increase by 9.7% a year over the past three years. Its revenue is up 65% over the last year.

We like the look of the strong year-on-year improvement in revenue. And in that context, the modest EPS improvement certainly isn't shabby. We'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Accelerate Resources Limited Been A Good Investment?

Few Accelerate Resources Limited shareholders would feel satisfied with the return of -42% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 6 warning signs for Accelerate Resources (of which 4 are potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AX8

Accelerate Resources

Operates as a mineral exploration company in Australia.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)