- Australia

- /

- Metals and Mining

- /

- ASX:AMI

How Governance Renewal and Performance Rights Changes at Aurelia Metals (ASX:AMI) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Aurelia Metals Limited recently announced significant board changes, including the retirement of Chair Peter Botten and the appointment of Rachel Brown as a Non-Executive Director, alongside the cessation of 1,318,029 performance rights due to unmet conditions.

- These updates highlight both governance renewal at the leadership level and shifting performance expectations, signaling an inflection point for company strategy and capital management.

- We’ll explore how changes in board composition, particularly the upcoming leadership transition, may influence Aurelia Metals’ forward investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Aurelia Metals Investment Narrative Recap

To be a shareholder in Aurelia Metals, you need confidence in its transition from gold dependency toward increased base metals exposure, as electrification and infrastructure spending trends reshape the sector. The board changes, including the retirement of Chair Peter Botten and appointment of Rachel Brown, are unlikely to materially affect the main short term catalyst: the Federation mine ramp-up. The most significant near-term risk remains execution on multiple growth projects, where delays or overruns could challenge the company’s internal funding and earnings forecasts.

Of the recent announcements, the full-year earnings report is the most relevant, confirming that while gold output fell and costs tightened, copper production increased and net income returned to positive territory. This financial turnaround underpins the importance of delivering sequential growth projects like Federation and Great Cobar, as any disruption there would weigh more heavily in light of recent leadership renewal and performance right cessations.

However, investors should be aware that, despite new board members and a focus on expansion, the risk of cost overruns and project delays in...

Read the full narrative on Aurelia Metals (it's free!)

Aurelia Metals' outlook anticipates A$453.8 million in revenue and A$61.8 million in earnings by 2028. This is based on expected annual revenue growth of 9.7% and reflects a A$12.9 million increase in earnings from the current A$48.9 million.

Uncover how Aurelia Metals' forecasts yield a A$0.316 fair value, a 22% upside to its current price.

Exploring Other Perspectives

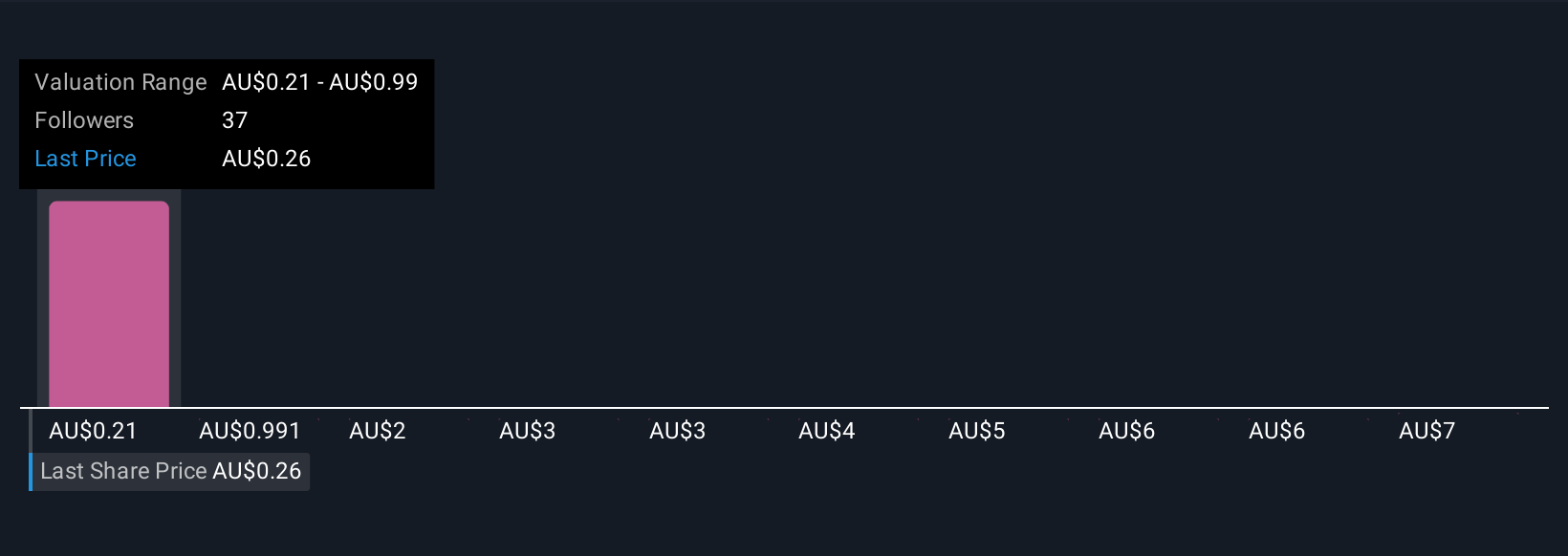

Simply Wall St Community members provided 14 fair value estimates for Aurelia Metals, ranging from A$0.21 to an outlier high of A$8.02 per share. With such diversity of opinion, consider how successful execution of the Federation mine ramp-up could impact future valuation and project timelines.

Explore 14 other fair value estimates on Aurelia Metals - why the stock might be a potential multi-bagger!

Build Your Own Aurelia Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aurelia Metals research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Aurelia Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aurelia Metals' overall financial health at a glance.

No Opportunity In Aurelia Metals?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AMI

Aurelia Metals

Engages in the exploration and production of mineral properties in Australia.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives