The ASX 200 is set to open slightly lower after the holiday break, reflecting a cautious mood in global markets as investors digest recent economic data and spending trends. In such a landscape, penny stocks—often representing smaller or newer companies—offer unique opportunities for growth, especially when they are supported by strong financials. Although the term "penny stocks" may seem outdated, these investments can still present value and potential for those looking to explore under-the-radar options with promising prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.95 | A$317.49M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.17 | A$146.32M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$199.48M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.88 | A$105.46M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Aurelia Metals (ASX:AMI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aurelia Metals Limited is an Australian company involved in the exploration and production of mineral properties, with a market cap of A$287.57 million.

Operations: The company's revenue is primarily derived from its operations at the Peak Mine (A$207.34 million) and Dargues Mine (A$102.36 million), with a smaller contribution from the Hera Mine (A$0.20 million).

Market Cap: A$287.57M

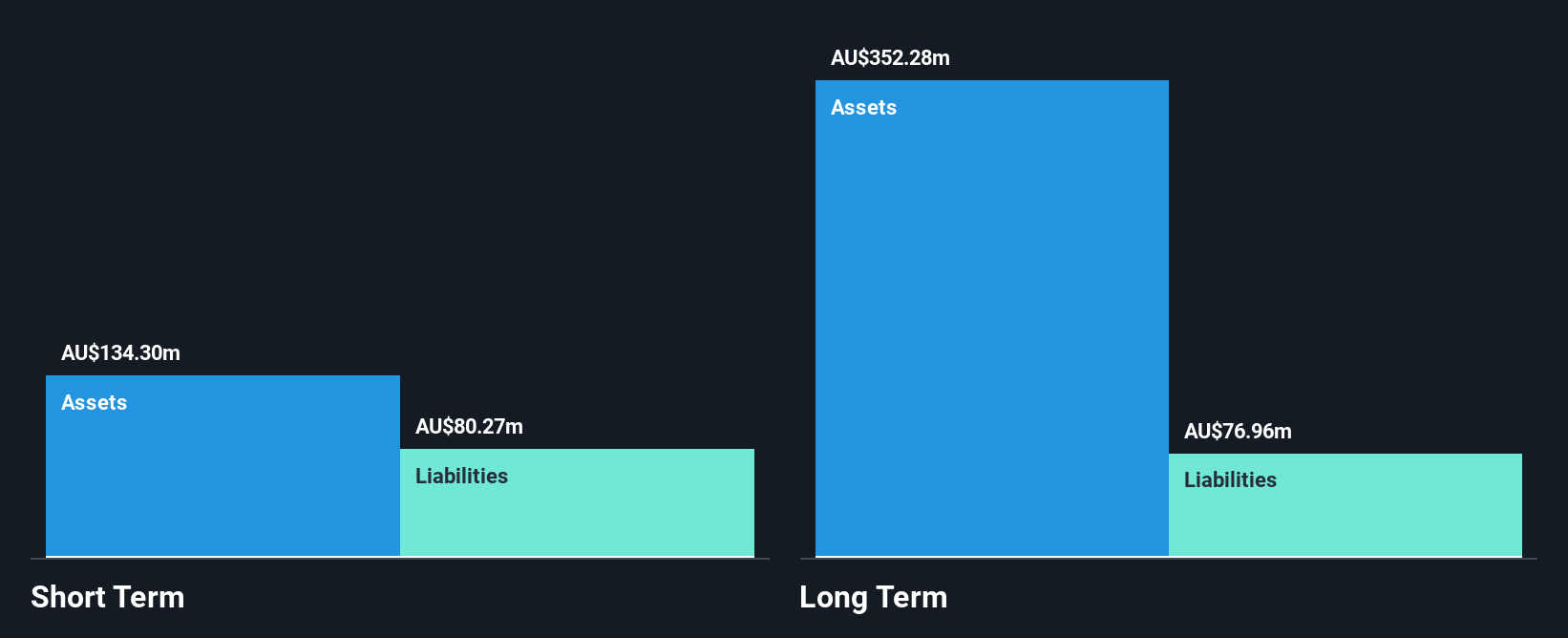

Aurelia Metals, with a market cap of A$287.57 million, is currently unprofitable but maintains a stable financial position due to its healthy cash runway exceeding three years and positive free cash flow. The company's short-term assets (A$165.3M) cover both its short-term (A$81.7M) and long-term liabilities (A$74M), indicating strong liquidity management. Despite trading significantly below estimated fair value, the stock has seen no meaningful shareholder dilution recently and analysts predict potential price appreciation of 54.9%. However, the board and management team are relatively inexperienced with average tenures of 2.3 and 1.5 years respectively.

- Take a closer look at Aurelia Metals' potential here in our financial health report.

- Gain insights into Aurelia Metals' future direction by reviewing our growth report.

Pancontinental Energy (ASX:PCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pancontinental Energy NL is involved in the exploration of oil and gas properties in Namibia and Australia, with a market capitalization of A$154.50 million.

Operations: Currently, there are no reported revenue segments for Pancontinental Energy NL.

Market Cap: A$154.5M

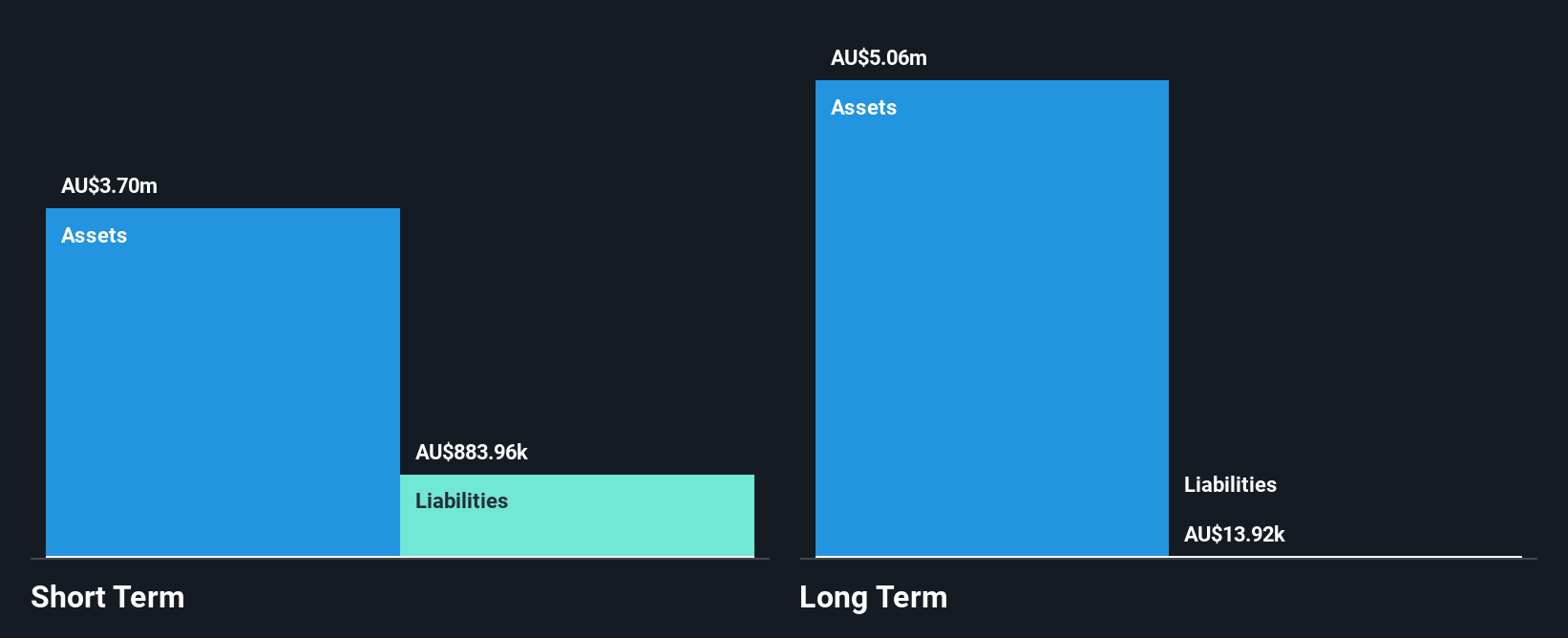

Pancontinental Energy, with a market cap of A$154.50 million, is pre-revenue and currently unprofitable but has managed to reduce its losses by 26.4% annually over the past five years. The company maintains a strong financial position with no debt and short-term assets of A$4.4 million that comfortably cover both its short-term liabilities of A$810.5K and long-term liabilities of A$12.8K, ensuring liquidity stability. Despite reporting a net loss of A$2.34 million for the full year ending June 2024, it has not experienced significant shareholder dilution recently and possesses a cash runway exceeding two years if cash flow growth continues as historically observed.

- Click here to discover the nuances of Pancontinental Energy with our detailed analytical financial health report.

- Gain insights into Pancontinental Energy's past trends and performance with our report on the company's historical track record.

Race Oncology (ASX:RAC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Race Oncology Limited is a clinical stage biopharmaceutical company dedicated to developing treatments for cancer patients with unmet needs, with a market cap of A$238.85 million.

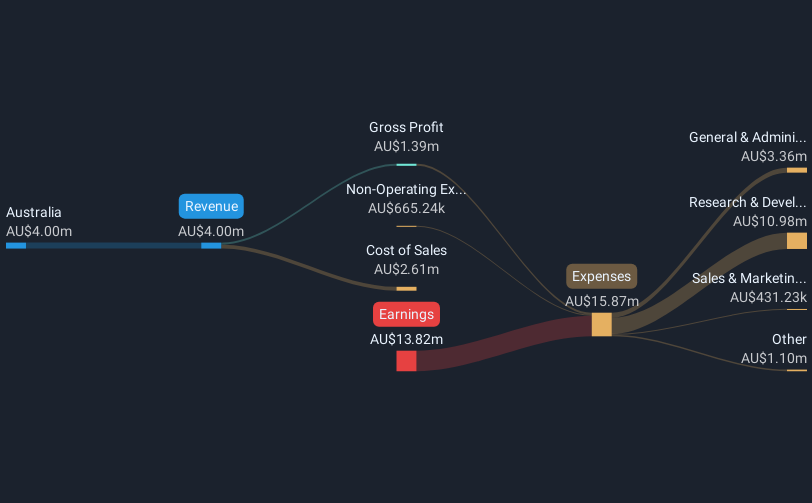

Operations: The company generates revenue exclusively from Australia, amounting to A$4 million.

Market Cap: A$238.85M

Race Oncology, with a market cap of A$238.85 million, is pre-revenue and unprofitable, with losses increasing by 27.6% annually over the past five years. The company's financials reveal no debt and short-term assets of A$17.4 million that surpass both its short-term liabilities of A$1.9 million and long-term liabilities of A$48.3K, indicating solid liquidity management. However, shareholders faced dilution last year as shares outstanding grew by 6.3%. Recent board changes include the appointment of Dr Megan Baldwin, an experienced executive in oncology drug development and capital raising, which may enhance strategic direction in this competitive sector.

- Unlock comprehensive insights into our analysis of Race Oncology stock in this financial health report.

- Gain insights into Race Oncology's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Access the full spectrum of 1,053 ASX Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RAC

Race Oncology

A clinical stage biopharmaceutical company, focuses on addressing the unmet needs of cancer patients for damaging treatments.

Flawless balance sheet low.

Market Insights

Community Narratives