- Australia

- /

- Metals and Mining

- /

- ASX:ALK

Is Alkane Resources Set for More Growth After 117% Surge in 2025?

Reviewed by Bailey Pemberton

If you have been watching Alkane Resources lately, you are probably wondering if now is your chance to get in, hold steady, or take some profits. Over the past year, it is fair to say this stock has delivered a wild ride, up 117.9% year to date and in the last 12 months. Just last month, Alkane jumped 12.1%, outperforming most of the sector, although it did dip 2.5% over the past week. This reminds us how quickly sentiment can shift when investors reassess risk and growth prospects in the mining space.

One reason for this attention is the company’s value score is currently sitting at 4 out of 6. That might not sound dramatic, but it suggests Alkane screens as undervalued in four out of the six classic methods analysts use to judge a mining stock’s worth. It is uncommon to see a company move this much and still show solid undervaluation signals, which is enough to pique even a cautious investor’s curiosity.

Rapid price appreciation often reflects more than just numbers on a balance sheet. In Alkane’s case, the rally connects to growing optimism around resource development and big-picture shifts impacting the sector. The main valuation approaches will be broken down next, so keep reading for what may be the smartest way for investors to weigh Alkane’s true value.

Approach 1: Alkane Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a commonly used tool for estimating what a company is really worth by projecting all future free cash flows and discounting them back to today’s value. This method helps investors judge whether a company’s current market price reflects its long-term earning power.

For Alkane Resources, the DCF approach uses a 2 Stage Free Cash Flow to Equity model. According to recent data, Alkane’s latest twelve months (LTM) Free Cash Flow stands at negative A$54.99 million, but analysts forecast a rapid shift. Based on consensus and extrapolation, Free Cash Flow is projected to grow to A$182 million by financial year 2030. These multi-year projections are modeled from analyst estimates for the next five years, with further growth extrapolated by Simply Wall St through 2035.

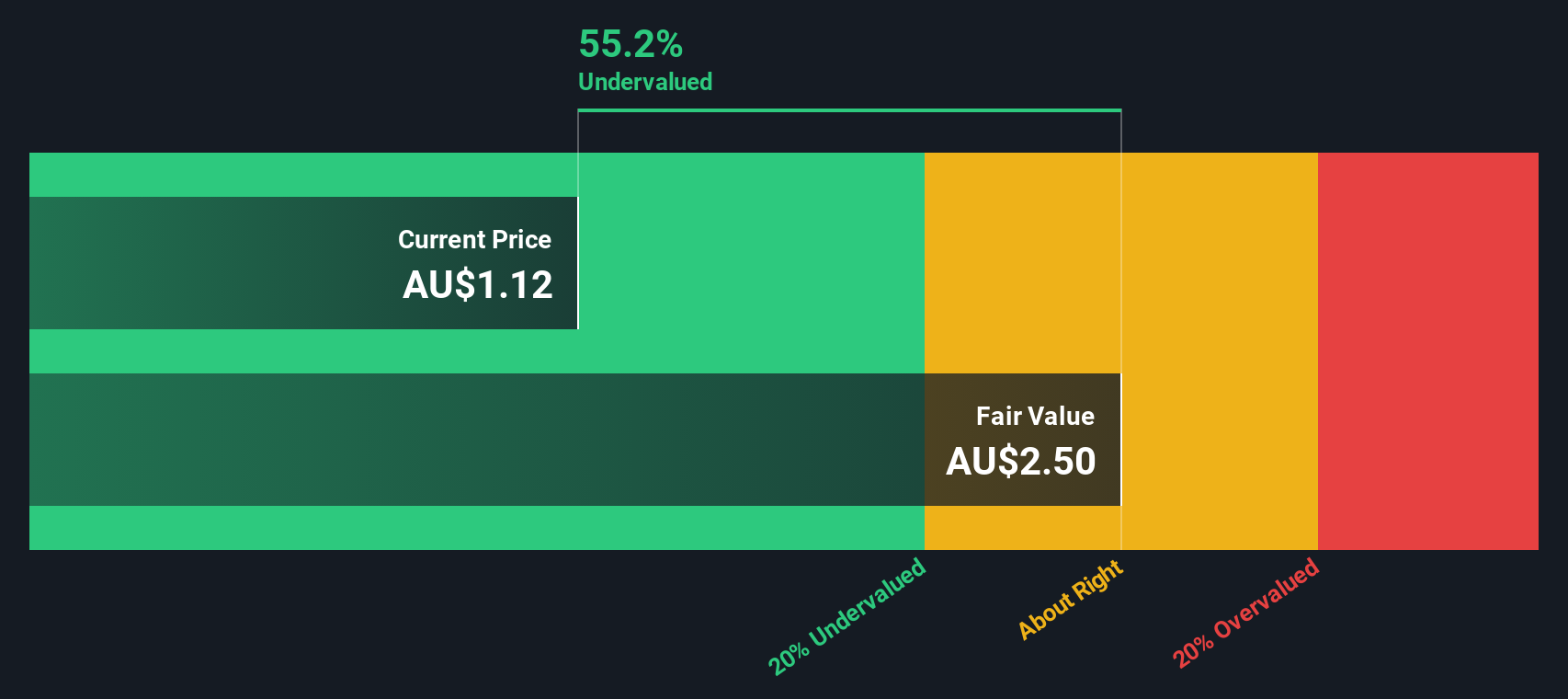

Crunching these numbers gives an estimated intrinsic value of A$2.69 per share. This is around 57% higher than Alkane’s recent market price, so the DCF model implies the stock is significantly undervalued right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alkane Resources is undervalued by 57.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Alkane Resources Price vs Earnings

For companies like Alkane Resources that are now profitable or expected to consistently generate earnings, the Price-to-Earnings (PE) ratio is a relevant and widely used valuation tool. The PE ratio helps investors understand how much the market is willing to pay today for a company's future earnings. It is often used because it quickly reflects both investor sentiment and expectations for growth and risk. Fast-growing, lower-risk companies generally command higher PE ratios, while slower or riskier businesses are priced lower.

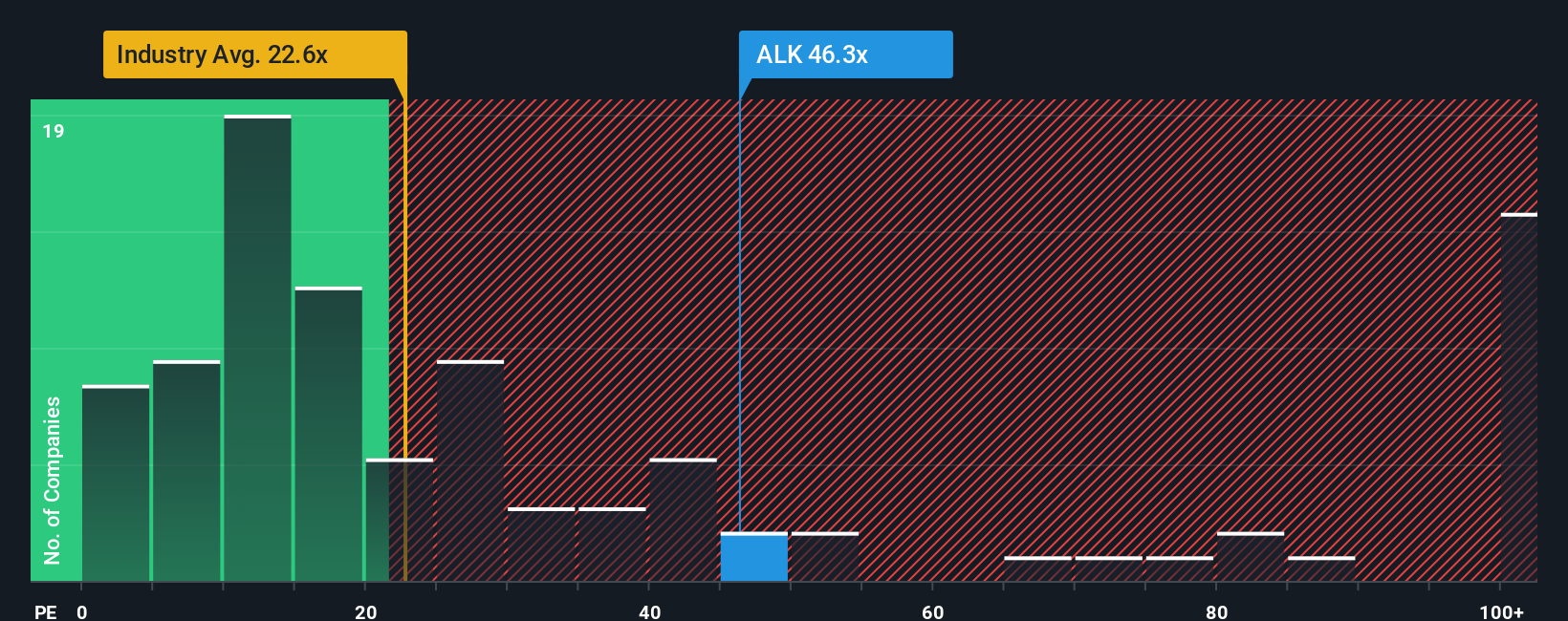

Currently, Alkane trades at a PE ratio of 47.7x. This is more expensive than the broader Metals and Mining industry average of 22.3x, yet cheaper than its direct peer average of 57.6x. That might raise questions about whether the stock is overpriced. However, relying only on these benchmarks ignores the full picture; high-growth prospects or unique risks can make a company deserve a higher or lower multiple than the average.

To address this, Simply Wall St calculates a “Fair Ratio” for Alkane Resources. In this case, the Fair Ratio is 30.0x. The Fair Ratio is designed to reflect Alkane’s specific strengths and weaknesses including earnings growth, profit margins, market cap, and risk level, rather than just comparing to an industry bucket. Because it incorporates more factors unique to Alkane, it is regarded as a more accurate measure of value than a simple peer or industry average.

Since Alkane’s actual PE ratio of 47.7x is substantially higher than its Fair Ratio of 30.0x, the shares look overvalued by this standard. Investors are currently paying more than what is suggested by Alkane’s underlying fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alkane Resources Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, which connects the facts and numbers, like your assumed fair value and forecasts for revenue, earnings, and margins, with your personal perspective on its future. Narratives link everything together, from a company’s backstory and market opportunities to financial forecasts and resulting fair value, giving you a big-picture view for smarter decision making.

Simply Wall St makes Narratives easy to use and accessible on its Community page, where millions of investors share their insights. By creating or following a Narrative, you can quickly see if Alkane’s Fair Value justifies the current Price, helping you decide when it might be time to buy, hold, or sell. What’s more, Narratives are dynamic; they automatically update as soon as new news or earnings figures are released, so your views can stay current without extra effort.

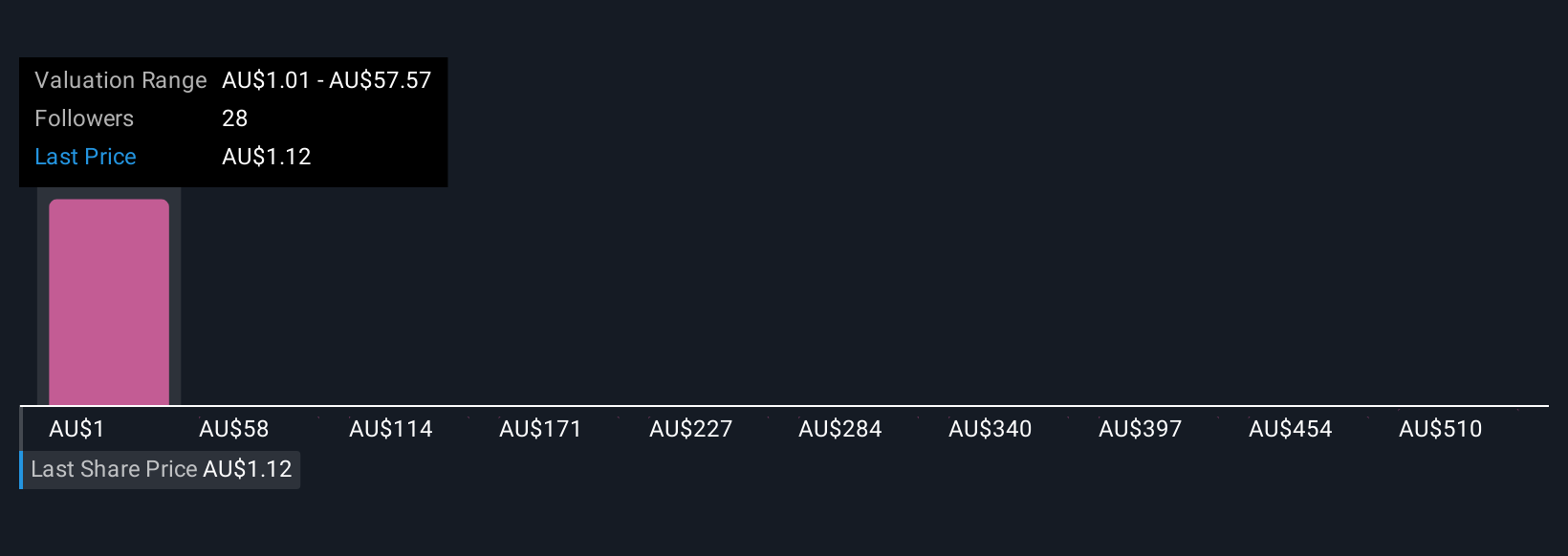

Using Alkane Resources as an example, some Narratives project an optimistic fair value well above today’s price, while others are more cautious, reflecting only modest upside. This shows just how personalized investment decisions can be.

Do you think there's more to the story for Alkane Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALK

Alkane Resources

Operates as a gold exploration and production company in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)